Answered step by step

Verified Expert Solution

Question

1 Approved Answer

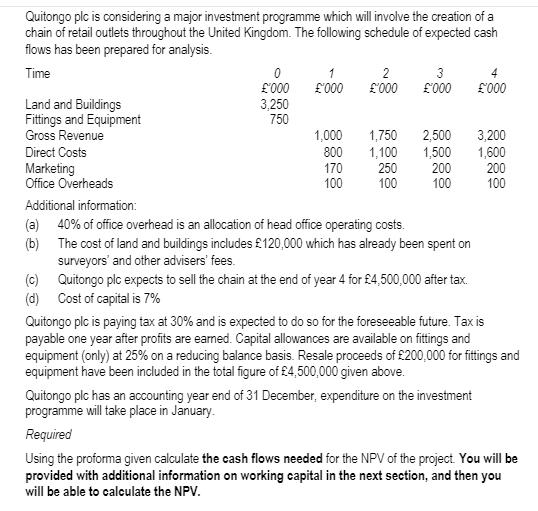

Quitongo plc is considering a major investment programme which will involve the creation of a chain of retail outlets throughout the United Kingdom. The

Quitongo plc is considering a major investment programme which will involve the creation of a chain of retail outlets throughout the United Kingdom. The following schedule of expected cash flows has been prepared for analysis. Time Land and Buildings Fittings and Equipment Gross Revenue Direct Costs Marketing Office Overheads 0 '000 3,250 750 1 '000 1,000 800 170 100 2 '000 1,750 1,100 250 100 3 '000 2,500 1,500 200 100 Additional information: (a) 40% of office overhead is an allocation of head office operating costs. (b) The cost of land and buildings includes 120,000 which has already been spent on surveyors' and other advisers' fees. (c) Quitongo plc expects to sell the chain at the end of year 4 for 4,500,000 after tax. (d) Cost of capital is 7% '000 Quitongo plc has an accounting year end of 31 December, expenditure on the investment programme will take place in January. Required 3,200 1,600 200 100 Quitongo plc is paying tax at 30% and is expected to do so for the foreseeable future. Tax is payable one year after profits are earned. Capital allowances are available on fittings and equipment (only) at 25% on a reducing balance basis. Resale proceeds of 200,000 for fittings and equipment have been included in the total figure of 4,500,000 given above. Using the proforma given calculate the cash flows needed for the NPV of the project. You will be provided with additional information on working capital in the next section, and then you will be able to calculate the NPV. Quitongo plc is considering a major investment programme which will involve the creation of a chain of retail outlets throughout the United Kingdom. The following schedule of expected cash flows has been prepared for analysis. Time Land and Buildings Fittings and Equipment Gross Revenue Direct Costs Marketing Office Overheads 0 '000 3,250 750 1 '000 1,000 800 170 100 2 '000 1,750 1,100 250 100 3 '000 2,500 1,500 200 100 Additional information: (a) 40% of office overhead is an allocation of head office operating costs. (b) The cost of land and buildings includes 120,000 which has already been spent on surveyors' and other advisers' fees. (c) Quitongo plc expects to sell the chain at the end of year 4 for 4,500,000 after tax. (d) Cost of capital is 7% '000 Quitongo plc has an accounting year end of 31 December, expenditure on the investment programme will take place in January. Required 3,200 1,600 200 100 Quitongo plc is paying tax at 30% and is expected to do so for the foreseeable future. Tax is payable one year after profits are earned. Capital allowances are available on fittings and equipment (only) at 25% on a reducing balance basis. Resale proceeds of 200,000 for fittings and equipment have been included in the total figure of 4,500,000 given above. Using the proforma given calculate the cash flows needed for the NPV of the project. You will be provided with additional information on working capital in the next section, and then you will be able to calculate the NPV. Quitongo plc is considering a major investment programme which will involve the creation of a chain of retail outlets throughout the United Kingdom. The following schedule of expected cash flows has been prepared for analysis. Time Land and Buildings Fittings and Equipment Gross Revenue Direct Costs Marketing Office Overheads 0 '000 3,250 750 1 '000 1,000 800 170 100 2 '000 1,750 1,100 250 100 3 '000 2,500 1,500 200 100 Additional information: (a) 40% of office overhead is an allocation of head office operating costs. (b) The cost of land and buildings includes 120,000 which has already been spent on surveyors' and other advisers' fees. (c) Quitongo plc expects to sell the chain at the end of year 4 for 4,500,000 after tax. (d) Cost of capital is 7% '000 Quitongo plc has an accounting year end of 31 December, expenditure on the investment programme will take place in January. Required 3,200 1,600 200 100 Quitongo plc is paying tax at 30% and is expected to do so for the foreseeable future. Tax is payable one year after profits are earned. Capital allowances are available on fittings and equipment (only) at 25% on a reducing balance basis. Resale proceeds of 200,000 for fittings and equipment have been included in the total figure of 4,500,000 given above. Using the proforma given calculate the cash flows needed for the NPV of the project. You will be provided with additional information on working capital in the next section, and then you will be able to calculate the NPV.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The cash flows needed for the NPV of the project are as follows Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started