How would I create a general journal?

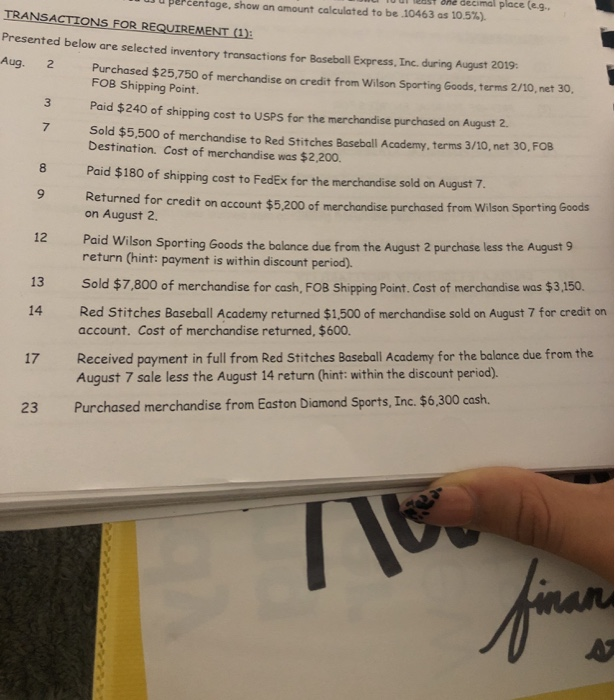

She decimal place (e.g. rentage, show an amount calculated to be 10463 as 10.5%). TRANSACTIONS FOR REQUIREMENT (1): Presented below are selected inventory transactions for Baseball Express, Inc. during August 2019: Aug. 2 Purchased $25,750 of merchandise on credit from Wilson Sporting Goods, terms 2/10, net 30, FOB Shipping Point. 3 Paid $240 of shipping cost to USPS for the merchandise purchased on August 2. 7 Sold $5,500 of merchandise to Red Stitches Baseball Academy, terms 3/10, net 30, FOB Destination. Cost of merchand ise was $2,200. Paid $180 of shipping cost to Fed Ex for the merchandise sold on August 7 Returned for credit on account $5,200 of merchandise purchased from Wilson Sporting Goods on August 2 Paid Wilson Sporting Goods the balance due from the August 2 purchase less the August 9 return (hint: payment is within discount period). 12 13 Sold $7,800 of merchandise for cash, FOB Shipping Point. Cost of merchandise was $3,150. Red Stitches Baseball Academy returned $1,500 of merchandise sold on August 7 for credit on account. Cost of merchandise returned, $600. 14 Received payment in full from Red Stitches Baseball Academy for the ba lance due from the August 7 sale less the August 14 return (hint: within the discount period) 17 Purchased merchand ise from Easton Diamond Sports, Inc. $6,300 cash. 23 She decimal place (e.g. rentage, show an amount calculated to be 10463 as 10.5%). TRANSACTIONS FOR REQUIREMENT (1): Presented below are selected inventory transactions for Baseball Express, Inc. during August 2019: Aug. 2 Purchased $25,750 of merchandise on credit from Wilson Sporting Goods, terms 2/10, net 30, FOB Shipping Point. 3 Paid $240 of shipping cost to USPS for the merchandise purchased on August 2. 7 Sold $5,500 of merchandise to Red Stitches Baseball Academy, terms 3/10, net 30, FOB Destination. Cost of merchand ise was $2,200. Paid $180 of shipping cost to Fed Ex for the merchandise sold on August 7 Returned for credit on account $5,200 of merchandise purchased from Wilson Sporting Goods on August 2 Paid Wilson Sporting Goods the balance due from the August 2 purchase less the August 9 return (hint: payment is within discount period). 12 13 Sold $7,800 of merchandise for cash, FOB Shipping Point. Cost of merchandise was $3,150. Red Stitches Baseball Academy returned $1,500 of merchandise sold on August 7 for credit on account. Cost of merchandise returned, $600. 14 Received payment in full from Red Stitches Baseball Academy for the ba lance due from the August 7 sale less the August 14 return (hint: within the discount period) 17 Purchased merchand ise from Easton Diamond Sports, Inc. $6,300 cash. 23