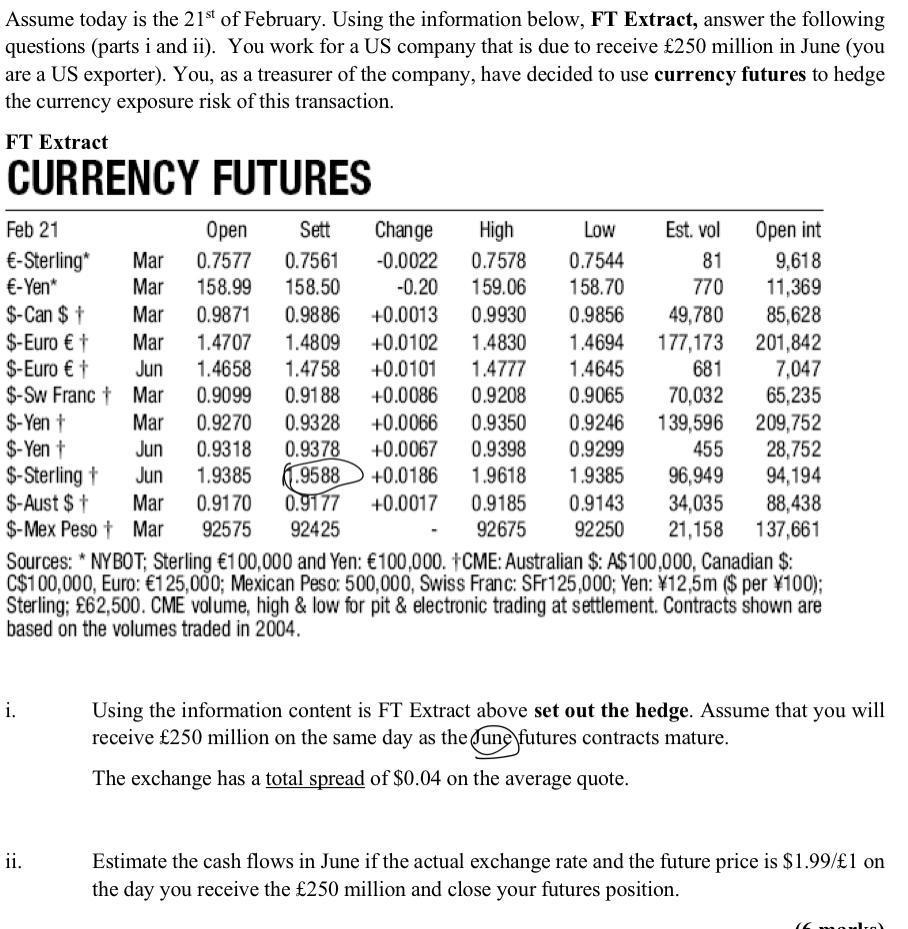

Assume today is the 21st of February. Using the information below, FT Extract, answer the following questions (parts i and ii). You work for

Assume today is the 21st of February. Using the information below, FT Extract, answer the following questions (parts i and ii). You work for a US company that is due to receive 250 million in June (you are a US exporter). You, as a treasurer of the company, have decided to use currency futures to hedge the currency exposure risk of this transaction. FT Extract CURRENCY FUTURES Feb 21 -Sterling* -Yen* $-Can $ t $-Euro + $-Euro + $-Sw Franc Open Sett Mar 0.7577 0.7561 Mar 158.99 158.50 Mar 0.9871 0.9886 Mar 1.4707 1.4809 +0.0102 1.4658 1.4758 +0.0101 Jun Mar +0.0086 0.9099 0.9188 0.9270 0.9328 +0.0066 Mar Jun 0.9318 0.9378 $-Sterling + Jun 1.9385 1.9588 $-Aust $t Mar 0.9170 $-Mex Peso Mar 92575 $-Yen t $-Yen t i. Change High -0.0022 0.7578 -0.20 159.06 +0.0013 0.9930 1.4830 1.4777 0.9208 0.9177 92425 ii. 0.9350 +0.0067 0.9398 +0.0186 1.9618 +0.0017 0.9185 92675 Est. vol Low 0.7544 81 158.70 770 0.9856 49,780 1.4694 177,173 1.4645 681 0.9065 70,032 0.9246 139,596 0.9299 455 1.9385 96,949 Open int 9,618 11,369 85,628 201,842 7,047 65,235 Sources: NYBOT; Sterling 100,000 and Yen: 100,000. CME: Australian $: A$100,000, Canadian $: C$100,000, Euro: 125,000; Mexican Peso: 500,000, Swiss Franc: SFr125,000; Yen: 12,5m ($ per 100); Sterling; 62,500. CME volume, high & low for pit & electronic trading at settlement. Contracts shown are based on the volumes traded in 2004. 209,752 28,752 94,194 88,438 0.9143 34,035 92250 21,158 137,661 Using the information content is FT Extract above set out the hedge. Assume that you will receive 250 million on the same day as the une futures contracts mature. The exchange has a total spread of $0.04 on the average quote. Estimate the cash flows in June if the actual exchange rate and the future price is $1.99/1 on the day you receive the 250 million and close your futures position. 16- ral

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To solve the problem well address both parts separately Part i Hedging with Currency Futures You nee... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 2 attachments)

635e3b5d3e2c5_182663.pdf

180 KBs PDF File

635e3b5d3e2c5_182663.docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards