Answered step by step

Verified Expert Solution

Question

1 Approved Answer

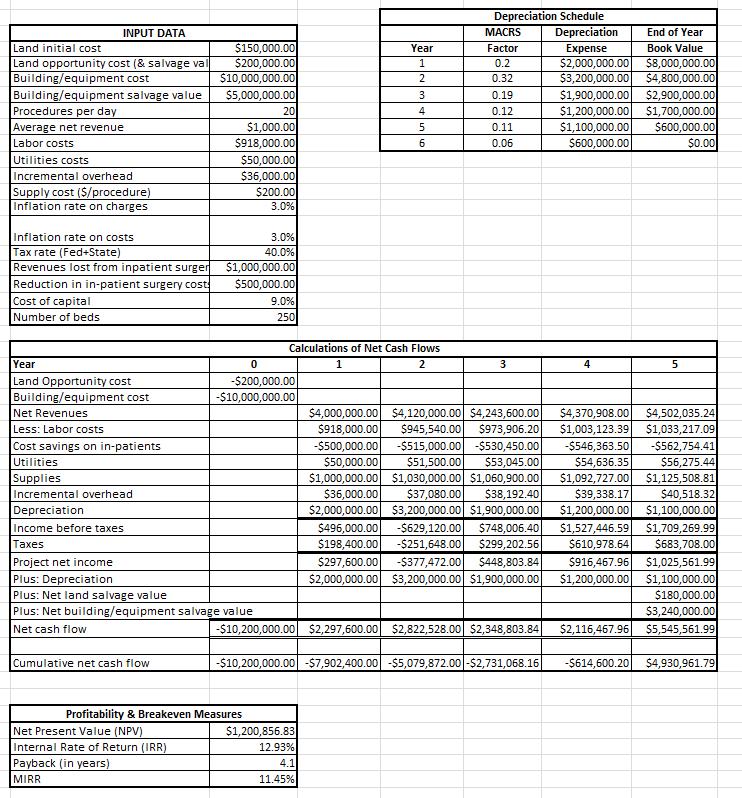

How would I go about calculating the impact of uncertain future inflation on NPV of a proposed ambulatory surgery center based on given levels of

How would I go about calculating the impact of uncertain future inflation on NPV of a proposed ambulatory surgery center based on given levels of net patient revenue inflation and levels of cost inflation? Here's what I am given and have already calculated:

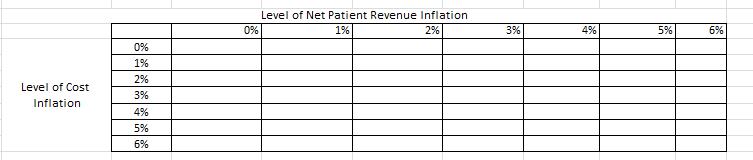

The follow boxes must be filled with NVPs:

What implications do these results have?

INPUT DATA Land initial cost Land opportunity cost (& salvage val Building/equipment cost Building/equipment salvage value Procedures per day Average net revenue Labor costs Utilities costs Incremental overhead Supply cost ($/procedure) Inflation rate on charges Inflation rate on costs Tax rate (Fed+State) Revenues lost from inpatient surger Reduction in in-patient surgery cost Cost of capital Number of beds Year Land Opportunity cost Building/equipment cost Net Revenues Less: Labor costs Cost savings on in-patients Utilities Supplies Incremental overhead Depreciation Income before taxes Taxes Cumulative net cash flow $150,000.00 $200,000.00 $10,000,000.00 $5,000,000.00 Net Present Value (NPV) 20 $1,000.00 $918,000.00 $50,000.00 $36,000.00 $200.00 3.0% Project net income Plus: Depreciation Plus: Net land salvage value Plus: Net building/equipment salvage value Net cash flow Internal Rate of Return (IRR) Payback (in years) MIRR $1,000,000.00 $500,000.00 3.0% 40.0% Profitability & Breakeven Measures 9.0% 250 0 -$200,000.00 -$10,000,000.00 Calculations of Net Cash Flows 2 Year 1 2 1 3 4 5 6 $1,200,856.83 12.93% 4.1 11.45% Depreciation Schedule MACRS Factor 0.2 0.32 0.19 0.12 0.11 0.06 3 $4,000,000.00 $4,120,000.00 $4,243,600.00 $918,000.00 $945,540.00 $973,906.20 -$500,000.00 -$515,000.00 -$530,450.00 $50,000.00 $51,500.00 $53,045.00 $37,080.00 $1,000,000.00 $1,030,000.00 $1,060,900.00 $36,000.00 $38,192.40 $2,000,000.00 $3,200,000.00 $1,900,000.00 $496,000.00 -$629,120.00 $748,006.40 $198,400.00 -$251,648.00 $299,202.56 $297,600.00 -$377,472.00 $448,803.84 $2,000,000.00 $3,200,000.00 $1,900,000.00 Depreciation Expense $2,000,000.00 $8,000,000.00 $3,200,000.00 $4,800,000.00 $1,900,000.00 $2,900,000.00 $1,200,000.00 $1,700,000.00 $1,100,000.00 $600,000.00 $600,000.00 $0.00 4 -$10,200,000.00 $2,297,600.00 $2,822,528.00 $2,348,803.84 $2,116,467.96 End of Year Book Value 5 $4,370,908.00 $4,502,035.24 $1,003,123.39 $1,033,217.09 -$546,363.50 -$562,754.41 $54,636.35 $56,275.44 $1,092,727.00 $1,125,508.81 $39,338.17 $40,518.32 $1,200,000.00 $1,100,000.00 $1,527,446.59 $1,709,269.99 $610,978.64 $683,708.00 $916,467.96 $1,025,561.99 $1,200,000.00 $1,100,000.00 $180,000.00 $3,240,000.00 $5,545,561.99 -$10,200,000.00 -$7,902,400.00 $5,079,872.00-$2,731,068.16 -$614,600.20 $4,930,961.79

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here is an example calculation using the figures provided 1 Define inflation scenarios Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started