Question

How would you explain the formula for computing individual taxable income. Why do you think this formula is so much more complicated than the formula

How would you explain the formula for computing individual taxable income. Why do you think this formula is so much more complicated than the formula for computing corporate taxable income?

Explain the three sources of tax law and the importance of each. Which source do you think is the most important?

How would you describe the relationship between tax base and tax rate in determining the revenue collected by the government? Give an example of how a particular tax would fit into the various components of the equation ?

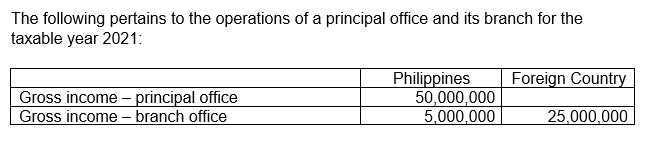

The following pertains to the operations of a principal office and its branch for the taxable year 2021: Gross income - principal office Gross income - branch office Philippines 50,000,000 5,000,000 Foreign Country 25,000,000

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To explain the formula for computing individual taxable income its important to understand that individual taxable income is calculated by star...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started