Answered step by step

Verified Expert Solution

Question

1 Approved Answer

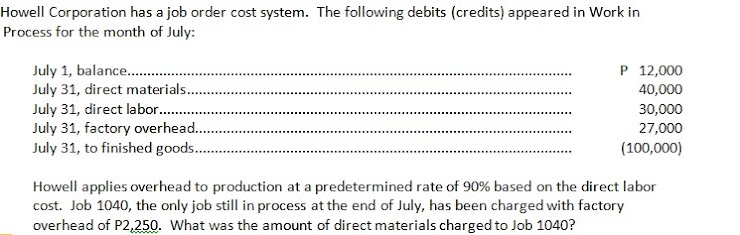

Howell Corporation has a job order cost system. The following debits (credits) appeared in Work in Process for the month of July: July 1,

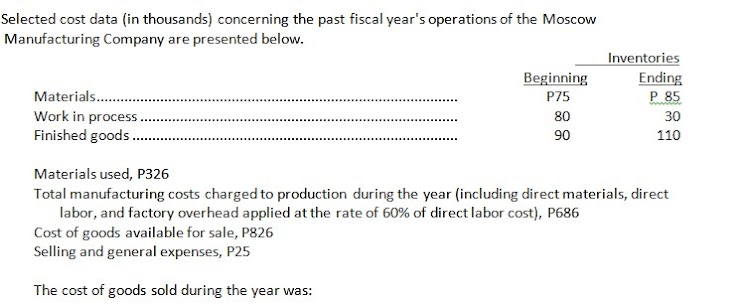

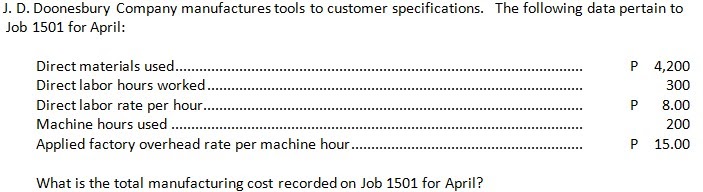

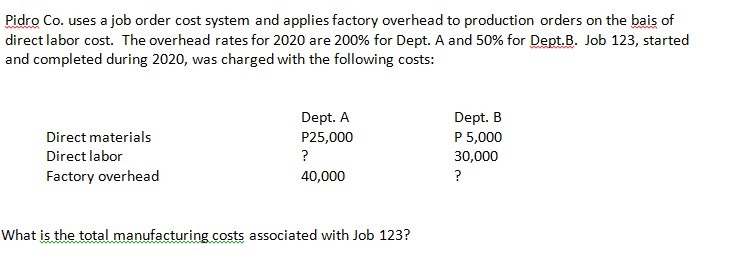

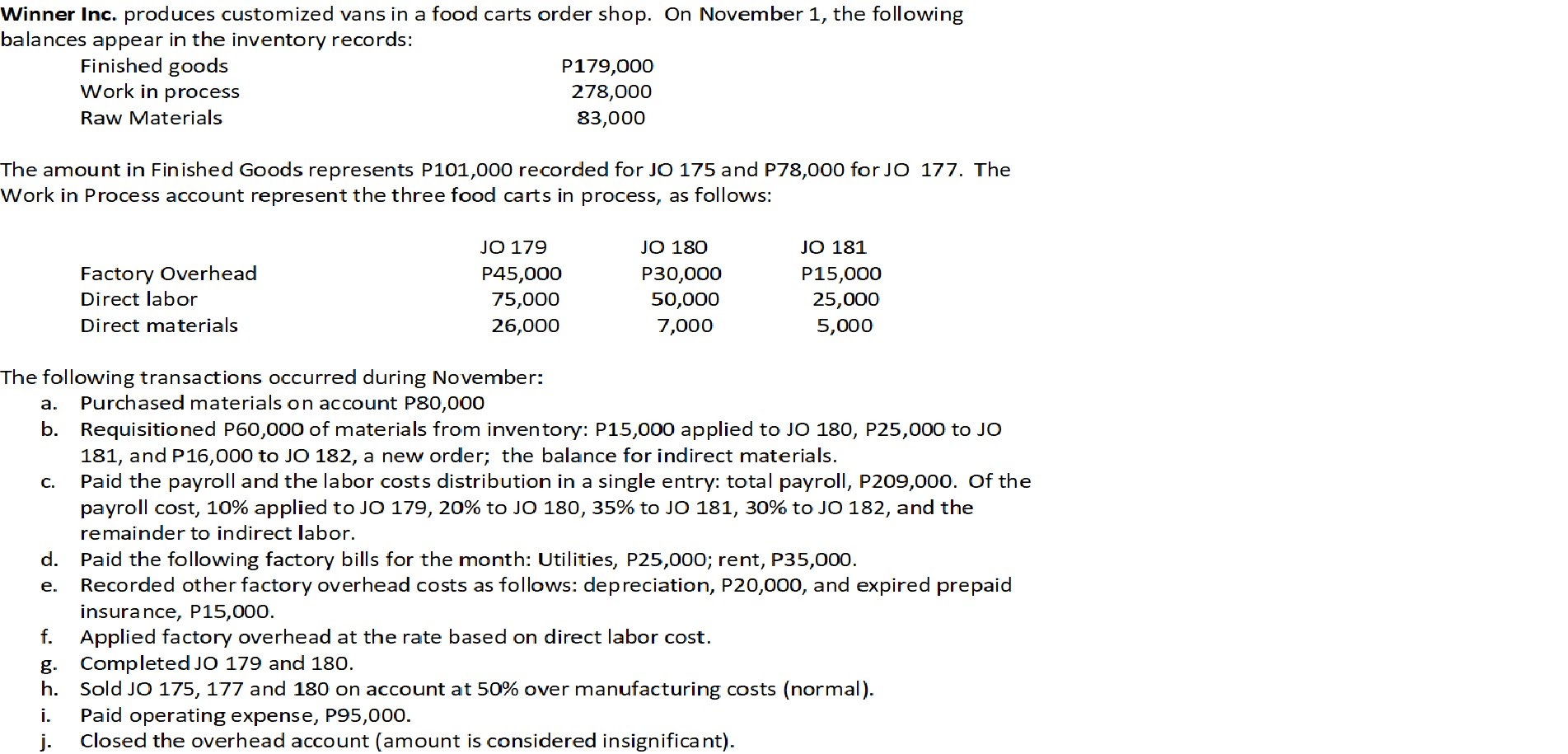

Howell Corporation has a job order cost system. The following debits (credits) appeared in Work in Process for the month of July: July 1, balance....... July 31, direct materials.. July 31, direct labor........ July 31, factory overhead... July 31, to finished goods........ P 12,000 40,000 30,000 27,000 (100,000) Howell applies overhead to production at a predetermined rate of 90% based on the direct labor cost. Job 1040, the only job still in process at the end of July, has been charged with factory overhead of P2,250. What was the amount of direct materials charged to Job 1040? Selected cost data (in thousands) concerning the past fiscal year's operations of the Moscow Manufacturing Company are presented below. Materials.... Work in process. Finished goods. Materials used, P326 Inventories Beginning P75 Ending P 85 80 30 90 110 Total manufacturing costs charged to production during the year (including direct materials, direct labor, and factory overhead applied at the rate of 60% of direct labor cost), P686 Cost of goods available for sale, P826 Selling and general expenses, P25 The cost of goods sold during the year was: J. D. Doonesbury Company manufactures tools to customer specifications. The following data pertain to Job 1501 for April: Direct materials used.......... Direct labor hours worked.. P 4,200 300 Direct labor rate per hour.......... Machine hours used....... P 8.00 200 Applied factory overhead rate per machine hour. P 15.00 What is the total manufacturing cost recorded on Job 1501 for April? Pidro Co. uses a job order cost system and applies factory overhead to production orders on the bais of direct labor cost. The overhead rates for 2020 are 200% for Dept. A and 50% for Dept. B. Job 123, started and completed during 2020, was charged with the following costs: Direct materials Direct labor Factory overhead Dept. A P25,000 Dept. B P 5,000 ? 30,000 40,000 ? What is the total manufacturing costs associated with Job 123? Winner Inc. produces customized vans in a food carts order shop. On November 1, the following balances appear in the inventory records: Finished goods Work in process Raw Materials P179,000 278,000 83,000 The amount in Finished Goods represents P101,000 recorded for JO 175 and P78,000 for JO 177. The Work in Process account represent the three food carts in process, as follows: Factory Overhead Direct labor Direct materials JO 179 P45,000 75,000 JO 180 P30,000 50,000 JO 181 P15,000 25,000 26,000 7,000 5,000 The following transactions occurred during November: Purchased materials on account P80,000 a. b. Requisitioned P60,000 of materials from inventory: P15,000 applied to JO 180, P25,000 to JO 181, and P16,000 to JO 182, a new order; the balance for indirect materials. C. Paid the payroll and the labor costs distribution in a single entry: total payroll, P209,000. Of the payroll cost, 10% applied to JO 179, 20% to JO 180, 35% to JO 181, 30% to JO 182, and the remainder to indirect labor. d. Paid the following factory bills for the month: Utilities, P25,000; rent, P35,000. e. Recorded other factory overhead costs as follows: depreciation, P20,000, and expired prepaid insurance, P15,000. f. Applied factory overhead at the rate based on direct labor cost. g. Completed JO 179 and 180. h. Sold JO 175, 177 and 180 on account at 50% over manufacturing costs (normal). . Paid operating expense, P95,000. j. Closed the overhead account (amount is considered insignificant).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started