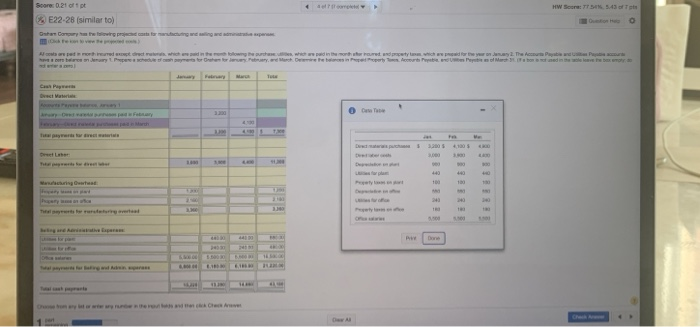

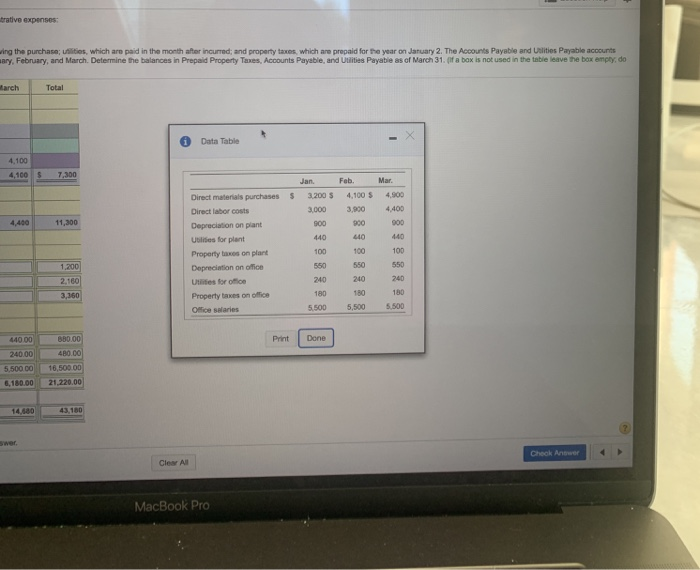

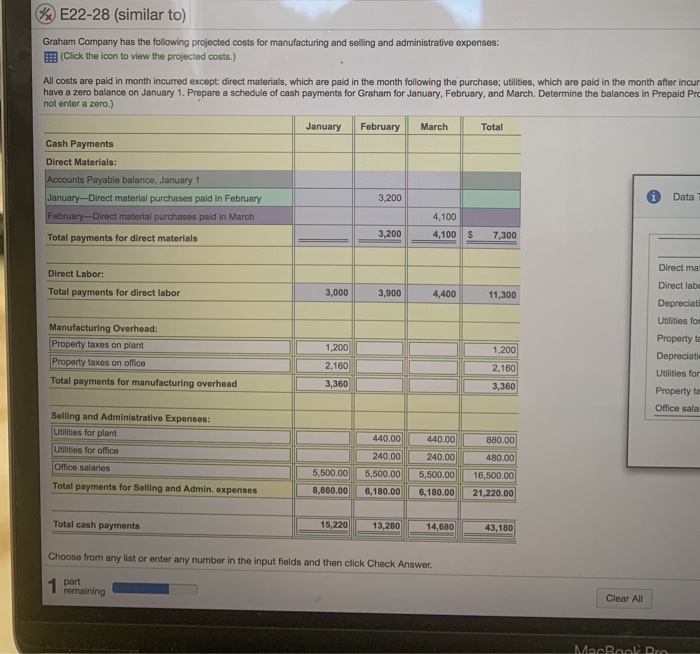

HW ST 5.43 Score: 0.21 pt E22-28 (similar to) Osta Company thing for acting ing we rumored trucks which er der Lehre where we wspid in the month to urdu poety ich we proud for the year. The com Can Pa 1.00 2005 105 40 100 150 24 20 De trative expenses ing the purchase; utilities, which are paid in the month after incurred; and property taxes, which are prepaid for the year on January 2. The Accounts Payable and Ulities Payable accounts ary, February, and March. Determine the balances in Prepaid Property Taxes, Accounts Payable, and Utilities Payable as of March 31. (if a bax is not used in the table leave the box empty, do March Total Data Table 4,100 4,100 $ 7.300 Jan. Feb. Mar. 4.800 3.200 S 3.000 900 440 4,100 S 3,900 900 4,400 900 4,400 11,300 440 440 Direct materials purchases S Direct labor costs Depreciation on plant Uses for plant Property taxes on plant Depreciation on office Uties for office Property taxes on office Office salaries 100 100 1.200 550 550 240 100 550 240 2.160 240 3,360 180 180 5,500 180 5,500 5.500 440.00 BB0.00 Print Done 240.00 5,500.00 480.00 16,500.00 21.220.00 6,180.00 14.680 43,180 Check Answer Cles All MacBook Pro BE22-28 (similar to) Graham Company has the following projected costs for manufacturing and selling and administrative expenses: Click the icon to view the projected costs.) All costs are paid in month incurred except: direct materials, which are paid in the month following the purchase, utilities, which are paid in the month after incur have a zero balance on January 1. Prepare a schedule of cash payments for Graham for January, February, and March. Determine the balances in Prepaid Pro not enter a zero.) January February March Cash Payments Direct Materials: Accounts Payable balance, January 1 January-Direct material purchases paid in February 3,200 Data February-Direct material purchases paid in March 4,100 3,200 4,100 $ 7,300 Total payments for direct materials Total Direct Labor: Total payments for direct labor Direct ma Direct lab 3,000 3,900 4,400 11,300 Depreciate Utilities for 1,200 Manufacturing Overhead: Property taxes on plant Property taxes on office Total payments for manufacturing overhead 2,160 3,360 1,200 2,160 3,360 Property to Depreciati Utilities for Property to Office sala Selling and Administrative Expenses: Utilities for plant Utilities for office 440.00 240.00 Office salaries 440.00 240.00 5,500.00 6,180.00 880.00 480.00 16,500.00 21,220.00 Total payments for Selling and Admin. expenses 5,500.00 8,860.00 5,500.00 6,180.00 Total cash payments 15,220 13,280 14,680 43,180 Choose from any list or enter any number in the input fields and then click Check Answer. 1 part remaining Clear All MacBool Dre