Answered step by step

Verified Expert Solution

Question

1 Approved Answer

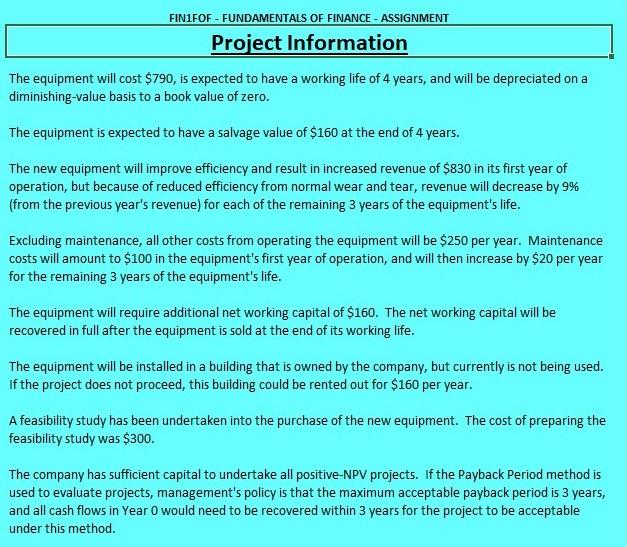

How would you work these out using the balance sheet provided FIN1FOF- FUNDAMENTALS OF FINANCE - ASSIGNMENT Project Information The equipment will cost $790, is

How would you work these out using the balance sheet provided

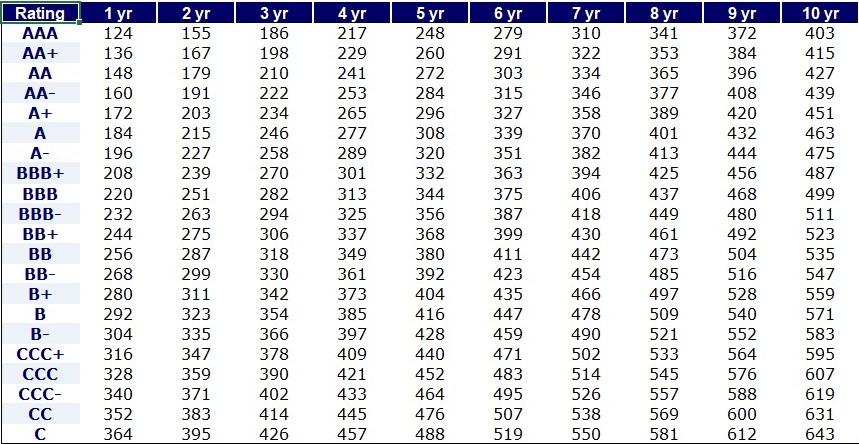

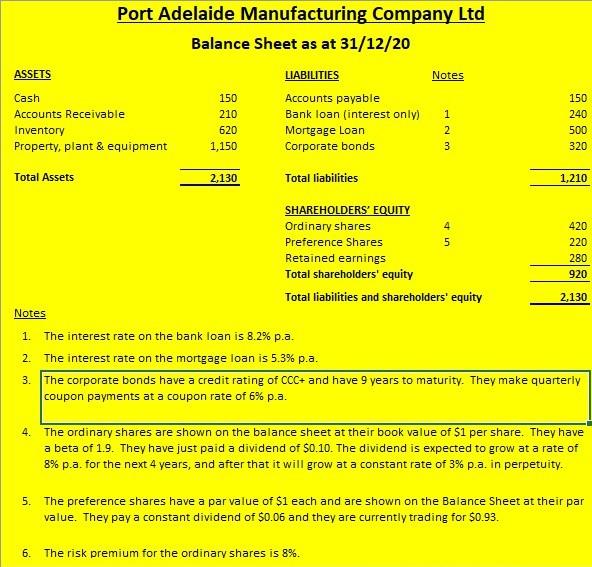

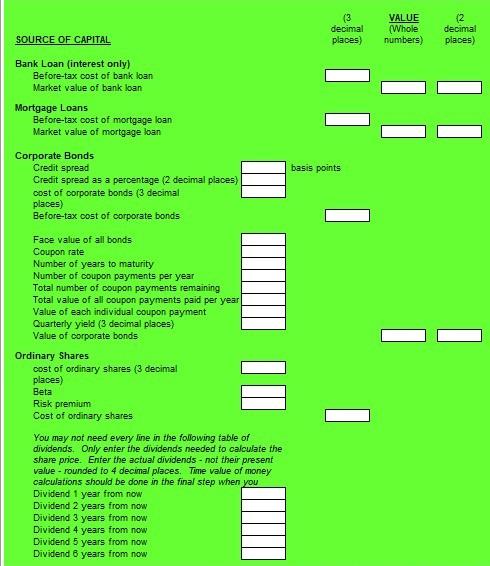

FIN1FOF- FUNDAMENTALS OF FINANCE - ASSIGNMENT Project Information The equipment will cost $790, is expected to have a working life of 4 years, and will be depreciated on a diminishing-value basis to a book value of zero. The equipment is expected to have a salvage value of $160 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $830 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 9% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $250 per year. Maintenance costs will amount to $100 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $160. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $160 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $300. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year O would need to be recovered within 3 years for the project to be acceptable under this method. 10 Rating AA+ AA- A+ - BBB+ BBB- BB+ BB- + B - CCC+ CCC- 1 124 136 148 160 172 184 196 208 220 232 244 256 268 280 292 304 316 328 340 352 364 2 yr 155 167 179 191 203 215 227 239 251 263 275 287 299 311 323 335 347 359 371 383 395 3 yr 186 198 210 222 234 246 258 270 282 294 306 318 330 342 354 366 378 390 402 414 426 4 217 229 241 253 265 277 289 301 313 325 337 349 361 373 385 397 409 421 433 445 457 5 yr 248 260 272 284 296 308 320 332 344 356 368 380 392 404 416 428 440 452 464 476 488 6 yr 279 291 303 315 327 339 351 363 375 387 399 411 423 435 447 459 471 483 495 507 519 7 yr 310 322 334 346 358 370 382 394 406 418 430 442 454 466 478 490 502 514 526 538 550 8 341 353 365 377 389 401 413 425 437 449 461 473 485 497 509 521 533 545 557 569 581 9 372 384 396 408 420 432 444 456 468 480 492 504 516 528 540 552 564 576 588 600 612 403 415 427 439 451 463 475 487 499 511 523 535 547 559 571 583 595 607 619 631 643 Port Adelaide Manufacturing Company Ltd Balance Sheet as at 31/12/20 ASSETS LIABILITIES Notes Cash 150 Accounts payable Accounts Receivable 210 Bank loan (interest only) Inventory 620 Mortgage Loan Property, plant & equipment 1,150 Corporate bonds 1 150 240 500 320 w N Total Assets 2,130 Total liabilities 1,210 4 SHAREHOLDERS' EQUITY Ordinary shares Preference Shares 5 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 420 220 280 920 2,130 Notes 1. The interest rate on the bank loan is 8.2% p.a. 2. The interest rate on the mortgage loan is 5.3% p.a. The corporate bonds have a credit rating of CCC+ and have 9 years to maturity. They make quarterly coupon payments at a coupon rate of 6% p.a. 3. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.9. They have just paid a dividend of $0.10. The dividend is expected to grow at a rate of 8% p.a. for the next 4 years, and after that it will grow at a constant rate of 3% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.06 and they are currently trading for $0.93. 6. The risk premium for the ordinary shares is 8%. decimal places) VALUE (Whole numbers) (2 decimal places) SOURCE OF CAPITAL Bank Loan (interest only) Before-tax cost of bank loan Market value of bank loan Mortgage Loans Before-tax cost of mortgage loan Market value of mortgage loan Corporate Bonds Credit spread Credit spread as a percentage (2 decimal places) cost of corporate bonds (3 decimal places) Before-tax cost of corporate bonds basis points Face value of all bonds Coupon rate Number of years to maturity Number of coupon payments per year Total number of coupon payments remaining Total value of all coupon payments paid per year Value of each individual coupon payment Quarterly yield (3 decimal places) Value of corporate bonds Ordinary Shares cost of ordinary shares (3 decimal places) Beta Risk premium Cost of ordinary shares You may not need every line in the following table of dividends. Only enter the dividends needed to calculate the share price. Enter the actual dividends - not their present value - rounded to 4 decimal places. Time value of money calculations should be done in the final step when you Dividend 1 year from now Dividend 2 years from now Dividend 3 years from now Dividend 4 years from now Dividend 5 years from now Dividend 6 years from now FIN1FOF- FUNDAMENTALS OF FINANCE - ASSIGNMENT Project Information The equipment will cost $790, is expected to have a working life of 4 years, and will be depreciated on a diminishing-value basis to a book value of zero. The equipment is expected to have a salvage value of $160 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $830 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 9% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $250 per year. Maintenance costs will amount to $100 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $160. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $160 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $300. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year O would need to be recovered within 3 years for the project to be acceptable under this method. 10 Rating AA+ AA- A+ - BBB+ BBB- BB+ BB- + B - CCC+ CCC- 1 124 136 148 160 172 184 196 208 220 232 244 256 268 280 292 304 316 328 340 352 364 2 yr 155 167 179 191 203 215 227 239 251 263 275 287 299 311 323 335 347 359 371 383 395 3 yr 186 198 210 222 234 246 258 270 282 294 306 318 330 342 354 366 378 390 402 414 426 4 217 229 241 253 265 277 289 301 313 325 337 349 361 373 385 397 409 421 433 445 457 5 yr 248 260 272 284 296 308 320 332 344 356 368 380 392 404 416 428 440 452 464 476 488 6 yr 279 291 303 315 327 339 351 363 375 387 399 411 423 435 447 459 471 483 495 507 519 7 yr 310 322 334 346 358 370 382 394 406 418 430 442 454 466 478 490 502 514 526 538 550 8 341 353 365 377 389 401 413 425 437 449 461 473 485 497 509 521 533 545 557 569 581 9 372 384 396 408 420 432 444 456 468 480 492 504 516 528 540 552 564 576 588 600 612 403 415 427 439 451 463 475 487 499 511 523 535 547 559 571 583 595 607 619 631 643 Port Adelaide Manufacturing Company Ltd Balance Sheet as at 31/12/20 ASSETS LIABILITIES Notes Cash 150 Accounts payable Accounts Receivable 210 Bank loan (interest only) Inventory 620 Mortgage Loan Property, plant & equipment 1,150 Corporate bonds 1 150 240 500 320 w N Total Assets 2,130 Total liabilities 1,210 4 SHAREHOLDERS' EQUITY Ordinary shares Preference Shares 5 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 420 220 280 920 2,130 Notes 1. The interest rate on the bank loan is 8.2% p.a. 2. The interest rate on the mortgage loan is 5.3% p.a. The corporate bonds have a credit rating of CCC+ and have 9 years to maturity. They make quarterly coupon payments at a coupon rate of 6% p.a. 3. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.9. They have just paid a dividend of $0.10. The dividend is expected to grow at a rate of 8% p.a. for the next 4 years, and after that it will grow at a constant rate of 3% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.06 and they are currently trading for $0.93. 6. The risk premium for the ordinary shares is 8%. decimal places) VALUE (Whole numbers) (2 decimal places) SOURCE OF CAPITAL Bank Loan (interest only) Before-tax cost of bank loan Market value of bank loan Mortgage Loans Before-tax cost of mortgage loan Market value of mortgage loan Corporate Bonds Credit spread Credit spread as a percentage (2 decimal places) cost of corporate bonds (3 decimal places) Before-tax cost of corporate bonds basis points Face value of all bonds Coupon rate Number of years to maturity Number of coupon payments per year Total number of coupon payments remaining Total value of all coupon payments paid per year Value of each individual coupon payment Quarterly yield (3 decimal places) Value of corporate bonds Ordinary Shares cost of ordinary shares (3 decimal places) Beta Risk premium Cost of ordinary shares You may not need every line in the following table of dividends. Only enter the dividends needed to calculate the share price. Enter the actual dividends - not their present value - rounded to 4 decimal places. Time value of money calculations should be done in the final step when you Dividend 1 year from now Dividend 2 years from now Dividend 3 years from now Dividend 4 years from now Dividend 5 years from now Dividend 6 years from nowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started