Question

Hugo Boss AG is a German designer, manufacturer, and distributer of mens and womens clothing, operating in the higher end of the clothing retail industry.

Hugo Boss AG is a German designer, manufacturer, and distributer of mens and womens clothing, operating in the higher end of the clothing retail industry. During the period 20042017, the company consistently earned returns on equity in excess of 20 percent, with peaks around 50 to 60 percent, grew its book value of equity (before special dividends) by 5 percent per year, on average, and paid out 6580 percent of its profit as dividends.

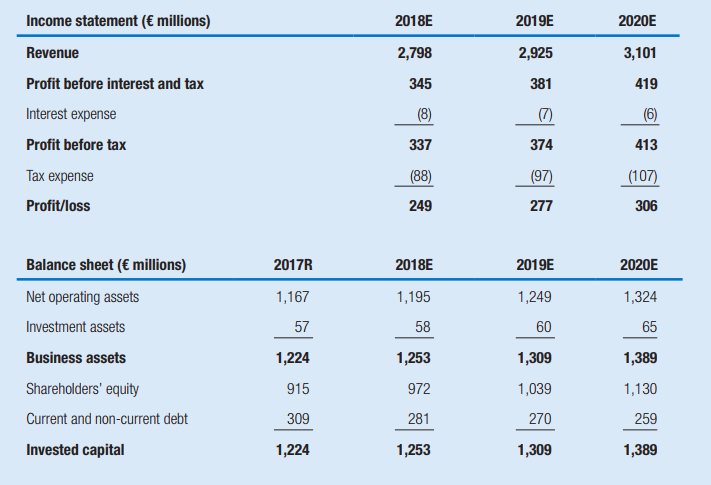

On March 29, 2018, before the publication of the first-quarter results, when Hugo Bosss 69.0 million common shares trade at about 71 per share, an analyst produces the following forecasts for Hugo Boss

question :

1. The analyst following Hugo Boss estimates a target price of 77 per share. Under the assumption that the companys profit margins, asset turnover, and capital structure remain constant after 2020, what is the terminal growth rate that is implicit in the analysts forecasts and target price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started