Answered step by step

Verified Expert Solution

Question

1 Approved Answer

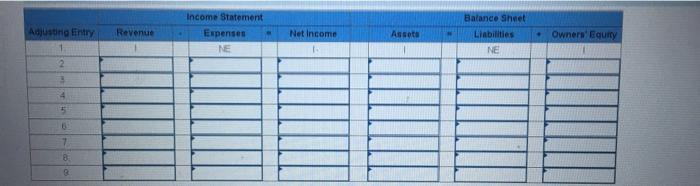

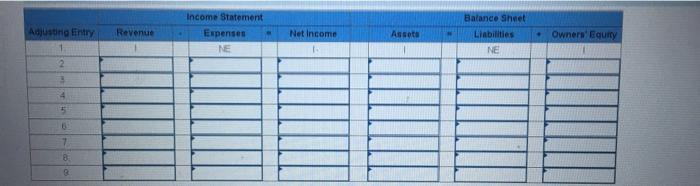

how would this be filled out using symbol I for increase, D for decrease, and Ne for no effect Ken Hensley Enterprises, Inc. is a

how would this be filled out using symbol I for increase, D for decrease, and Ne for no effect

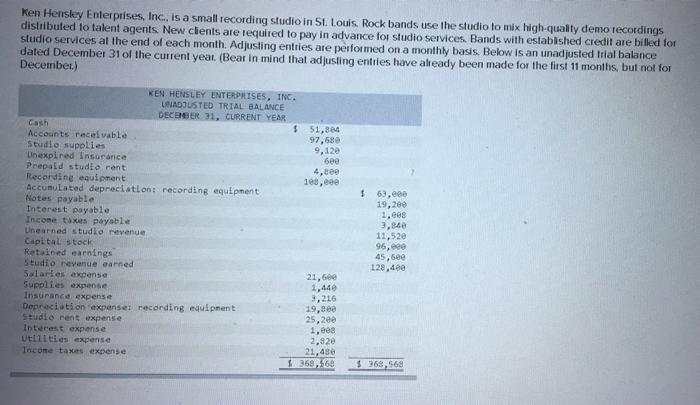

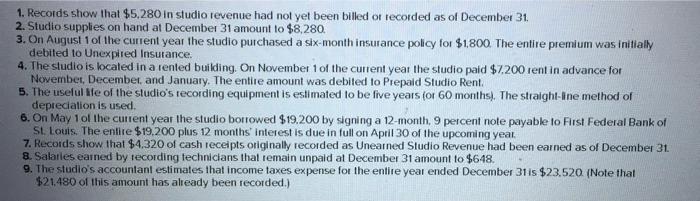

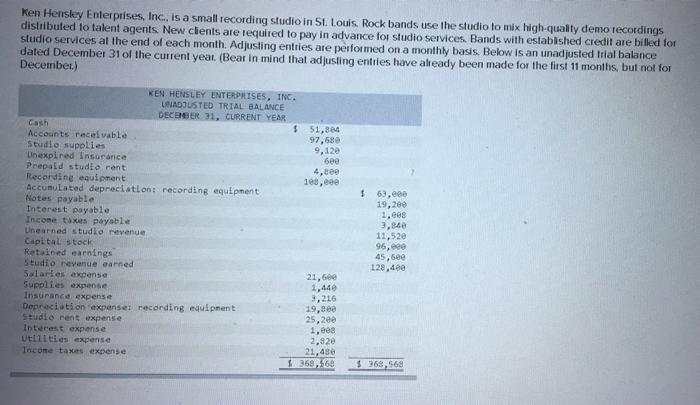

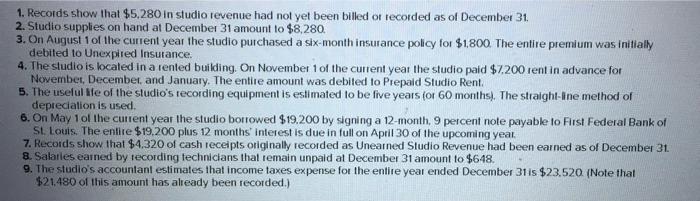

Ken Hensley Enterprises, Inc. is a small recording studio in St. Louis. Rock bands use the studio to mix high-qualty demo recordings distributed to talent agents. New clients are required to pay in advance for studio services. Bands with established credit are billed for studio services at the end of each month. Adjusting entries are performed on a monthly basis. Below is an unadjusted trial balance dated December 31 of the current year. (Bear in mind that adjusting entries have already been made for the first 11 months, but not for December) $ KEN HERSLEY ENTERPRISES, INC. UNADJUSTED TRIAL BALANCE DECEMBER 31, CURRENT YEAR Cash $ 51,800 Accounts receivable 97,580 Studio supplies 9,120 Unexpired Insurance bee Prepaid studio rent 4,8ee Recording equipment 108,ese Accumulated depreciation recording equipment Notes payable Interest payable Income taxes payable Unearned studio wavenue Capital stock Retained earnings Studio revenue earned Salaries excense 21,600 Supplies expense 1,440 Insurance expense 3,216 Depreciation expenser recording equipment 19,8 Studio rent expense 25,200 Interest expense 1.ee Utilities expense 2,920 Income taxes expense 21,480 1 368,568 63, 19,280 1.ee 3.840 12,520 95, ese 45,6ee 128,4 $368,568 1. Records show that $5,280 in studio revenue had not yet been billed or recorded as of December 31 2. Studio supplies on hand at December 31 amount to $8,280. 3. On August 1 of the current year the studio purchased a six-month insurance policy for $1,800. The entire premium was initially debited to Unexpired Insurance. 4. The studio is located in a rented building. On November 1 of the current year the studio paid $7.200 rent in advance for November, December, and January, The entire amount was debited to Prepaid Studio Rent 5. The useful le of the studio's recording equipment is estimated to be five years for 60 months). The straight-line method of depreciation is used. 6. On May 1 of the current year the studio borrowed $19.200 by signing a 12-month, 9 percent note payable to list Federal Bank of St. Louis. The entire $19.200 plus 12 months' interest is due in full on April 30 of the upcoming year. 7. Records show that $4.320 of cash receipts originally recorded as Unearned Studio Revenue had been earned as of December 31. 8. Salaties earned by tecording technicians that remain unpaid al December 31 amount to $648. 9. The studio's accountant estimates that income taxes expense for the entire year ended December 31is $23.520 (Note that $21.480 of this amount has already been recorded.) Revenue Income Statement Expenses NE Net Income Asset Balance Sheet Liabilities NE . Owners' Equity Adjusting Entry 1 2 3 4 5 7 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started