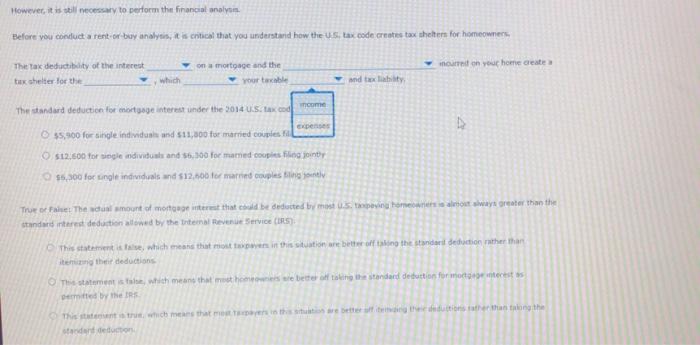

However, it is still necessary to perform the financal analysis Before you conduct a rent or buy analysis, it is critical that you understand how the U.S. tax code creates tax shelters for homeowners. incurred on your home create a The tax deductibility of the interest tax shelter for the on a mortone and the your taxable and tax ability earned The standard deduction for mortopad under the 2014 Stix code 55,900 for single individuals and 11,800 for married couples filing jointly $12.600 for single individuals and 56,000 for mamed couples ing jointly 56,500 for single individuals and 513,600 for named couples ing jointly True False: The actual smount of mortgage interest that could be deducted by most us, taxpaying homeowners mest always greater than the standard interest deduction allowed by the Internal Revenue Service (RS) The sements which means that most taxpayers in the station are better off taking the standard deduction rather than eming their deduction The statements, which means that most homeowners are better of taking the standard duction for mortgages Dermed by the The statement to which means that most stoor are better of the dochons other than the Standard seducto However, it is still necessary to perform the financial analysis. Before you conduct a rent or buy analysis, it is entical that you understand how the US tax code creates tax shelters for homeowners incurred on your home create a The tax deductibility of the interest tax shelter for the which on a mortgage and the your acab repair and maintenance expenses The standard deduction for mortgage interest under the 2014 U.S. tax property taxes $5,900 for single individuals and 11,800 for marned couples filing only $12,600 for single individuals and 56,300 for manned couples in joint $6,000 for single individuals and 512,600 for manned couplesing only True or Face The actual amount of mortgage interest that could be deducted by most taxpein homeowners almost always greater than the Standard interest deduction allowed by the Internal Revenue Service (RS) The statement to which means that most tapes in the store better off on the standard deduction rather than itemcing their deduction The statements, which means that most homeowners are better off taking the standarditeduction formato de rest permitted by the RS Thement strut, which means that matters in this store better to their des her that along the Standard deduction, However, it is still necessary to perform the Financial acalysis. Before you conducta rent or buy analysis, it is cntical that you understand how the US, tax code creates tax shelters for homeowners curred on your home create a The tax deductibility of the interest tux shelter for the on a mortgage and the your table which and tax liability homeowner The standard dedu agentages under the 2014 U.S. tax code in renter $5.900 Jums and $11,800 for married couples ting jointly $12,600 for single individuals and 56.300 for marned couples Filing jointly $6,500 for single individuals and $12.000 for married couples Filing jointly True or False The actual amount of mortgage rest that could be deducted by Saving homeowners is almost always greater than the standard interest deduction allowed by the Internal Revenue Service (IRS) This statement is false, which means that most taxpayers in the station are better off taking the standard deduction rather than te their deductions This statement is false, which means that most homeowners better offsking the standard decentret bermitted by the This statement is to which means that most taxpayers that are better in the doctorather than in the standard deduction However, it is still necessary to perform the Financial analyut. Before you conduct a rent-or-buy endlysis, is entical that you understand how the US, tax code creates a shelters for homeowners. incurred on your home create a The tax deductibility of the interest tax shelter for the on mortgage and the Your taxable which and taxay The standard deduction for more Mere Increases 1014 05. tax code reduce $5.900 for single individuals and med couples ont 512,600 for single individuals and 56.300 for married couples ing jointly $5,000 for single individuals and 17.500 formed couples filing only True or Fall The act out of mortgages that could be deducted by mo.. homeowners most water than the standart interested in lowed by the revenue Service (RS) This statements which means that mest that are better off to the standard dution rather than mother deduction This to which means the most home better taking these for more miehet This time in which means that meet the neemther dutionsther than the standard deduction However, it is all necessary to perform the financial analysis, Before you conduct a rent or buy analytis, it is critical that you understand how the u.. tax code crates tax theher for homeowners or on your home create The tax deductibility of the interest tax shelter for the on mortgage and the your table which and tax liability come The standard deduction for mortgage interest under the 2014 U.S. Kod Expenses $5,900 for single individuals and 511,800 for married couples $12.00 for single individuals and 56,500 for manned couples in joint 15.300 for single individuals and 512.00 or married couples True or The dualamount of mortgages that could be deducted by most ..ping met sway Greater than the standard interest deduction towed by the Internal Revenue Service (RS) This statement ist, which means that most in this situation are better off sing the standardeduction rather than tength deductions This statement is the which means that the better of the standard deduction for monterest med by the RS This stort which means that most in the better with other than talong the standard deduction