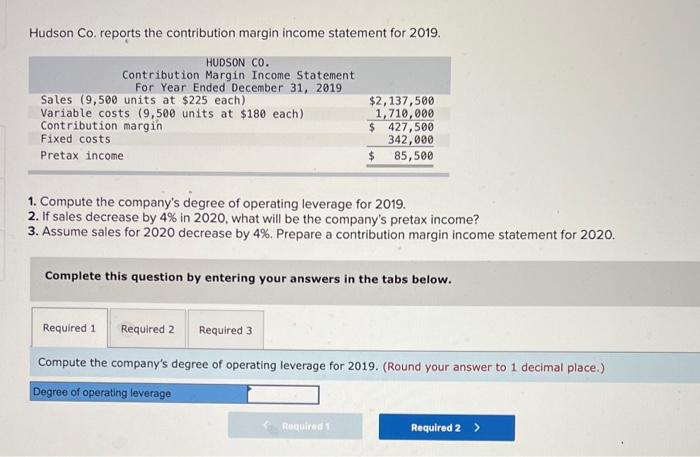

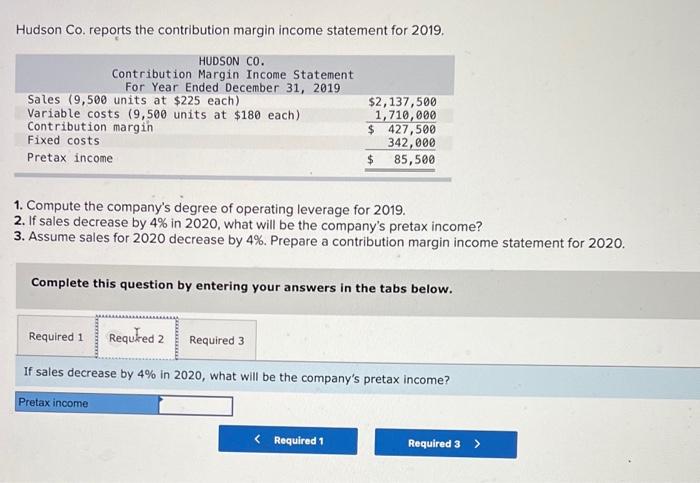

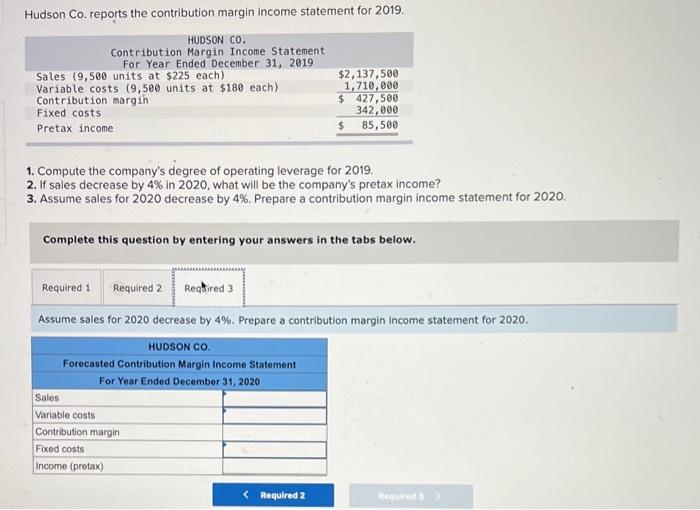

Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (9,500 units at $225 each) Variable costs (9,500 units at $180 each). Contribution margin Fixed costs Pretax income $2,137,500 1,710,000 $427,500 342,000 85,500 1. Compute the company's degree of operating leverage for 2019. 2. If sales decrease by 4% in 2020, what will be the company's pretax income? 3. Assume sales for 2020 decrease by 4%. Prepare a contribution margin income statement for 2020. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the company's degree of operating leverage for 2019. (Round your answer to 1 decimal place.) Degree of operating leverage Required 1 Required 2 > Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (9,500 units at $225 each) Variable costs (9,500 units at $180 each) Contribution margin Fixed costs Pretax income 1. Compute the company's degree of operating leverage for 2019. 2. If sales decrease by 4% in 2020, what will be the company's pretax income? 3. Assume sales for 2020 decrease by 4%. Prepare a contribution margin income statement for 2020. $2,137,500 1,710,000 $ 427,500 342,000 $ 85,500 Complete this question by entering your answers in the tabs below. Required 1 Required 2 If sales decrease by 4% in 2020, what will be the company's pretax income? Pretax income Required 3 Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (9,500 units at $225 each) Variable costs (9,500 units at $180 each) Contribution margin Fixed costs Pretax income 1. Compute the company's degree of operating leverage for 2019. 2. If sales decrease by 4% in 2020, what will be the company's pretax income? 3. Assume sales for 2020 decrease by 4%. Prepare a contribution margin income statement for 2020. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume sales for 2020 decrease by 4%. Prepare a contribution margin Income statement for 2020. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 $2,137,500 1,710,000 $ 427,500 342,000 85,500 Sales Variable costs Contribution margin Fixed costs Income (pretax)