Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Humboldt Company manufactures and sells a single product. A partially completed schedule of the company's total and per-unit costs over the relevant range of

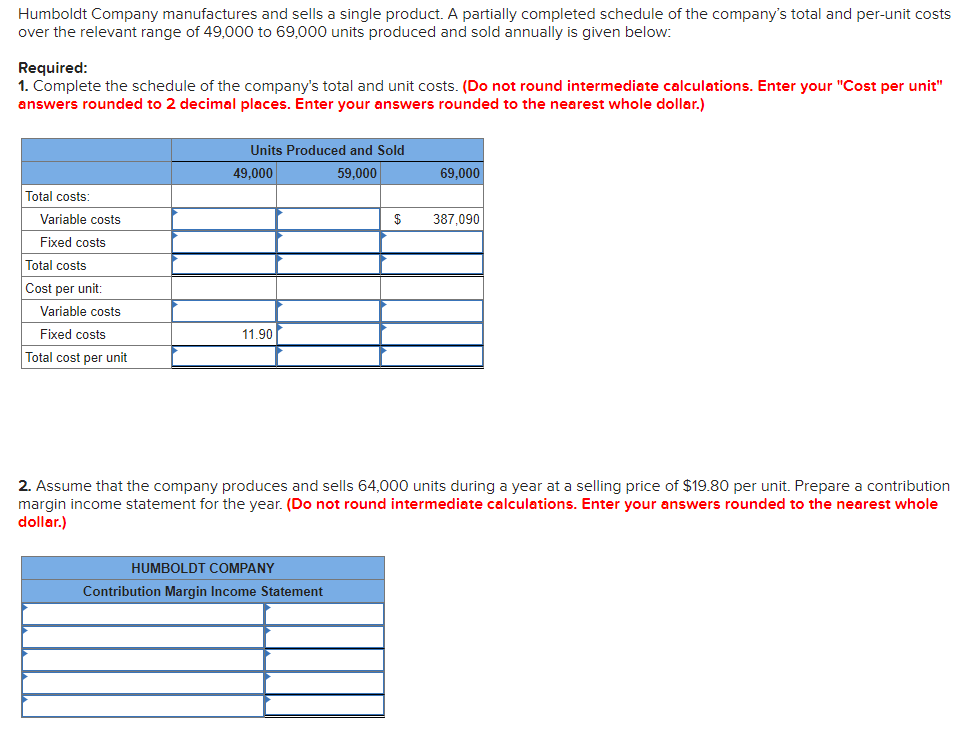

Humboldt Company manufactures and sells a single product. A partially completed schedule of the company's total and per-unit costs over the relevant range of 49,000 to 69,000 units produced and sold annually is given below: Required: 1. Complete the schedule of the company's total and unit costs. (Do not round intermediate calculations. Enter your "Cost per unit" answers rounded to 2 decimal places. Enter your answers rounded to the nearest whole dollar.) Total costs: Variable costs Fixed costs Total costs Cost per unit: Variable costs Fixed costs Total cost per unit Units Produced and Sold 49,000 59,000 69,000 11.90 $ 387,090 2. Assume that the company produces and sells 64,000 units during a year at a selling price of $19.80 per unit. Prepare a contribution margin income statement for the year. (Do not round intermediate calculations. Enter your answers rounded to the nearest whole dollar.) HUMBOLDT COMPANY Contribution Margin Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started