Question

Hudsons Bay Company was founded in 1670 and is Canadas oldest corporation. It currently is headquartered in Toronto, Ontario. The company operates online and retail

Hudson’s Bay Company was founded in 1670 and is Canada’s oldest corporation. It currently is headquartered in Toronto, Ontario. The company operates online and retail stores throughout Canada and the United States under the banners of Hudson's Bay, Lord & Taylor, Saks Fifth Avenue, Saks OFF 5TH, Find @ Lord & Taylor, Home Outfitters, Galeria Kaufhof, Galeria INNO, and Sportarena.

The company operates in a highly competitive industry sector and as a result, their business model has changed multiple times since their inception in 1670. More recently, in 2020, shareholders overwhelmingly voted to take the firm private so as to undertake key strategic initiatives.

Background:

https://www.macleans.ca/culture/books/how-the-hudsons-bay-company-shaped-canadas-history-and-itsborders/

https://www.cbc.ca/news/canada/manitoba/hbc-350-years-history-1.5569656

https://www.forbes.com/sites/walterloeb/2016/06/13/hudsons-bay-companys-transformation-leads-to-fastgrowth/?sh=422fd8af6d82

Current News:

https://retail-insider.com/retail-insider/2021/08/hudsons-bay-shifting-canadian-department-store-model-byseparating-physical-stores-and-online-business/

https://financialpost.com/news/retail-marketing/were-not-neiman-marcus-hudsons-bay-says-it-plans-to-bearound-for-another-350-years-despite-recent-troubles

https://www.ctvnews.ca/business/hudson-s-bay-splitting-stores-from-online-marketplace-to-create-twobusinesses-1.5544453

You will apply the course concepts and tools utilized in the first six units of this course to complete this case lab Step 1: Read the news on (links) the Hudson’s Bay Company. * You may use additional sources to complete this assignment. However, they much be quality sources (i.e., from a credible news source - not Wikipedia or someone’s blog or opinion) You must ensure that you correctly cite these additional sources. Failure to do so constitutes plagiarism.

Step 2: Answer the following four questions and relate your answers to your readings:

QUESTIONS TO BE ANSWERED IN THIS DELIVERABLE:

Please refer to the readings linked above:

Students are to answer all 4 questions as part of this assignment.

- In your own words, summarize Hudson’s Bays’ current situation based on your readings outlined above. Be detailed and specific and utilize course concepts and tools discussed to date. Be sure to identify the who, what, where, why and how of the scenario. (15 marks)

- A) Complete an external assessment of Hudson’s Bay by incorporating the current information given in the linked articles above (35 marks). In your discussion you should also:

- B) Identify which tool would be best utilized to complete an adequate external audit of Hudson’s Bay and explain why you have chosen this one over the others.

- C) Utilize this tool to complete the external audit.

- A) Complete an internal assessment of Hudson’s Bay by incorporating the current information given in the linked articles above (35 marks) In your discussion you should also:

- B) Identify which tool would be best utilized to complete an adequate internal assessment of Hudson’s Bay and explain why you have chosen this one over the others.

- C) Utilize this tool to complete the internal audit. (SWAP ANALYSIS OR OTHER AUDITING TOOL)

- Provide an overall summary of your key findings/learnings (15 marks).

Total Marks = 100 (Please note that marks will be deducted if the presentation, grammar, spelling, and correct citations are not presented as per below).

Weighting: 12.5% of final grade

INSTRUCTIONS:

- Clearly number your answers and answer all questions in grammatical correct sentences with no spelling errors (you will lose marks if it is not).

- Include the questions and answers (and number of marks question is worth) in your report but erase the instructions I have given here.

- Cite the articles and any textbook references using MLA citation (additional external sources are not required for this assignment) (2 marks will be deducted for not doing this; 1 mark for not citing correctly).

- No plagiarism

- This assignment must be done individually. Do not share your work with anyone – this is considered plagiarism. All assignments will be run through SafeAssign.

- You may use additional sources to complete this assignment. However, they much be quality sources (i.e., from a credible news source - not Wikipedia or someone’s blog or opinion) You must ensure that you correctly cite these additional sources. Failure to do so constitutes plagiarism.

GRADING FOR THE ASSIGNMENT:

Key topics | Main areas to be included | Possible Marks | |||||||||||||||||||||||||||||||||||

Summary of current situation. Discussion should identify the who, what, when, where and why (where possible). | 15 | ||||||||||||||||||||||||||||||||||||

External Assessment discussion should be detailed, identify which tools is best used for an external assessment and the provide a rationale. Discussion should also present a summary of the analysis from the use of tool. | 35 | ||||||||||||||||||||||||||||||||||||

Internal Assessment discussion should be detailed, identify which tools is best used for an external assessment and the provide a rationale. Discussion should also present a summary of the analysis from the use of tool. | 35 | ||||||||||||||||||||||||||||||||||||

Summarize key findings/learnings | 15 |

BOLT BLADES LTD.

Bolt Blades Ltd. (BBL) is a manufacturer of blades used in industrial equipment. The

manufacturing process starts with compressing and cutting large pieces of steel, called “blanks,” into rough-cut blades that BBL calls “Part No. 101.” Part No. 101 is then ground and polished, and the polished blades are cut into the shapes required for customers’ orders. The blades must pass strict tolerance requirements. Part No. 101 is an essential part of all of BBL’s finished products. Although BBL has a reputation in the market for producing high-quality blades, the finished products are generic, so BBL competes mostly on price and on-time delivery.

Today is April 1, 2018. You, CPA, are the finance manager at BBL, and the general manager has

called a meeting with you and the managers from engineering, production, and purchasing.

The general manager begins the meeting: “BBL’s production variances have been reaching

alarming levels.”

The production manager responds: “Machine 1, which produces Part No. 101, is causing all the

difficulties. Machine 1 uses old technology, vibrates loudly and stops often during the production process, causing blades to break. To slow the vibration and reduce pressure, we added gaskets to the machine but the improvement did not last long. The broken blades need to be removed from the machine, which increases labour hours and wastes direct materials – the blanks. I have scheduled our most experienced technicians on Machine 1 but have had little success.”

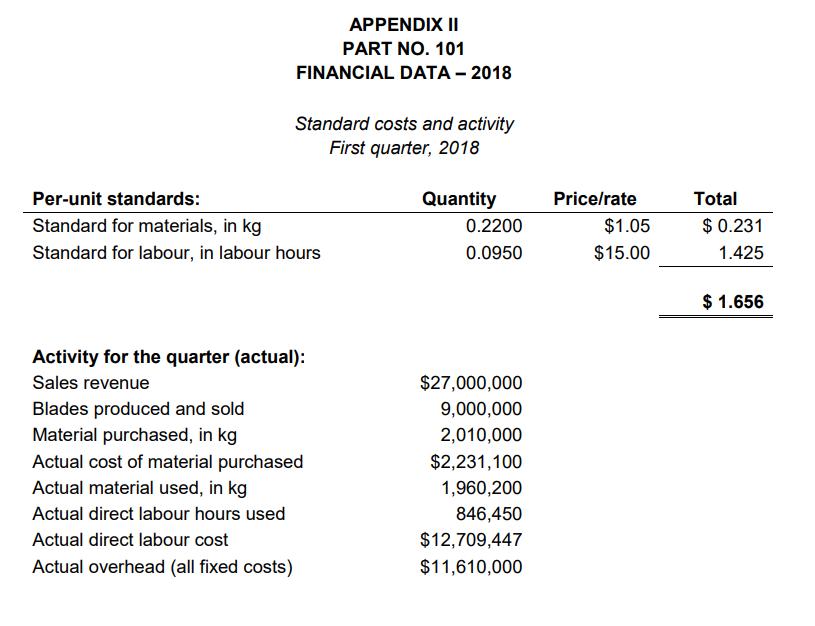

The purchasing manager adds: “In an attempt to solve this issue, I obtained extra-thin blanks from a new vendor, which were used for the entire first quarter of 2018. These blanks are more fragile than the regular blanks used by BBL.”

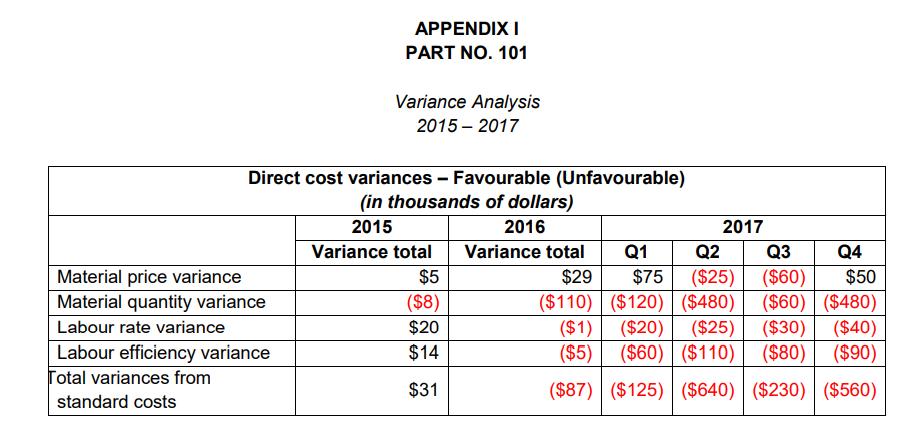

The general manager turns to you: “I want you to review the historical variance report (Appendix I) and the production activity data from the first quarter of 2018 (Appendix II), explain the main causes of the unfavourable variances in previous years, and determine whether the variances have improved in the first quarter of 2018 with the use of the extra-thin blanks.”

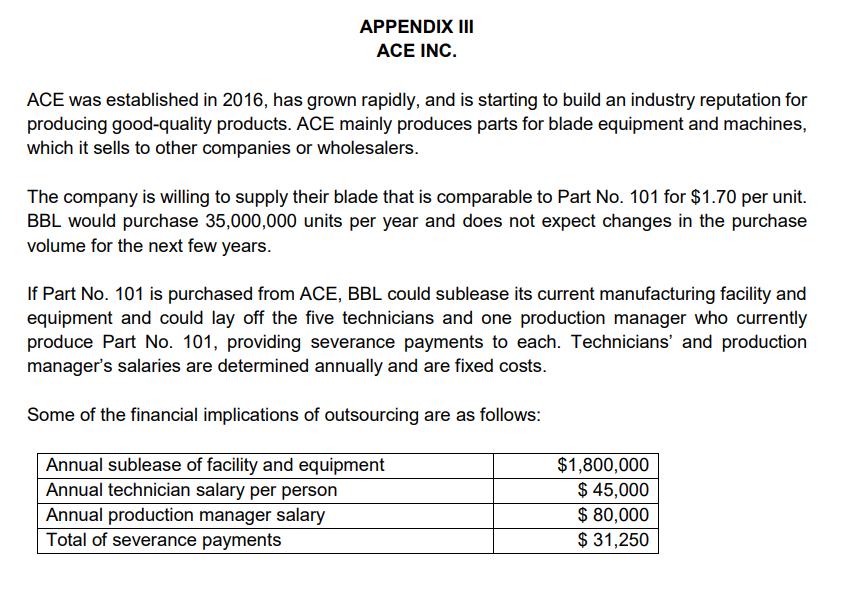

The engineering manager mentions: “I am not sure that the use of extra-thin blanks will be a

saving in the long term because we may have more product returns. There are many suppliers

that produce parts equivalent to Part No. 101. I inspected the quality of blades produced by ACE Inc. (ACE) and find them comparable to Part No. 101, but I do not know whether purchasing from ACE would be financially beneficial to BBL (Appendix III).”

APPENDIX I PART NO. 101 Material price variance Material quantity variance Labour rate variance Labour efficiency variance Total variances from standard costs Variance Analysis 2015 - 2017 Direct cost variances - Favourable (Unfavourable) (in thousands of dollars) 2015 2016 Variance total $5 ($8) $20 $14 $31 2017 Variance total Q1 Q2 Q3 Q4 $29 $75 ($25) ($60) $50 ($110) ($120) ($480) ($60) ($480) ($1) ($20) ($25) ($30) ($40) ($5) ($60) ($110) ($80) ($90) ($87) ($125) ($640) ($230) ($560) APPENDIX II PART NO. 101 FINANCIAL DATA - 2018 Standard costs and activity First quarter, 2018 Per-unit standards: Standard for materials, in kg Standard for labour, in labour hours Blades produced and sold Material purchased, in kg Activity for the quarter (actual): Sales revenue Actual cost of material purchased Actual material used, in kg Actual direct labour hours used Actual direct labour cost Actual overhead (all fixed costs) Quantity 0.2200 0.0950 $27,000,000 9,000,000 2,010,000 $2,231,100 1,960,200 846,450 $12,709,447 $11,610,000 Price/rate $1.05 $15.00 Total $ 0.231 1.425 $ 1.656 APPENDIX III ACE INC. ACE was established in 2016, has grown rapidly, and is starting to build an industry reputation for producing good-quality products. ACE mainly produces parts for blade equipment and machines, which it sells to other companies or wholesalers. The company is willing to supply their blade that is comparable to Part No. 101 for $1.70 per unit. BBL would purchase 35,000,000 units per year and does not expect changes in the purchase volume for the next few years. If Part No. 101 is purchased from ACE, BBL could sublease its current manufacturing facility and equipment and could lay off the five technicians and one production manager who currently produce Part No. 101, providing severance payments to each. Technicians and production manager s salaries are determined annually and are fixed costs. Some of the financial implications of outsourcing are as follows: Annual sublease of facility and equipment Annual technician salary per person Annual production manager salary Total of severance payments $1,800,000 $ 45,000 $ 80,000 $ 31,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bolt Blades Ltd Case Study To General Manager Bolt Blades Ltd From Nasreen Merchant Finance Manager Subject Report on Production Variances Date February 10 2022 Variance analysis is a tool applied for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

62593623bd63a_96611.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started