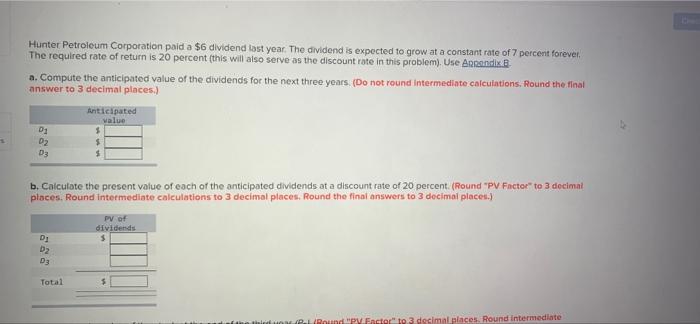

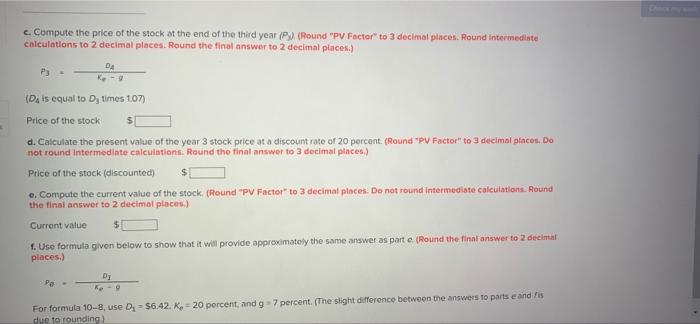

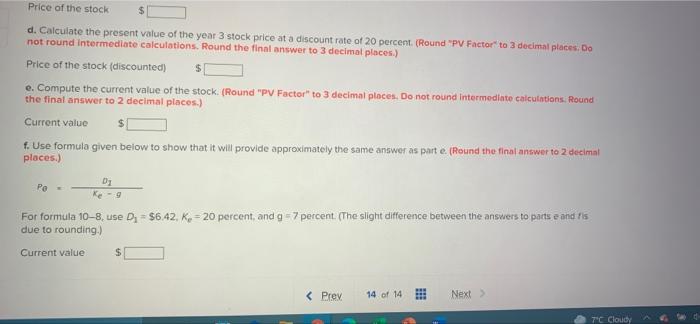

Hunter Petroleum Corporation paid a $6 dividend last year. The dividend is expected to grow at a constant rate of 7 percent forever The required rate of return is 20 percent this will also serve as the discount rate in this problem). Use Aprendix B a. Compute the anticipated value of the dividends for the next three years. (Do not round Intermediate calculations. Round the final answer to 3 decimal places.) Anticipated value $ 5 $ D1 D2 D3 3 b. Calculate the present value of each of the anticipated dividends at a discount rate of 20 percent. (Round "PV Factor" to 3 decimal places. Round Intermediate calculations to 3 decimal places. Round the final answers to 3 decimal places) PV of dividends D] 5 D2 D3 Total $ Round Factor to 3 decimal places. Round Intermediate c. Compute the price of the stock at the end of the third year (P) (Round "PV Factor" to 3 decimal places. Round Intermediate calculations to 2 decimal places. Round the final answer to 2 decimal places.) D4 Ke- (D, is equal to D, times 107) Price of the stock d. Calculate the present value of the year 3 stock price at a discount rate of 20 percent. (Round "PV Factor" to 3 decimal places, Do not round Intermediate calculations. Round the final answer to 3 decimal places.) Price of the stock (discounted) o. Compute the current value of the stock (Round "PU Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Current value 1. Use formula given below to show that it will provide approximately the same answer as parte (Round the final answer to 2 decimal places.) D] Pe- For formula 10-8, use D = $6.42. K = 20 percent, and g -7 percent. (The slight difference between the answers to parts and is due to founding Price of the stock d. Calculate the present value of the year 3 stock price at a discount rate of 20 percent. (Round "PV Factor to 3 decimal places. Do not round Intermediate calculations. Round the final answer to 3 decimal places.) Price of the stock (discounted) e. Compute the current value of the stock. (Round "PU Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Current value f. Use formula given below to show that it will provide approximately the same answer as parte (Round the final answer to 2 decimal places.) Po D Ke-9 For formula 10-8, use D. = $6.42. K = 20 percent, and g -7 percent. (The slight difference between the answers to parts and is due to rounding) Current value $ 70 Cloudy