Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a simple market one-period binomial tree model, we know that the simple compounding annual effective interest rate is given by i = 8%.

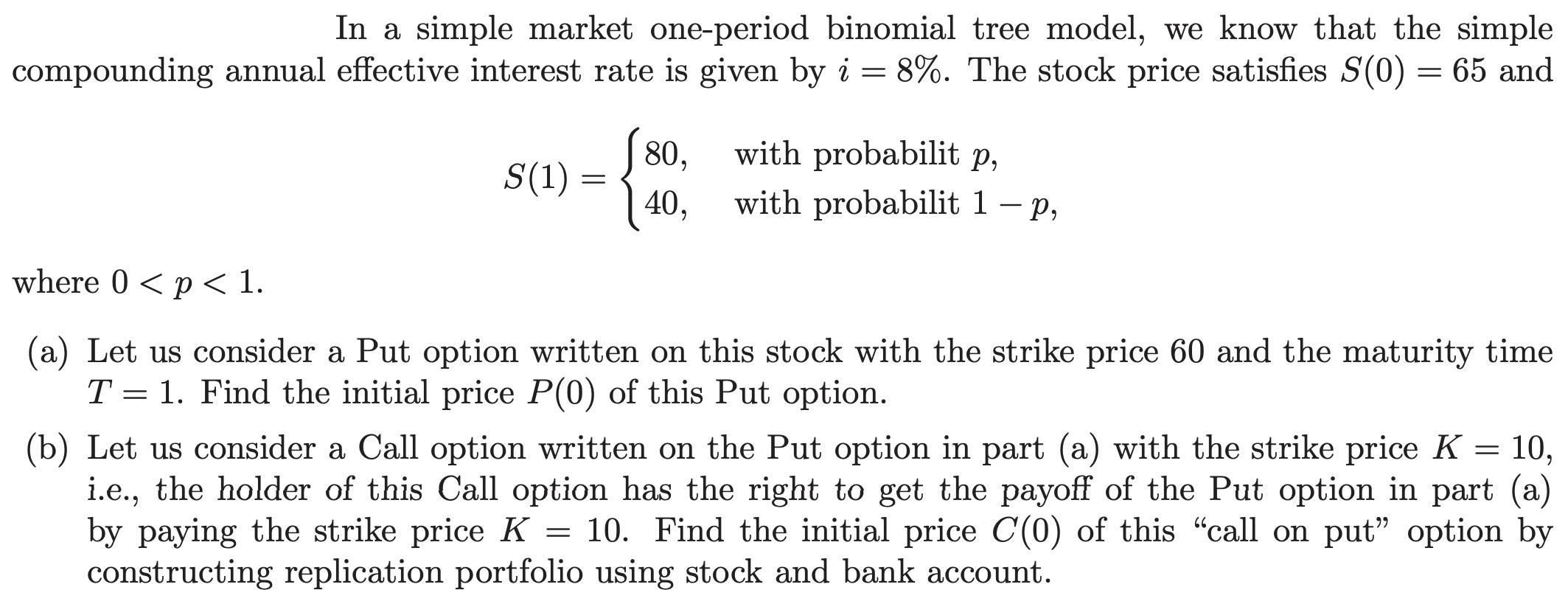

In a simple market one-period binomial tree model, we know that the simple compounding annual effective interest rate is given by i = 8%. The stock price satisfies S(0) = 65 and S(1): = 80, with probabilit p, 40, with probabilit 1 - p, where 0 < p < 1. (a) Let us consider a Put option written on this stock with the strike price 60 and the maturity time T = 1. Find the initial price P(0) of this Put option. (b) Let us consider a Call option written on the Put option in part (a) with the strike price K = 10, i.e., the holder of this Call option has the right to get the payoff of the Put option in part (a) by paying the strike price K = 10. Find the initial price C(0) of this "call on put" option by constructing replication portfolio using stock and bank account.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a P0 100 050 050 We know that the value of the Put option at time T is given by PT max0 KST where K ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started