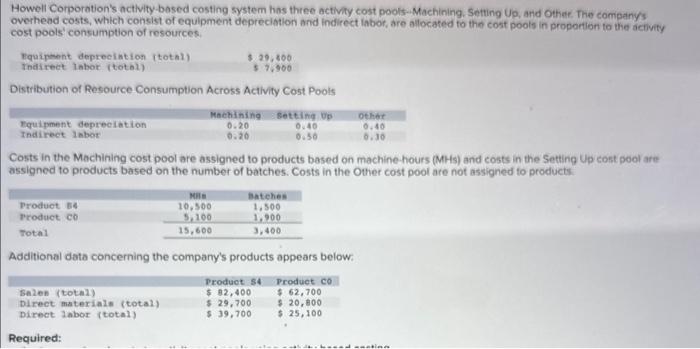

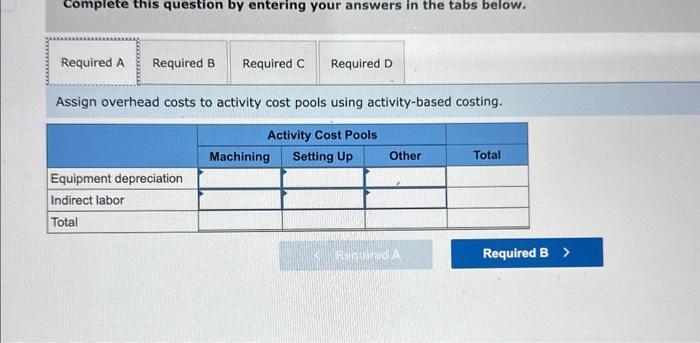

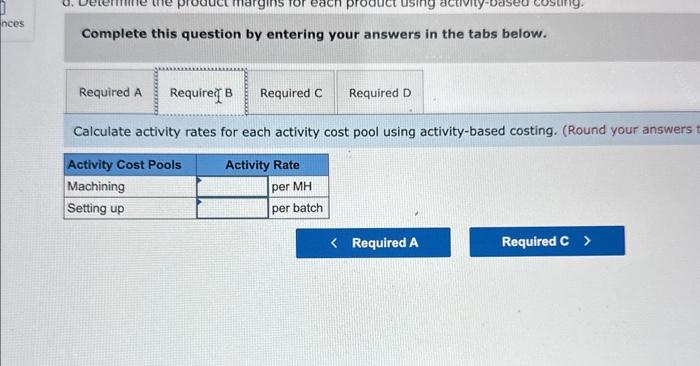

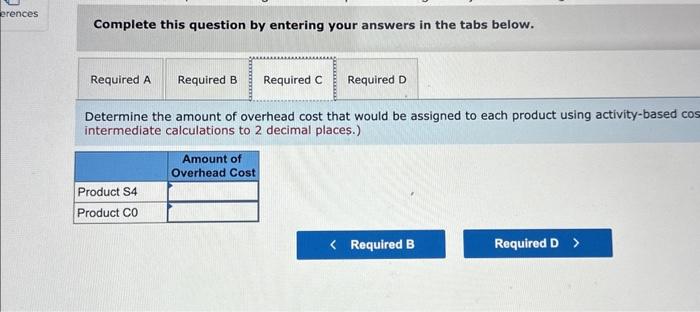

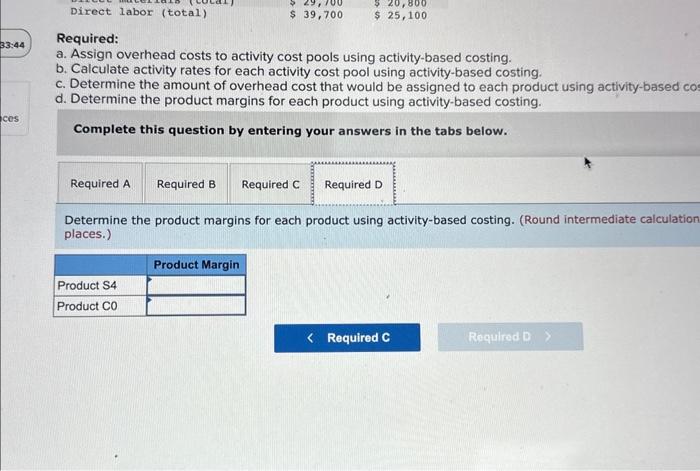

Howell Corporation's nctlvity-besed costing system has three activily cost pools-Machining. Setting Up, and Other. The companys overhead costs, which consist of equipment deprecintion and indirect iabor, are allocated to the cost poots in proportion to the activity cost pools' consumption of resources. Distribution of Resource Consumption Across Activity Cost Pools Costs in the Machining cost pool are assigned to products based on machine hours (MHs) and costs in the Seting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products Additional data concerning the company's products appears below: Complete this question by entering your answers in the tabs below. Assign overhead costs to activity cost pools using activity-based costing. Complete this question by entering your answers in the tabs below. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers Complete this question by entering your answers in the tabs below. Determine the amount of overhead cost that would be assigned to each product using activity-based ec intermediate calculations to 2 decimal places.) Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based co d. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Determine the product margins for each product using activity-based costing. (Round intermediate calculation places.) Howell Corporation's nctlvity-besed costing system has three activily cost pools-Machining. Setting Up, and Other. The companys overhead costs, which consist of equipment deprecintion and indirect iabor, are allocated to the cost poots in proportion to the activity cost pools' consumption of resources. Distribution of Resource Consumption Across Activity Cost Pools Costs in the Machining cost pool are assigned to products based on machine hours (MHs) and costs in the Seting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products Additional data concerning the company's products appears below: Complete this question by entering your answers in the tabs below. Assign overhead costs to activity cost pools using activity-based costing. Complete this question by entering your answers in the tabs below. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers Complete this question by entering your answers in the tabs below. Determine the amount of overhead cost that would be assigned to each product using activity-based ec intermediate calculations to 2 decimal places.) Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based co d. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Determine the product margins for each product using activity-based costing. (Round intermediate calculation places.)