How would I solve this question? Plz look at the consolidated statement of Air Canada below: Use 2020 values

The company intends to raise additional capital to finance an expansion. The expected cost is $20M Canadian dollars. The board is uncertain whether it should issue additional shares or new debt, given the current capital structure. The current lending rate is 10% (assumed). Advise the board on the impact of the two financing options on the companys current capital structure. In your analysis, show calculations and analysis of the following:

-

The revised number of outstanding shares and the impact this share issue may have on the existing shareholders;

-

The impact of the additional share issuance on the earnings per share;

-

The day 1 journal entry to record the share issuance option;

-

The day 1 journal entry to record the debt option; and

-

The impact on the financial statements (Assume the declaration takes place on July 1 in the financial year. a. if the company were to declare a $.01 share dividend at the end of the first financial year, b. or the impact of debt option at the end of the first year.

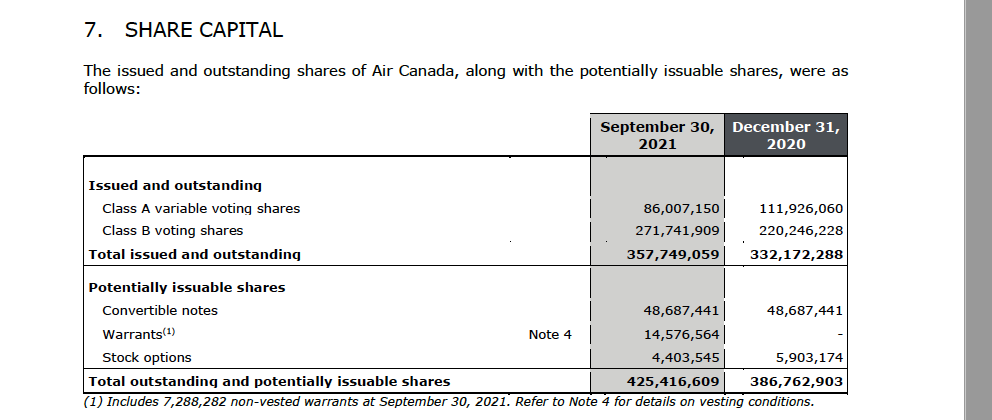

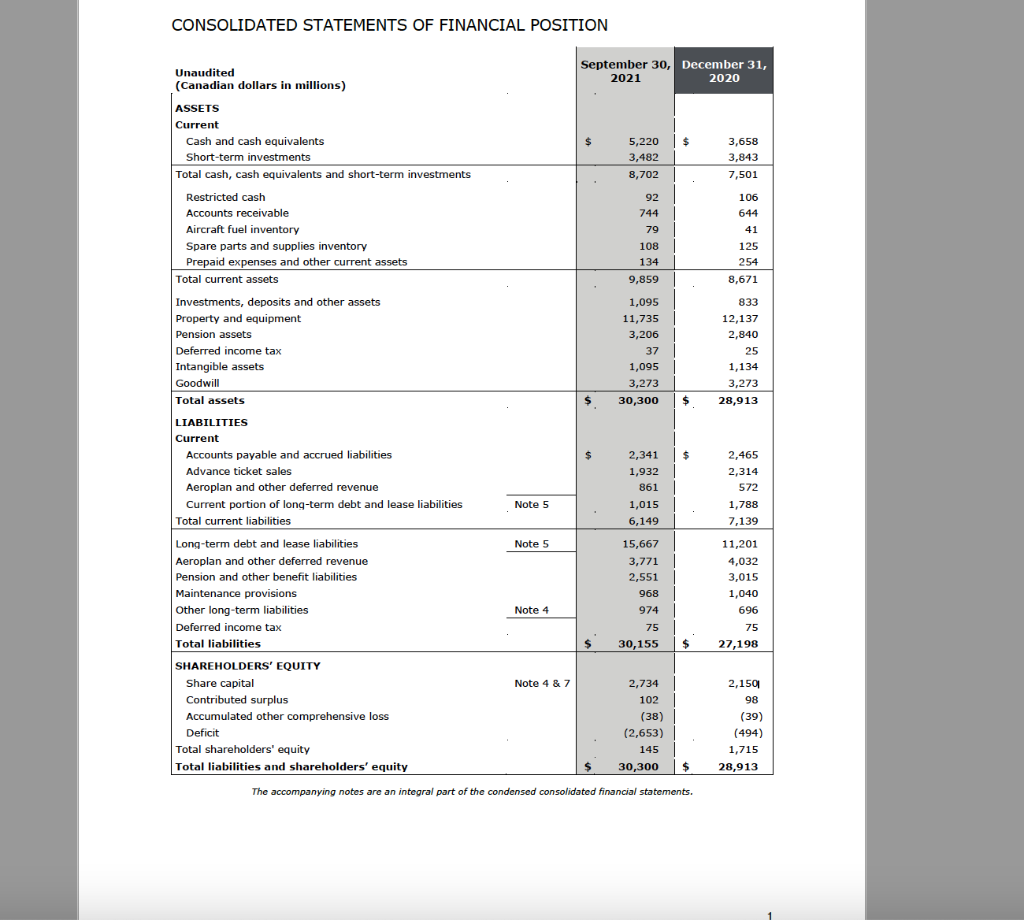

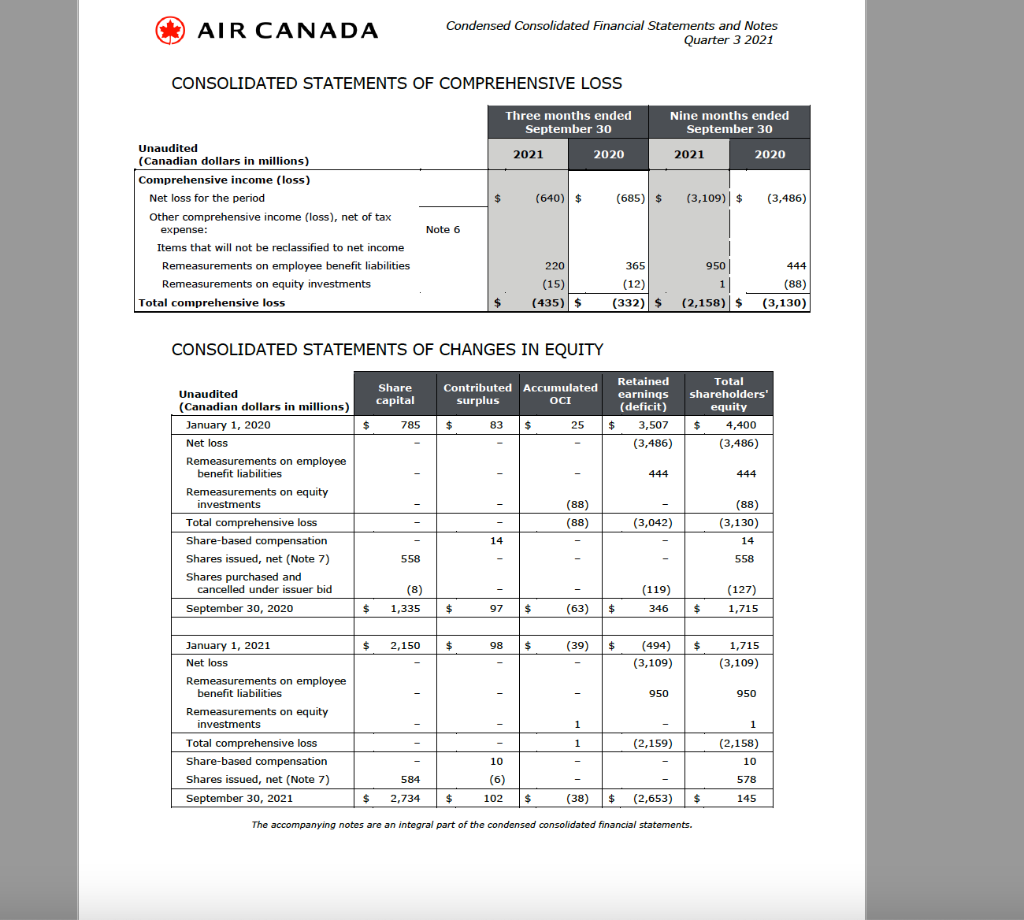

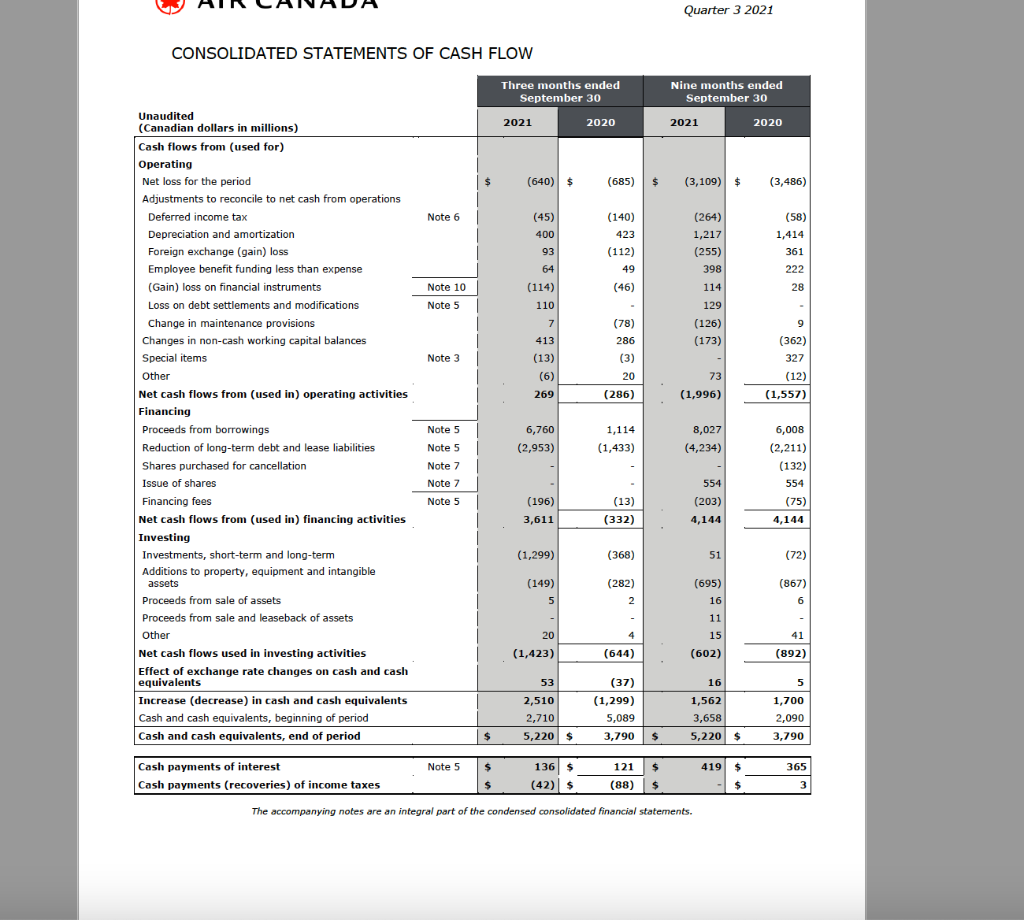

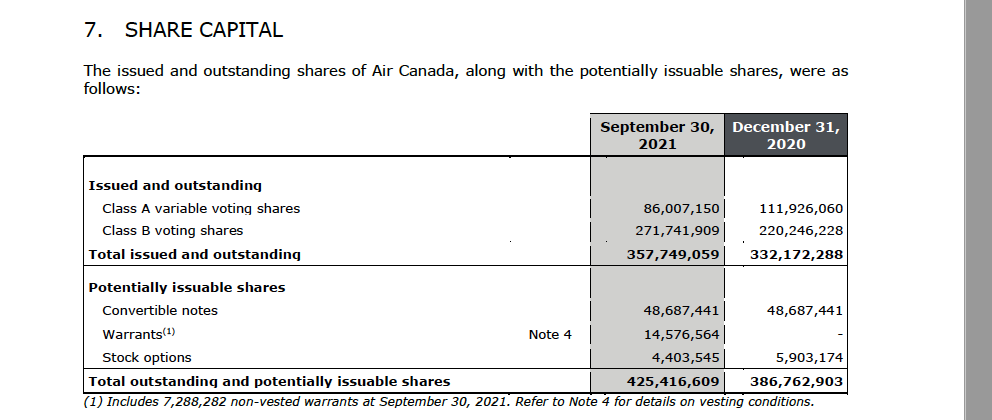

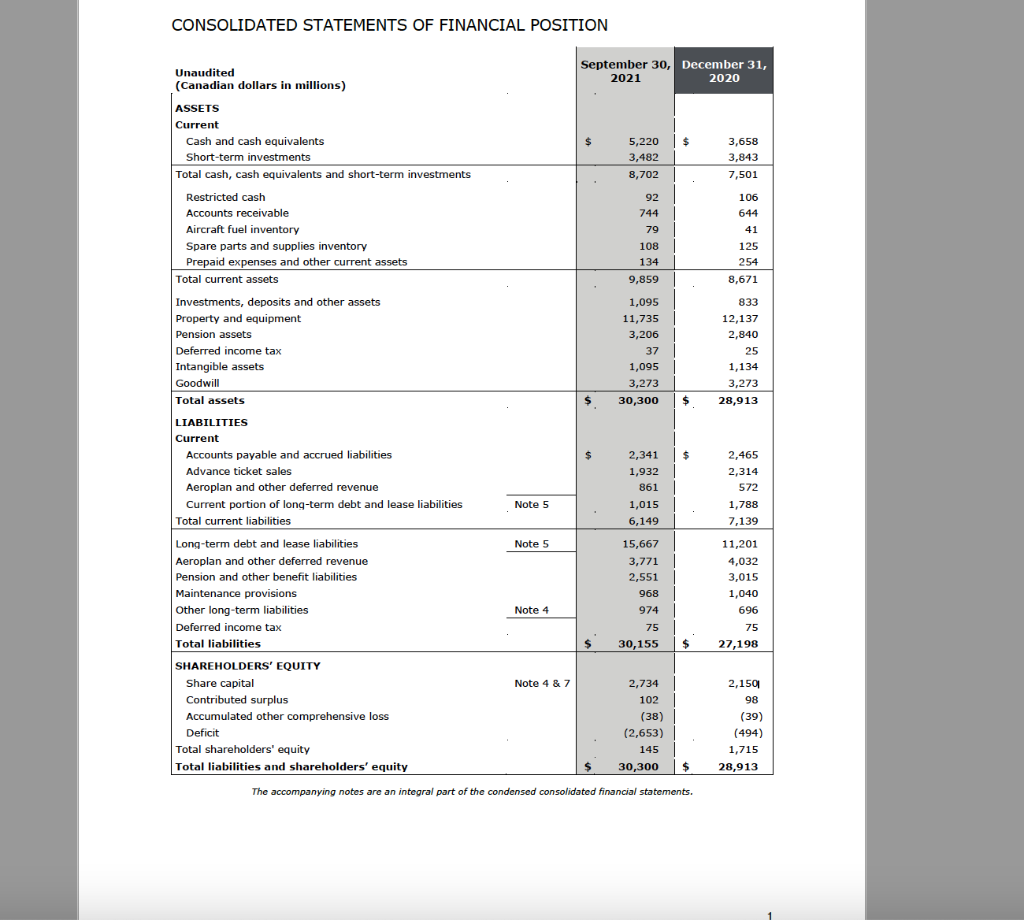

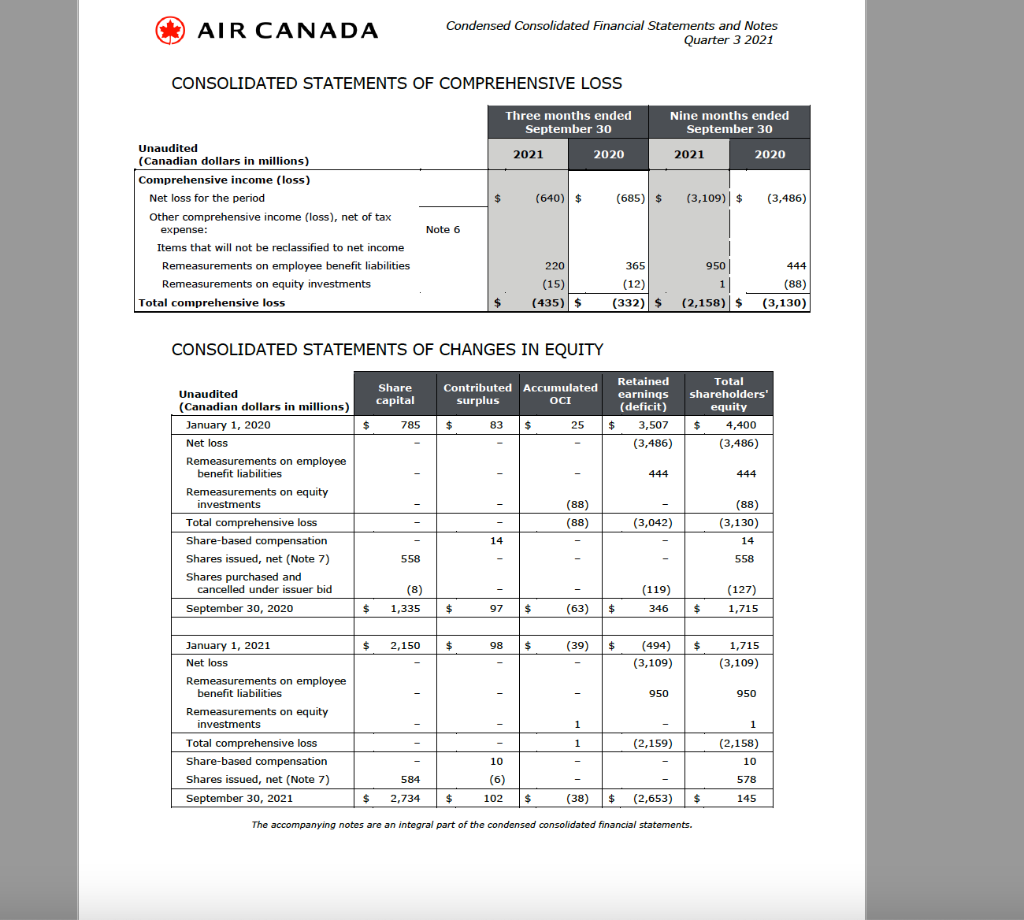

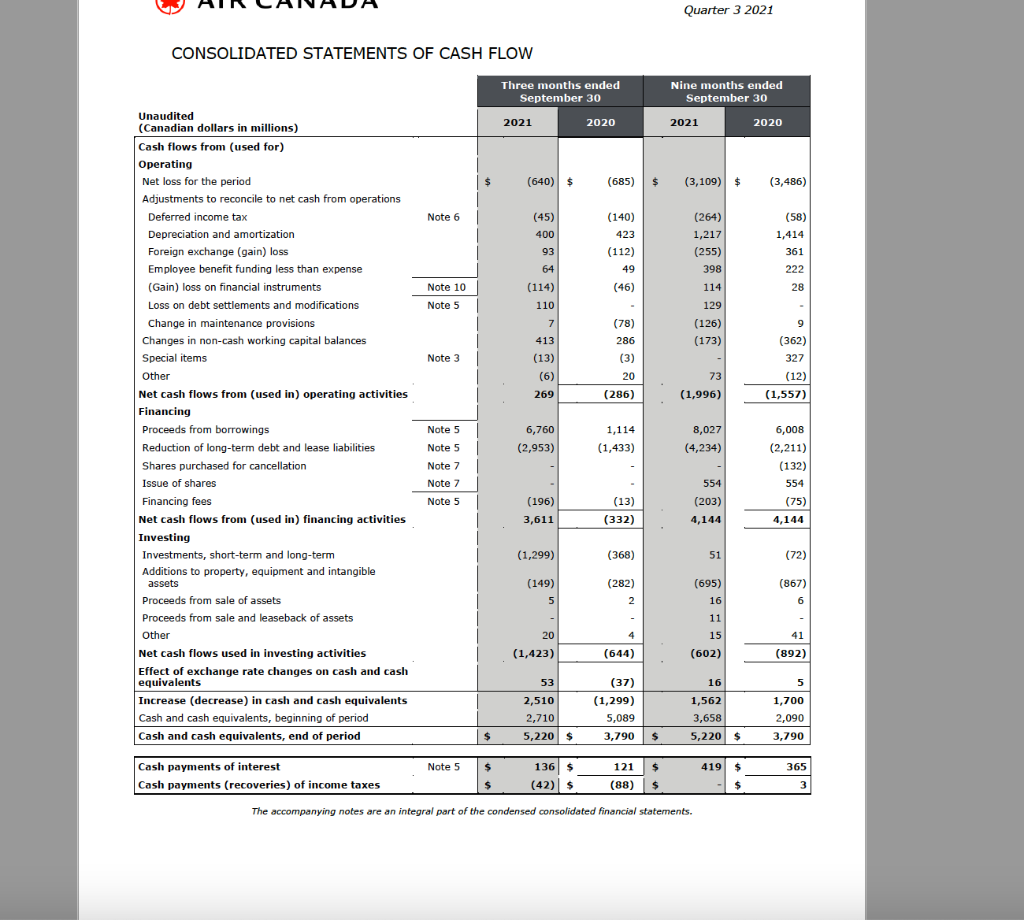

7. SHARE CAPITAL The issued and outstanding shares of Air Canada, along with the potentially issuable shares, were as follows: September 30, December 31, 2021 2020 Issued and outstanding Class A variable voting shares Class B voting shares Total issued and outstanding 86,007,150 271,741,909 357,749,059 111,926,060 220,246,228 332,172,288 Potentially issuable shares Convertible notes 48,687,441 48,687,441 Warrants(1) Note 4 14,576,564 Stock options 4,403,545 5,903,174 Total outstanding and potentially issuable shares 425,416,609 386,762,903 (1) Includes 7,288,282 non-vested warrants at September 30, 2021. Refer to Note 4 for details on vesting conditions. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Unaudited September 30, December 31, (Canadian dollars in millions) 2021 2020 ASSETS Current Cash and cash equivalents $ 5,220 $ 3,658 Short-term investments 3,482 3,843 Total cash, cash equivalents and short-term investments , 8,702 7,501 Restricted cash 92 106 Accounts receivable 744 644 Aircraft fuel inventory 79 41 Spare parts and supplies inventory 108 125 Prepaid expenses and other current assets 134 254 Total current assets 9,859 8,671 Investments, deposits and other assets , 1,095 833 Property and equipment 11,735 12,137 Pension assets 3,206 | 2,840 Deferred income tax 37 25 Intangible assets 1,095 1,134 Goodwill 3,273 3,273 Total assets $ 30,300 $ 28,913 LIABILITIES Current Accounts payable and accrued liabilities 2,341 $ 2,465 Advance ticket sales 1,932 2,314 Aeroplan and other deferred revenue 861 572 Current portion of long-term debt and lease liabilities Note 5 1,015 1,788 Total current liabilities 6,149 7,139 Long-term debt and lease liabilities Note 5 15,667 11,201 Aeroplan and other deferred revenue 3,771 4,032 Pension and other benefit liabilities 2,551 3,015 Maintenance provisions 968 1,040 Other long-term liabilities Note 4 974 | 696 Deferred income tax 75 75 Total liabilities $ 30,155 $ 27,198 SHAREHOLDERS' EQUITY Share capital Note 4 & 7 2,734 2,1501 Contributed surplus 102 98 Accumulated other comprehensive loss (38) (39) Deficit (2,653) Total shareholders' equity 145 1,715 Total liabilities and shareholders' equity 30,300 $ 28,913 The accompanying notes are an integral part of the condensed consolidated financial statements. . (494) AIR CANADA Condensed Consolidated Financial Statements and Notes Quarter 3 2021 CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS Three months ended September 30 Nine months ended September 30 2021 2020 2021 2020 $ (640) $ (685) $ (3,109) $ (3,486) Unaudited (Canadian dollars in millions) Comprehensive income (loss) Net loss for the period Other comprehensive income (loss), net of tax expense: Items that will not be reclassified to net income Remeasurements on employee benefit liabilities Remeasurements on equity investments Total comprehensive loss Note 6 220 (15) (435) $ () 365 950 444 (12) 1 (88) (332) $ (2,158) $ (3,130) $ CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Share capital Contributed Accumulated surplus OCI Retained earnings (deficit) $ 3,507 (3,486) Total shareholders' equity $ 4,400 (3,486) $ 785 $ 83 $ 25 444 444 Unaudited (Canadian dollars in millions) January 1, 2020 Net loss Remeasurements on employee benefit liabilities Remeasurements on equity investments Total comprehensive loss Share-based compensation Shares issued, net (Note 7) Shares purchased and cancelled under issuer bid September 30, 2020 - (88) (88) () - (3,042) (88) (3,130) 14 14 558 - 558 - (8) 1,335 (119) 346 (127) 1,715 $ $ 97 $ (63) $ $ $ 2,150 $ 98 $ (39) $ $ $ (494) (3,109) 1,715 (3,109) 950 950 January 1, 2021 Net loss Remeasurements on employee benefit liabilities Remeasurements on equity investments Total comprehensive loss Share-based compensation Shares issued, net (Note 7) September 30, 2021 - 1 1 1 1 (2,159) (2,158) 10 - - 584 10 6 (6) 102 578 $ 2,734 $ $ $ (38) $ (2,653) $ $ 145 The accompanying notes are an integral part of the condensed consolidated financial statements. Quarter 3 2021 CONSOLIDATED STATEMENTS OF CASH FLOW Three months ended September 30 Nine months ended September 30 2021 2020 2021 2020 $ (640) $ () (685) $ (3,109) $ (3,486) Note 6 (45) 400 (140) 423 (112) ) 49 (46) (58) 1,414 361 93 64 (114) 110 222 (264) 1,217 (255) 398 114 129 (126) (173) Note 10 Note 5 28 7 9 (78) 286 413 (362) Note 3 (13) (3) 327 (6) 20 (286) 73 (1,996) (12) ( (1,557) 269 Unaudited (Canadian dollars in millions) Cash flows from (used for) Operating Net loss for the period Adjustments to reconcile to net cash from operations Deferred income tax Depreciation and amortization Foreign exchange (gain) loss Employee benefit funding less than expense (Gain) loss on financial instruments Loss on debt settlements and modifications Change in maintenance provisions Changes in non-cash working capital balances Special items Other Net cash flows from (used in) operating activities Financing Proceeds from borrowings Reduction of long-term debt and lease liabilities Shares purchased for cancellation Issue of shares Financing fees Net cash flows from (used in) financing activities Investing Investments, short-term and long-term Additions to property, equipment and intangible assets Proceeds from sale of assets Proceeds from sale and leaseback of assets Other Net cash flows used in investing activities Effect of exchange rate changes on cash and cash equivalents Increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Note 5 6,760 1,114 8,027 (4,234) (2,953) (1,433) Note 5 Note 7 7 Note 7 Note 5 5 6,008 (2,211) (132) 554 (75) 4,144 (196) 3,611 (13) (332) 554 (203) 4,144 (1,299) (368) 51 (72) (867) (149) 5 (282) 2 2. 6 (695) 16 11 15 (602) 20 4 41 (1,423) (644) (892) 53 16 5 2,510 2,710 5,220 $ (37) (1,299) 5,089 3,790 1,562 3,658 1,700 2,090 3,790 $ $ 5,220 $ Note 5 $ 365 Cash payments of interest Cash payments (recoveries) of income taxes 136 $ (42) $ 121 $ (88) $ 419 $ $ $ $ 3 The accompanying notes are an integral part of the condensed consolidated financial statements. 7. SHARE CAPITAL The issued and outstanding shares of Air Canada, along with the potentially issuable shares, were as follows: September 30, December 31, 2021 2020 Issued and outstanding Class A variable voting shares Class B voting shares Total issued and outstanding 86,007,150 271,741,909 357,749,059 111,926,060 220,246,228 332,172,288 Potentially issuable shares Convertible notes 48,687,441 48,687,441 Warrants(1) Note 4 14,576,564 Stock options 4,403,545 5,903,174 Total outstanding and potentially issuable shares 425,416,609 386,762,903 (1) Includes 7,288,282 non-vested warrants at September 30, 2021. Refer to Note 4 for details on vesting conditions. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION Unaudited September 30, December 31, (Canadian dollars in millions) 2021 2020 ASSETS Current Cash and cash equivalents $ 5,220 $ 3,658 Short-term investments 3,482 3,843 Total cash, cash equivalents and short-term investments , 8,702 7,501 Restricted cash 92 106 Accounts receivable 744 644 Aircraft fuel inventory 79 41 Spare parts and supplies inventory 108 125 Prepaid expenses and other current assets 134 254 Total current assets 9,859 8,671 Investments, deposits and other assets , 1,095 833 Property and equipment 11,735 12,137 Pension assets 3,206 | 2,840 Deferred income tax 37 25 Intangible assets 1,095 1,134 Goodwill 3,273 3,273 Total assets $ 30,300 $ 28,913 LIABILITIES Current Accounts payable and accrued liabilities 2,341 $ 2,465 Advance ticket sales 1,932 2,314 Aeroplan and other deferred revenue 861 572 Current portion of long-term debt and lease liabilities Note 5 1,015 1,788 Total current liabilities 6,149 7,139 Long-term debt and lease liabilities Note 5 15,667 11,201 Aeroplan and other deferred revenue 3,771 4,032 Pension and other benefit liabilities 2,551 3,015 Maintenance provisions 968 1,040 Other long-term liabilities Note 4 974 | 696 Deferred income tax 75 75 Total liabilities $ 30,155 $ 27,198 SHAREHOLDERS' EQUITY Share capital Note 4 & 7 2,734 2,1501 Contributed surplus 102 98 Accumulated other comprehensive loss (38) (39) Deficit (2,653) Total shareholders' equity 145 1,715 Total liabilities and shareholders' equity 30,300 $ 28,913 The accompanying notes are an integral part of the condensed consolidated financial statements. . (494) AIR CANADA Condensed Consolidated Financial Statements and Notes Quarter 3 2021 CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS Three months ended September 30 Nine months ended September 30 2021 2020 2021 2020 $ (640) $ (685) $ (3,109) $ (3,486) Unaudited (Canadian dollars in millions) Comprehensive income (loss) Net loss for the period Other comprehensive income (loss), net of tax expense: Items that will not be reclassified to net income Remeasurements on employee benefit liabilities Remeasurements on equity investments Total comprehensive loss Note 6 220 (15) (435) $ () 365 950 444 (12) 1 (88) (332) $ (2,158) $ (3,130) $ CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY Share capital Contributed Accumulated surplus OCI Retained earnings (deficit) $ 3,507 (3,486) Total shareholders' equity $ 4,400 (3,486) $ 785 $ 83 $ 25 444 444 Unaudited (Canadian dollars in millions) January 1, 2020 Net loss Remeasurements on employee benefit liabilities Remeasurements on equity investments Total comprehensive loss Share-based compensation Shares issued, net (Note 7) Shares purchased and cancelled under issuer bid September 30, 2020 - (88) (88) () - (3,042) (88) (3,130) 14 14 558 - 558 - (8) 1,335 (119) 346 (127) 1,715 $ $ 97 $ (63) $ $ $ 2,150 $ 98 $ (39) $ $ $ (494) (3,109) 1,715 (3,109) 950 950 January 1, 2021 Net loss Remeasurements on employee benefit liabilities Remeasurements on equity investments Total comprehensive loss Share-based compensation Shares issued, net (Note 7) September 30, 2021 - 1 1 1 1 (2,159) (2,158) 10 - - 584 10 6 (6) 102 578 $ 2,734 $ $ $ (38) $ (2,653) $ $ 145 The accompanying notes are an integral part of the condensed consolidated financial statements. Quarter 3 2021 CONSOLIDATED STATEMENTS OF CASH FLOW Three months ended September 30 Nine months ended September 30 2021 2020 2021 2020 $ (640) $ () (685) $ (3,109) $ (3,486) Note 6 (45) 400 (140) 423 (112) ) 49 (46) (58) 1,414 361 93 64 (114) 110 222 (264) 1,217 (255) 398 114 129 (126) (173) Note 10 Note 5 28 7 9 (78) 286 413 (362) Note 3 (13) (3) 327 (6) 20 (286) 73 (1,996) (12) ( (1,557) 269 Unaudited (Canadian dollars in millions) Cash flows from (used for) Operating Net loss for the period Adjustments to reconcile to net cash from operations Deferred income tax Depreciation and amortization Foreign exchange (gain) loss Employee benefit funding less than expense (Gain) loss on financial instruments Loss on debt settlements and modifications Change in maintenance provisions Changes in non-cash working capital balances Special items Other Net cash flows from (used in) operating activities Financing Proceeds from borrowings Reduction of long-term debt and lease liabilities Shares purchased for cancellation Issue of shares Financing fees Net cash flows from (used in) financing activities Investing Investments, short-term and long-term Additions to property, equipment and intangible assets Proceeds from sale of assets Proceeds from sale and leaseback of assets Other Net cash flows used in investing activities Effect of exchange rate changes on cash and cash equivalents Increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period Note 5 6,760 1,114 8,027 (4,234) (2,953) (1,433) Note 5 Note 7 7 Note 7 Note 5 5 6,008 (2,211) (132) 554 (75) 4,144 (196) 3,611 (13) (332) 554 (203) 4,144 (1,299) (368) 51 (72) (867) (149) 5 (282) 2 2. 6 (695) 16 11 15 (602) 20 4 41 (1,423) (644) (892) 53 16 5 2,510 2,710 5,220 $ (37) (1,299) 5,089 3,790 1,562 3,658 1,700 2,090 3,790 $ $ 5,220 $ Note 5 $ 365 Cash payments of interest Cash payments (recoveries) of income taxes 136 $ (42) $ 121 $ (88) $ 419 $ $ $ $ 3 The accompanying notes are an integral part of the condensed consolidated financial statements