Question

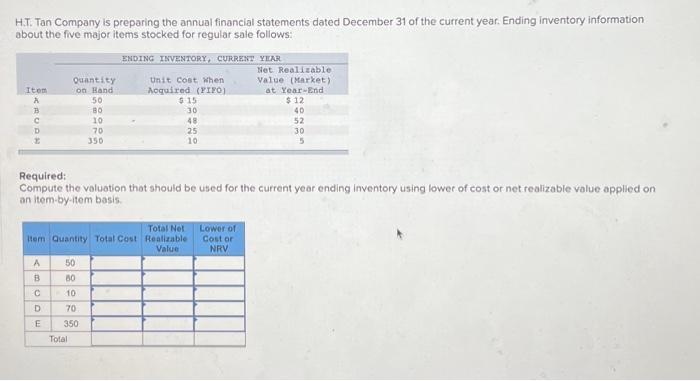

H.T. Tan Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items

H.T. Tan Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sale follows: ENDING INVENTORY, CURRENT YLAR Net Realizable Quantity on Hand 50 80 10 Value (Market) at Year-End $ 12 40 52 Unit Cost When Aoquired (FIE0) $ 15 30 Item 48 70 25 30 350 10 Required: Compute the valuotion that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. Lower of Cost or NRV Total Net Item Quantity Total Cost Realizable Value 50 80 10 D. 70 350 Total

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Calculate following Item Quantity Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby

5th edition

78025915, 978-1259115400, 1259115402, 978-0078025914

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App