Answered step by step

Verified Expert Solution

Question

1 Approved Answer

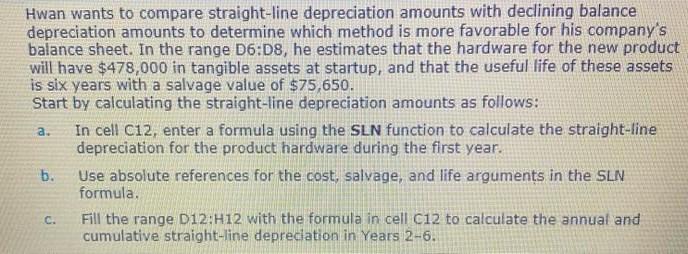

Hwan wants to compare straight-line depreciation amounts with declining balance depreciation amounts to determine which method is more favorable for his company's balance sheet. In

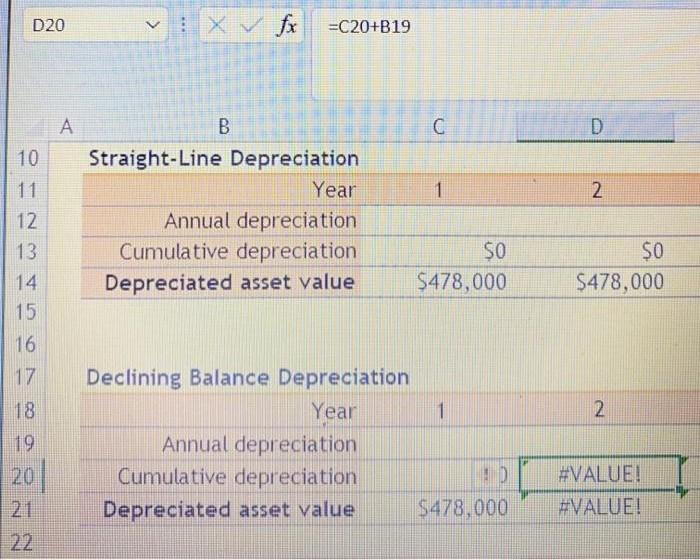

Hwan wants to compare straight-line depreciation amounts with declining balance depreciation amounts to determine which method is more favorable for his company's balance sheet. In the range D6:D8, he estimates that the hardware for the new product will have $478,000 in tangible assets at startup, and that the useful life of these assets is six years with a salvage value of $75,650. Start by calculating the straight-line depreciation amounts as follows: a. In cell C12, enter a formula using the SLN function to calculate the straight-line depreciation for the product hardware during the first year. b. Use absolute references for the cost, salvage, and life arguments in the SLN formula. c. Fill the range D12:H12 with the formula in cell C12 to calculate the annual and cumulative straight-line depreciation in Years 26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started