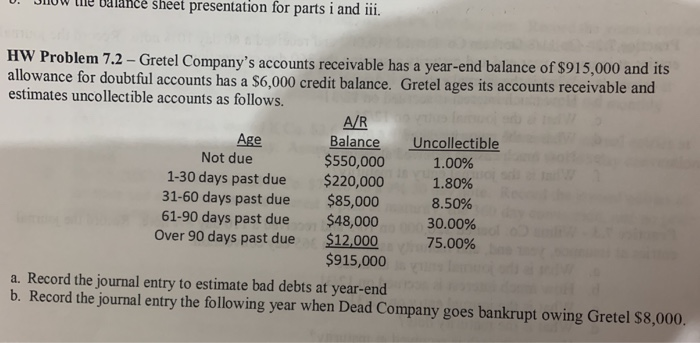

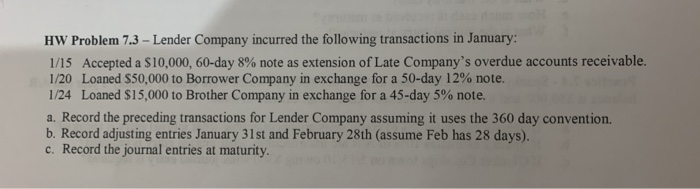

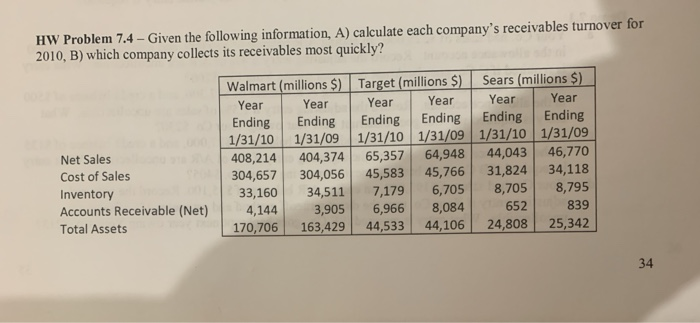

HW Problem 7.1 - Hansel Company had 2011 credit sales of $2,250,000 and cash sales of $1 million. At year end, Hansel Co's accounts receivable balance was $600,000 and the allowance for doubtful accounts had a $15,000 debit balance. a. What journal entry is required under each of the following assumptions? i. Hansel estimates 2.5% of credit sales are uncollectible ii. Hansel estimates 1.5% of total sales are uncollectible iii. Hansel estimates 6% of accounts receivable are uncollectible b. Show the balance sheet presentation for parts i and iii. klam 72-Gretel Company's accounts receivable has a year-end balance of $915,000 and its lance sheet presentation for parts i and iii. HW Problem 7.2 - Gretel Company's accounts receivable has a year-end balance of $915,000 and its allowance for doubtful accounts has a $6,000 credit balance. Gretel ages its accounts receivable and estimates uncollectible accounts as follows. A/R Age Balance Uncollectible Not due $550,000 1.00% 1-30 days past due $220,000 1.80% 31-60 days past due $85,000 8.50% 61-90 days past due $48,000 30.00% Over 90 days past due $12,000 75.00% $915,000 a. Record the journal entry to estimate bad debts at year-end b. Record the journal entry the following year when Dead Company goes bankrupt owing Gretel $8,000. HW Problem 7.3 - Lender Company incurred the following transactions in January 1/15 Accepted a $10,000, 60-day 8% note as extension of Late Company's overdue accounts receivable. 1/20 Loaned $50,000 to Borrower Company in exchange for a 50-day 12% note. 1/24 Loaned $15,000 to Brother Company in exchange for a 45-day 5% note. a. Record the preceding transactions for Lender Company assuming it uses the 360 day convention. b. Record adjusting entries January 31st and February 28th (assume Feb has 28 days). c. Record the journal entries at maturity. HW Problem 7.4 - Given the following information, A) calculate each company's receivables turnover for 2010, B) which company collects its receivables most quickly? Net Sales Cost of Sales Inventory Accounts Receivable (Net) Total Assets Walmart (millions $) Target (millions $) Sears (millions $) Year Year Year Year Year Year Ending Ending Ending Ending Ending Ending 1/31/10 1/31/09 1/31/10 1/31/09 1/31/10 1/31/09 408,214 404,374 65,357 64,948 44,043 46,770 304,657 304,056 45,583 45,766 31,824 34,118 33,160 34,511 7,179 6,705 8,705 8,795 4,144 3,905 6,966 8,084 652 839 170,706 163,429 44,533 44,106 24,808 25,342 34