Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HSImain HSI Futures Main(JAN3) Day Session 01/26 13:55:02 22474+ +489 +2.22% Volume 101706 Position 90785 Position Change a. At Premium 4 High 22512 Open

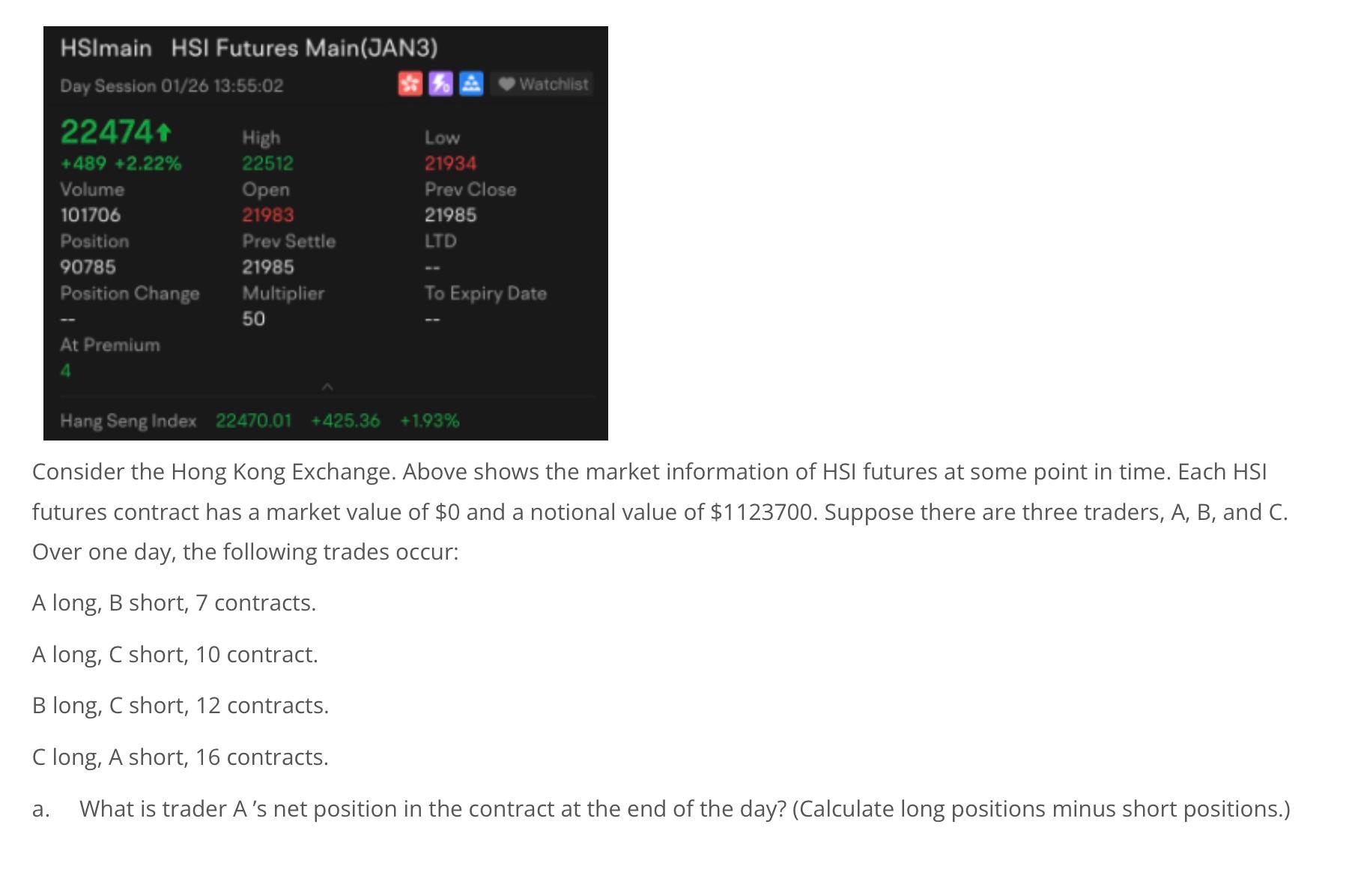

HSImain HSI Futures Main(JAN3) Day Session 01/26 13:55:02 22474+ +489 +2.22% Volume 101706 Position 90785 Position Change a. At Premium 4 High 22512 Open 21983 Prev Settle 21985 Multiplier 50 Low 21934 Prev Close 21985 LTD Watchlist To Expiry Date Hang Seng Index 22470.01 +425.36 +1.93% Consider the Hong Kong Exchange. Above shows the market information of HSI futures at some point in time. Each HSI futures contract has a market value of $0 and a notional value of $1123700. Suppose there are three traders, A, B, and C. Over one day, the following trades occur: A long, B short, 7 contracts. A long, C short, 10 contract. B long, C short, 12 contracts. C long, A short, 16 contracts. What is trader A's net position in the contract at the end of the day? (Calculate long positions minus short positions.)

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Trader As net position in the contracts at the end of the day we need to consid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started