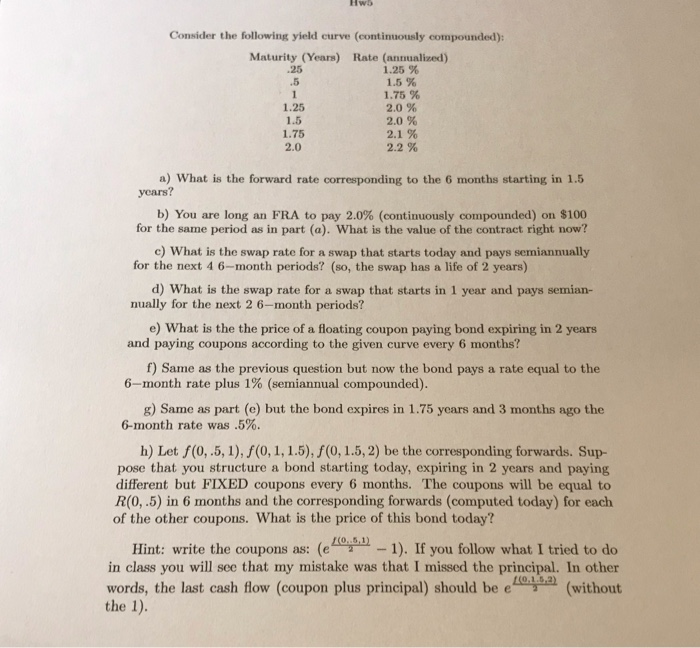

Hws Consider the following yield curve (continuously compounded): Maturity (Years) Rate (annualized) .25 1.25 % .5 1.5 % 1 1.75 % 1.25 2.0 % 1.5 2.0 % 1.75 2.1 % 2.0 2.2 % a) What is the forward rate corresponding to the 6 months starting in 1.5 years? b) You are long an FRA to pay 2.0% (continuously compounded) on $100 for the same period as in part (a). What is the value of the contract right now? c) What is the swap rate for a swap that starts today and pays semiannually for the next 4 6-month periods? (so, the swap has a life of 2 years) d) What is the swap rate for a swap that starts in 1 year and pays semian- nually for the next 2 6-month periods? e) What is the the price of a floating coupon paying bond expiring in 2 years and paying coupons according to the given curve every 6 months? f) Same as the previous question but now the bond pays a rate equal to the 6-month rate plus 1% (semiannual compounded). g) Same as part (e) but the bond expires in 1.75 years and 3 months ago the 6-month rate was .5%. h) Let f(0,.5, 1), f(0,1,1.5), f(0,1.5, 2) be the corresponding forwards. Sup- pose that you structure a bond starting today, expiring in 2 years and paying different but FIXED coupons every 6 months. The coupons will be equal to R(0,.5) in 6 months and the corresponding forwards (computed today) for each of the other coupons. What is the price of this bond today? Hint: write the coupons as: (e 10,0.1) 1). If you follow what I tried to do in class you will see that my mistake was that I missed the principal. In other 10,1,0,.2) words, the last cash flow (coupon plus principal) should be e (without the 1). Hws Consider the following yield curve (continuously compounded): Maturity (Years) Rate (annualized) .25 1.25 % .5 1.5 % 1 1.75 % 1.25 2.0 % 1.5 2.0 % 1.75 2.1 % 2.0 2.2 % a) What is the forward rate corresponding to the 6 months starting in 1.5 years? b) You are long an FRA to pay 2.0% (continuously compounded) on $100 for the same period as in part (a). What is the value of the contract right now? c) What is the swap rate for a swap that starts today and pays semiannually for the next 4 6-month periods? (so, the swap has a life of 2 years) d) What is the swap rate for a swap that starts in 1 year and pays semian- nually for the next 2 6-month periods? e) What is the the price of a floating coupon paying bond expiring in 2 years and paying coupons according to the given curve every 6 months? f) Same as the previous question but now the bond pays a rate equal to the 6-month rate plus 1% (semiannual compounded). g) Same as part (e) but the bond expires in 1.75 years and 3 months ago the 6-month rate was .5%. h) Let f(0,.5, 1), f(0,1,1.5), f(0,1.5, 2) be the corresponding forwards. Sup- pose that you structure a bond starting today, expiring in 2 years and paying different but FIXED coupons every 6 months. The coupons will be equal to R(0,.5) in 6 months and the corresponding forwards (computed today) for each of the other coupons. What is the price of this bond today? Hint: write the coupons as: (e 10,0.1) 1). If you follow what I tried to do in class you will see that my mistake was that I missed the principal. In other 10,1,0,.2) words, the last cash flow (coupon plus principal) should be e (without the 1)