Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Husky Builders builds manufactured houses on speculation of being able to sell them. Husky uses a normal job costing system and applies overhead on

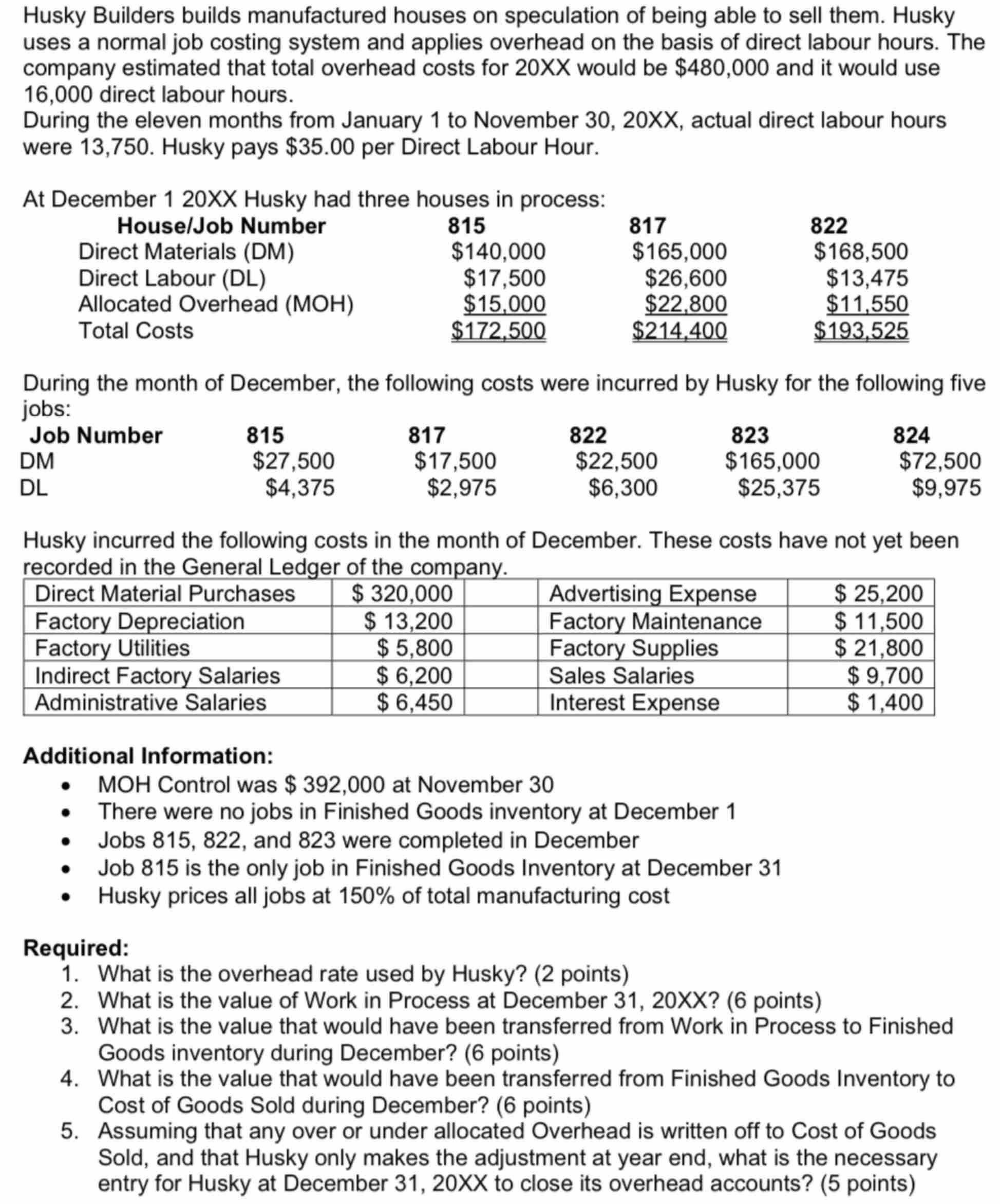

Husky Builders builds manufactured houses on speculation of being able to sell them. Husky uses a normal job costing system and applies overhead on the basis of direct labour hours. The company estimated that total overhead costs for 20XX would be $480,000 and it would use 16,000 direct labour hours. During the eleven months from January 1 to November 30, 20XX, actual direct labour hours were 13,750. Husky pays $35.00 per Direct Labour Hour. At December 1 20XX Husky had three houses in process: House/Job Number Direct Materials (DM) 815 $140,000 817 822 $165,000 $168,500 Direct Labour (DL) $17,500 $26,600 $13,475 Allocated Overhead (MOH) $15,000 $22,800 $11,550 Total Costs $172,500 $214.400 $193,525 During the month of December, the following costs were incurred by Husky for the following five jobs: Job Number DM 815 $27,500 $4,375 817 $17,500 $2,975 822 823 $22,500 $165,000 824 $72,500 $6,300 $25,375 $9,975 DL Husky incurred the following costs in the month of December. These costs have not yet been. recorded in the General Ledger of the company. Direct Material Purchases $ 320,000 Factory Depreciation $ 13,200 Factory Utilities $5,800 Indirect Factory Salaries $ 6,200 Administrative Salaries $ 6,450 Advertising Expense Factory Maintenance $ 25,200 $ 11,500 Factory Supplies $ 21,800 Sales Salaries Interest Expense $ 9,700 $1,400 Additional Information: MOH Control was $ 392,000 at November 30. There were no jobs in Finished Goods inventory at December 1 Jobs 815, 822, and 823 were completed in December Job 815 is the only job in Finished Goods Inventory at December 31 Husky prices all jobs at 150% of total manufacturing cost Required: 1. What is the overhead rate used by Husky? (2 points) 2. What is the value of Work in Process at December 31, 20XX? (6 points) 3. What is the value that would have been transferred from Work in Process to Finished Goods inventory during December? (6 points) 4. What is the value that would have been transferred from Finished Goods Inventory to Cost of Goods Sold during December? (6 points) 5. Assuming that any over or under allocated Overhead is written off to Cost of Goods Sold, and that Husky only makes the adjustment at year end, what is the necessary entry for Husky at December 31, 20XX to close its overhead accounts? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started