Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HW help Saul Sellers is the Chief Accountant for Bright Day Cafe (BDC) and is close to retirement. Traditionally, BDC provides a retirement plan that

HW help

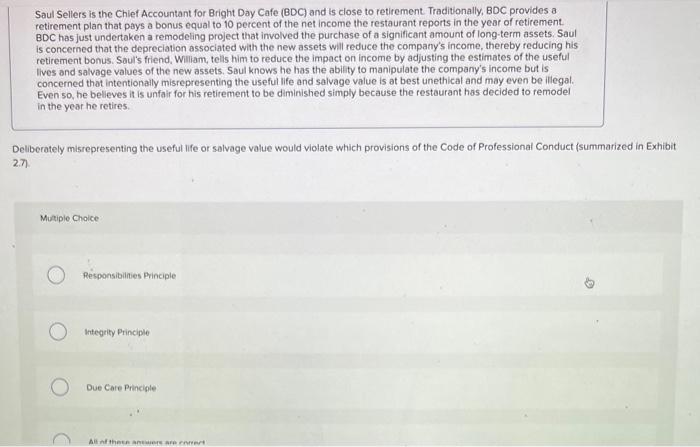

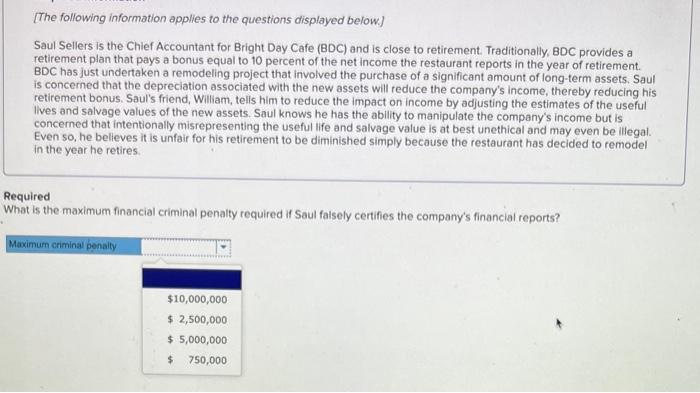

Saul Sellers is the Chief Accountant for Bright Day Cafe (BDC) and is close to retirement. Traditionally, BDC provides a retirement plan that pays a bonus equal to 10 percent of the net income the restaurant reports in the year of retirement. BDC has just undertaken a remodeling project that involved the purchase of a significant amount of long-term assets. Saul is concerned that the depreciation associated with the new assets will reduce the company's income, thereby reducing his retirement bonus. Saul's friend, William, tells him to reduce the impact on income by adjusting the estimates of the useful lives and salvage values of the new assets. Saul knows he has the ability to manipulate the company's income but is concerned that intentionally misrepresenting the useful life and salvage value is at best unethical and may even be illegal. Even so, he believes it is unfair for his retirement to be diminished simply because the restaurant has decided to remodel in the year he retires. tequired How will net income be affected (overstated, understated, or no change) if Saul overstates the salvage value of the assets? Saul Sellers is the Chief Accountant for Bright Day Cafe (BDC) and is close to retirement. Traditionally, BDC provides a retirement plan that pays a bonus equal to 10 percent of the net income the restaurant reports in the year of retirement. BDC has just undertaken a remodeling project that involved the purchase of a significant amount of long-term assets. Saul is concerned that the depreciation associated with the new assets will reduce the company's income, thereby reducing his retirement bonus. Saul's friend, William, tells him to reduce the impact on income by adjusting the estimates of the useful lives and salvage values of the new assets. Saul knows he has the ability to manipulate the company's income but is concerned that intentionally misrepresenting the useful life and salvage value is at best unethical and may even be illegal. Even so, he believes it is unfair for his retirement to be diminished simply because the restaurant has decided to remodel in the year he retires. Required How will net income be affected (overstated, understated, or no change) if Saul understates the salvage value of the assets? Saul Sellers is the Chief Accountant for Bright Day Cafe (BDC) and is close to retirement Traditionally, BDC provides a retirement plan that pays a bonus equal to 10 percent of the net income the restaurant reports in the year of retirement. BDC has just undertaken a remodeling project that involved the purchase of a significant amount of long-term assets. Saul is concerned that the depreciation associated with the new assets will reduce the company's income, thereby reducing his retirement bonus. Saul's friend, Willam, telis him to reduce the impact on income by adjusting the estimates of the useful lives and salvage values of the new assets. Saul knows he has the ability to manipulate the company's income but is concerned thot intentionaily misrepresenting the useful life and salvage value is at best unethical and may even be illegal. Even so, he belleves it is unfair for his retirement to be diminished simply because the restaurant has decided to remodel in the year he retires. Deliberately misrepresenting the useful life or salvage value would violate which provisions of the Code of Professional Conduct (summarized in Exhibit 27 Mutiple Choice Responsibilities Principle Integrity Principle Due Care Princigle [The following information applies to the questions displayed below.] Saul Sellers is the Chief Accountant for Bright Day Cafe (BDC) and is close to retirement. Traditionally, BDC provides a retirement plan that pays a bonus equal to 10 percent of the net income the restaurant reports in the year of retirement. BDC has just undertaken a remodeling project that involved the purchase of a significant amount of long-term assets. Saul is concerned that the depreciation associated with the new assets will reduce the company's income, thereby reducing his retirement bonus. Saul's friend, William, tells him to reduce the impact on income by adjusting the estimates of the useful lives and salvage values of the new assets. Saul knows he has the ability to manipulate the company's income but is concerned that intentionally misrepresenting the useful life and salvage value is at best unethical and may even be illegal. Even so, he believes it is unfair for his retirement to be diminished simply because the restaurant has decided to remodel in the year he retires. Required What is the maximum financial criminal penalty required if Saul falsely certifies the company's financial reports

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started