Answered step by step

Verified Expert Solution

Question

1 Approved Answer

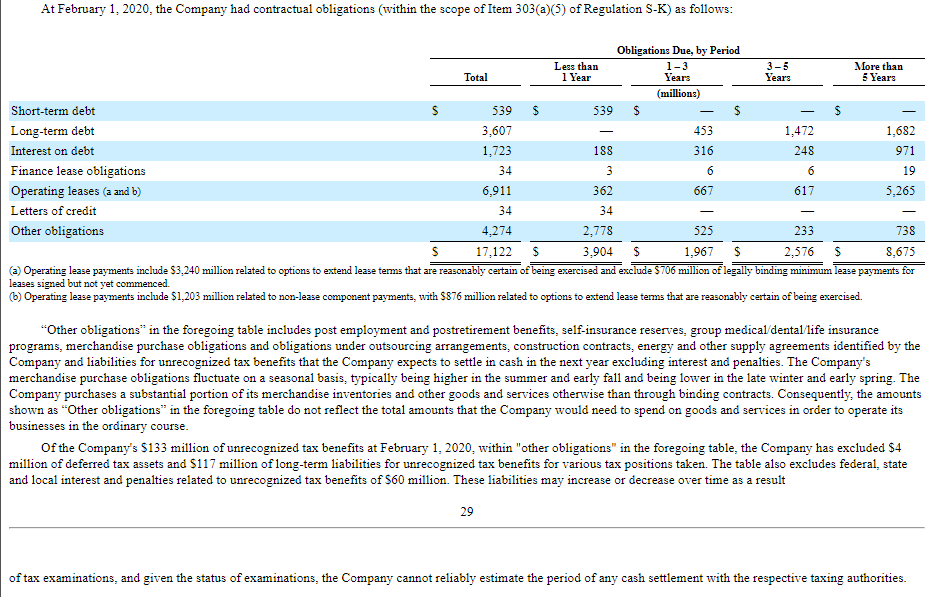

How would you describe the pattern of required debt payments over the next five years, increasing, decreasing, or exhibiting no discernible pattern? At February 1,

How would you describe the pattern of required debt payments over the next five years, increasing, decreasing, or exhibiting no discernible pattern?"

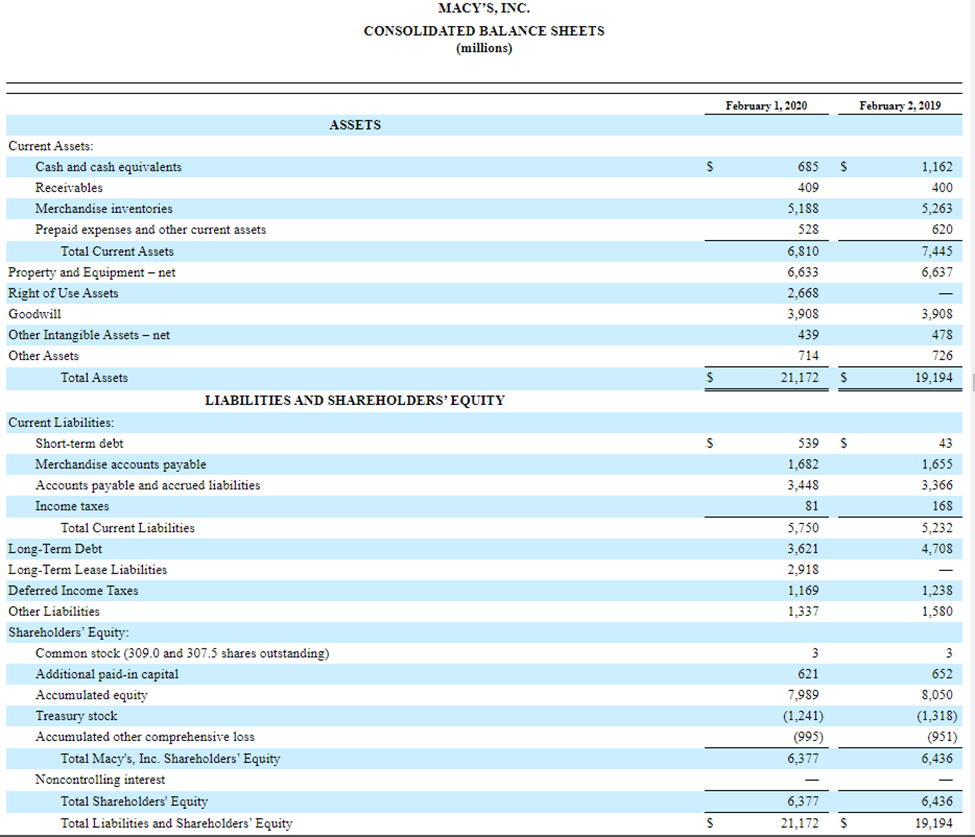

At February 1, 2020, the Company had contractual obligations (within the scope of Item 303(a)(5) of Regulation S-K) as follows: Short-term debt Long-term debt Interest on debt Finance lease obligations Operating leases (a and b) Letters of credit Total S 539 Less than 1 Year Obligation: Due, by Period 1-3 Years 3-5 Years (millions) 539 $ - S - 3,607 453 1,723 188 316 1,472 248 34 3 6 6 6,911 362 667 617 S 34 4,274 17,122 $ 34 - - 2,778 3,904 $ More than 5 Years S - 1,682 971 19 5,265 Other obligations 525 1,967 $ 233 2,576 $ 738 8,675 (a) Operating lease payments include $3,240 million related to options to extend lease terms that are reasonably certain of being exercised and exclude $706 million of legally binding minimum lease payments for leases signed but not yet commenced. (b) Operating lease payments include $1,203 million related to non-lease component payments, with $876 million related to options to extend lease terms that are reasonably certain of being exercised. "Other obligations" in the foregoing table includes post employment and postretirement benefits, self-insurance reserves, group medical/dental/life insurance programs, merchandise purchase obligations and obligations under outsourcing arrangements, construction contracts, energy and other supply agreements identified by the Company and liabilities for unrecognized tax benefits that the Company expects to settle in cash in the next year excluding interest and penalties. The Company's merchandise purchase obligations fluctuate on a seasonal basis, typically being higher in the summer and early fall and being lower in the late winter and early spring. The Company purchases a substantial portion of its merchandise inventories and other goods and services otherwise than through binding contracts. Consequently, the amounts shown as "Other obligations" in the foregoing table do not reflect the total amounts that the Company would need to spend on goods and services in order to operate its businesses in the ordinary course. Of the Company's $133 million of unrecognized tax benefits at February 1, 2020, within "other obligations" in the foregoing table, the Company has excluded $4 million of deferred tax assets and $117 million of long-term liabilities for unrecognized tax benefits for various tax positions taken. The table also excludes federal, state and local interest and penalties related to unrecognized tax benefits of $60 million. These liabilities may increase or decrease over time as a result 29 of tax examinations, and given the status of examinations, the Company cannot reliably estimate the period of any cash settlement with the respective taxing authorities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started