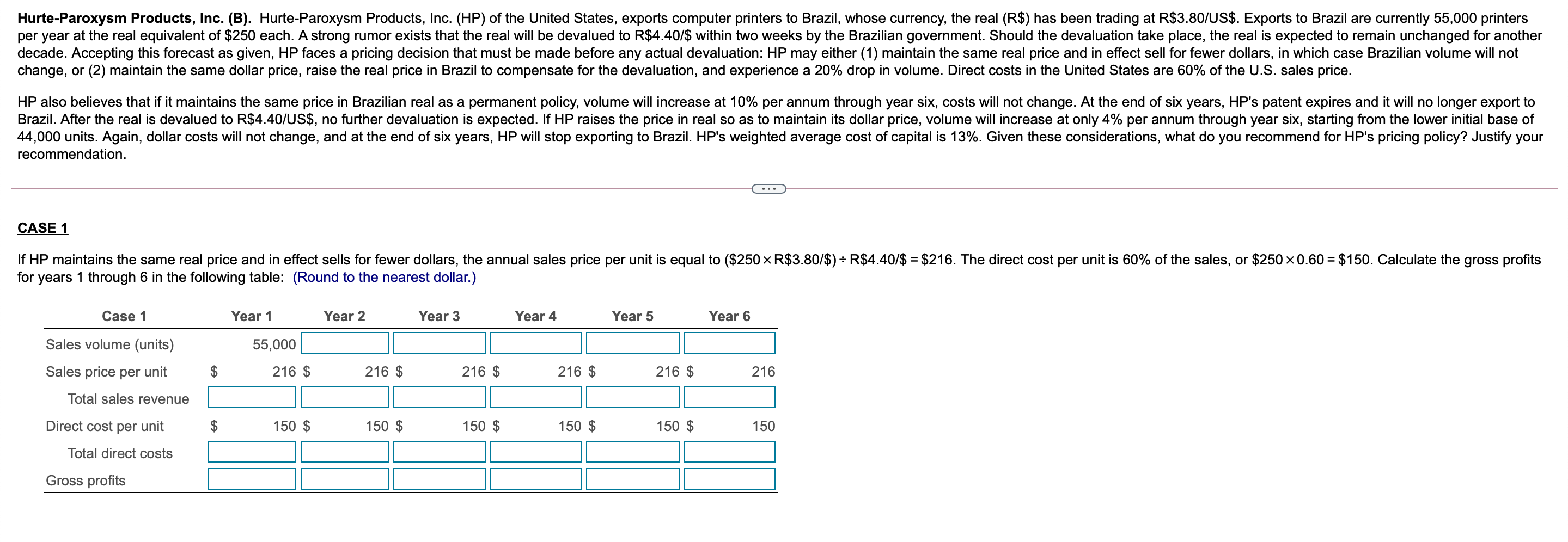

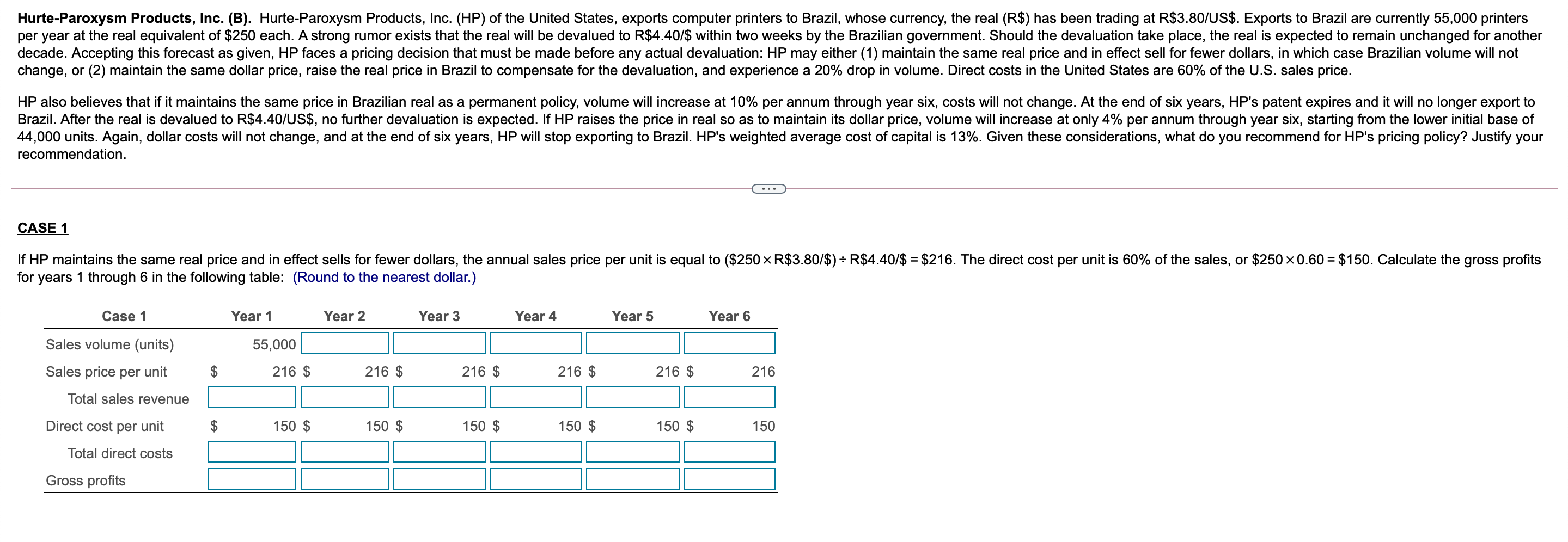

Hurte-paroxysm Products, Inc. (B). Hurte-Paroxysm Products, Inc. (HP) of the United States, exports computer printers to Brazil, whose currency, the real (R$) has been trading at R$3.80/US$. Exports to Brazil are currently 55,000 printers per year at the real equivalent of $250 each. A strong rumor exists that the real will be devalued to R$4.40/$ within two weeks by the Brazilian government. Should the devaluation take place, the real is expected to remain unchanged for another decade. Accepting this forecast as given, HP faces a pricing decision that must be made before any actual devaluation: HP may either (1) maintain the same real price and in effect sell for fewer dollars, in which case Brazilian volume will not change, or (2) maintain the same dollar price, raise the real price in Brazil to compensate for the devaluation, and experience a 20% drop in volume. Direct costs in the United States are 60% of the U.S. sales price. HP also believes that if it maintains the same price in Brazilian real as a permanent policy, volume will increase at 10% per annum through year six, costs will not change. At the end of six years, HP's patent expires and it will no longer export to Brazil. After the real is devalued to R$4.40/US$, no further devaluation is expected. If HP raises the price in real so as to maintain its dollar price, volume will increase at only 4% per annum through year six, starting from the lower initial base of 44,000 units. Again, dollar costs will not change, and at the end of six years, HP will stop exporting to Brazil. HP's weighted average cost of capital is 13%. Given these considerations, what do you recommend for HP's pricing policy? Justify your recommendation. CASE 1 + If HP maintains the same real price and in effect sells for fewer dollars, the annual sales price per unit is equal to ($250 x R$3.80/$) = R$4.40/$ = $216. The direct cost per unit is 60% of the sales, or $250 x0.60 = $150. Calculate the gross profits for years 1 through 6 in the following table: (Round to the nearest dollar.) Case 1 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 55,000 $ 216 $ 216 $ 216 $ 216 $ 216 $ 216 Sales volume (units) Sales price per unit Total sales revenue Direct cost per unit 150 $ 150 $ 150 $ 150 $ 150 $ 150 Total direct costs Gross profits Hurte-paroxysm Products, Inc. (B). Hurte-Paroxysm Products, Inc. (HP) of the United States, exports computer printers to Brazil, whose currency, the real (R$) has been trading at R$3.80/US$. Exports to Brazil are currently 55,000 printers per year at the real equivalent of $250 each. A strong rumor exists that the real will be devalued to R$4.40/$ within two weeks by the Brazilian government. Should the devaluation take place, the real is expected to remain unchanged for another decade. Accepting this forecast as given, HP faces a pricing decision that must be made before any actual devaluation: HP may either (1) maintain the same real price and in effect sell for fewer dollars, in which case Brazilian volume will not change, or (2) maintain the same dollar price, raise the real price in Brazil to compensate for the devaluation, and experience a 20% drop in volume. Direct costs in the United States are 60% of the U.S. sales price. HP also believes that if it maintains the same price in Brazilian real as a permanent policy, volume will increase at 10% per annum through year six, costs will not change. At the end of six years, HP's patent expires and it will no longer export to Brazil. After the real is devalued to R$4.40/US$, no further devaluation is expected. If HP raises the price in real so as to maintain its dollar price, volume will increase at only 4% per annum through year six, starting from the lower initial base of 44,000 units. Again, dollar costs will not change, and at the end of six years, HP will stop exporting to Brazil. HP's weighted average cost of capital is 13%. Given these considerations, what do you recommend for HP's pricing policy? Justify your recommendation. CASE 1 + If HP maintains the same real price and in effect sells for fewer dollars, the annual sales price per unit is equal to ($250 x R$3.80/$) = R$4.40/$ = $216. The direct cost per unit is 60% of the sales, or $250 x0.60 = $150. Calculate the gross profits for years 1 through 6 in the following table: (Round to the nearest dollar.) Case 1 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 55,000 $ 216 $ 216 $ 216 $ 216 $ 216 $ 216 Sales volume (units) Sales price per unit Total sales revenue Direct cost per unit 150 $ 150 $ 150 $ 150 $ 150 $ 150 Total direct costs Gross profits