Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hydro paddleboard please help me and do part 1 only. please record the transaction and journal entries thank you! In this assignment you are are

hydro paddleboard please help me and do part 1 only. please record the transaction and journal entries

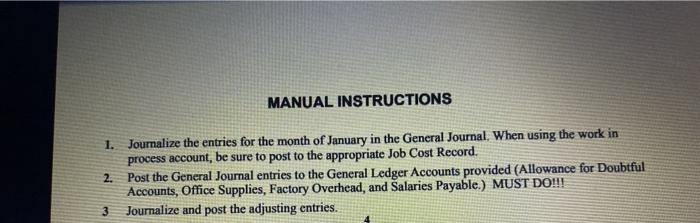

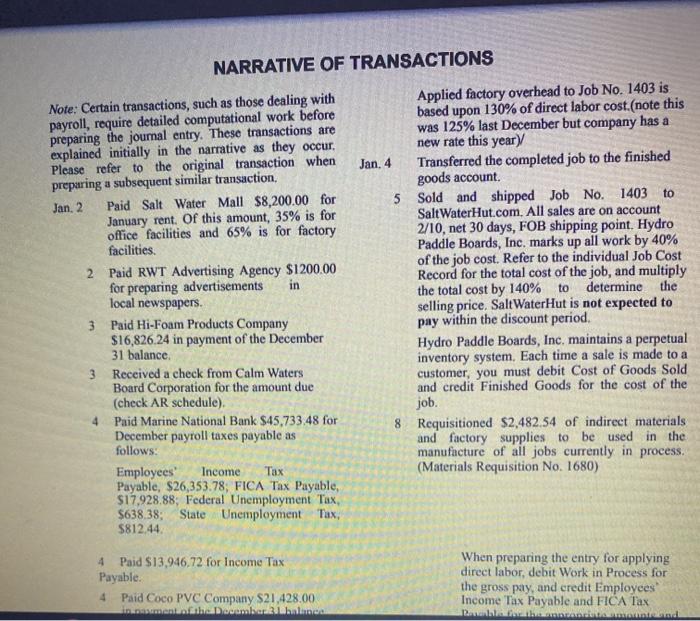

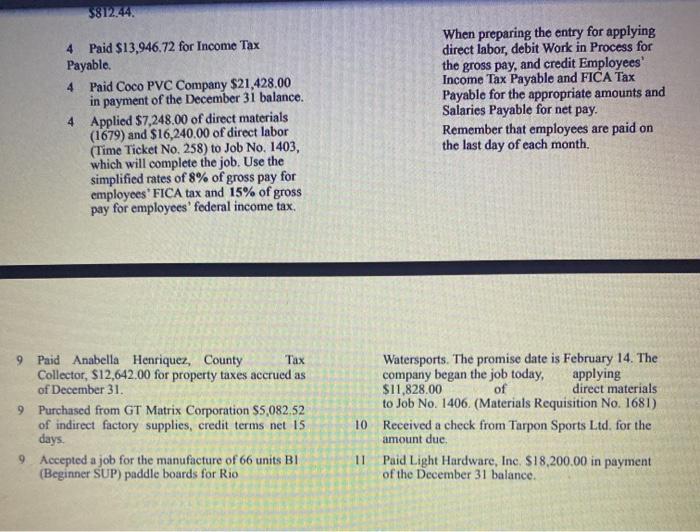

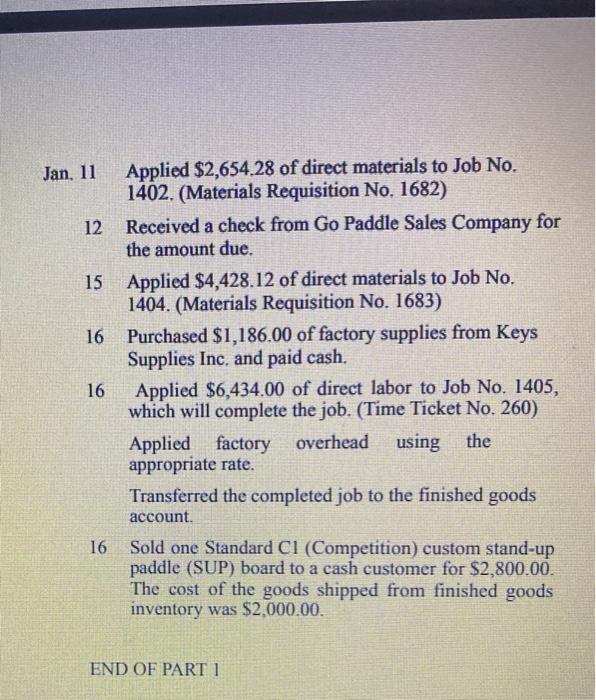

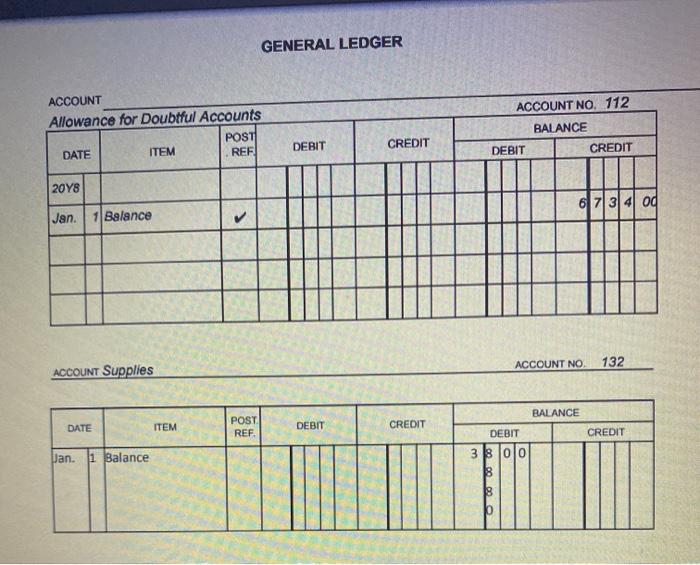

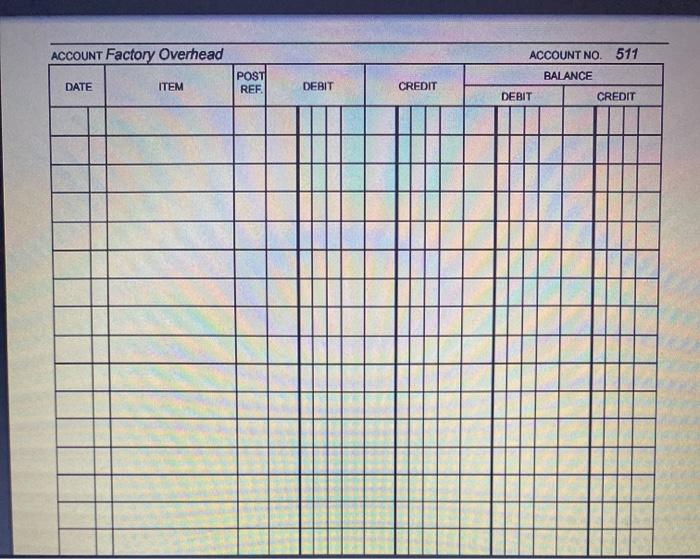

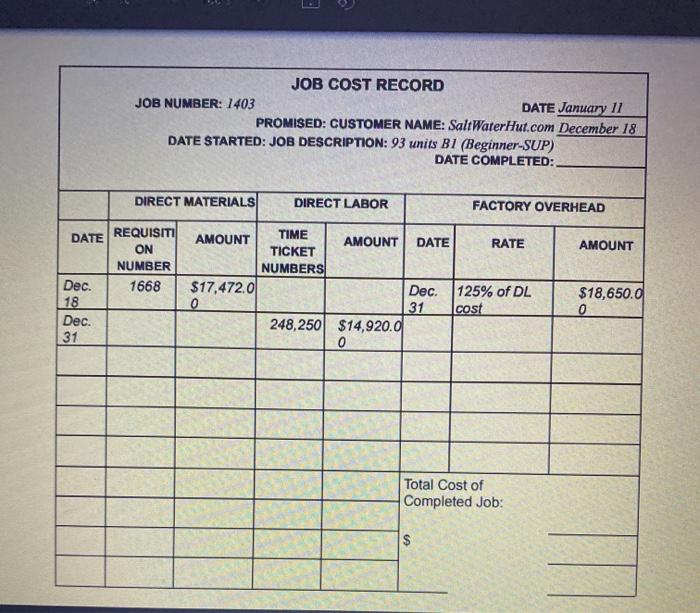

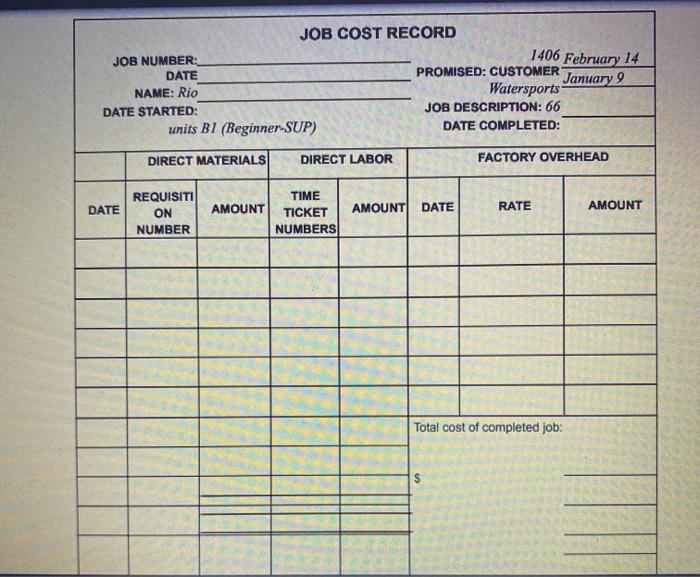

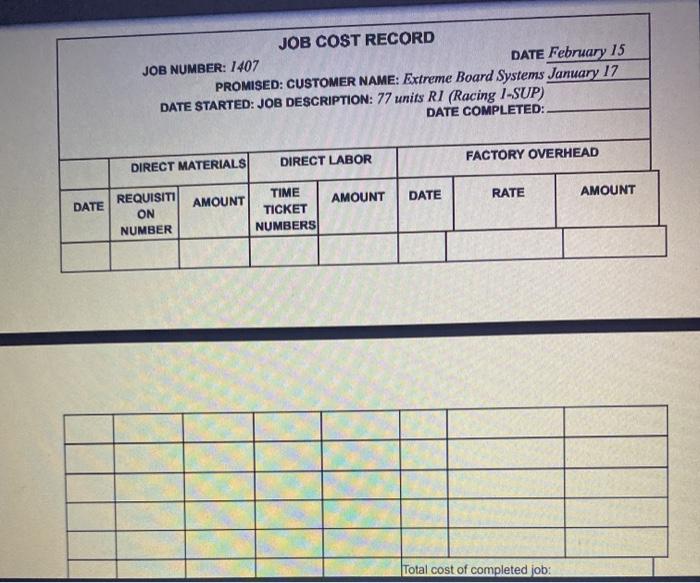

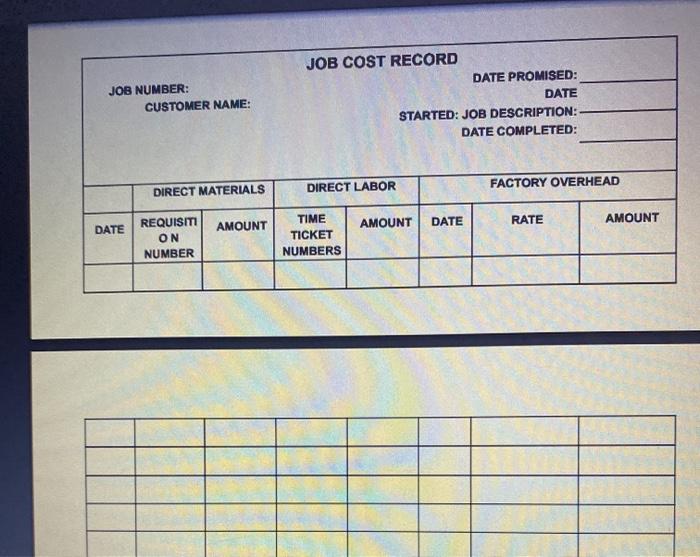

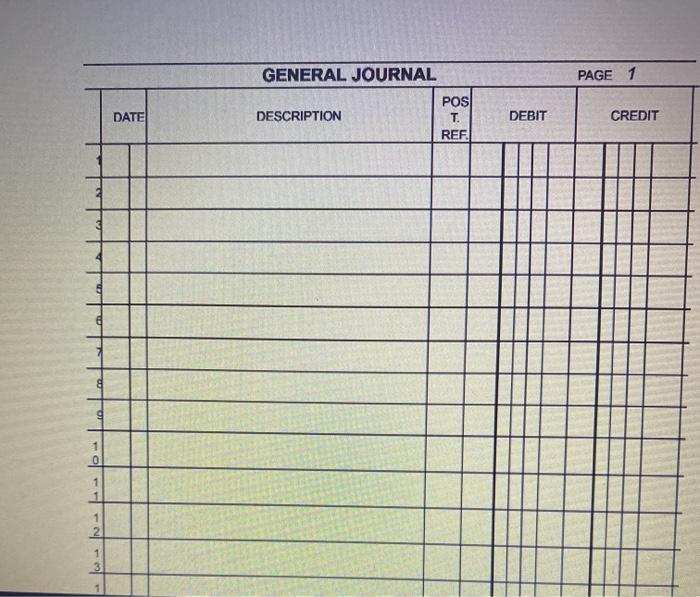

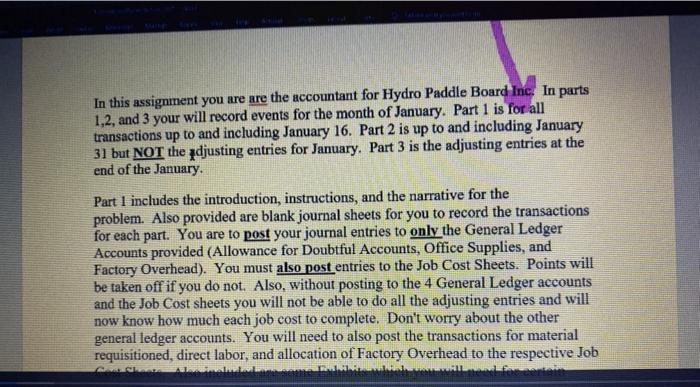

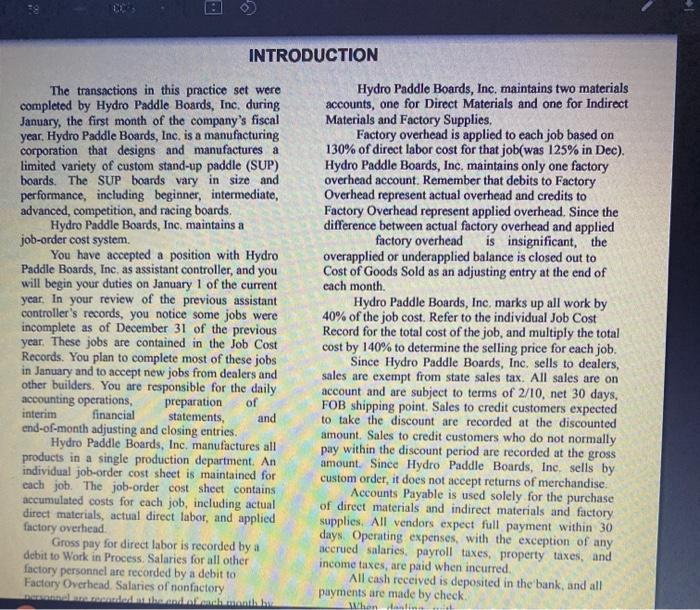

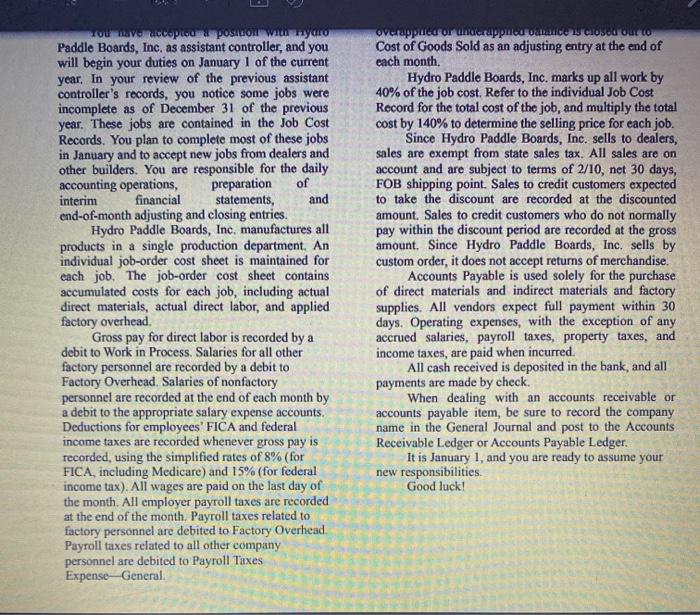

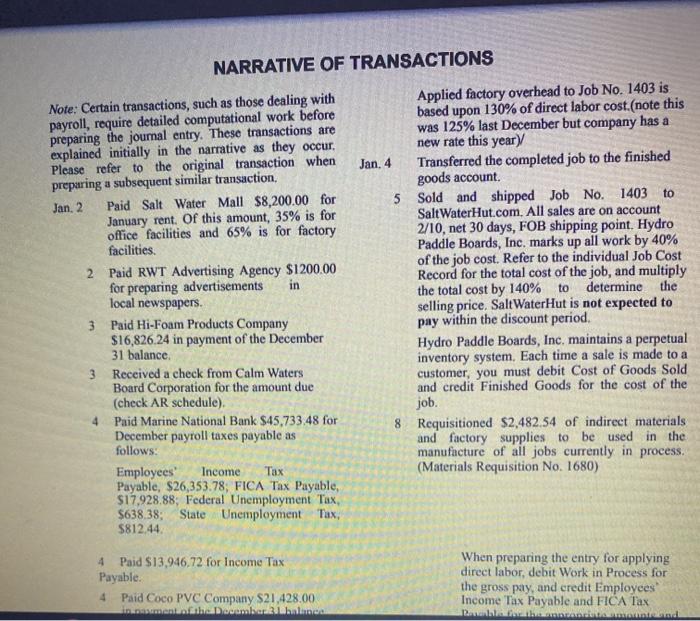

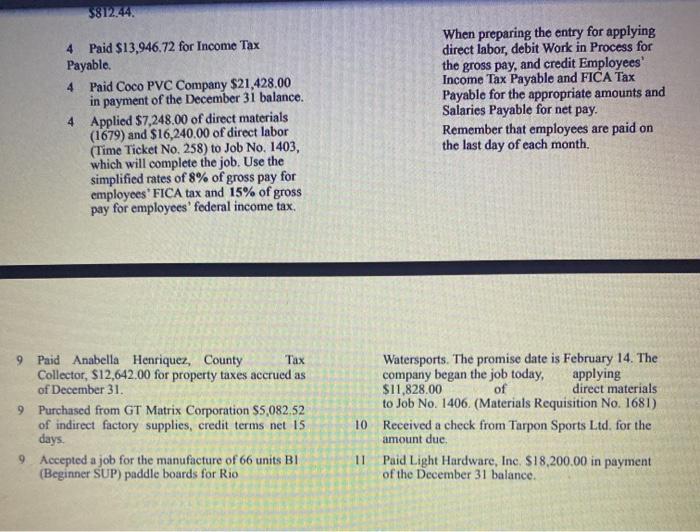

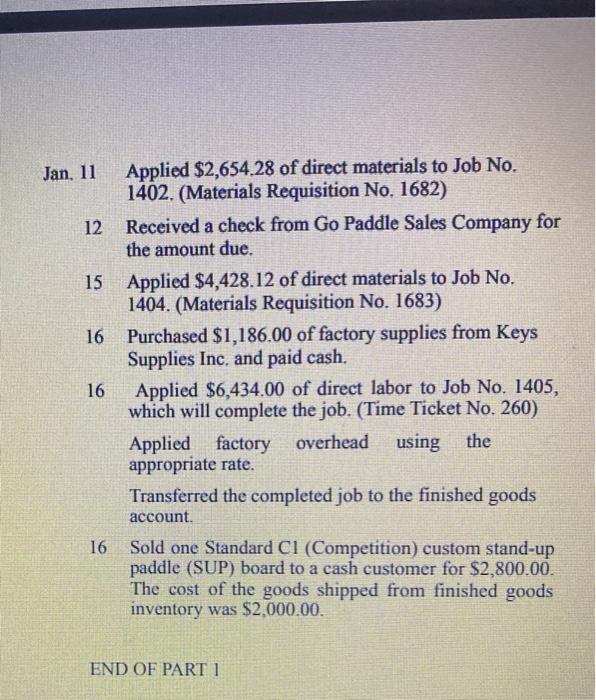

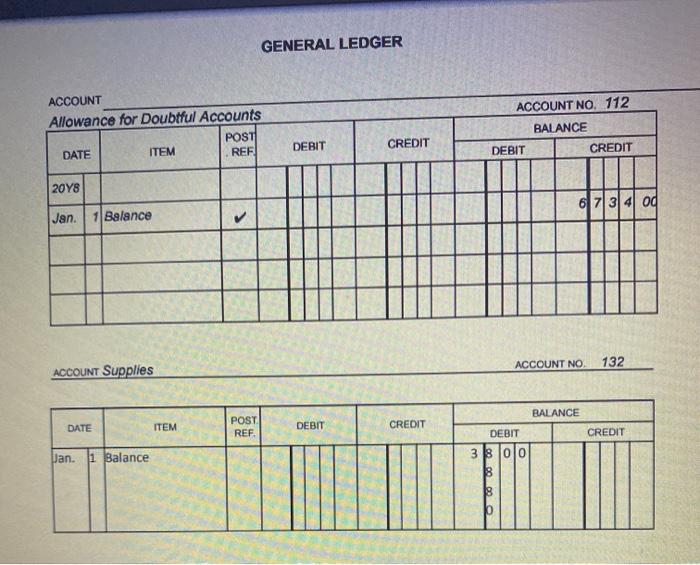

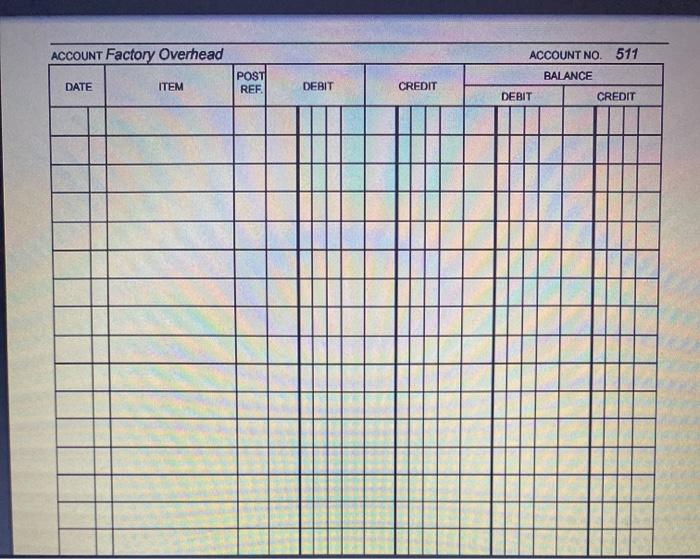

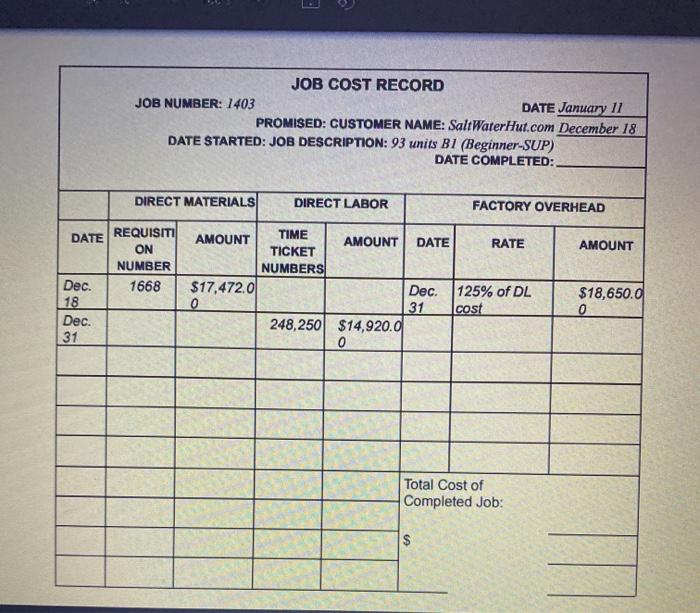

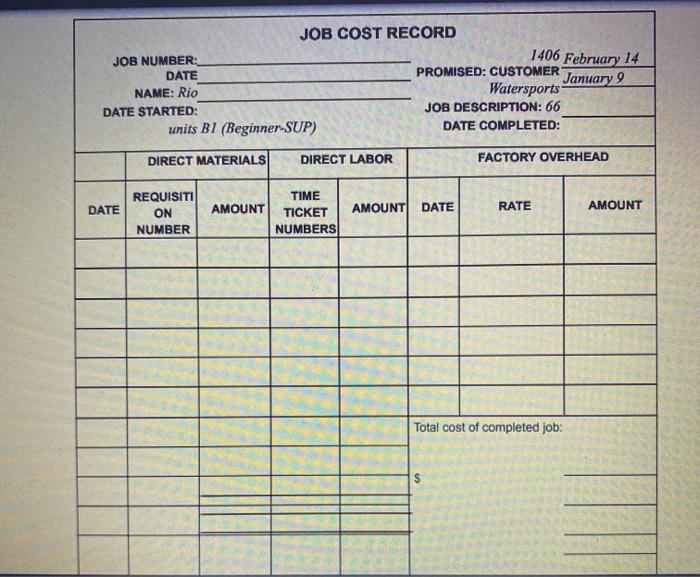

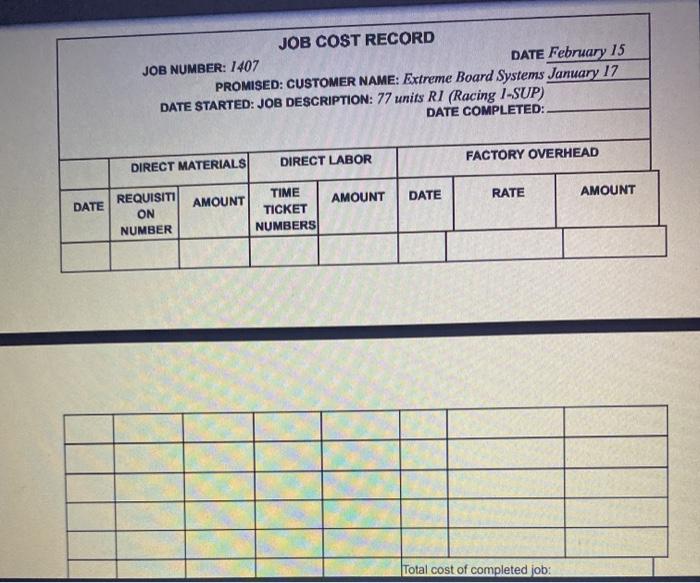

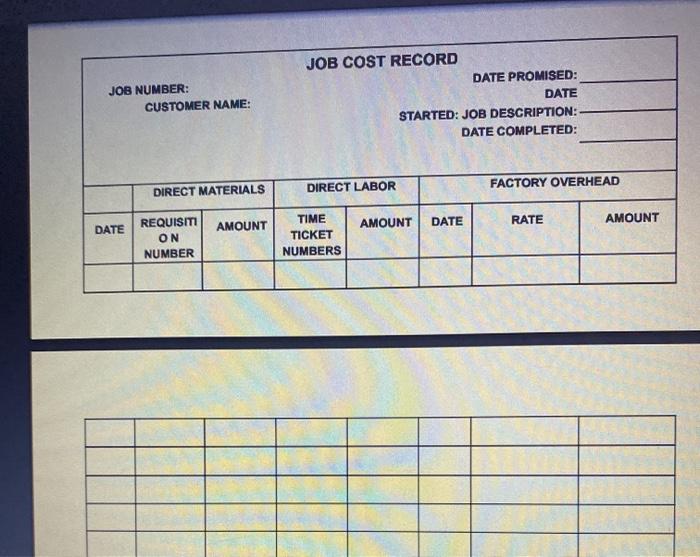

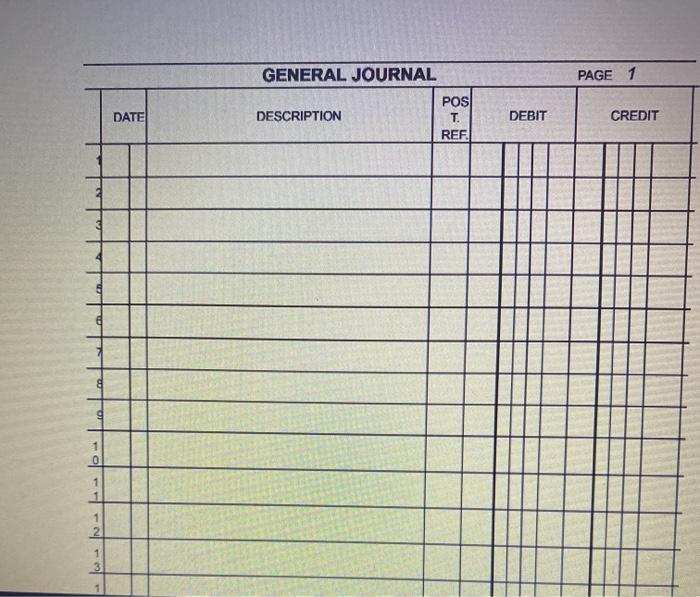

In this assignment you are are the accountant for Hydro Paddle Board Inc. In parts 1,2, and 3 your will record events for the month of January. Part 1 is for all transactions up to and including January 16. Part 2 is up to and including January 31 but NOT the adjusting entries for January. Part 3 is the adjusting entries at the end of the January. Part 1 includes the introduction, instructions, and the narrative for the problem. Also provided are blank journal sheets for you to record the transactions for each part. You are to post your journal entries to only the General Ledger Accounts provided (Allowance for Doubtful Accounts, Office Supplies, and Factory Overhead). You must also post entries to the Job Cost Sheets. Points will be taken off if you do not. Also, without posting to the 4 General Ledger accounts and the Job Cost sheets you will not be able to do all the adjusting entries and will now know how much each job cost to complete. Don't worry about the other general ledger accounts. You will need to also post the transactions for material requisitioned, direct labor, and allocation of Factory Overhead to the respective Job Chat We will end of the January Part 1 includes the introduction, instructions, and the narrative for the problem. Also provided are blank journal sheets for you to record the transactions for each part. You are to post your journal entries to only the General Ledger Accounts provided (Allowance for Doubtful Accounts, Office Supplies, and Factory Overhead). You must also post entries to the Job Cost Sheets. Points will be taken off if yds do not. Also, without posting to the 4 General Ledger accounts and the Job Cost sheets you will not be able to do all the adjusting entries and will now know how much each job cost to complete. Don't worry about the other general ledger accounts. You will need to also post the transactions for material requisitioned, direct labor, and allocation of Factory Overhead to the respective Job Cost Sheets. Also included are some Exhibits which you will need for certain transactions INTRODUCTION The transactions in this practice set were Hydro Paddle Boards, Inc. maintains two materials completed by Hydro Paddle Boards, Inc. during accounts, one for Direct Materials and one for Indirect January, the first month of the company's fiscal Materials and Factory Supplies. year. Hydro Paddle Boards, Inc. is a manufacturing Factory overhead is applied to each job based on corporation that designs and manufactures a 130% of direct labor cost for that job(was 125% in Dec). limited variety of custom stand-up paddle (SUP) Hydro Paddle Boards, Inc, maintains only one factory boards. The SUP boards vary in size and overhead account. Remember that debits to Factory performance, including beginner, intermediate, Overhead represent actual overhead and credits to advanced, competition, and racing boards, Factory Overhead represent applied overhead. Since the Hydro Paddle Boards, Inc, maintains a difference between actual factory overhead and applied job-order cost system. factory overhead is insignificant, the You have accepted a position with Hydro overapplied or underapplied balance is closed out to Paddle Boards, Inc, as assistant controller, and you Cost of Goods Sold as an adjusting entry at the end of will begin your duties on January 1 of the current cach month. year. In your review of the previous assistant Hydro Paddle Boards, Ine, marks up all work by controller's records, you notice some jobs were 40% of the job cost. Refer to the individual Job Cost incomplete as of December 31 of the previous Record for the total cost of the job, and multiply the total year. These jobs are contained in the Job Cost cost by 140% to determine the selling price for each job. Records. You plan to complete most of these jobs Since Hydro Paddle Boards, Inc, sells to dealers, in January and to accept new jobs from dealers and sales are exempt from state sales tax. All sales are on other builders. You are responsible for the daily account and are subject to terms of 2/10, net 30 days, accounting operations, preparation of FOB shipping point. Sales to credit customers expected interim financial statements, and to take the discount are recorded at the discounted end-of-month adjusting and closing entries. amount. Sales to credit customers who do not normally Hydro Paddle Boards, Inc, manufactures all pay within the discount period are recorded at the gross products in a single production department. An amount. Since Hydro Paddle Boards, Inc. sells by individual job-order cost sheet is maintained for custom order, it does not accept returns of merchandise cach job. The job-order cost sheet contains Accounts Payable is used solely for the purchase accumulated costs for each job, including actual of direct materials and indirect materials and factory direct materials, actual direct labor, and applied supplies. All vendors expect full payment within 30 factory overhead Gross pay for direct labor is recorded by a days Operating expenses, with the exception of any accrued salaries, payroll taxes, property taxes, and debit to Work in Process. Salaries for all other income taxes, are paid when incurred. factory personnel are recorded by a debit to Factory Overhead. Salaries of nonfactory All cash received is deposited in the bank, and all payments are made by check done and want When . YOU HAVoccopic position W wyro Paddle Boards, Inc. as assistant controller, and you will begin your duties on January 1 of the current year. In your review of the previous assistant controller's records, you notice some jobs were incomplete as of December 31 of the previous year. These jobs are contained in the Job Cost Records. You plan to complete most of these jobs in January and to accept new jobs from dealers and other builders. You are responsible for the daily accounting operations, preparation of interim financial statements, and end-of-month adjusting and closing entries. Hydro Paddle Boards, Inc., manufactures all products in a single production department. An individual job-order cost sheet is maintained for each job. The job-order cost sheet contains accumulated costs for each job, including actual direct materials, actual direct labor, and applied factory overhead Gross pay for direct labor is recorded by a debit to Work in Process. Salaries for all other factory personnel are recorded by a debit to Factory Overhead. Salaries of nonfactory personnel are recorded at the end of each month by a debit to the appropriate salary expense accounts. Deductions for employees' FICA and federal income taxes are recorded whenever gross pay is recorded, using the simplified rates of 8% (for FICA, including Medicare) and 15% (for federal income tax). All wages are paid on the last day of the month. All employer payroll taxes are recorded at the end of the month, Payroll taxes related to factory personnel are debited to Factory Overhead Payroll taxes related to all other company personnel are debited to Payroll Taxes Expense-General overapprice or an approace 13 closed out to Cost of Goods Sold as an adjusting entry at the end of each month, Hydro Paddle Boards, Inc. marks up all work by 40% of the job cost. Refer to the individual Job Cost Record for the total cost of the job, and multiply the total cost by 140% to determine the selling price for each job. Since Hydro Paddle Boards, Inc. sells to dealers, sales are exempt from state sales tax. All sales are on account and are subject to terms of 2/10, net 30 days, FOB shipping point. Sales to credit customers expected to take the discount are recorded at the discounted amount. Sales to credit customers who do not normally pay within the discount period are recorded at the gross amount. Since Hydro Paddle Boards, Inc. sells by custom order, it does not accept returns of merchandise. Accounts Payable is used solely for the purchase of direct materials and indirect materials and factory supplies. All vendors expect full payment within 30 days. Operating expenses, with the exception of any accrued salaries, payroll taxes, property taxes, and income taxes, are paid when incurred. All cash received is deposited in the bank, and all payments are made by check. When dealing with an accounts receivable or accounts payable item, be sure to record the company name in the General Journal and post to the Accounts Receivable Ledger or Accounts Payable Ledger. It is January 1, and you are ready to assume your new responsibilities Good luck! MANUAL INSTRUCTIONS 1. Journalize the entries for the month of January in the General Journal, When using the work in process account, be sure to post to the appropriate Job Cost Record. 2. Post the General Journal entries to the General Ledger Accounts provided (Allowance for Doubtful Accounts, Office Supplies, Factory Overhead, and Salaries Payable.) MUST DO!!! 3 Journalize and post the adjusting entries. NARRATIVE OF TRANSACTIONS Note: Certain transactions, such as those dealing with Applied factory overhead to Job No. 1403 is payroll, require detailed computational work before based upon 130% of direct labor cost.(note this preparing the journal entry. These transactions are was 125% last December but company has a explained initially in the narrative as they occur new rate this year) Please refer to the original transaction when Jan. 4 Transferred the completed job to the finished preparing a subsequent similar transaction, goods account. Jan. 2 Paid Salt Water Mall $8,200.00 for 5 Sold and shipped Job No. 1403 to January rent. Of this amount, 35% is for Salt WaterHut.com. All sales are on account office facilities and 65% is for factory 2/10, net 30 days, FOB shipping point. Hydro facilities. Paddle Boards, Inc, marks up all work by 40% 2 Paid RWT Advertising Agency $1200.00 of the job cost. Refer to the individual Job Cost Record for the total cost of the job, and multiply for preparing advertisements in the the total cost by 140% to determine local newspapers selling price. Salt WaterHut is not expected to 3 Paid Hi-Foam Products Company pay within the discount period, $16,826.24 in payment of the December 31 balance Hydro Paddle Boards, Inc, maintains a perpetual inventory system. Each time a sale is made to a 3 Received a check from Calm Waters Board Corporation for the amount due customer, you must debit Cost of Goods Sold and credit Finished Goods for the cost of the (check AR schedule). job. Paid Marine National Bank $45,733.48 for December payroll taxes payable as 8 Requisitioned $2,482.54 of indirect materials follows: and factory supplies to be used in the manufacture of all jobs currently in process. Employees Income Tax (Materials Requisition No. 1680) Payable, $26,353.78; FICA Tax Payable, $17.928.88; Federal Unemployment Tax $638 38: State Unemployment Tax, 5812.44 4 4 Paid $13,946.72 for Income Tax Payable. Paid Coco PVC Company S21,428.00 mann. Dambollida When preparing the entry for applying direct labor, debit Work in Process for the gross pay, and credit Employees Income Tax Payable and FICA Tax Richard $812.44 4 Paid $13,946.72 for Income Tax Payable. 4 Paid Coco PVC Company $21,428.00 in payment of the December 31 balance. 4 Applied $7,248.00 of direct materials (1679) and $16,240.00 of direct labor (Time Ticket No. 258) to Job No. 1403, which will complete the job. Use the simplified rates of 8% of gross pay for employees' FICA tax and 15% of gross pay for employees' federal income tax. When preparing the entry for applying direct labor, debit Work in Process for the gross pay, and credit Employees Income Tax Payable and FICA Tax Payable for the appropriate amounts and Salaries Payable for net pay. Remember that employees are paid on the last day of each month. 9 Paid Anabella Henriquez, County Tax Collector, $12,642.00 for property taxes accrued as of December 31. 9 Purchased from GT Matrix Corporation $5,082.52 of indirect factory supplies, credit terms net 15 days 9 Accepted a job for the manufacture of 66 units BI (Beginner SUP) Paddle boards for Rio Watersports. The promise date is February 14. The company began the job today, applying $11,828.00 of direct materials to Job No. 1406. (Materials Requisition No. 1681) 10 Received a check from Tarpon Sports Ltd. for the amount due 11 Paid Light Hardware, Inc. $18,200.00 in payment of the December 31 balance. Jan, 11 Applied $2,654.28 of direct materials to Job No. 1402. (Materials Requisition No. 1682) 12 Received a check from Go Paddle Sales Company for the amount due. 15 Applied $4,428.12 of direct materials to Job No. 1404. (Materials Requisition No. 1683) 16 Purchased $1,186.00 of factory supplies from Keys Supplies Inc. and paid cash, 16 Applied $6,434.00 of direct labor to Job No. 1405, which will complete the job. (Time Ticket No. 260) Applied factory factory overhead using the appropriate rate. Transferred the completed job to the finished goods account. 16 Sold one Standard CI (Competition) custom stand-up paddle (SUP) board to a cash customer for $2,800.00. The cost of the goods shipped from finished goods inventory was $2,000.00. END OF PART 1 GENERAL LEDGER ACCOUNT Allowance for Doubtful Accounts POST DATE ITEM REF ACCOUNT NO. 112 BALANCE DEBIT CREDIT DEBIT CREDIT 2048 67 34 od Jan. 1 Balance ACCOUNT NO. 132 ACCOUNT Supplies BALANCE DATE ITEM POST REF DEBIT CREDIT CREDIT Jan. 1 Balance DEBIT 3800 8 ACCOUNT Factory Overhead ACCOUNT NO. 511 BALANCE DATE ITEM POST REF DEBIT CREDIT DEBIT CREDIT JOB COST RECORD JOB NUMBER: 1403 DATE January 11 PROMISED: CUSTOMER NAME: Salt WaterHut.com December 18 DATE STARTED: JOB DESCRIPTION: 93 units Bl (Beginner-SUP) DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD DATE AMOUNT DATE RATE AMOUNT REQUISITI ON NUMBER 1668 Dec. 18 Dec. 31 AMOUNT TIME TICKET NUMBERS $17,472.00 0 248,250 Dec. 31 $14,920.0 125% of DL cost $18,650.0 0 Total Cost of Completed Job: JOB COST RECORD JOB NUMBER: 1406 February 14 DATE PROMISED: CUSTOMER January 9 NAME: Rio Watersports DATE STARTED: JOB DESCRIPTION: 66 units Bl (Beginner-SUP) DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD DATE AMOUNT DATE REQUISITI ON NUMBER AMOUNT RATE AMOUNT TIME TICKET NUMBERS Total cost of completed job: JOB COST RECORD JOB NUMBER: 1407 DATE February 15 PROMISED: CUSTOMER NAME: Extreme Board Systems January 17 DATE STARTED: JOB DESCRIPTION: 77 units RI (Racing 1-SUP) DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD DATE AMOUNT AMOUNT RATE DATE REQUISITI ON NUMBER TIME AMOUNT TICKET NUMBERS Total cost of completed job: JOB NUMBER: CUSTOMER NAME: JOB COST RECORD DATE PROMISED: DATE STARTED: JOB DESCRIPTION: DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD AMOUNT DATE RATE AMOUNT DATE REQUISITI ON NUMBER TIME AMOUNT TICKET NUMBERS PAGE 1 GENERAL JOURNAL POSI DESCRIPTION T. REF. DATE DEBIT CREDIT & 1 1 1 1 2 1 3 In this assignment you are are the accountant for Hydro Paddle Board Inc. In parts 1,2, and 3 your will record events for the month of January. Part 1 is for all transactions up to and including January 16. Part 2 is up to and including January 31 but NOT the adjusting entries for January. Part 3 is the adjusting entries at the end of the January. Part 1 includes the introduction, instructions, and the narrative for the problem. Also provided are blank journal sheets for you to record the transactions for each part. You are to post your journal entries to only the General Ledger Accounts provided (Allowance for Doubtful Accounts, Office Supplies, and Factory Overhead). You must also post entries to the Job Cost Sheets. Points will be taken off if you do not. Also, without posting to the 4 General Ledger accounts and the Job Cost sheets you will not be able to do all the adjusting entries and will now know how much each job cost to complete. Don't worry about the other general ledger accounts. You will need to also post the transactions for material requisitioned, direct labor, and allocation of Factory Overhead to the respective Job Chat We will end of the January Part 1 includes the introduction, instructions, and the narrative for the problem. Also provided are blank journal sheets for you to record the transactions for each part. You are to post your journal entries to only the General Ledger Accounts provided (Allowance for Doubtful Accounts, Office Supplies, and Factory Overhead). You must also post entries to the Job Cost Sheets. Points will be taken off if yds do not. Also, without posting to the 4 General Ledger accounts and the Job Cost sheets you will not be able to do all the adjusting entries and will now know how much each job cost to complete. Don't worry about the other general ledger accounts. You will need to also post the transactions for material requisitioned, direct labor, and allocation of Factory Overhead to the respective Job Cost Sheets. Also included are some Exhibits which you will need for certain transactions INTRODUCTION The transactions in this practice set were Hydro Paddle Boards, Inc. maintains two materials completed by Hydro Paddle Boards, Inc. during accounts, one for Direct Materials and one for Indirect January, the first month of the company's fiscal Materials and Factory Supplies. year. Hydro Paddle Boards, Inc. is a manufacturing Factory overhead is applied to each job based on corporation that designs and manufactures a 130% of direct labor cost for that job(was 125% in Dec). limited variety of custom stand-up paddle (SUP) Hydro Paddle Boards, Inc, maintains only one factory boards. The SUP boards vary in size and overhead account. Remember that debits to Factory performance, including beginner, intermediate, Overhead represent actual overhead and credits to advanced, competition, and racing boards, Factory Overhead represent applied overhead. Since the Hydro Paddle Boards, Inc, maintains a difference between actual factory overhead and applied job-order cost system. factory overhead is insignificant, the You have accepted a position with Hydro overapplied or underapplied balance is closed out to Paddle Boards, Inc, as assistant controller, and you Cost of Goods Sold as an adjusting entry at the end of will begin your duties on January 1 of the current cach month. year. In your review of the previous assistant Hydro Paddle Boards, Ine, marks up all work by controller's records, you notice some jobs were 40% of the job cost. Refer to the individual Job Cost incomplete as of December 31 of the previous Record for the total cost of the job, and multiply the total year. These jobs are contained in the Job Cost cost by 140% to determine the selling price for each job. Records. You plan to complete most of these jobs Since Hydro Paddle Boards, Inc, sells to dealers, in January and to accept new jobs from dealers and sales are exempt from state sales tax. All sales are on other builders. You are responsible for the daily account and are subject to terms of 2/10, net 30 days, accounting operations, preparation of FOB shipping point. Sales to credit customers expected interim financial statements, and to take the discount are recorded at the discounted end-of-month adjusting and closing entries. amount. Sales to credit customers who do not normally Hydro Paddle Boards, Inc, manufactures all pay within the discount period are recorded at the gross products in a single production department. An amount. Since Hydro Paddle Boards, Inc. sells by individual job-order cost sheet is maintained for custom order, it does not accept returns of merchandise cach job. The job-order cost sheet contains Accounts Payable is used solely for the purchase accumulated costs for each job, including actual of direct materials and indirect materials and factory direct materials, actual direct labor, and applied supplies. All vendors expect full payment within 30 factory overhead Gross pay for direct labor is recorded by a days Operating expenses, with the exception of any accrued salaries, payroll taxes, property taxes, and debit to Work in Process. Salaries for all other income taxes, are paid when incurred. factory personnel are recorded by a debit to Factory Overhead. Salaries of nonfactory All cash received is deposited in the bank, and all payments are made by check done and want When . YOU HAVoccopic position W wyro Paddle Boards, Inc. as assistant controller, and you will begin your duties on January 1 of the current year. In your review of the previous assistant controller's records, you notice some jobs were incomplete as of December 31 of the previous year. These jobs are contained in the Job Cost Records. You plan to complete most of these jobs in January and to accept new jobs from dealers and other builders. You are responsible for the daily accounting operations, preparation of interim financial statements, and end-of-month adjusting and closing entries. Hydro Paddle Boards, Inc., manufactures all products in a single production department. An individual job-order cost sheet is maintained for each job. The job-order cost sheet contains accumulated costs for each job, including actual direct materials, actual direct labor, and applied factory overhead Gross pay for direct labor is recorded by a debit to Work in Process. Salaries for all other factory personnel are recorded by a debit to Factory Overhead. Salaries of nonfactory personnel are recorded at the end of each month by a debit to the appropriate salary expense accounts. Deductions for employees' FICA and federal income taxes are recorded whenever gross pay is recorded, using the simplified rates of 8% (for FICA, including Medicare) and 15% (for federal income tax). All wages are paid on the last day of the month. All employer payroll taxes are recorded at the end of the month, Payroll taxes related to factory personnel are debited to Factory Overhead Payroll taxes related to all other company personnel are debited to Payroll Taxes Expense-General overapprice or an approace 13 closed out to Cost of Goods Sold as an adjusting entry at the end of each month, Hydro Paddle Boards, Inc. marks up all work by 40% of the job cost. Refer to the individual Job Cost Record for the total cost of the job, and multiply the total cost by 140% to determine the selling price for each job. Since Hydro Paddle Boards, Inc. sells to dealers, sales are exempt from state sales tax. All sales are on account and are subject to terms of 2/10, net 30 days, FOB shipping point. Sales to credit customers expected to take the discount are recorded at the discounted amount. Sales to credit customers who do not normally pay within the discount period are recorded at the gross amount. Since Hydro Paddle Boards, Inc. sells by custom order, it does not accept returns of merchandise. Accounts Payable is used solely for the purchase of direct materials and indirect materials and factory supplies. All vendors expect full payment within 30 days. Operating expenses, with the exception of any accrued salaries, payroll taxes, property taxes, and income taxes, are paid when incurred. All cash received is deposited in the bank, and all payments are made by check. When dealing with an accounts receivable or accounts payable item, be sure to record the company name in the General Journal and post to the Accounts Receivable Ledger or Accounts Payable Ledger. It is January 1, and you are ready to assume your new responsibilities Good luck! MANUAL INSTRUCTIONS 1. Journalize the entries for the month of January in the General Journal, When using the work in process account, be sure to post to the appropriate Job Cost Record. 2. Post the General Journal entries to the General Ledger Accounts provided (Allowance for Doubtful Accounts, Office Supplies, Factory Overhead, and Salaries Payable.) MUST DO!!! 3 Journalize and post the adjusting entries. NARRATIVE OF TRANSACTIONS Note: Certain transactions, such as those dealing with Applied factory overhead to Job No. 1403 is payroll, require detailed computational work before based upon 130% of direct labor cost.(note this preparing the journal entry. These transactions are was 125% last December but company has a explained initially in the narrative as they occur new rate this year) Please refer to the original transaction when Jan. 4 Transferred the completed job to the finished preparing a subsequent similar transaction, goods account. Jan. 2 Paid Salt Water Mall $8,200.00 for 5 Sold and shipped Job No. 1403 to January rent. Of this amount, 35% is for Salt WaterHut.com. All sales are on account office facilities and 65% is for factory 2/10, net 30 days, FOB shipping point. Hydro facilities. Paddle Boards, Inc, marks up all work by 40% 2 Paid RWT Advertising Agency $1200.00 of the job cost. Refer to the individual Job Cost Record for the total cost of the job, and multiply for preparing advertisements in the the total cost by 140% to determine local newspapers selling price. Salt WaterHut is not expected to 3 Paid Hi-Foam Products Company pay within the discount period, $16,826.24 in payment of the December 31 balance Hydro Paddle Boards, Inc, maintains a perpetual inventory system. Each time a sale is made to a 3 Received a check from Calm Waters Board Corporation for the amount due customer, you must debit Cost of Goods Sold and credit Finished Goods for the cost of the (check AR schedule). job. Paid Marine National Bank $45,733.48 for December payroll taxes payable as 8 Requisitioned $2,482.54 of indirect materials follows: and factory supplies to be used in the manufacture of all jobs currently in process. Employees Income Tax (Materials Requisition No. 1680) Payable, $26,353.78; FICA Tax Payable, $17.928.88; Federal Unemployment Tax $638 38: State Unemployment Tax, 5812.44 4 4 Paid $13,946.72 for Income Tax Payable. Paid Coco PVC Company S21,428.00 mann. Dambollida When preparing the entry for applying direct labor, debit Work in Process for the gross pay, and credit Employees Income Tax Payable and FICA Tax Richard $812.44 4 Paid $13,946.72 for Income Tax Payable. 4 Paid Coco PVC Company $21,428.00 in payment of the December 31 balance. 4 Applied $7,248.00 of direct materials (1679) and $16,240.00 of direct labor (Time Ticket No. 258) to Job No. 1403, which will complete the job. Use the simplified rates of 8% of gross pay for employees' FICA tax and 15% of gross pay for employees' federal income tax. When preparing the entry for applying direct labor, debit Work in Process for the gross pay, and credit Employees Income Tax Payable and FICA Tax Payable for the appropriate amounts and Salaries Payable for net pay. Remember that employees are paid on the last day of each month. 9 Paid Anabella Henriquez, County Tax Collector, $12,642.00 for property taxes accrued as of December 31. 9 Purchased from GT Matrix Corporation $5,082.52 of indirect factory supplies, credit terms net 15 days 9 Accepted a job for the manufacture of 66 units BI (Beginner SUP) Paddle boards for Rio Watersports. The promise date is February 14. The company began the job today, applying $11,828.00 of direct materials to Job No. 1406. (Materials Requisition No. 1681) 10 Received a check from Tarpon Sports Ltd. for the amount due 11 Paid Light Hardware, Inc. $18,200.00 in payment of the December 31 balance. Jan, 11 Applied $2,654.28 of direct materials to Job No. 1402. (Materials Requisition No. 1682) 12 Received a check from Go Paddle Sales Company for the amount due. 15 Applied $4,428.12 of direct materials to Job No. 1404. (Materials Requisition No. 1683) 16 Purchased $1,186.00 of factory supplies from Keys Supplies Inc. and paid cash, 16 Applied $6,434.00 of direct labor to Job No. 1405, which will complete the job. (Time Ticket No. 260) Applied factory factory overhead using the appropriate rate. Transferred the completed job to the finished goods account. 16 Sold one Standard CI (Competition) custom stand-up paddle (SUP) board to a cash customer for $2,800.00. The cost of the goods shipped from finished goods inventory was $2,000.00. END OF PART 1 GENERAL LEDGER ACCOUNT Allowance for Doubtful Accounts POST DATE ITEM REF ACCOUNT NO. 112 BALANCE DEBIT CREDIT DEBIT CREDIT 2048 67 34 od Jan. 1 Balance ACCOUNT NO. 132 ACCOUNT Supplies BALANCE DATE ITEM POST REF DEBIT CREDIT CREDIT Jan. 1 Balance DEBIT 3800 8 ACCOUNT Factory Overhead ACCOUNT NO. 511 BALANCE DATE ITEM POST REF DEBIT CREDIT DEBIT CREDIT JOB COST RECORD JOB NUMBER: 1403 DATE January 11 PROMISED: CUSTOMER NAME: Salt WaterHut.com December 18 DATE STARTED: JOB DESCRIPTION: 93 units Bl (Beginner-SUP) DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD DATE AMOUNT DATE RATE AMOUNT REQUISITI ON NUMBER 1668 Dec. 18 Dec. 31 AMOUNT TIME TICKET NUMBERS $17,472.00 0 248,250 Dec. 31 $14,920.0 125% of DL cost $18,650.0 0 Total Cost of Completed Job: JOB COST RECORD JOB NUMBER: 1406 February 14 DATE PROMISED: CUSTOMER January 9 NAME: Rio Watersports DATE STARTED: JOB DESCRIPTION: 66 units Bl (Beginner-SUP) DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD DATE AMOUNT DATE REQUISITI ON NUMBER AMOUNT RATE AMOUNT TIME TICKET NUMBERS Total cost of completed job: JOB COST RECORD JOB NUMBER: 1407 DATE February 15 PROMISED: CUSTOMER NAME: Extreme Board Systems January 17 DATE STARTED: JOB DESCRIPTION: 77 units RI (Racing 1-SUP) DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD DATE AMOUNT AMOUNT RATE DATE REQUISITI ON NUMBER TIME AMOUNT TICKET NUMBERS Total cost of completed job: JOB NUMBER: CUSTOMER NAME: JOB COST RECORD DATE PROMISED: DATE STARTED: JOB DESCRIPTION: DATE COMPLETED: DIRECT MATERIALS DIRECT LABOR FACTORY OVERHEAD AMOUNT DATE RATE AMOUNT DATE REQUISITI ON NUMBER TIME AMOUNT TICKET NUMBERS PAGE 1 GENERAL JOURNAL POSI DESCRIPTION T. REF. DATE DEBIT CREDIT & 1 1 1 1 2 1 3 thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started