Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hugh Payne operates a fishing resort in Nome Alaska. Depreciation on the resort buildings is $6,000 per year. Real estate taxes are $8,000 per

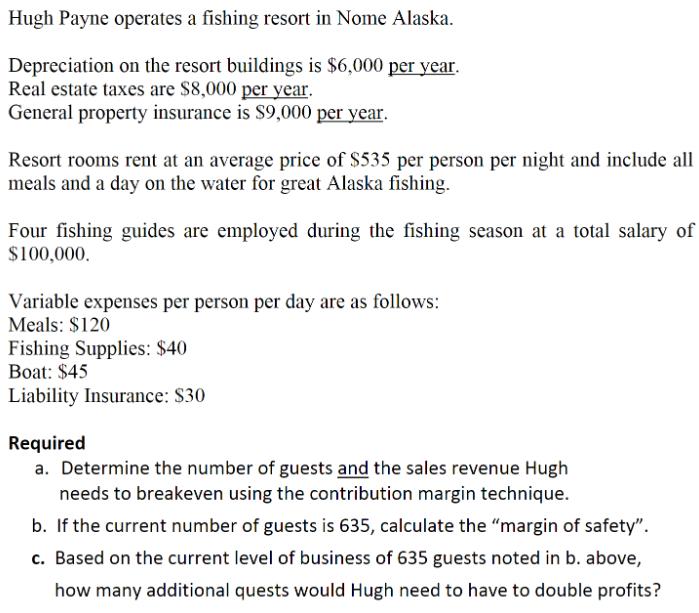

Hugh Payne operates a fishing resort in Nome Alaska. Depreciation on the resort buildings is $6,000 per year. Real estate taxes are $8,000 per year. General property insurance is $9,000 per year. Resort rooms rent at an average price of $535 per person per night and include all meals and a day on the water for great Alaska fishing. Four fishing guides are employed during the fishing season at a total salary of $100,000. Variable expenses per person per day are as follows: Meals: $120 Fishing Supplies: $40 Boat: $45 Liability Insurance: $30 Required a. Determine the number of guests and the sales revenue Hugh needs to breakeven using the contribution margin technique. b. If the current number of guests is 635, calculate the "margin of safety". c. Based on the current level of business of 635 guests noted in b. above, how many additional quests would Hugh need to have to double profits?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Fixed costs Depreciation 6000 Real estate taxes 8000 General property insurance 9000 Total fishing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started