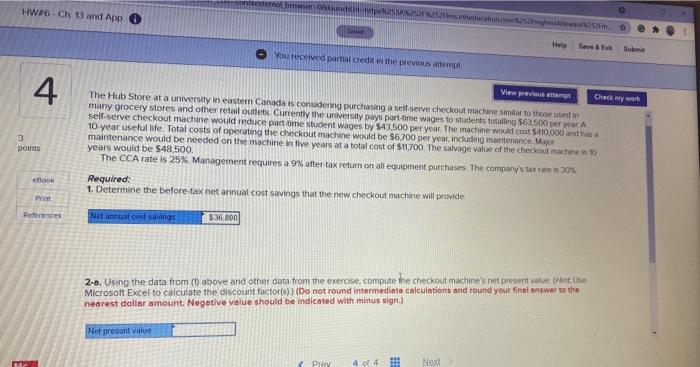

HW 6 Ch 13 and App des Sub You received partial credit the previous attempt 4 3 points View previous Check my work The Hub Store at a university in eastern Canada is considering purchasing a self serve checkout machines to those used in many grocery stores and other retail outlets Currently the university paysportime wages to students totaling 562 500 per year A self-serve checkout machine would reduce part-time student wages by $43.500 per year. The machine would cost $410,000 and has 10-year useful life. Total costs of operating the checkout machine would be 56700 per year, including martenance Mejor maintenance would be needed on the machine in five years at a total cost of $11.700 The salvage value of the checkout machine in 10 years would be $48,500, The CCA rate is 25% Management requires a 9% after-tax return on all equipment purchases. The company's tax rates 20% Required: 1. Determine the before tax net annual cost savings that the new checkout machine will provide Book PY References Net annual savings $36.800 2-a. Using the data from (1) above and other data from the exercise, compute the checkout machines net present value. (Hint Use Microsoft Excel to calculate the discount factors)) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negotive value should be indicated with minus sign) Net prosont value Pra Next HW 6 Ch 13 and App des Sub You received partial credit the previous attempt 4 3 points View previous Check my work The Hub Store at a university in eastern Canada is considering purchasing a self serve checkout machines to those used in many grocery stores and other retail outlets Currently the university paysportime wages to students totaling 562 500 per year A self-serve checkout machine would reduce part-time student wages by $43.500 per year. The machine would cost $410,000 and has 10-year useful life. Total costs of operating the checkout machine would be 56700 per year, including martenance Mejor maintenance would be needed on the machine in five years at a total cost of $11.700 The salvage value of the checkout machine in 10 years would be $48,500, The CCA rate is 25% Management requires a 9% after-tax return on all equipment purchases. The company's tax rates 20% Required: 1. Determine the before tax net annual cost savings that the new checkout machine will provide Book PY References Net annual savings $36.800 2-a. Using the data from (1) above and other data from the exercise, compute the checkout machines net present value. (Hint Use Microsoft Excel to calculate the discount factors)) (Do not round intermediate calculations and round your final answer to the nearest dollar amount. Negotive value should be indicated with minus sign) Net prosont value Pra Next