Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I all Chly request an UNIC UCVIL VI LICUIL accounts, that the UCUIL aLLUuUTILS (in order of dollar amount - large amount to small

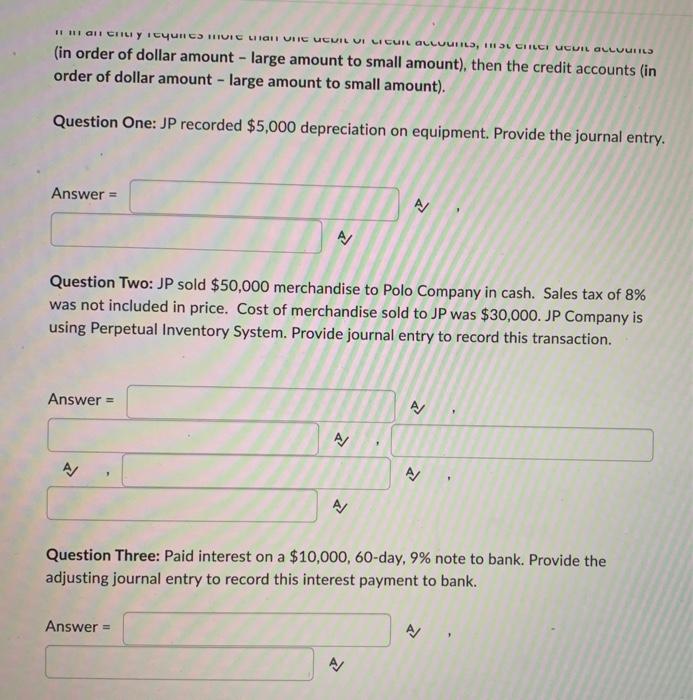

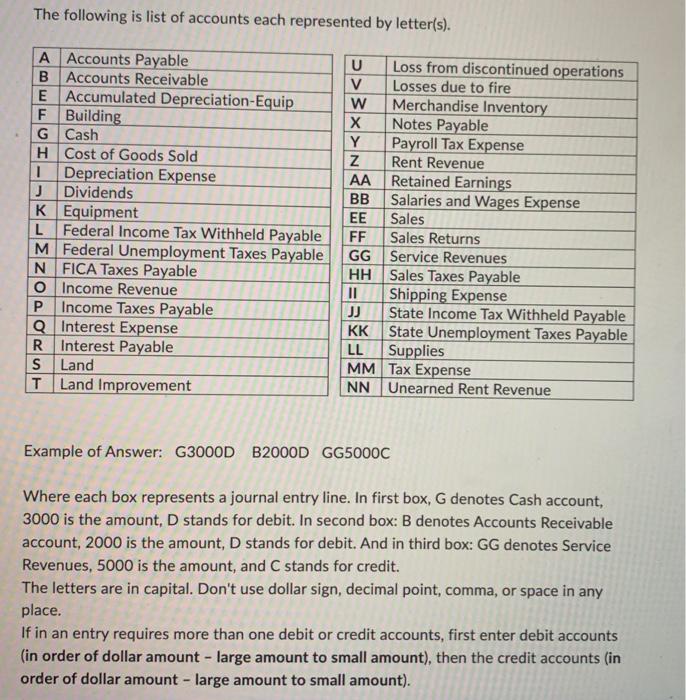

I all Chly request an UNIC UCVIL VI LICUIL accounts, that the UCUIL aLLUuUTILS (in order of dollar amount - large amount to small amount), then the credit accounts (in order of dollar amount - large amount to small amount). Question One: JP recorded $5,000 depreciation on equipment. Provide the journal entry. Answer= Question Two: JP sold $50,000 merchandise to Polo Company in cash. Sales tax of 8% was not included in price. Cost of merchandise sold to JP was $30,000. JP Company is using Perpetual Inventory System. Provide journal entry to record this transaction. Answer= A/ Answer= A 2 A 2 Question Three: Paid interest on a $10,000, 60-day, 9% note to bank. Provide the adjusting journal entry to record this interest payment to bank. 2 A/ The following is list of accounts each represented by letter(s). A Accounts Payable B Accounts Receivable E Accumulated Depreciation-Equip F Building G Cash H 1 Depreciation Expense J Dividends K Equipment L Federal Income Tax Withheld Payable M Federal Unemployment Taxes Payable FICA Taxes Payable O Income Revenue N P Income Taxes Payable Q Interest Expense R Interest Payable Land S T Land Improvement Cost of Goods Sold U V W X Y Z AA BB EE FF GG HH II JJ KK LL Loss from discontinued operations Losses due to fire Merchandise Inventory Notes Payable Payroll Tax Expense Rent Revenue Retained Earnings Salaries and Wages Expense Sales Sales Returns Service Revenues Sales Taxes Payable Shipping Expense State Income Tax Withheld Payable State Unemployment Taxes Payable Supplies Tax Expense Example of Answer: G3000D B2000D GG5000C MM NN Unearned Rent Revenue Where each box represents a journal entry line. In first box, G denotes Cash account, 3000 is the amount, D stands for debit. In second box: B denotes Accounts Receivable account, 2000 is the amount, D stands for debit. And in third box: GG denotes Service Revenues, 5000 is the amount, and C stands for credit. The letters are in capital. Don't use dollar sign, decimal point, comma, or space in any place. If in an entry requires more than one debit or credit accounts, first enter debit accounts (in order of dollar amount - large amount to small amount), then the credit accounts (in order of dollar amount - large amount to small amount).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the instructions and the chart of accounts provided lets address each question to create th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started