Answered step by step

Verified Expert Solution

Question

1 Approved Answer

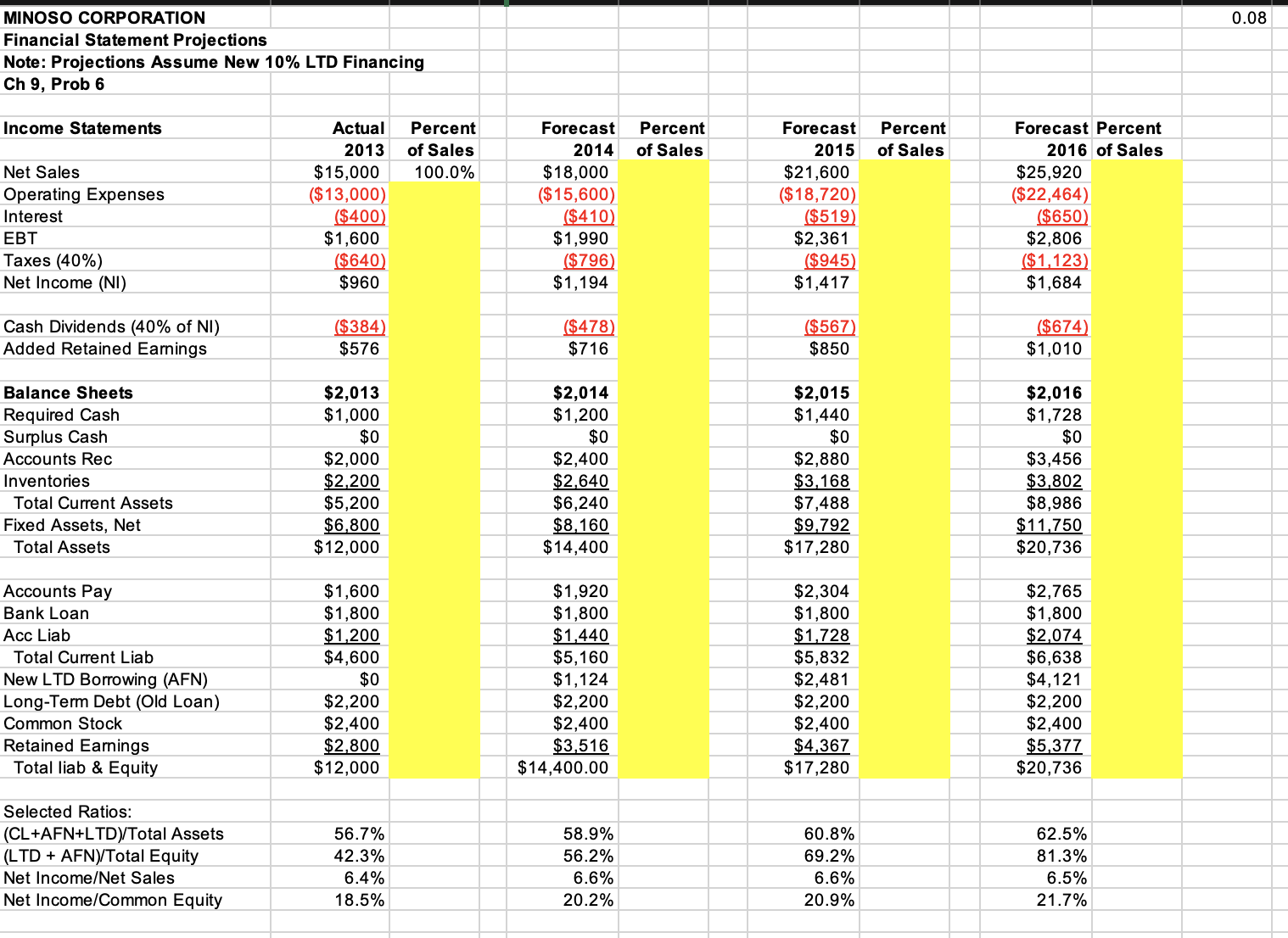

How we do the projection of percent of sales for those years (in yellow) MINOSO CORPORATION Financial Statement Projections Note: Projections Assume New 10% LTD

How we do the projection of percent of sales for those years (in yellow)

MINOSO CORPORATION Financial Statement Projections Note: Projections Assume New 10% LTD Financing Ch 9, Prob 6 Income Statements Actual Percent Forecast Percent Forecast Percent 2013 of Sales 2014 of Sales Net Sales $15,000 100.0% $18,000 2015 $21,600 of Sales Forecast Percent 2016 of Sales $25,920 Operating Expenses ($13,000) ($15,600) ($18,720) ($22,464) Interest ($400) ($410) ($519) ($650) EBT $1,600 $1,990 $2,361 $2,806 Taxes (40%) ($640) ($796) ($945) ($1,123) Net Income (NI) $960 $1,194 $1,417 $1,684 Cash Dividends (40% of NI) ($384) ($478) ($567) ($674) Added Retained Earnings $576 $716 $850 $1,010 Balance Sheets $2,013 $2,014 $2,015 $2,016 Required Cash $1,000 $1,200 $1,440 $1,728 Surplus Cash $0 $0 $0 $0 Accounts Rec $2,000 $2,400 $2,880 $3,456 Inventories $2,200 $2,640 $3,168 $3,802 Total Current Assets $5,200 $6,240 $7,488 $8,986 Fixed Assets, Net $6,800 $8,160 $9,792 $11,750 Total Assets $12,000 $14,400 $17,280 $20,736 Accounts Pay $1,600 $1,920 $2,304 $2,765 Bank Loan $1,800 $1,800 $1,800 $1,800 Acc Liab $1,200 $1,440 $1,728 $2,074 Total Current Liab $4,600 $5,160 $5,832 $6,638 New LTD Borrowing (AFN) $0 $1,124 $2,481 $4,121 Long-Term Debt (Old Loan) $2,200 $2,200 $2,200 $2,200 Common Stock $2,400 $2,400 $2,400 $2,400 Retained Earnings $2,800 $3,516 $4,367 $5,377 Total liab & Equity $12,000 $14,400.00 $17,280 $20,736 Selected Ratios: (CL+AFN+LTD)/Total Assets 56.7% 58.9% 60.8% 62.5% (LTD + AFN)/Total Equity 42.3% 56.2% 69.2% 81.3% Net Income/Net Sales 6.4% 6.6% 6.6% 6.5% Net Income/Common Equity 18.5% 20.2% 20.9% 21.7% 0.08

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To project the percent of sales for the years 2016 and beyond we can use the historical dat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started