Question

Huntsman Associates is considering upgrading its escalator equipment. Machines from vendors A and B have the same output, but have different useful lives and

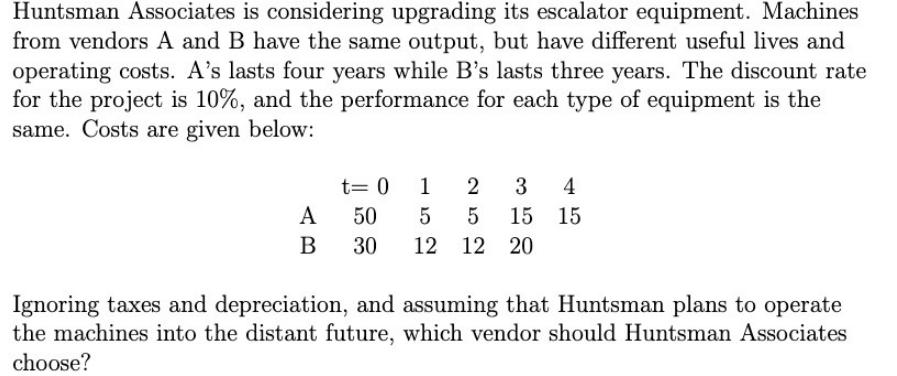

Huntsman Associates is considering upgrading its escalator equipment. Machines from vendors A and B have the same output, but have different useful lives and operating costs. A's lasts four years while B's lasts three years. The discount rate for the project is 10%, and the performance for each type of equipment is the same. Costs are given below: A B t= 0 50 30 12 12 20 1 2 3 4 5 5 15 15 Ignoring taxes and depreciation, and assuming that Huntsman plans to operate the machines into the distant future, which vendor should Huntsman Associates choose?

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

For A Details Year Discounting factor 11Dicounting ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App