Question

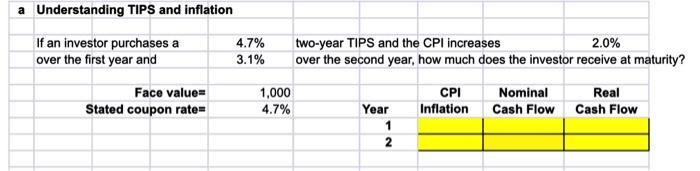

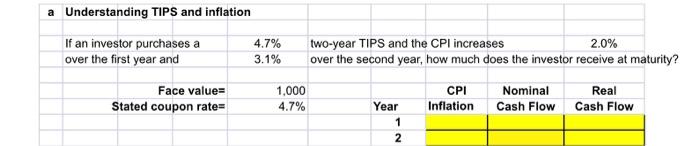

How would you work this out in excel? a Understanding TIPS and inflation If an investor purchases a over the first year and Face value==

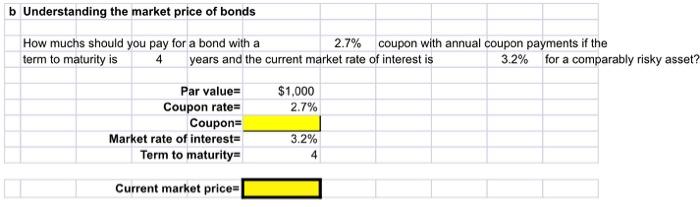

How would you work this out in excel?

a Understanding TIPS and inflation If an investor purchases a over the first year and Face value== Stated coupon rate= 4.7% 3.1% 1,000 4.7% two-year TIPS and the CPI increases 2.0% over the second year, how much does the investor receive at maturity? Year 1 2 CPI Inflation Nominal Cash Flow Real Cash Flow

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Note that in TIPS the principal amount increases by the inflation so as the investors returns are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cases and Exercises in Organization Development & Change

Authors: Donald L. Anderson

1st edition

1412987733, 978-1412987738

Students also viewed these Business Communication questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App