i already asked the same question twice, this is the third time. i need all the answers

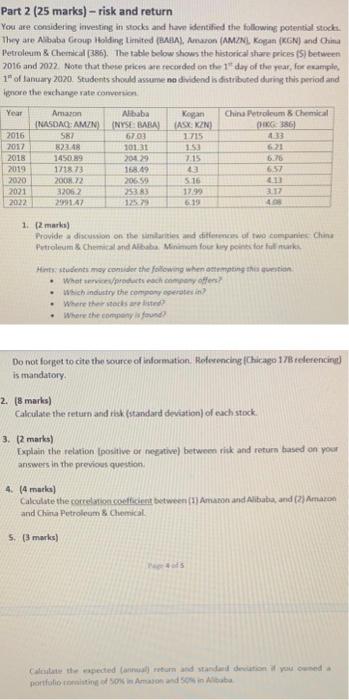

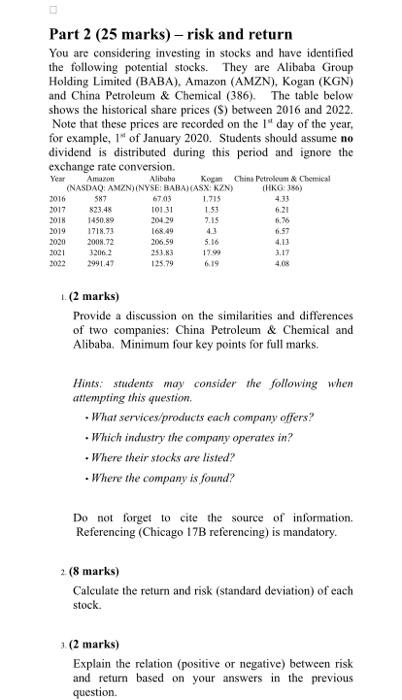

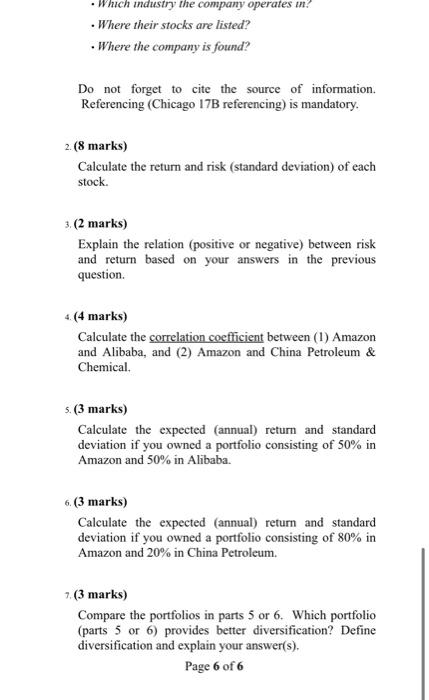

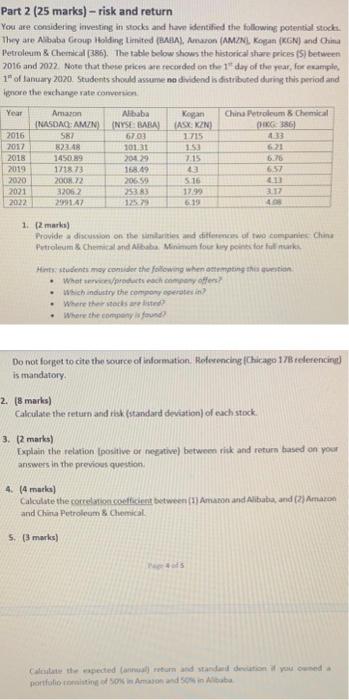

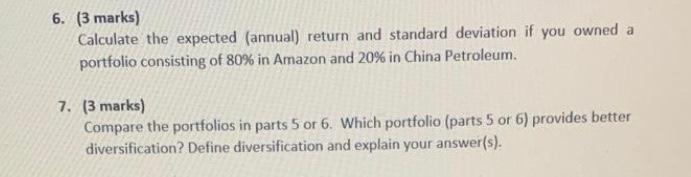

Part 2 ( 25 marks) - risk and return Yous are considering investing in stocks and thw isentified the following potentiol stocks Petrolerum \& Cherrical (386). The rable below shows the historical share prices (5) between 7016 and 2072 Note that these prices are recorded on the 1 "dy of the rear, for ecarmine. 17 of lanuiry 2020 . Students should assume no dindend is ditributed during this period and ienore the exchange rate wimention. 1. {2 markis } Provide a discustion on the lintarities and ditietmers of two coerparies Ching - Weich indurtry the conyooty oserater in? - Where ther stads aep kisted? - Where the connery jufand? Do not forget to cite the vource of information. Refesencing (Chicago 178 tederencinut) is mandatory. 2. (8 marks) Calculate the return and risk (rtandard deviation) of each stock: 3. (2 marks) Feplatin the relation Ipositive of negative) between rikk and return based on your answers in the previons question: 4. (4 maeks) Calculate the cocrel anpocodfecient between (1) Amawon and Aitatia, and (2) Amaron and China Petroleum \& Chemical. 5. (3 marks) Face 4 at 5 (3 marks) Calculate the expected (annual) return and standard deviation if you owned a portfolio consisting of 80% in Amazon and 20% in China Petroleum. 7. ( 3 marks) Compare the portfolios in parts 5 or 6 . Which portfolio (parts 5 or 6 ) provides better diversification? Define diversification and explain your answer(s). Part 2 ( 25 marks) - risk and return You are considering investing in stocks and have identified the following potential stocks. They are Alibaba Group Holding Limited (BABA), Amazon (AMZN), Kogan (KGN) and China Petroleum \& Chemical (386). The table below shows the historical share prices (\$) between 2016 and 2022. Note that these prices are recorded on the 1a day of the year, for example, 1 of January 2020 . Students should assume no dividend is distributed during this period and ignore the exchange rate conversion. 1. (2 marks) Provide a discussion on the similarities and differences of two companies: China Petroleum \& Chemical and Alibaba, Minimum four key points for full marks. Hints: students may consider the following when attempting this question. - What services/products each company offers? - Which industry the company operates in? - Where their stocks are listed? - Where the company is found? Do not forget to cite the source of information. Referencing (Chicago 17B referencing) is mandatory. 2 (8 marks) Calculate the return and risk (standard deviation) of each stock. 3. (2 marks) Explain the relation (positive or negative) between risk and return based on your answers in the previous question. - Which industry the company operates in? - Where their stocks are listed? -Where the company is found? Do not forget to cite the source of information. Referencing (Chicago 17B referencing) is mandatory. 2. (8 marks) Calculate the return and risk (standard deviation) of each stock. 3. (2 marks) Explain the relation (positive or negative) between risk and return based on your answers in the previous question. 4. (4 marks) Calculate the correlation coefficient between (1) Amazon and Alibaba, and (2) Amazon and China Petroleum \& Chemical. 5. (3 marks) Calculate the expected (annual) return and standard deviation if you owned a portfolio consisting of 50% in Amazon and 50% in Alibaba. 6. (3 marks) Calculate the expected (annual) return and standard deviation if you owned a portfolio consisting of 80% in Amazon and 20% in China Petroleum. 7. (3 marks) Compare the portfolios in parts 5 or 6 . Which portfolio (parts 5 or 6 ) provides better diversification? Define diversification and explain your answer(s). Page 6 of 6