Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hugo Sports Equipment Limited (HSEL), a Swedish manufacturer of tennis equipment, is considering the purchase of equipment for their new racquet line. You work

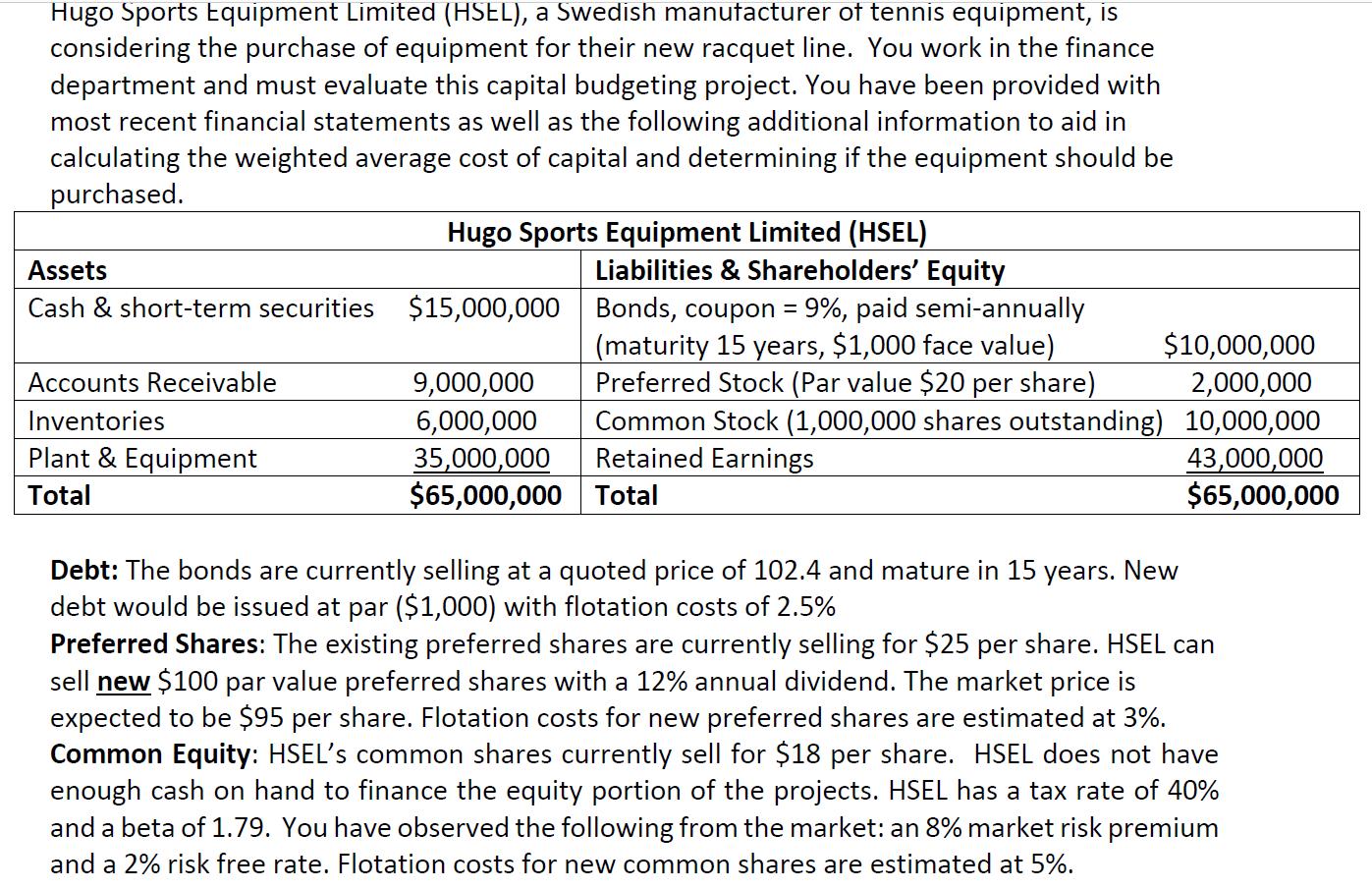

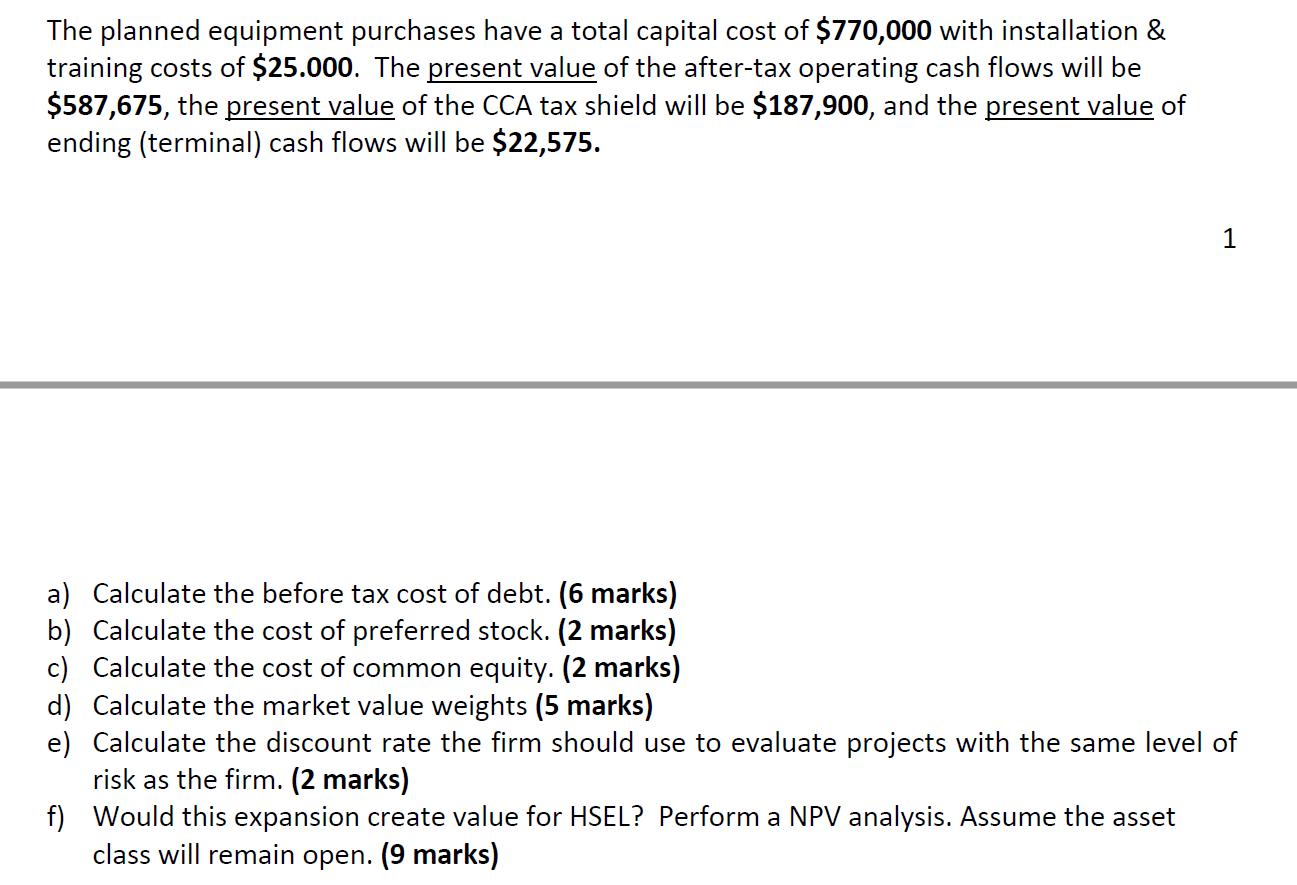

Hugo Sports Equipment Limited (HSEL), a Swedish manufacturer of tennis equipment, is considering the purchase of equipment for their new racquet line. You work in the finance department and must evaluate this capital budgeting project. You have been provided with most recent financial statements as well as the following additional information to aid in calculating the weighted average cost of capital and determining if the equipment should be purchased. Assets Cash & short-term securities Accounts Receivable Inventories Plant & Equipment Total Hugo Sports Equipment Limited (HSEL) Liabilities & Shareholders' Equity $15,000,000 9,000,000 6,000,000 35,000,000 $65,000,000 Bonds, coupon = 9%, paid semi-annually (maturity 15 years, $1,000 face value) Preferred Stock (Par value $20 per share) Common Stock (1,000,000 shares outstanding) Retained Earnings Total $10,000,000 2,000,000 10,000,000 43,000,000 $65,000,000 Debt: The bonds are currently selling at a quoted price of 102.4 and mature in 15 years. New debt would be issued at par ($1,000) with flotation costs of 2.5% Preferred Shares: The existing preferred shares are currently selling for $25 per share. HSEL can sell new $100 par value preferred shares with a 12% annual dividend. The market price is expected to be $95 per share. Flotation costs for new preferred shares are estimated at 3%. Common Equity: HSEL's common shares currently sell for $18 per share. HSEL does not have enough cash on hand to finance the equity portion of the projects. HSEL has a tax rate of 40% and a beta of 1.79. You have observed the following from the market: an 8% market risk premium and a 2% risk free rate. Flotation costs for new common shares are estimated at 5%. The planned equipment purchases have a total capital cost of $770,000 with installation & training costs of $25.000. The present value of the after-tax operating cash flows will be $587,675, the present value of the CCA tax shield will be $187,900, and the present value of ending (terminal) cash flows will be $22,575. a) Calculate the before tax cost of debt. (6 marks) b) Calculate the cost of preferred stock. (2 marks) c) Calculate the cost of common equity. (2 marks) d) Calculate the market value weights (5 marks) 1 e) Calculate the discount rate the firm should use to evaluate projects with the same level of risk as the firm. (2 marks) f) Would this expansion create value for HSEL? Perform a NPV analysis. Assume the asset class will remain open. (9 marks)

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER DEBT PREFERRED SHARES COMMON EQUITY COST OF EQUITY Ke COST OF DEBT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started