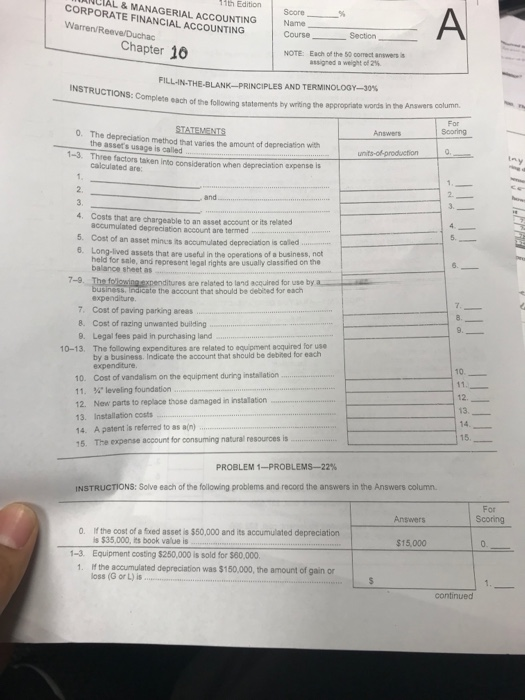

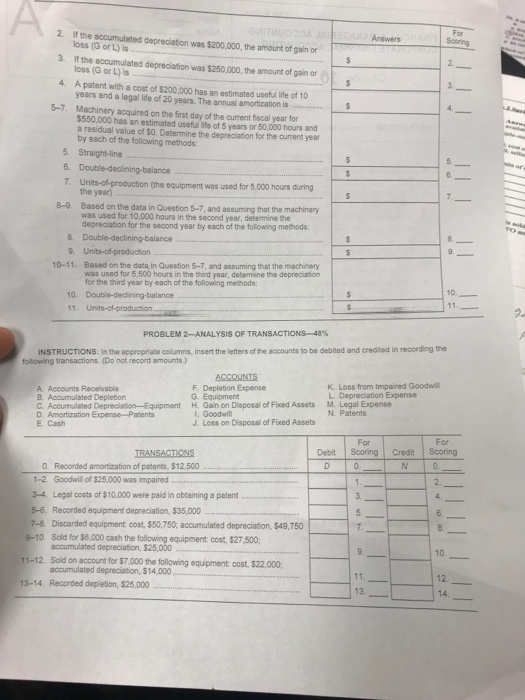

Hth EditionScore CIAL&MANAGERIAL ACCOUNTING Name ORPORATE FINANCIAL ACCOUNTING Section Chapter 16 Course NOTE: Each of the 50 correct answerss assgred a weight of 2%. FILL-IN-THE-BLANK-PRINCIPLES AND TERMINOLOg-30% each of the following statements by writing the appropriate words in the Answers column For Answers The depreciation method that varies the amount of depreciation with the asset s usage is called 0. 1 Three factors taken into consideration when deprecintion expense is calculated are and 3. 4. Costs that are chargeable to an asset account or its related 5. Cost of an asset mincs ts acoumulated depreciation is accumulated depreciation account are termed called 6. Long-lived assets that are useful in the operations of a business, nct beis ftor sale, and represant legal rights are usuly classihed on the balance sheet as 7-9. Th are related to land acquired for use by a. siness. Indicate the account that should be debited for each expenditure 7. Cost of paving parking areas 8. Cost of razing unwanted building 9. Legal fees paid in purchasing land 10-13. The following expenditures are related to equipment acquired for use by a business. Indicate the account that should be debited for each 10. expenditure. 10. Cost of vandalism on the equipment during installation 11, %" leveling foundation 12. New parts to replace those damaged in instalation 13. Installation costs 14. A patent is referred to as a(n) 15. The expense account for consuming natural resources is 12. 13. 14 5 PROBLEM 1-PROBLEMS-22% INSTRUCTIONS: Solve each of the following problems and record the answers in the Answers column. For Scoring Answers 0. If the cost of a fxed asset is $50,000 and its accumulated depreciation $15,000 s $35,000, its book value is 1-3. Equipment costing $250,000 is sold for $80,000 1. the accumulated depreciation was $150,000, the amount of gain or loss (G or L) continued Hth EditionScore CIAL&MANAGERIAL ACCOUNTING Name ORPORATE FINANCIAL ACCOUNTING Section Chapter 16 Course NOTE: Each of the 50 correct answerss assgred a weight of 2%. FILL-IN-THE-BLANK-PRINCIPLES AND TERMINOLOg-30% each of the following statements by writing the appropriate words in the Answers column For Answers The depreciation method that varies the amount of depreciation with the asset s usage is called 0. 1 Three factors taken into consideration when deprecintion expense is calculated are and 3. 4. Costs that are chargeable to an asset account or its related 5. Cost of an asset mincs ts acoumulated depreciation is accumulated depreciation account are termed called 6. Long-lived assets that are useful in the operations of a business, nct beis ftor sale, and represant legal rights are usuly classihed on the balance sheet as 7-9. Th are related to land acquired for use by a. siness. Indicate the account that should be debited for each expenditure 7. Cost of paving parking areas 8. Cost of razing unwanted building 9. Legal fees paid in purchasing land 10-13. The following expenditures are related to equipment acquired for use by a business. Indicate the account that should be debited for each 10. expenditure. 10. Cost of vandalism on the equipment during installation 11, %" leveling foundation 12. New parts to replace those damaged in instalation 13. Installation costs 14. A patent is referred to as a(n) 15. The expense account for consuming natural resources is 12. 13. 14 5 PROBLEM 1-PROBLEMS-22% INSTRUCTIONS: Solve each of the following problems and record the answers in the Answers column. For Scoring Answers 0. If the cost of a fxed asset is $50,000 and its accumulated depreciation $15,000 s $35,000, its book value is 1-3. Equipment costing $250,000 is sold for $80,000 1. the accumulated depreciation was $150,000, the amount of gain or loss (G or L) continued