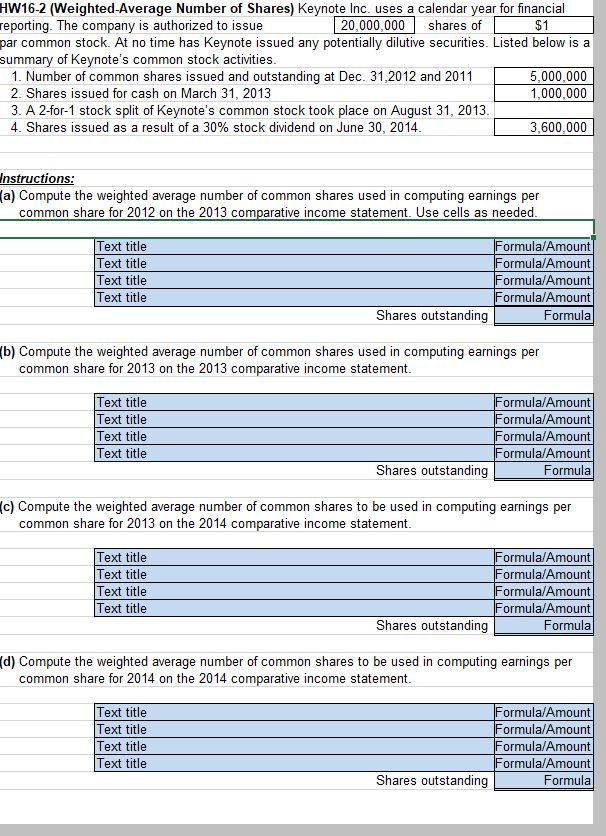

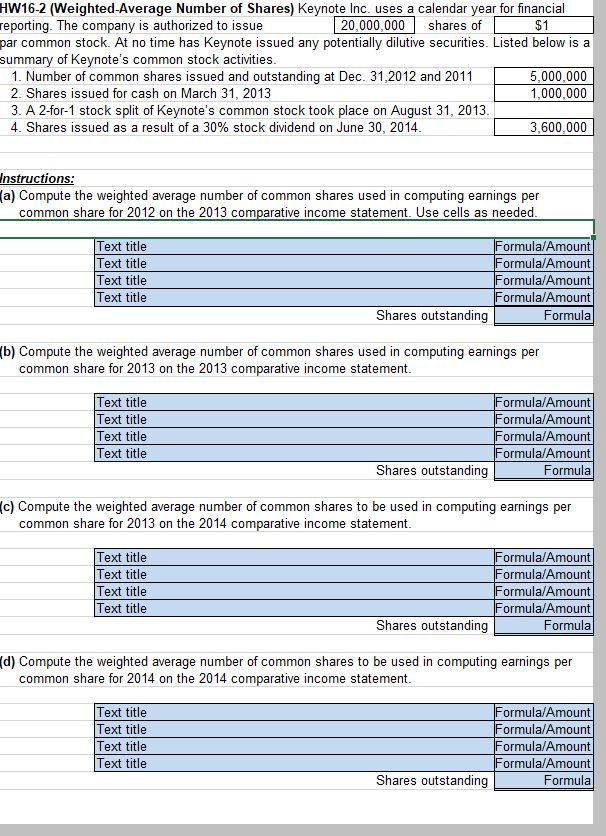

HW16-2 (Weighted-Average Number of Shares) Keynote Inc. uses a calendar year for financia reporting. The company is authorized to issue par common stock. At no time has Keynote issued any potentially dilutive securities. Listed below is a summary of Keynote's common stock activities 20,000,000 shares of $1 2 Shares suedan eaceh ding at Dec 31.2012 and 2011 1. Number of common shares issued and outstanding at Dec. 31,2012 and 2011 2. Shares issued for cash on March 31, 2013 3. A 2-for-1 stock split of Keynote's common stock took place on August 31, 2013 4. Shares issued as a result of a 30% stock dividend on June 30, 2014 5,000,000 1,000,000 3,600,000 nstructions: (a) Compute the weighted average number of common shares used in computing earnings per common share for 2012 on the 2013 comparative income statement. Use cells as needed Text title Text title Text title Text title ormula/Amount ormula/Amount Formula/Amount Formula/Amount Formula Shares outstanding (b) Compute the weighted average number of common shares used in computing earnings per common share for 2013 on the 2013 comparative income statement. Formula/Amount ormula/Amount Formula/Amount Formula/Amount Formula Text title Text title Text title (c) Compute the weighted average number of common shares to be used in computing earnings per common share for 2013 on the 2014 comparative income statement. Text title Text title Text title Text title Formula/Amount Formula/Amount Formula/Amount Formula/Amount Formula Shares outstanding (d) Compute the weighted average number of common shares to be used in computing earnings per common share for 2014 on the 2014 comparative income statement. rmula/Amount Formula/Amount ormula/Amount ormula/Amount Formula Text title Text title Text title Shares outstanding HW16-2 (Weighted-Average Number of Shares) Keynote Inc. uses a calendar year for financia reporting. The company is authorized to issue par common stock. At no time has Keynote issued any potentially dilutive securities. Listed below is a summary of Keynote's common stock activities 20,000,000 shares of $1 2 Shares suedan eaceh ding at Dec 31.2012 and 2011 1. Number of common shares issued and outstanding at Dec. 31,2012 and 2011 2. Shares issued for cash on March 31, 2013 3. A 2-for-1 stock split of Keynote's common stock took place on August 31, 2013 4. Shares issued as a result of a 30% stock dividend on June 30, 2014 5,000,000 1,000,000 3,600,000 nstructions: (a) Compute the weighted average number of common shares used in computing earnings per common share for 2012 on the 2013 comparative income statement. Use cells as needed Text title Text title Text title Text title ormula/Amount ormula/Amount Formula/Amount Formula/Amount Formula Shares outstanding (b) Compute the weighted average number of common shares used in computing earnings per common share for 2013 on the 2013 comparative income statement. Formula/Amount ormula/Amount Formula/Amount Formula/Amount Formula Text title Text title Text title (c) Compute the weighted average number of common shares to be used in computing earnings per common share for 2013 on the 2014 comparative income statement. Text title Text title Text title Text title Formula/Amount Formula/Amount Formula/Amount Formula/Amount Formula Shares outstanding (d) Compute the weighted average number of common shares to be used in computing earnings per common share for 2014 on the 2014 comparative income statement. rmula/Amount Formula/Amount ormula/Amount ormula/Amount Formula Text title Text title Text title Shares outstanding