Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HW9 Navigation 1 2. 3 4 5 6 Finish attempt... eBook Question 4 Not complete Mark 0.89 out of 2.00 P Flag question Bonds Payable

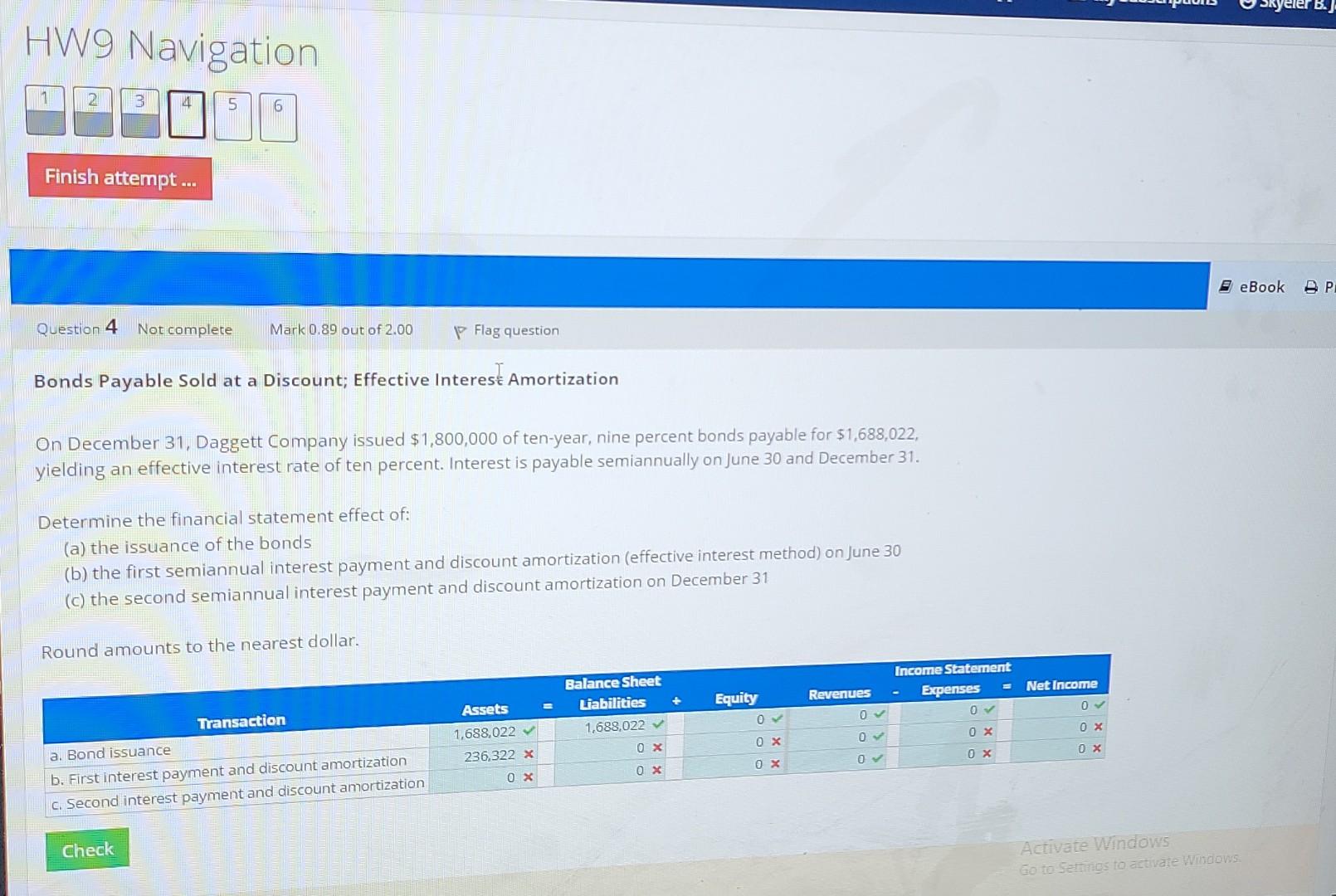

HW9 Navigation 1 2. 3 4 5 6 Finish attempt... eBook Question 4 Not complete Mark 0.89 out of 2.00 P Flag question Bonds Payable Sold at a Discount; Effective Interese Amortization On December 31, Daggett Company issued $1,800,000 of ten-year, nine percent bonds payable for $1,688,022, yielding an effective interest rate of ten percent. Interest is payable semiannually on June 30 and December 31. Determine the financial statement effect of: (a) the issuance of the bonds (b) the first semiannual interest payment and discount amortization (effective interest method) on June 30 (C) the second semiannual interest payment and discount amortization on December 31 Round amounts to the nearest dollar. Net Income Revenues Income Statement Expenses 0 Balance Sheet Liabilities 1,688,022 Equity O 0 O Assets 1,688,022 236,322 x 0 x 0x 0 0 x 0 x OX O Transaction a. Bond issuance b. First interest payment and discount amortization C. Second interest payment and discount amortization Ox 0 x OX 0 X Check Activate Windows Go to Sees to activate wmdows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started