HW Chapter 3.2: Problem 3-38 Advanced Accounting

Problem 3-38 (Algo) (LO 3-4, 3-6) On January 1, Palisades, Inc., acquired 100 percent of Sherwood Companys common stock for a fair value of $120,480,000 in cash and stock. The carrying amounts of Sherwoods assets and liabilities equaled their fair values except for its equipment, which was undervalued by $548,000 and had a 10-year remaining life.

Palisades specializes in media distribution and viewed its acquisition of Sherwood as a strategic move into content ownership and creation. Palisades expected both cost and revenue synergies from controlling Sherwoods artistic content (a large library of classic movies) and its sports programming specialty video operation. Accordingly, Palisades allocated all of Sherwoods assets and liabilities (including all $49,640,000 of goodwill recognized in the acquisition) to a newly formed operating segment appropriately designated as a reporting unit.

However, Sherwoods assets have taken longer than anticipated to produce the expected synergies with Palisadess operations. Accordingly, Palisades reviewed events and circumstances and concluded that Sherwoods fair value was likely less than its carrying amount. At year-end, Palisades assessed the Sherwood reporting units fair value to $110,480,000.

At December 31, Palisades and Sherwood submitted the following balances for consolidation. There were no intra-entity payables on that date. Also, Palisades had not yet recorded any goodwill impairment.

Palisades, Inc. Sherwood Co. Revenues $ (18,570,000 ) $ (12,480,000 ) Operating expenses 10,350,000 12,280,000 Equity in Sherwood's earnings (145,200 ) Dividends declared 420,000 128,000 Retained earnings, 1/1 (52,720,000 ) (2,552,000 ) Cash 487,000 133,000 Receivables (net) 258,000 921,000 Investment in Sherwood 120,497,200 Broadcast licenses 470,000 14,062,000 Movie library 485,000 45,480,000 Equipment (net) 131,240,000 17,740,000 Current liabilities (209,000 ) (770,000 ) Long-term debt (22,035,000 ) (7,490,000 ) Common stock (170,240,000 ) (67,740,000 )

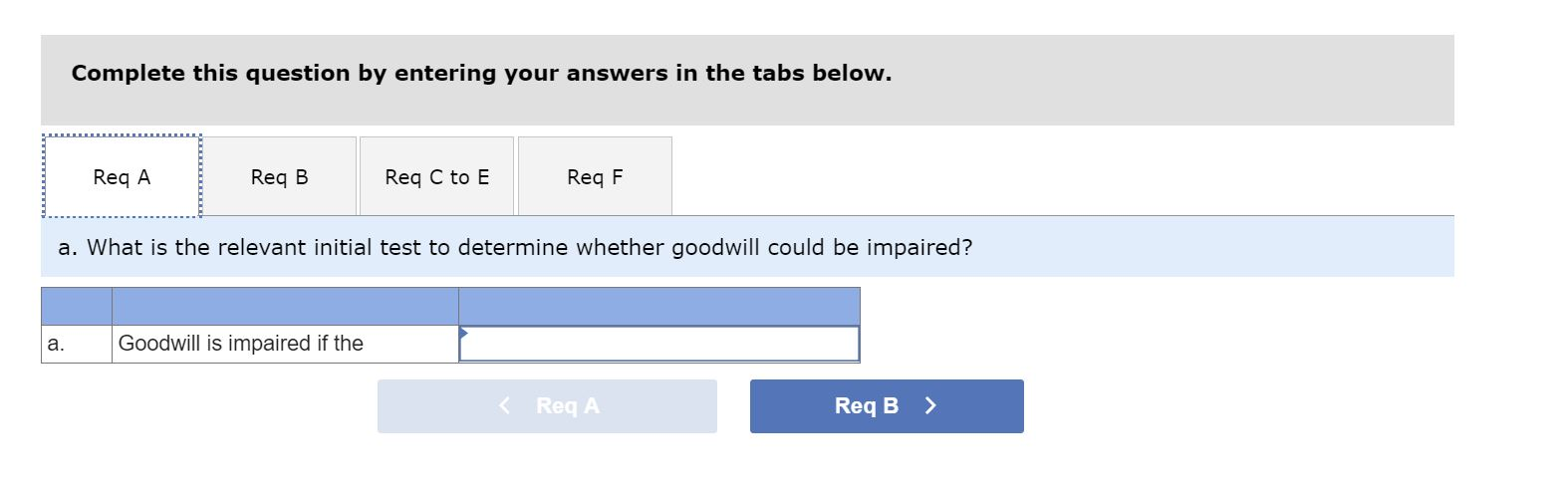

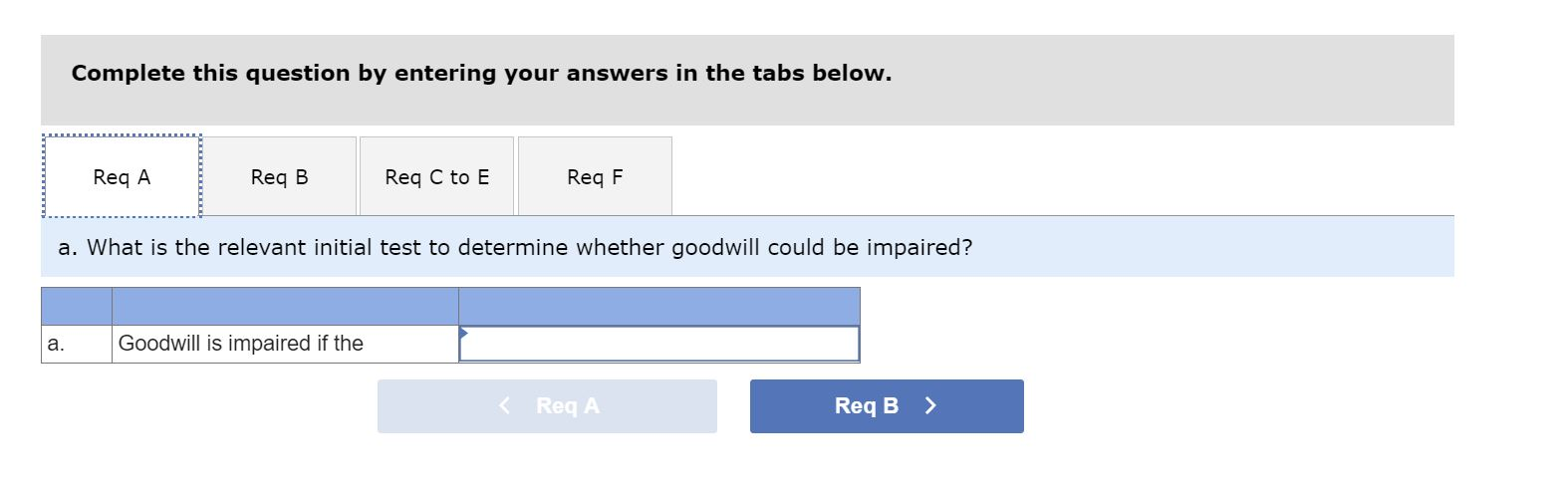

What is the relevant test to determine whether goodwill is impaired?

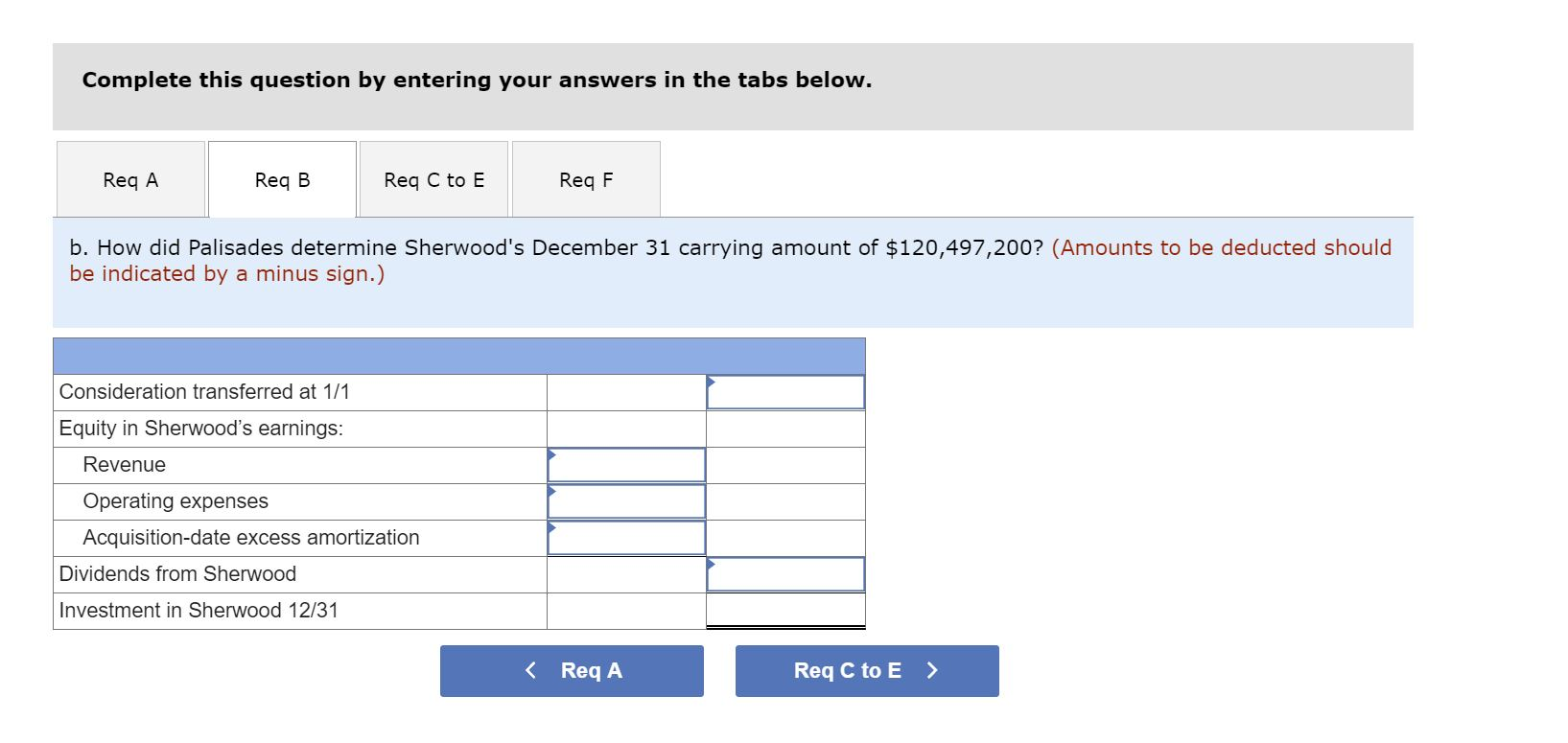

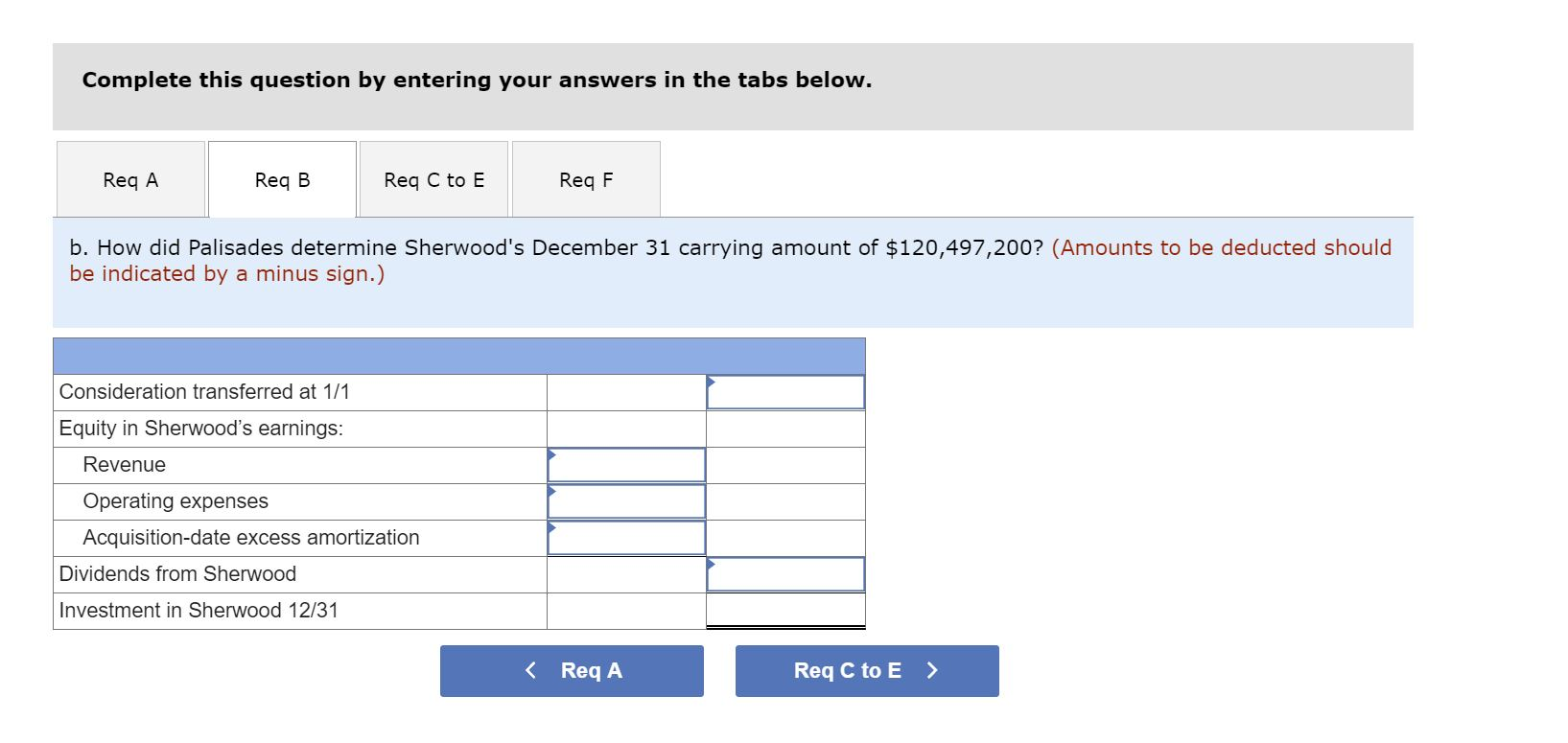

How did Palisades determine Sherwood's December 31 carrying amount of $120,497,200?

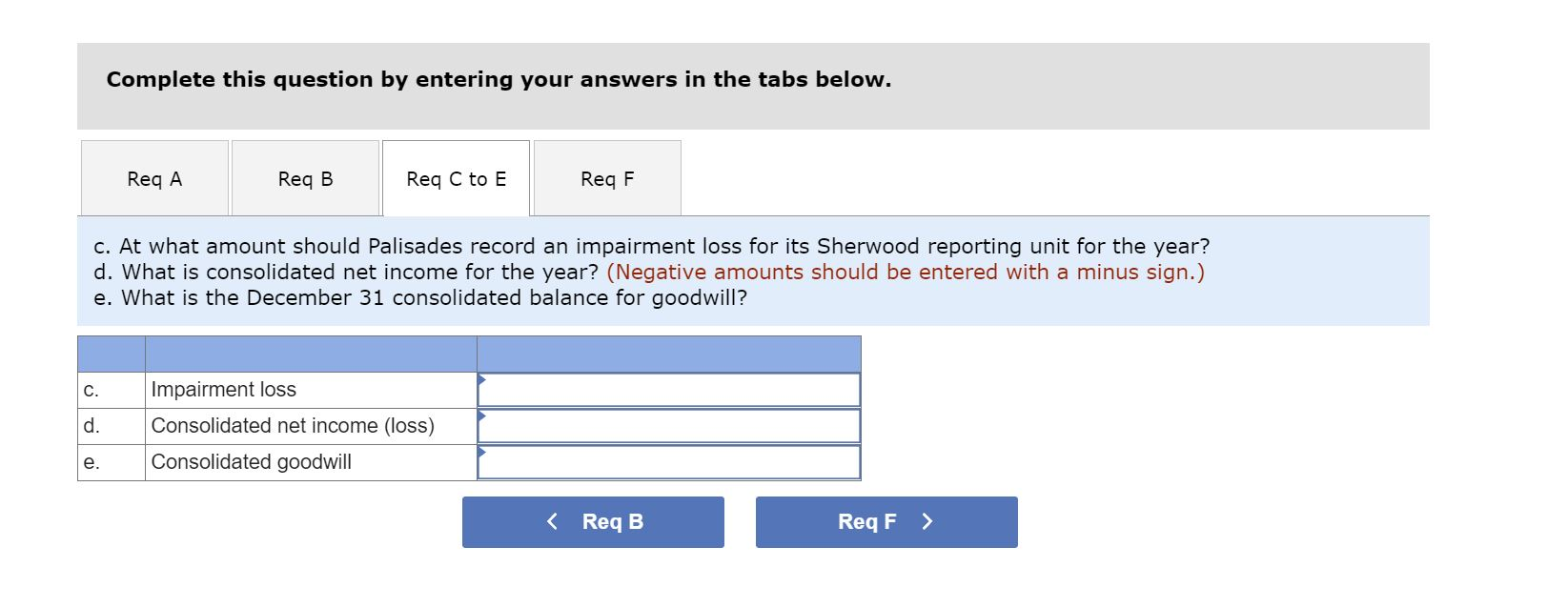

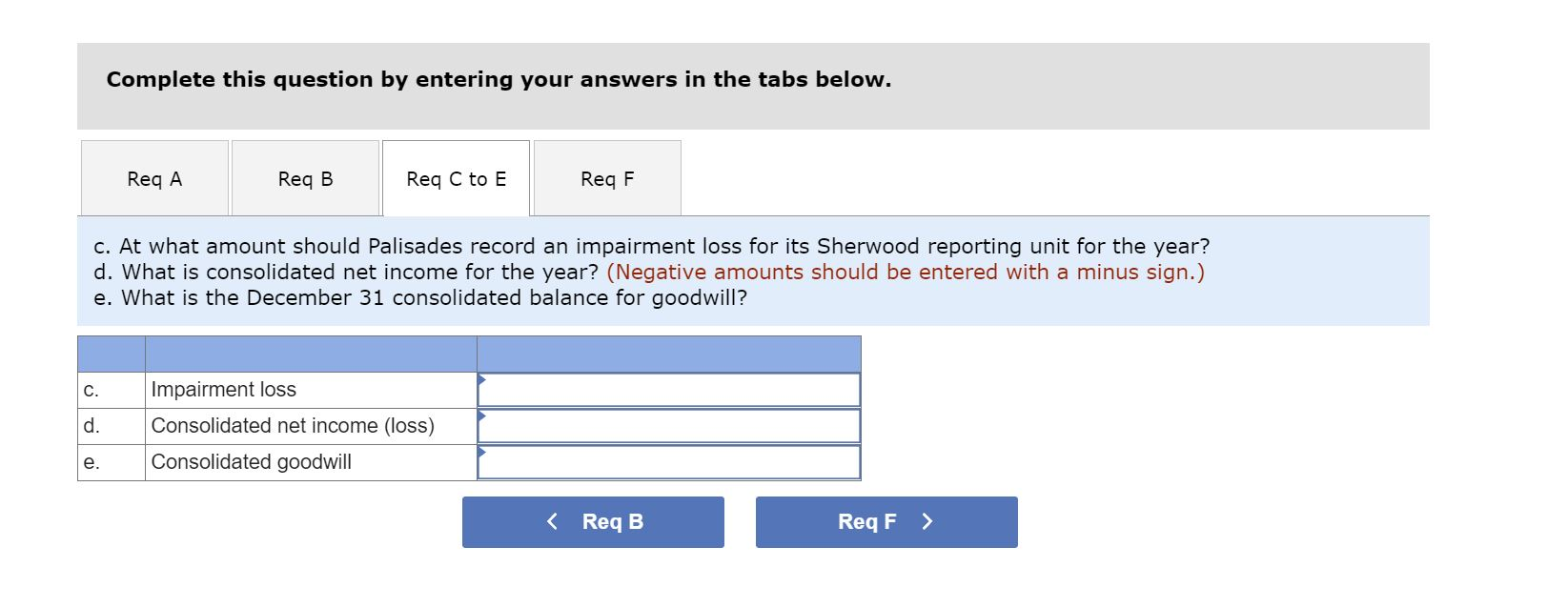

At what amount should Palisades record an impairment loss for its Sherwood reporting unit for the year?

What is consolidated net income for the year?

What is the December 31 consolidated balance for goodwill?

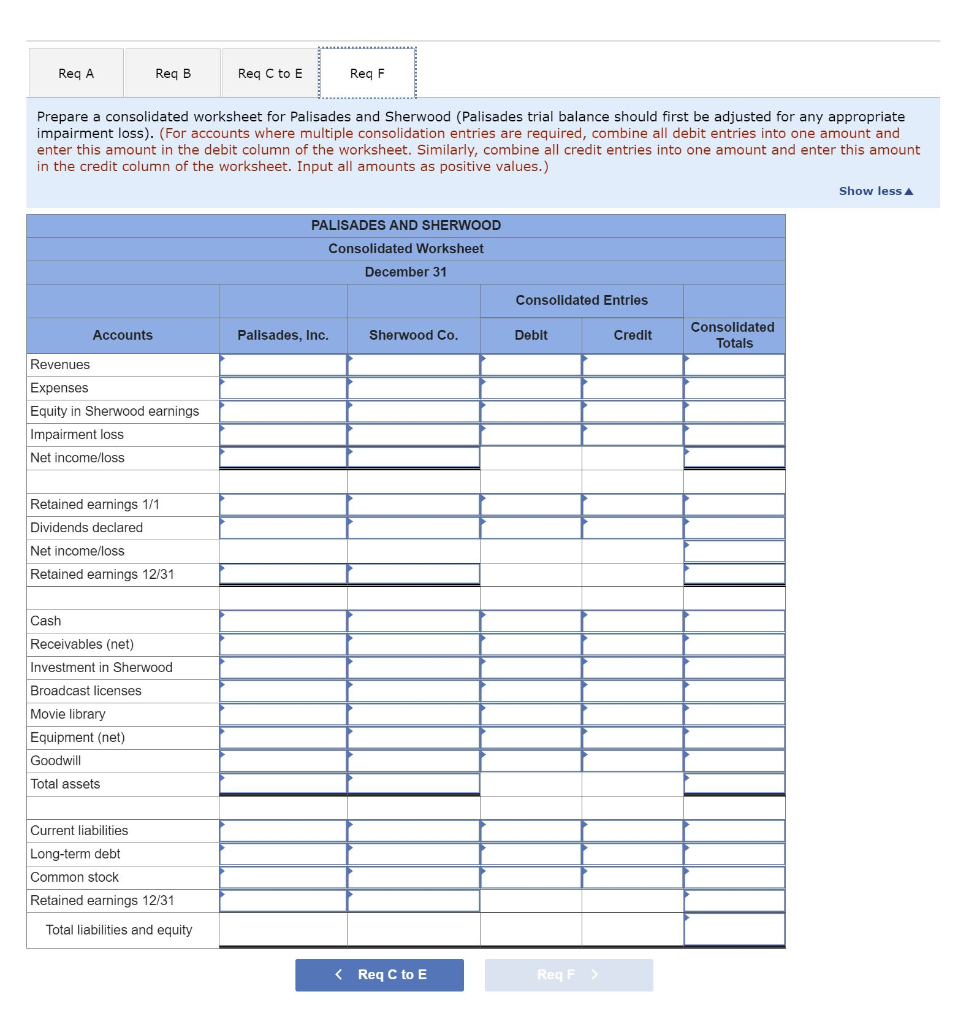

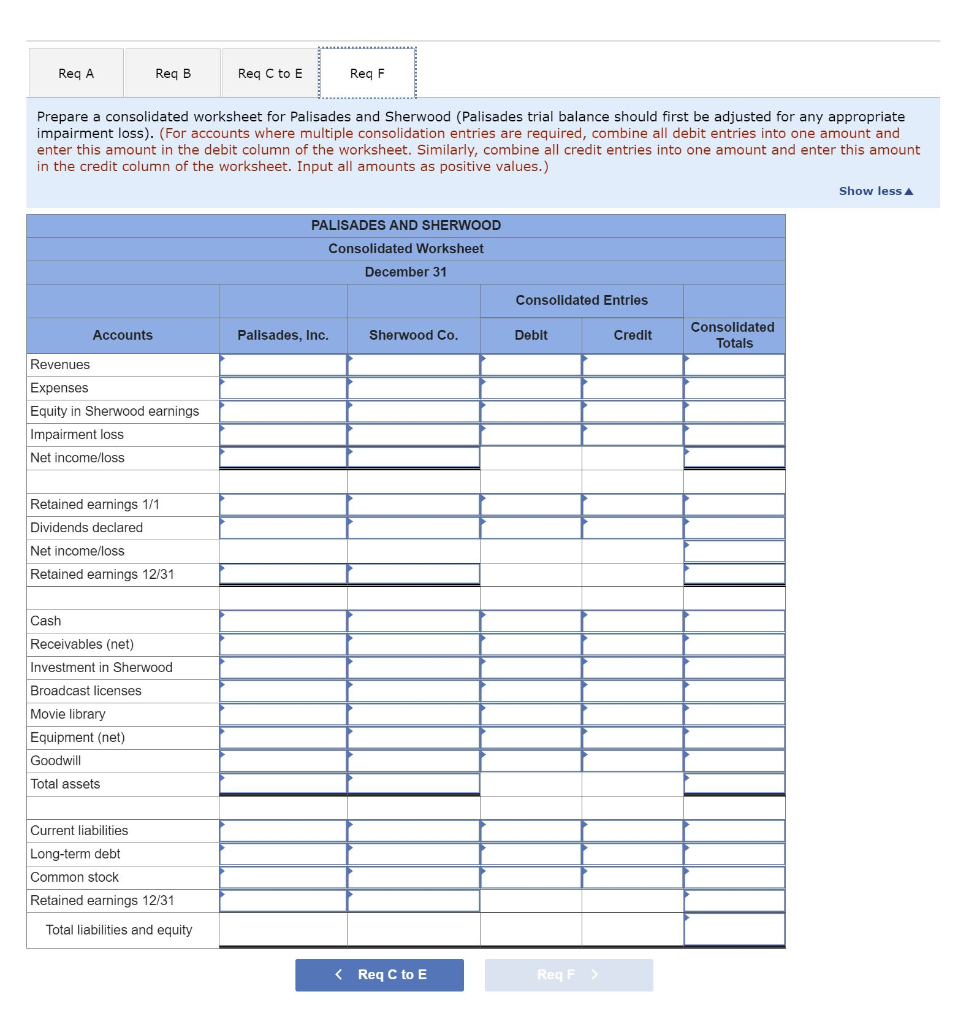

Prepare a consolidated worksheet for Palisades and Sherwood (Palisadess trial balance should first be adjusted for any appropriate impairment loss).

Complete this question by entering your answers in the tabs below. Req A Req B Req C to E Req F a. What is the relevant initial test to determine whether goodwill could be impaired? a. Goodwill is impaired if the Complete this question by entering your answers in the tabs below. Req A Reg B Reg C to E Reg F b. How did Palisades determine Sherwood's December 31 carrying amount of $120,497,200? (Amounts to be deducted should be indicated by a minus sign.) Consideration transferred at 1/1 Equity in Sherwood's earnings: Revenue Operating expenses Acquisition-date excess amortization Dividends from Sherwood Investment in Sherwood 12/31 Complete this question by entering your answers in the tabs below. Req A Req B Req C to E Reg F c. At what amount should Palisades record an impairment loss for its Sherwood reporting unit for the year? d. What is consolidated net income for the year? (Negative amounts should be entered with a minus sign.) e. What is the December 31 consolidated balance for goodwill? C. d. Impairment loss Consolidated net income (loss) Consolidated goodwill e. Reg A Req B Reg C to E Reg F Prepare a consolidated worksheet for Palisades and Sherwood (Palisades trial balance should first be adjusted for any appropriate impairment loss). (For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.) Show less A PALISADES AND SHERWOOD Consolidated Worksheet December 31 Consolidated Entries Accounts Palisades, Inc. Sherwood Co. Debit Credit Consolidated Totals Revenues Expenses Equity in Sherwood earnings Impairment loss Net income/loss Retained earnings 1/1 Dividends declared Net income/loss Retained earnings 12/31 Cash Receivables (net) Investment in Sherwood Broadcast licenses Movie library Equipment (net) Goodwill Total assets Current liabilities Long-term debt Common stock Retained earnings 12/31 Total liabilities and equity Complete this question by entering your answers in the tabs below. Req A Reg B Reg C to E Reg F b. How did Palisades determine Sherwood's December 31 carrying amount of $120,497,200? (Amounts to be deducted should be indicated by a minus sign.) Consideration transferred at 1/1 Equity in Sherwood's earnings: Revenue Operating expenses Acquisition-date excess amortization Dividends from Sherwood Investment in Sherwood 12/31 Complete this question by entering your answers in the tabs below. Req A Req B Req C to E Reg F c. At what amount should Palisades record an impairment loss for its Sherwood reporting unit for the year? d. What is consolidated net income for the year? (Negative amounts should be entered with a minus sign.) e. What is the December 31 consolidated balance for goodwill? C. d. Impairment loss Consolidated net income (loss) Consolidated goodwill e. Reg A Req B Reg C to E Reg F Prepare a consolidated worksheet for Palisades and Sherwood (Palisades trial balance should first be adjusted for any appropriate impairment loss). (For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.) Show less A PALISADES AND SHERWOOD Consolidated Worksheet December 31 Consolidated Entries Accounts Palisades, Inc. Sherwood Co. Debit Credit Consolidated Totals Revenues Expenses Equity in Sherwood earnings Impairment loss Net income/loss Retained earnings 1/1 Dividends declared Net income/loss Retained earnings 12/31 Cash Receivables (net) Investment in Sherwood Broadcast licenses Movie library Equipment (net) Goodwill Total assets Current liabilities Long-term debt Common stock Retained earnings 12/31 Total liabilities and equity