Answered step by step

Verified Expert Solution

Question

1 Approved Answer

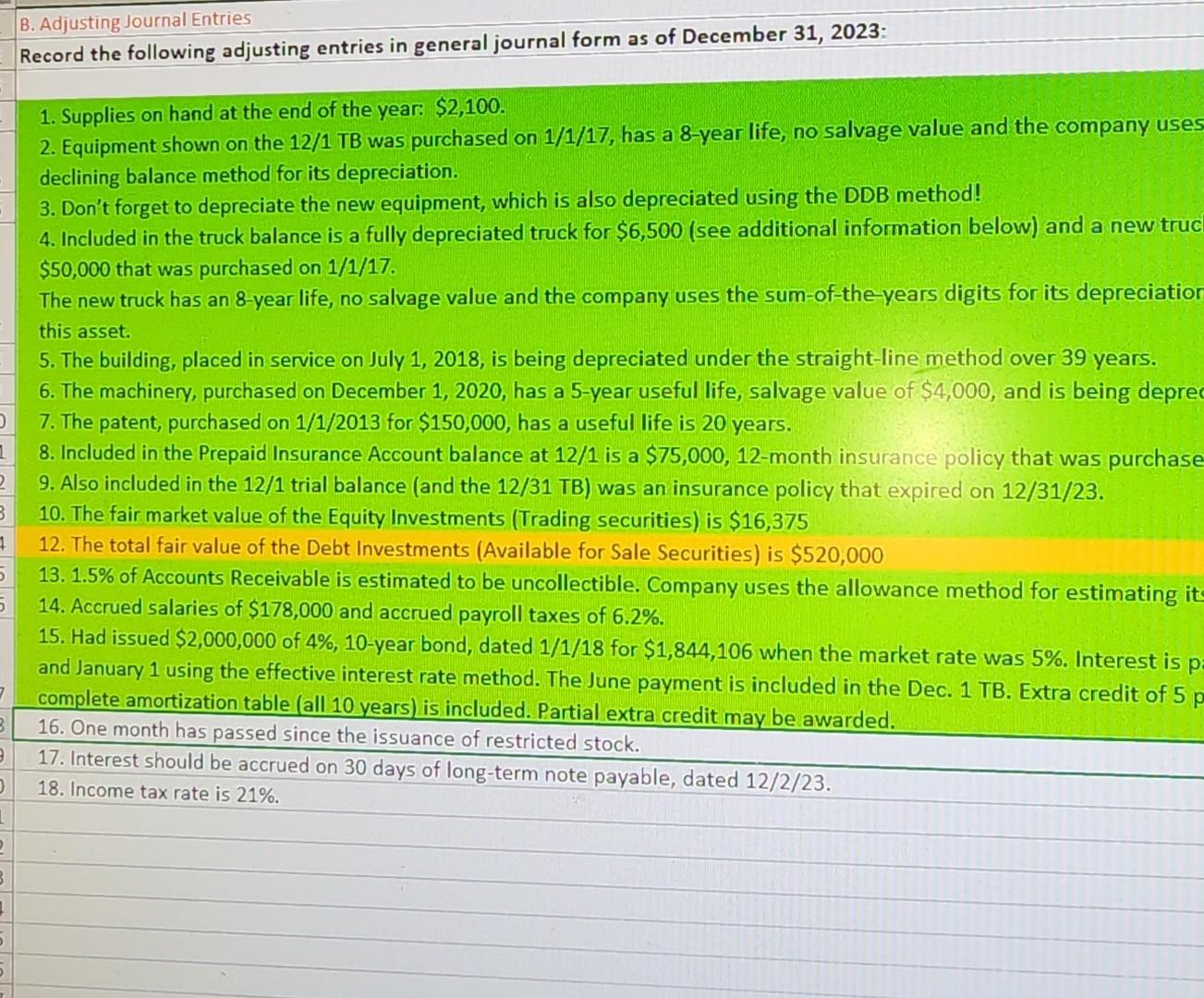

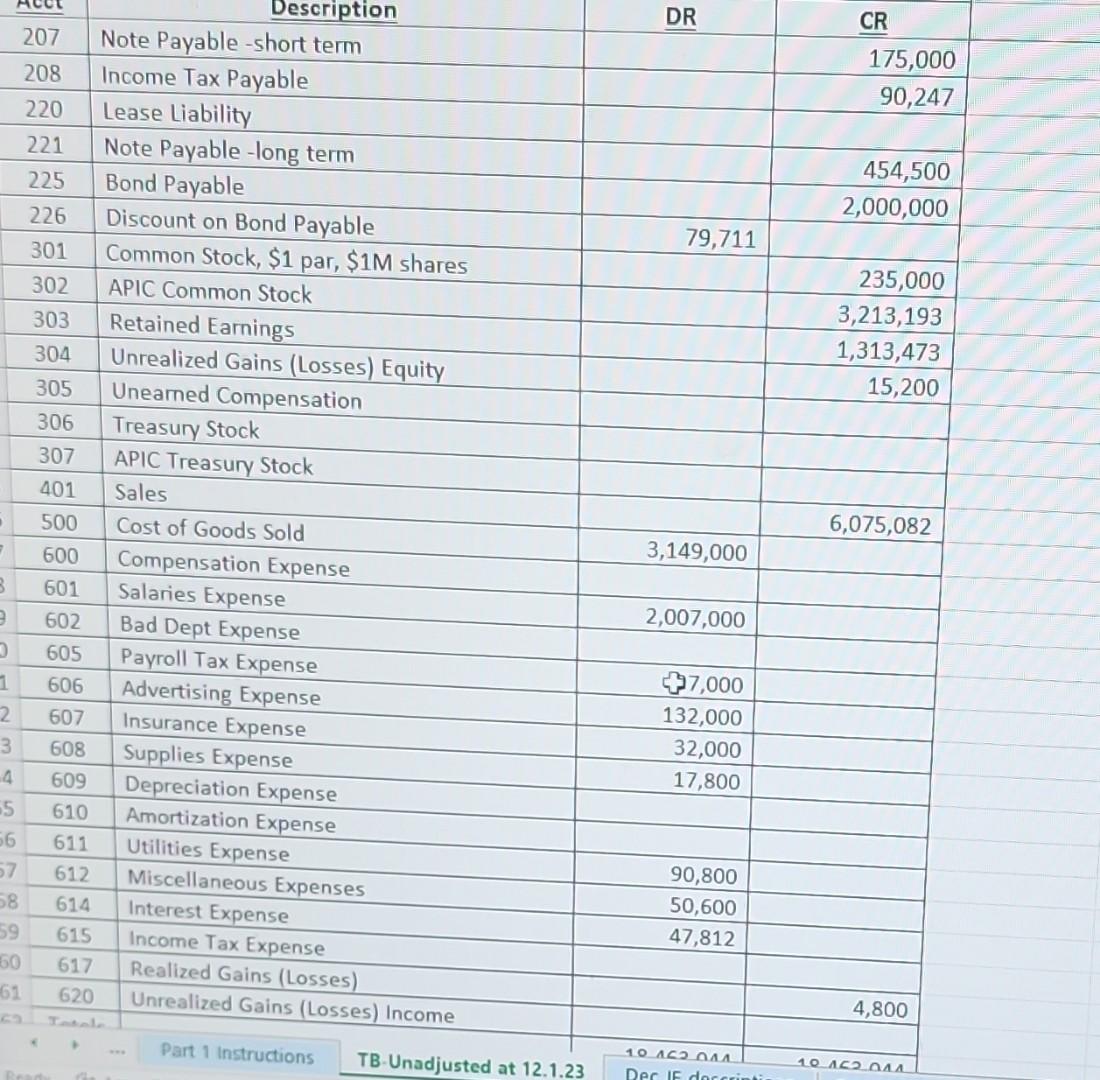

how would I computer #12 ,#16-#18? 1. Supplies on hand at the end of the year: $2,100. 2. Equipment shown on the 12/1TB was purchased

how would I computer #12 ,#16-#18?

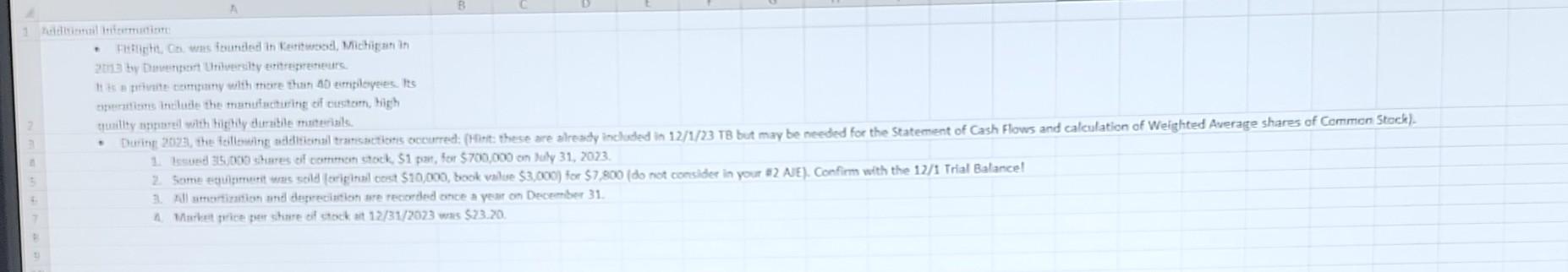

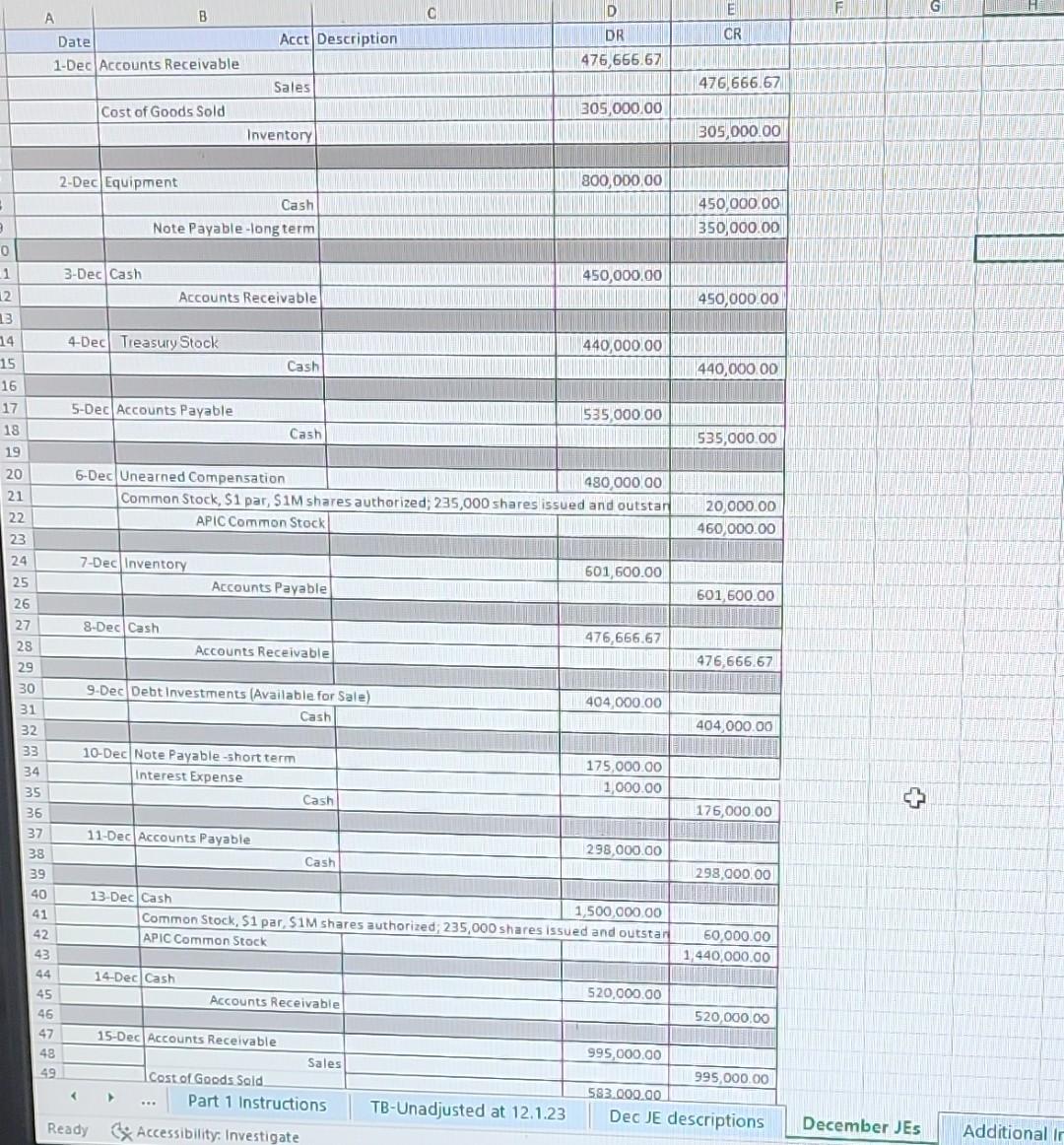

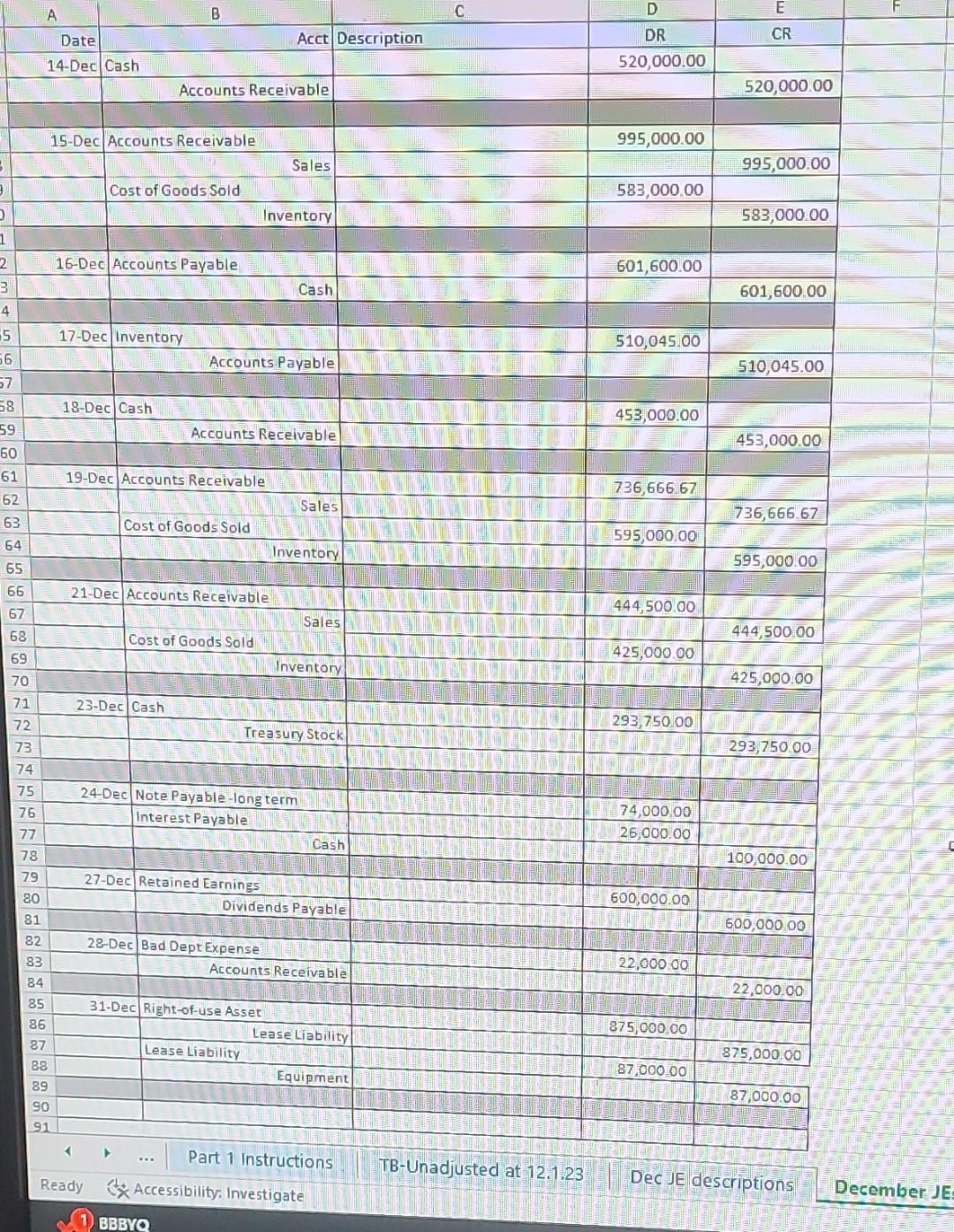

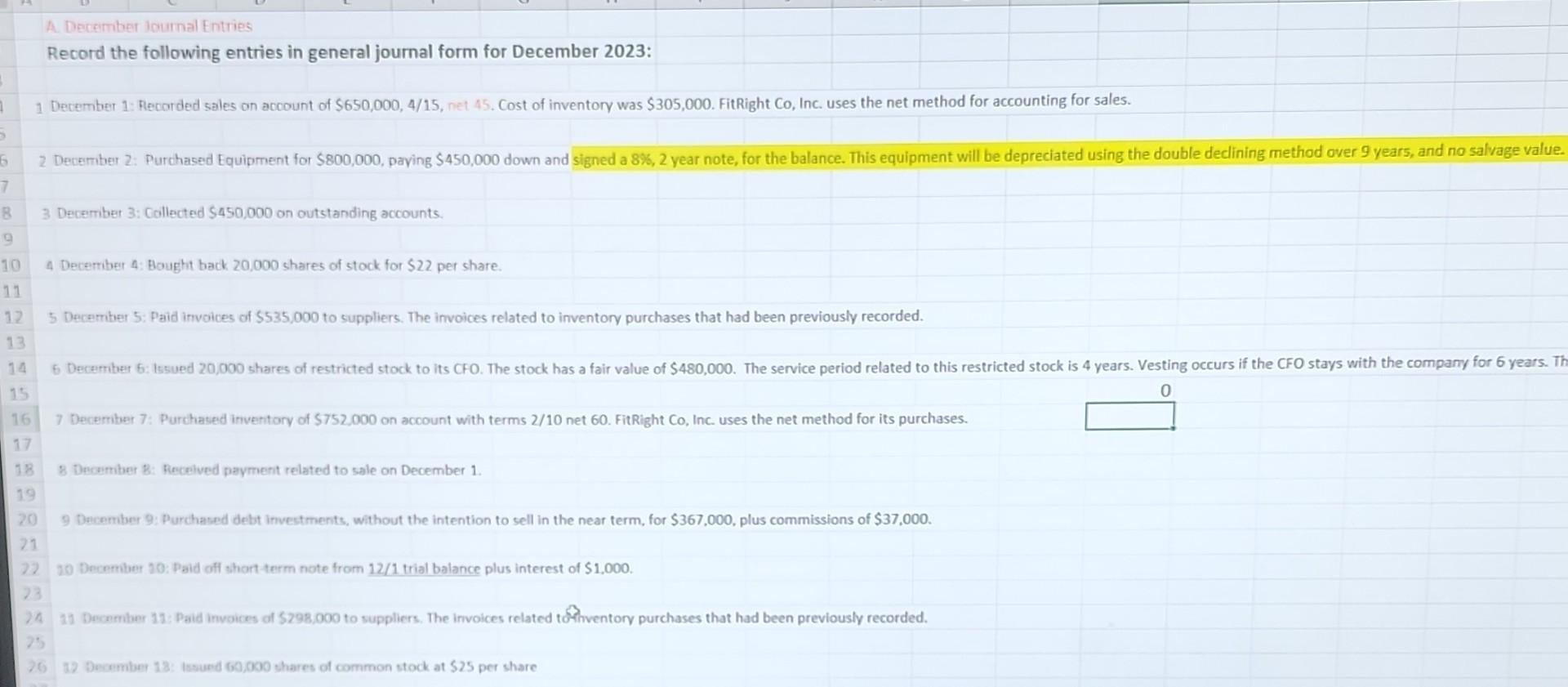

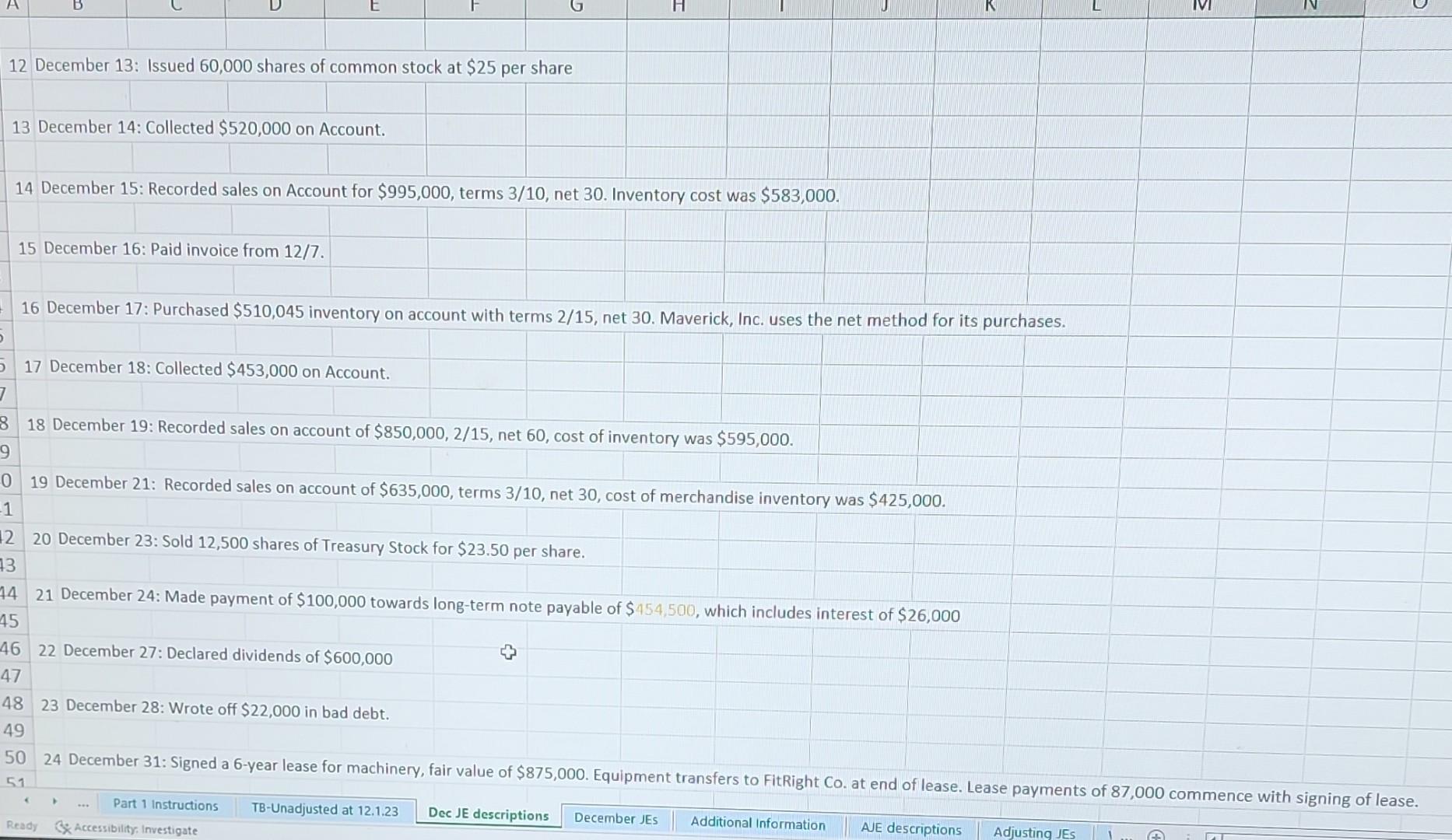

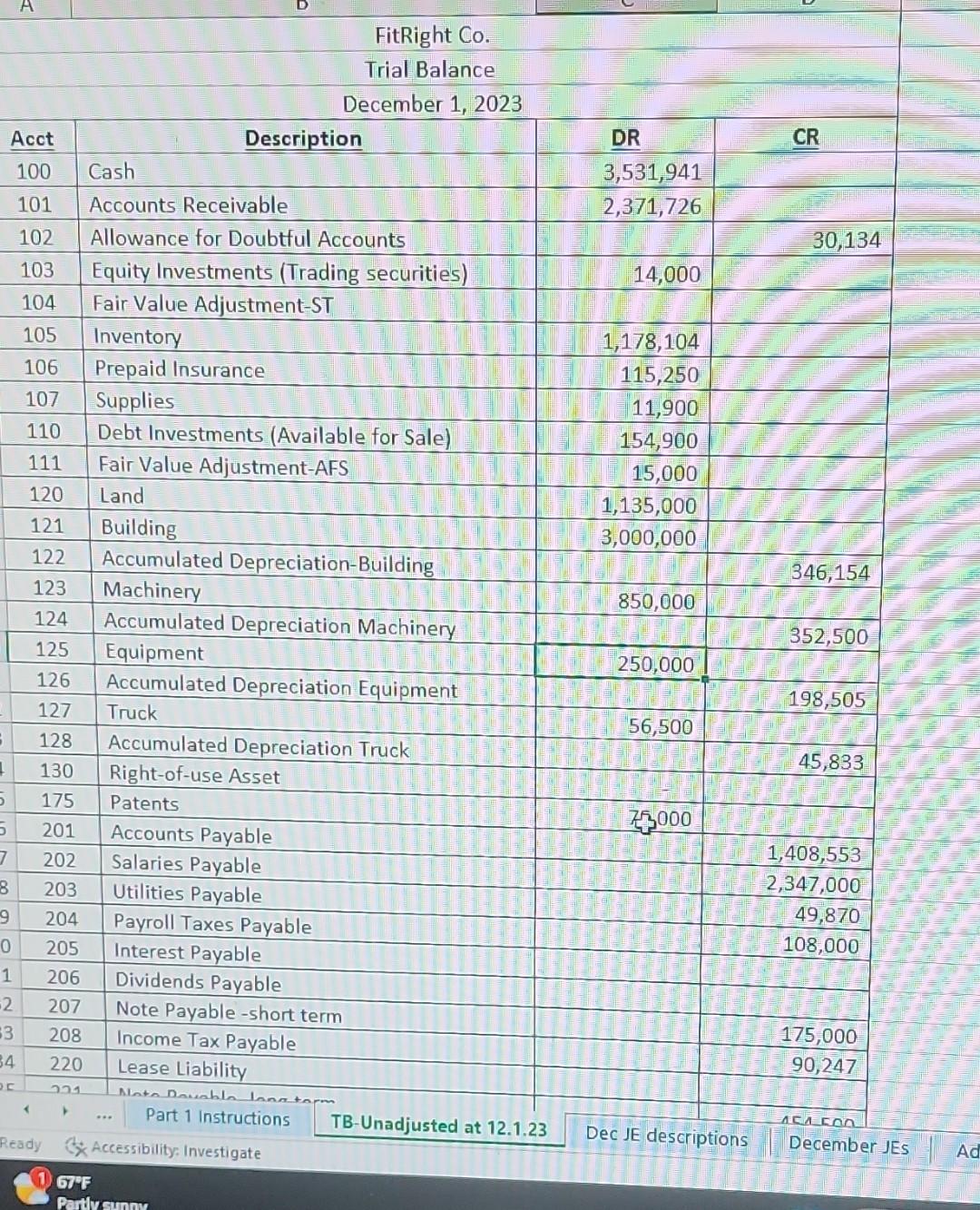

1. Supplies on hand at the end of the year: $2,100. 2. Equipment shown on the 12/1TB was purchased on 1/1/17, has a 8 -year life, no salvage value and the company use declining balance method for its depreciation. 3. Don't forget to depreciate the new equipment, which is also depreciated using the DDB method! 4. Included in the truck balance is a fully depreciated truck for $6,500 (see additional information below) and a new truc $50,000 that was purchased on 1/1/17. The new truck has an 8-year life, no salvage value and the company uses the sum-of-the-years digits for its depreciatior this asset. 5. The building, placed in service on July 1,2018 , is being depreciated under the straight-line method over 39 years. 6. The machinery, purchased on December 1,2020 , has a 5-year useful life, salvage value of $4,000, and is being depre 7. The patent, purchased on 1/1/2013 for $150,000, has a useful life is 20 years. 8. Included in the Prepaid Insurance Account balance at 12/1 is a $75,000,12-month insurance policy that was purchase 9. Also included in the 12/1 trial balance (and the 12/31 TB) was an insurance policy that expired on 12/31/23. 10. The fair market value of the Equity Investments (Trading securities) is $16,375 12. The total fair value of the Debt Investments (Available for Sale Securities) is $520,000 13. 1.5% of Accounts Receivable is estimated to be uncollectible. Company uses the allowance method for estimating it 14. Accrued salaries of $178,000 and accrued payroll taxes of 6.2%. 15. Had issued $2,000,000 of 4%,10-year bond, dated 1/1/18 for $1,844,106 when the market rate was 5%. Interest is p and January 1 using the effective interest rate method. The June payment is included in the Dec. 1 TB. Extra credit of 5 complete amortization table (all 10 years) is included. Partial extra credit may be awarded. 16. One month has passed since the issuance of restricted stock. 17. Interest should be accrued on 30 days of long-term note payable, dated 12/2/23. 18. Income tax rate is 21%. - Fistingti, Cn. whs itsunted in Keititursse, Michigan in 2 This ty Dhmentert Unituersily eritreipremeurs. It is B prinite camtimy with miare thati ab eimpilsyeies. Its ciserntism indude the manuficturitig of curstam, high chuility wiporel with hightily dienatile miterible. 2. Some qugmmirit wris soild (coripiribl cost $10,000, book value $3,000 ) for $7,800 (do not conslifer in your s2 AJ). Confirm with the 12/1 Trial Balancel 3. All strortimition and deprecietion are recorded ance a year on Deceember 31. 4. Markit price per shire of stock at 12/31/2023 was $23.20. A. December lournal Entries Record the following entries in general journal form for December 2023: 1 December 1: Hecorded sales on account of $650,000,4/15, net 45 . Cost of inventory was $305,000. FitRight Co, Inc. uses the net method for accounting for sales. 2 Decemiber 2: Purchased Equipment for $800,000, paving $450,000 down and signed a 8%,2 year note, for the balance. This equipment will be depreciated using the double declining method over 9 years, and no salvage value. 3 Decemiber 3: Collected S450,000 on outstanding accounts. 4 December 4: Bought back 20,000 shares of stack for $22 per share. 5 Decamber 5: Paid invoices of $535,000 to suppliers. The invoices related to inventory purchases that had been previously recorded. 6 December 6 : issued 20,000 shares of restricted stock to its CFO. The stock has a fair value of $480,000. The service period related to this restricted stock is 4 years. Vesting occurs if the cFo stays with the company for 6 years. Th 7 December 7: Purchased inventory of 5752,000 on account with terms 2/10 net 60 . Fit Right Co, Inc. uses the net method for its purchases. 8 Decamiber 8: Reccived payment related to sale on December 1. 9 Derember 9: Purchased debt investments, without the intention to sell in the near term, for $367,000, plus commissions of $37,000. 20 Decomber 20: Paid of shon term note from 12/1 trial balance plus interest of $1,000. 11. Decomber 12: Paid invoices of S298,000 to suppliers. The invoices related tof hiventory purchases that had been previously recorded. 12 December 13: tssued 60,000 shares of common stock at $25 per share 12 December 13: Issued 60,000 shares of common stock at \$25 per share 13 December 14: Collected $520,000 on Account. 14 December 15: Recorded sales on Account for $995,000, terms 3/10, net 30 . Inventory cost was $583,000. 15 December 16: Paid invoice from 12/7. 16 December 17: Purchased $510,045 inventory on account with terms 2/15, net 30 . Maverick, Inc. uses the net method for its purchases. 17 December 18: Collected $453,000 on Account. 18 December 19: Recorded sales on account of $850,000,2/15, net 60 , cost of inventory was $595,000. 19 December 21: Recorded sales on account of $635,000, terms 3/10, net 30 , cost of merchandise inventory was $425,000. 20 December 23: Sold 12,500 shares of Treasury Stock for $23.50 per share. 21 December 24: Made payment of $100,000 towards long-term note payable of $454,500, which includes interest of $26,000 22 December 27: Declared dividends of $600,000 23 December 28: Wrote off $22,000 in bad debt. 24 December 31: Signed a 6-year lease for machinery, fair value of $875,000. Equipment transfers to FitRight C0. at end of lease. Lease payments of 87,000 commence with signing of lease. FitRight Co. Trial Balance December 1, 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started