Question

[Hull, Chapter 28, problem 22, slightly modified.] Calculate the price of a cap on the three- month LIBOR rate in nine months' time when the

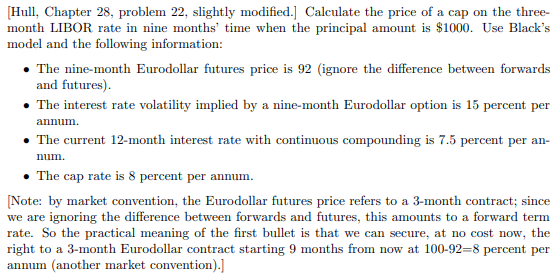

[Hull, Chapter 28, problem 22, slightly modified.] Calculate the price of a cap on the three-\ month LIBOR rate in nine months' time when the principal amount is

$1000. Use Black's\ model and the following information:\ The nine-month Eurodollar futures price is 92 (ignore the difference between forwards\ and futures).\ The interest rate volatility implied by a nine-month Eurodollar option is 15 percent per\ annum.\ The current 12-month interest rate with continuous compounding is 7.5 percent per an-\ num.\ The cap rate is 8 percent per annum.\ [Note: by market convention, the Eurodollar futures price refers to a 3-month contract; since\ we are ignoring the difference between forwards and futures, this amounts to a forward term\ rate. So the practical meaning of the first bullet is that we can secure, at no cost now, the\ right to a 3-month Eurodollar contract starting 9 months from now at

100-92=8percent per\ annum (another market convention).]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started