hw1

Round answer to nearest dollar $:

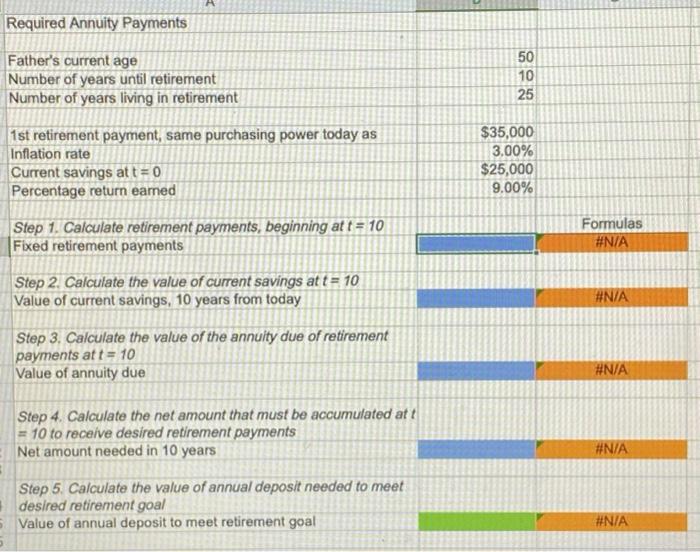

Assume that your father is now 50 years old, plans to retire in 10 years, and expects to live for 25 years after he retires - that is, until age 85. He wants his first retirement payment to have the same purchasing power at the time he retires as $35,000 has today. He wants all his subsequent retirement payments to be equal to his first retirement payment. (Do not let the retirement payments grow with inflation: Your father realizes that if inflation occurs the real value of his retirement income will decline year by year after he retires). His retirement income will begin the day he retires, 10 years from today, and he will then receive 24 additional annual payments. Inflation is expected to be 3% per year from today forward. He currently has $25,000 saved and expects to earn a return on his savings of 9% per year with annual compounding. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet How much must he save during each of the next 10 years (with equal deposits being made at the end of each year, beginning a year from today) to meet his retirement goal? (Note: Neither the amount he saves nor the amount he withdraws upon retirement is a growing annuity.) Do not round intermediate calculations. Round your answer to the nearest dollar. Required Annuity Payments Father's current age Number of years until retirement Number of years living in retirement 50 10 25 1st retirement payment, same purchasing power today as Inflation rate Current savings at t = 0 Percentage return eamed $35,000 3.00% $25,000 9.00% Step 1. Calculate retirement payments, beginning at t = 10 Fixed retirement payments Formulas #N/A Step 2. Calculate the value of current savings at t= 10 Value of current savings, 10 years from today #N/A Step 3. Calculate the value of the annuity due of retirement payments at t= 10 Value of annuity due #N/A Step 4. Calculate the net amount that must be accumulated att = 10 to receive desired retirement payments Net amount needed in 10 years #N/A Step 5. Calculate the value of annual deposit needed to meet desired retirement goal 5. Value of annual deposit to meet retirement goal #N/A