How would you complete a full tax return for a partnership, s-corp and c-corp based on the information provided below.

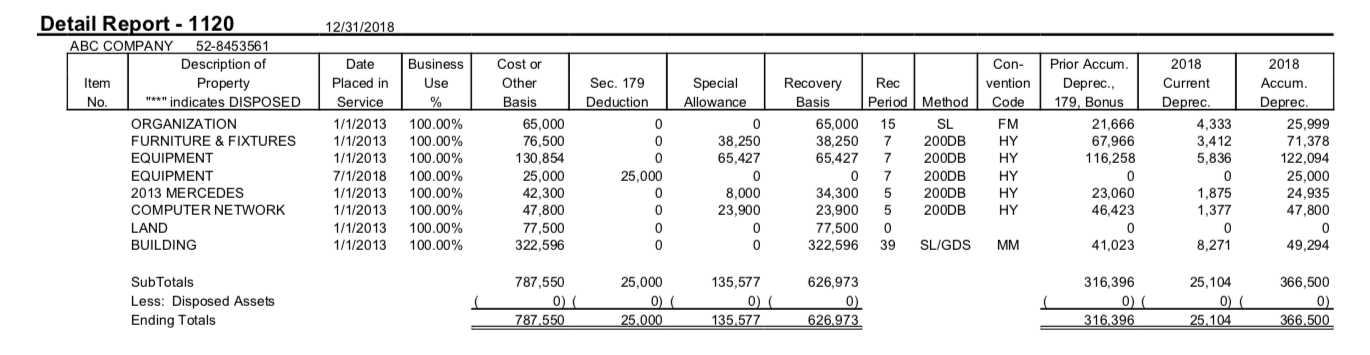

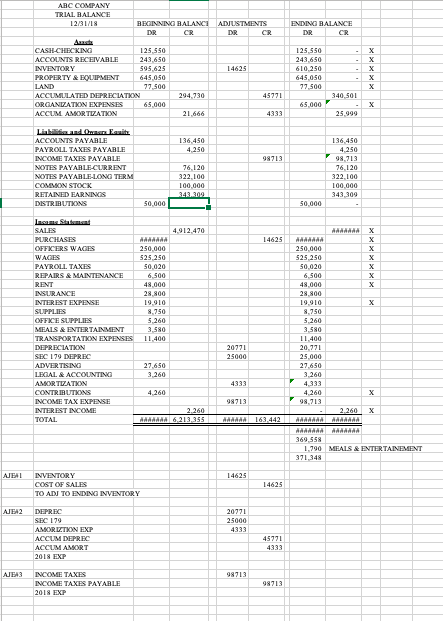

Detail Report - 1120 12/31/2018 ABC COMPANY 52-8453561 Description of Date Business Cost or Con- Prior Accum. 2018 2018 Item Property Placed in Use Other Sec. 179 Special Recovery Rec vention Deprec., Current Accum. No. "**" indicates DISPOSED Service % Basis Deduction Allowance Basis Period Method Code 179, Bonus Deprec. Deprec. ORGANIZATION 1/1/2013 100.00% 65,000 0 65,000 15 SL FM 21,666 4,333 25,999 FURNITURE & FIXTURES 1/1/2013 100.00% 76,500 38,250 38,250 7 200DB HY 67,966 3,412 71,378 EQUIPMENT 1/1/2013 100.00% 130,854 65,427 65,427 200DB HY 116,258 5,836 122,094 EQUIPMENT 7/1/2018 100.00% 25,000 25,000 0 0 200DB HY 0 25,000 2013 MERCEDES 1/1/2013 100.00% 42.300 8,000 34,300 200DB HY 23,060 1,875 24,935 COMPUTER NETWORK 1/1/2013 100.00% 47,800 23,900 23,900 200DB HY 46,423 1,377 47,800 LAND 1/1/2013 100.00% 77,500 0 77,500 0 0 BUILDING 1/1/2013 100.00% 322,596 O 322,596 39 SL/GDS MM 41,023 8,271 49,294 Sub Totals 787,550 25,000 135,577 626,973 316,396 25, 104 366,500 Less: Disposed Assets 0) ( D) ( 0) 0) ( 0) ( 0) Ending Totals 787.550 25,000 135.577 626,973 316,396 25.104 366.500ARC COMPANY TRIAL BALANCE 1231/8 BEGINNING BALANCE ADJUSTMENTS ENDING BALANCE DR. CR DR CR CASH-CHECKING 125.550 125,550 ACCOUNTS RECEIVABLE 243.650 243.650 X X INVENTORY 595.625 14625 610.250 PROPERTY & EQUIPMENT 645,050 645 050 LAND 77.500 77.500 ACCUMULATED DEPRECIATION 294 730 45771 340.501 ORGANRATIONN EXPENSES 65 000 65 000 F ACCUM AMORTRATION 21.666 4333 25,909 ACCOUNTS PAYABLE 136,450 136 450 PAYROLL TAXES PAYABLE 4.250 4.250 INCOME TAXES PAYABLE 98713 08,713 NOTES PAYABLE CURRENT 76. 120 76. 120 NOTES PAYABLE-LONG TERM 322,100 322,100 COMMON STOCK 10G.060 RETAINED EARNINGS 343.304 343,309 DISTRIBUTIONS 50.060 50.000 SALE 4.912.470 PURCHASES 14625 OFFICERS WAGES 250.000 250.060 WAGE 525,250 525,250 X PAYROLL TAXES 50.020 50.020 X REPAIRS & MAINTENANCE 6.500 6.500 X RENT 48 000 48,060 INSURANCE 28.800 28,800 INTEREST EXPENSE 19.910 19.910 X SUPPLIES 8.750 8.750 OFFICE SUPPLIES 5.260 5,260 MEALS & ENTERTAINMENT 3.580 3.580 TRANSPORTATION EXPENSES 11.400 1 1.400 DEPRECIATION 20771 SEC 179 DEPREC 20.371 25060 25.060 ADVERTISING 27.650 LEGAL & ACCOUNTING 27.650 3.260 3.260 AMORTIZATION BEEF 4.933 CONTRIBUTIONS 4.260 4.260 X INCOME TAX EXPENSE 98713 98,713 INTEREST INCOME 2.260 2.260 TOTAL MMMMMM 6.213,355 MAMMA 163.442 369.558 1, 790 MEALS & ENTERTAINEMENT 371,348 INVENTORY 14625 COST OF SALES 14625 TO ADI TO ENDING INVENTORY DEPREC 20771 SEC 179 25060 AMORETHAN EXIT 4393 ACCUM DEPREC 45771 ACCUM AMORT FEET 2018 EXP INCOME TAXES 93713 INCOME TAXES PAYABLE 98713 2018 EXP