Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hubert, a 66 years old worker, is deciding between retirement either this year or the next year. His average monthly benefit is determined to be

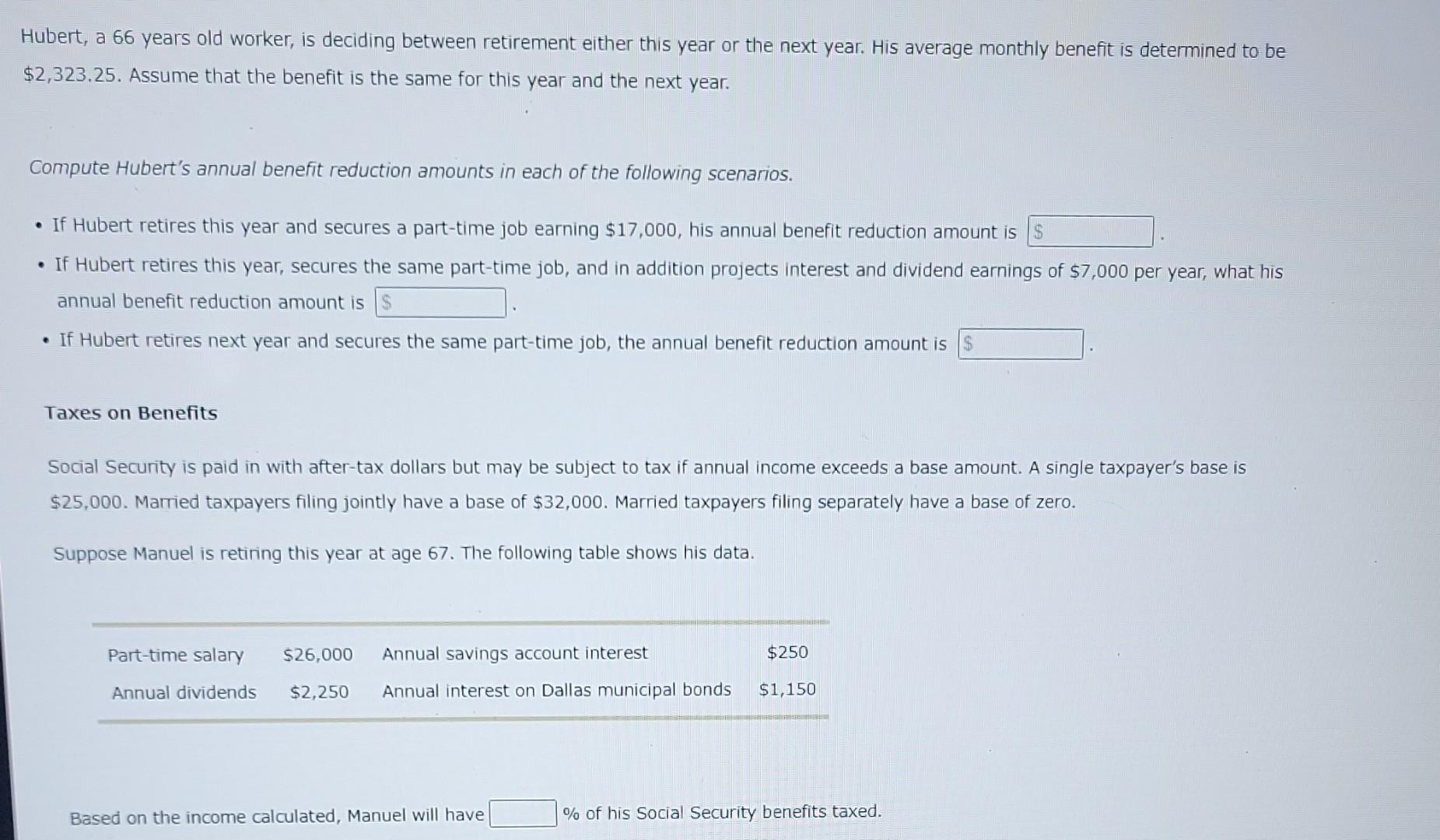

Hubert, a 66 years old worker, is deciding between retirement either this year or the next year. His average monthly benefit is determined to be $2,323.25. Assume that the benefit is the same for this year and the next year. Compute Hubert's annual benefit reduction amounts in each of the following scenarios. - If Hubert retires this year and secures a part-time job earning $17,000, his annual benefit reduction amount is - If Hubert retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what his annual benefit reduction amount is - If Hubert retires next year and secures the same part-time job, the annual benefit reduction amount is Taxes on Benefits Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. A single taxpayer's base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. Suppose Manuel is retiring this year at age 67. The following table shows his data. Based on the income calculated, Manuel will have % of his Social Security benefits taxed. Hubert, a 66 years old worker, is deciding between retirement either this year or the next year. His average monthly benefit is determined to be $2,323.25. Assume that the benefit is the same for this year and the next year. Compute Hubert's annual benefit reduction amounts in each of the following scenarios. - If Hubert retires this year and secures a part-time job earning $17,000, his annual benefit reduction amount is - If Hubert retires this year, secures the same part-time job, and in addition projects interest and dividend earnings of $7,000 per year, what his annual benefit reduction amount is - If Hubert retires next year and secures the same part-time job, the annual benefit reduction amount is Taxes on Benefits Social Security is paid in with after-tax dollars but may be subject to tax if annual income exceeds a base amount. A single taxpayer's base is $25,000. Married taxpayers filing jointly have a base of $32,000. Married taxpayers filing separately have a base of zero. Suppose Manuel is retiring this year at age 67. The following table shows his data. Based on the income calculated, Manuel will have % of his Social Security benefits taxed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started