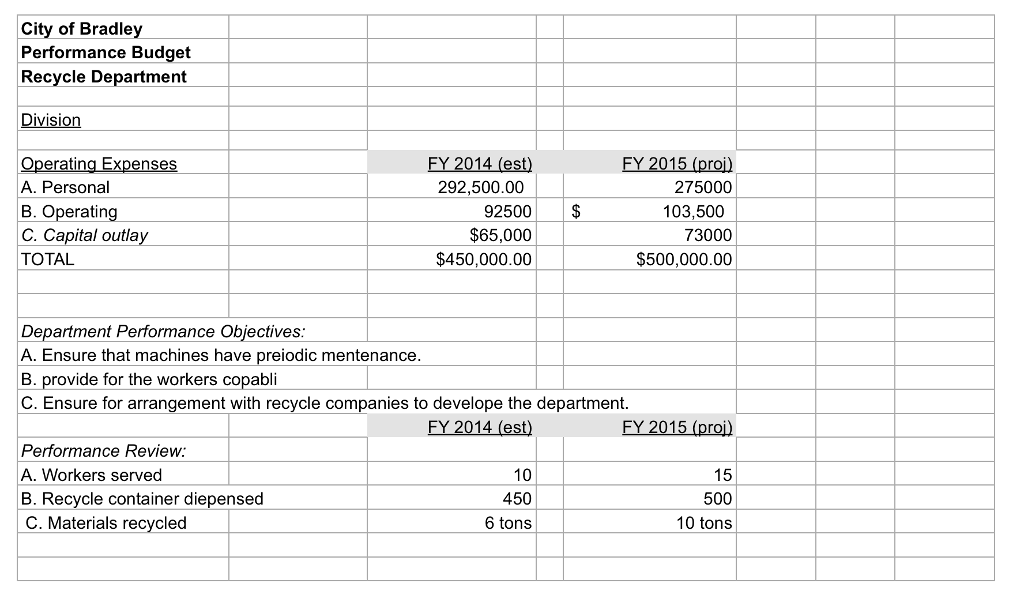

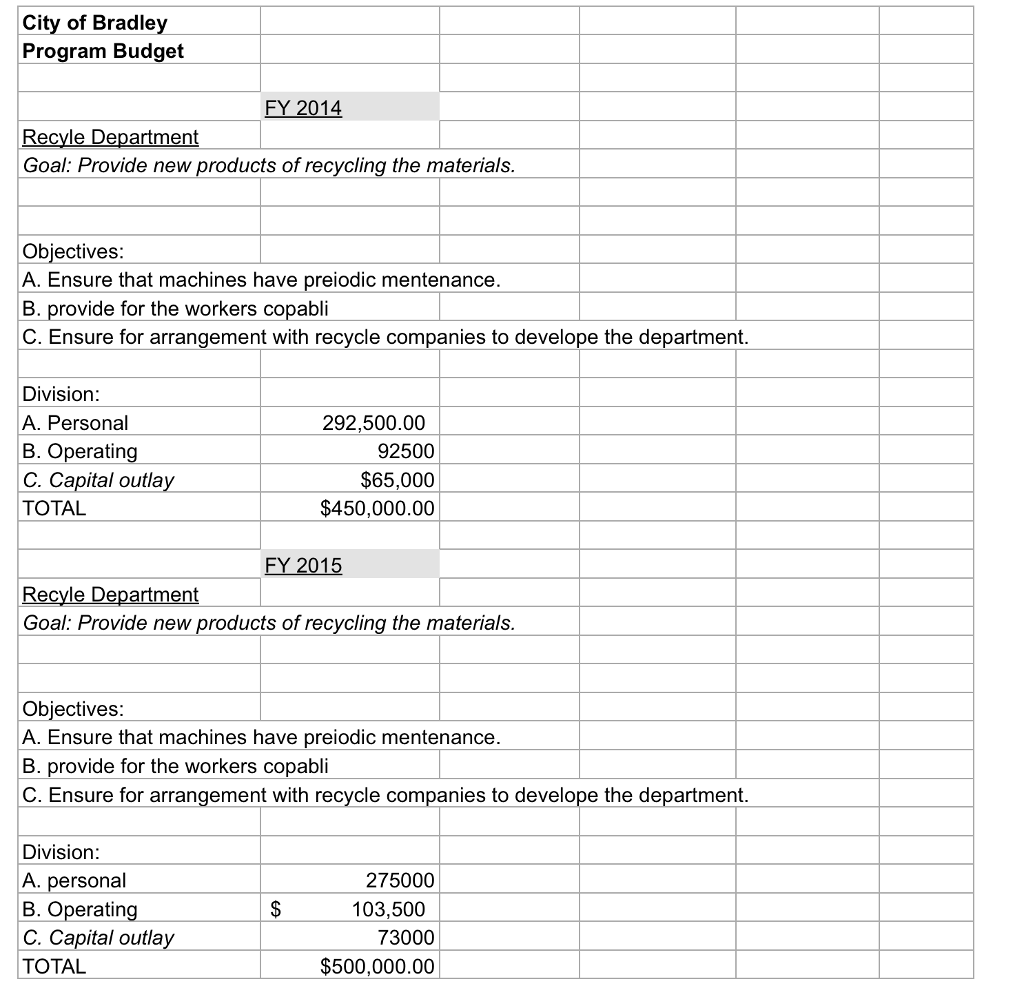

I already did the first one. I only want to from question 2,3,4, and 5.

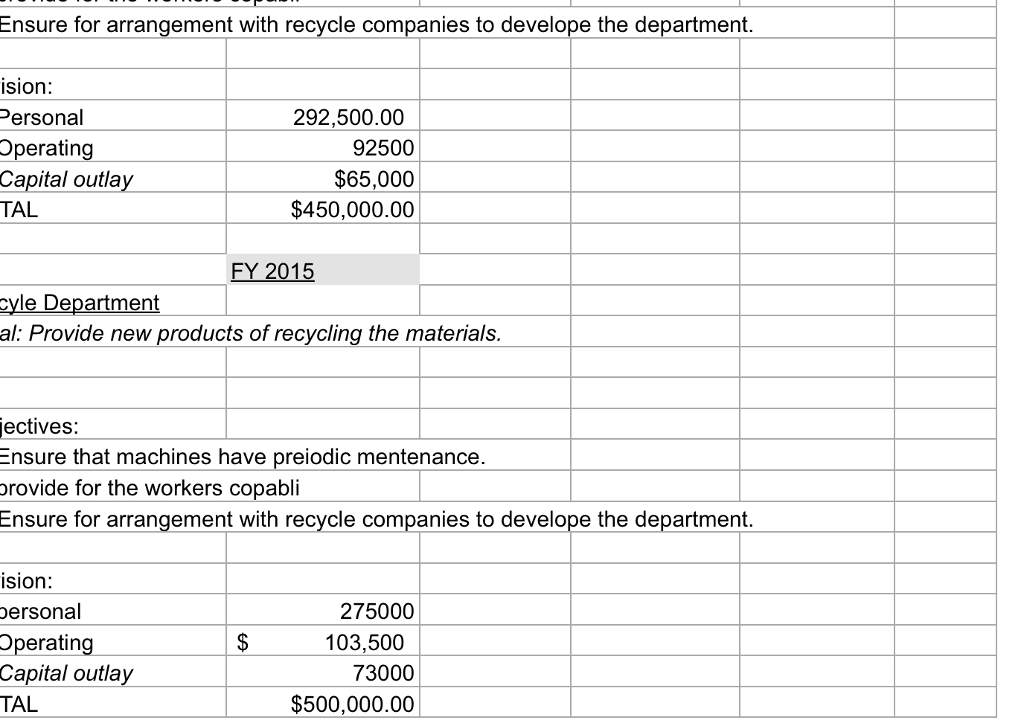

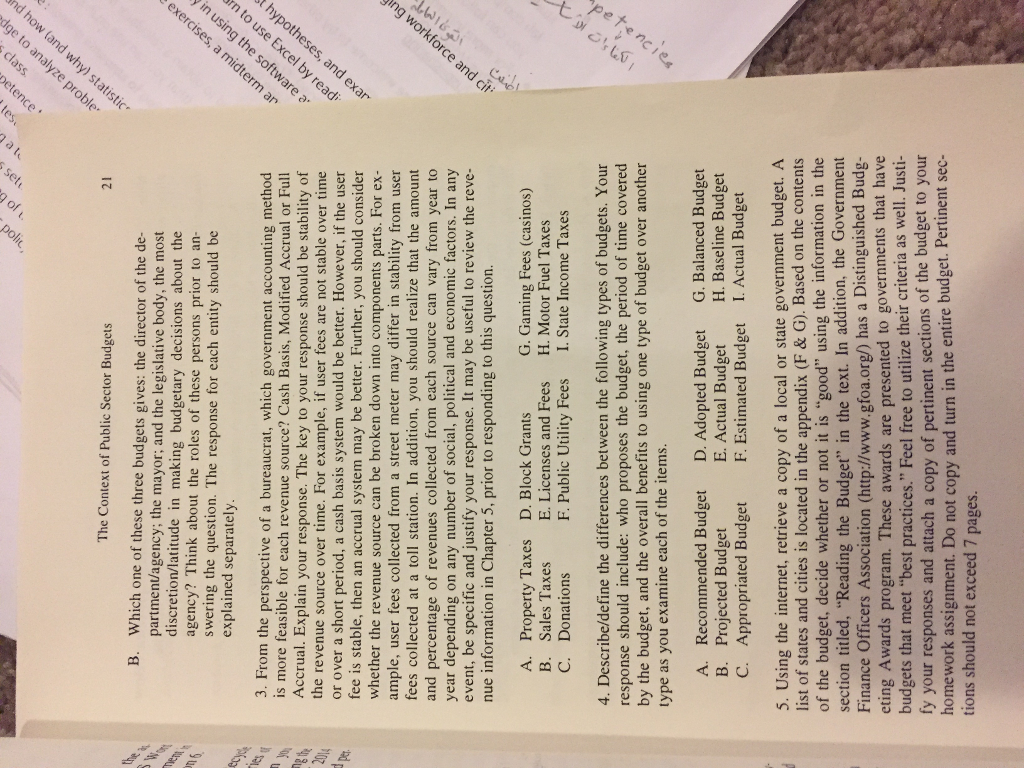

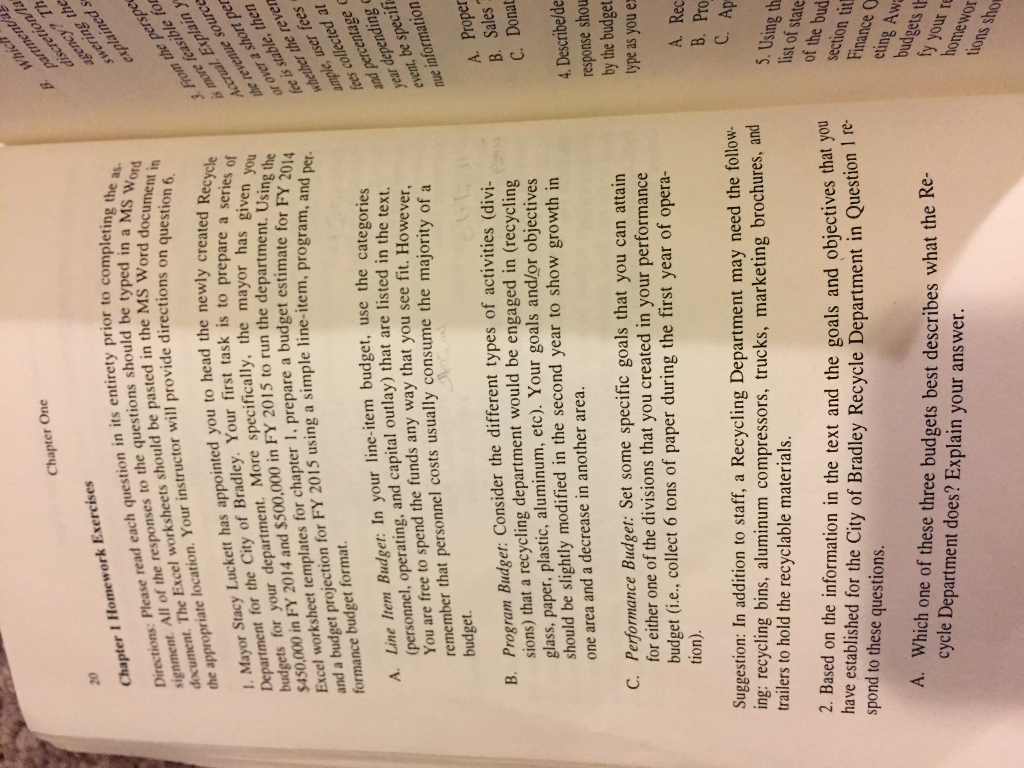

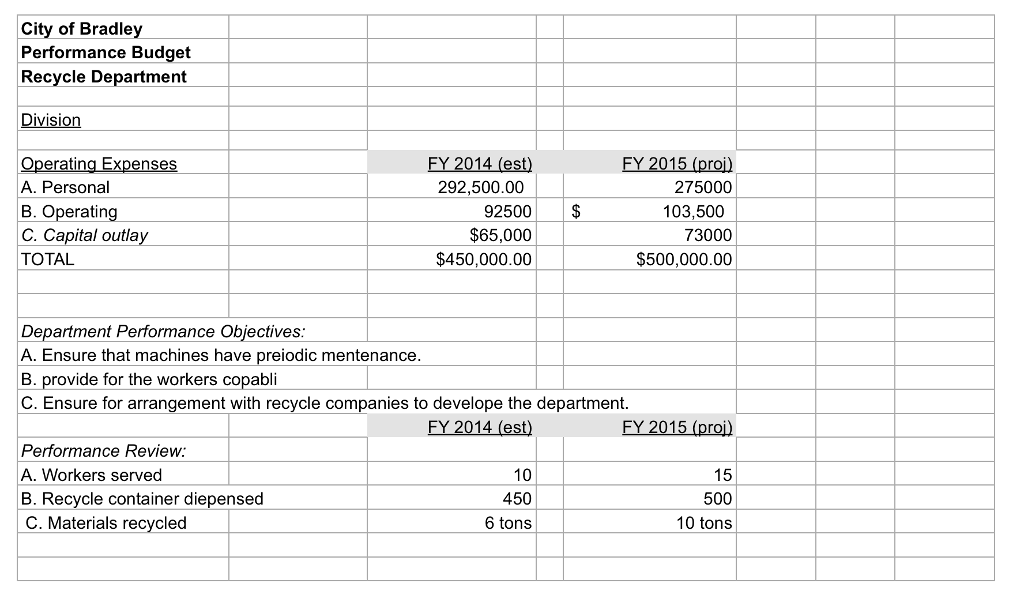

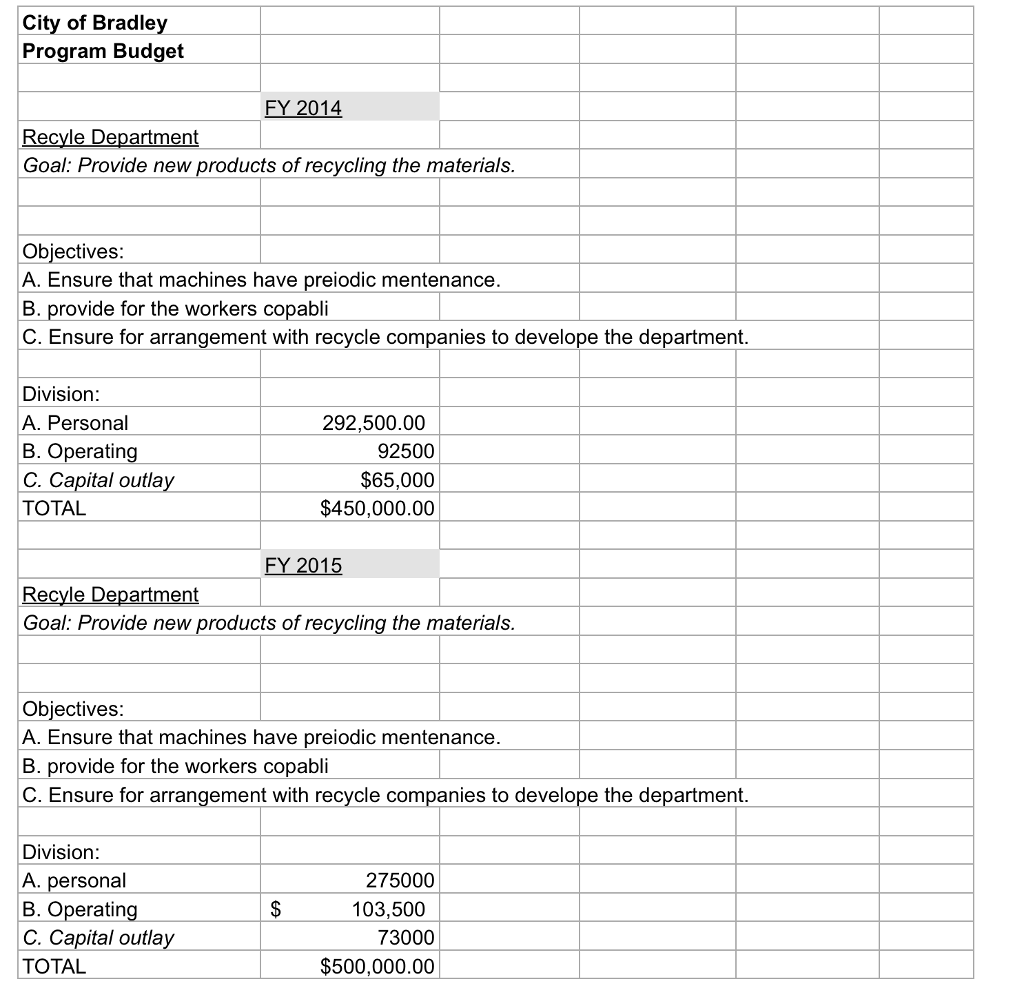

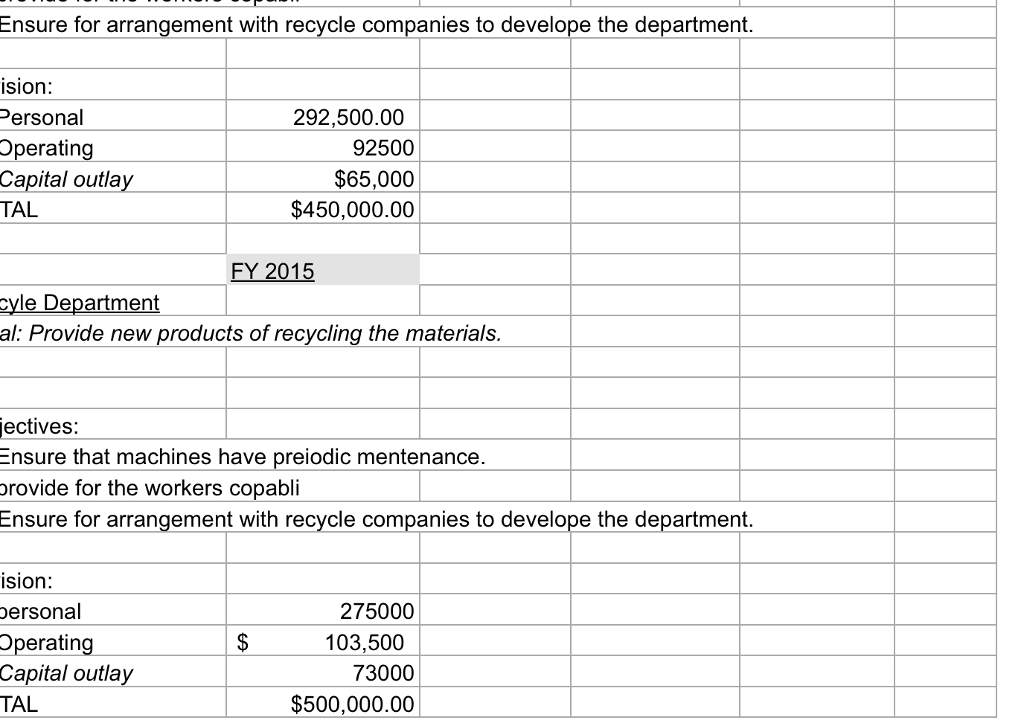

The Context of Public Sector Budgets B. Which one of these three budgets gives: the director of the de the mayor; and the legislative body, the most discretion/latitude in making budgetary decisions about the agency? Think about the roles of these persons prior to an swering the question. The response for each entity should be explained separately 3. From the perspective of a bureaucrat, which government accounting method is more feasible for each revenue source? Cash Basis, Modified Accrual or Full Accrual. Explain your response. The key to your response should be stability of the revenue source over time. For example, if user fees are not stable over time or over a short period, a cash basis system would be better. However, if the user fee is stable, then an accrual system may be better. Further, you should consider whether the revenue source can be broken down into components parts. For ex- ample, user fees collected from a street meter may differ in stability from user fees collected at a toll station. In addition, you should realize that the amount and percentage of revenues collected from each source can vary from year to year depending on any number of social, political and economic factors. In any event, be specific and justify your response. It may be useful to review the reve nue information in Chapter 5, prior to responding to this question. A. Property Taxes D. Block Grants G. Gaming Fees (casinos) E. Licenses and Fees H. Motor Fuel Taxes B. Sales Taxes F. Public Utility Fees I. State Income Taxes C. Donations 4. Describe/define the differences between the following types of budgets. Your response should include who proposes the budget, the period of time covered by the budget, and the overall benefits to using one type of budget over another type as you examine each of the items A. Recommended Budget D. Adopted Budget G. Balanced Budget H. Baseline Budget E. Actual Budget B. Projected Budget F. Estimated Budget I. Actual Budget C. Appropriated Budget 5. Using the internet, retrieve a copy of a local or state government budget. A list of states and cities is located in the appendix (F & G). Based on the contents of the budget, decide whether or not it is "good" using the information in the the text. In addition, the Government section titled, "Reading the Budget" in has a Distinguished Budg Finance officers Association (http://www.gfoa.org/) eting Awards program. These awards are presented to governments that have budgets that meet "best practices." Feel free to utilize their criteria as well. Just responses and attach a copy of pertinent ions of the budget to your homework assignment. Do not copy and turn in the entire budget. Pertinent sec tions should not exceed 7 pages The Context of Public Sector Budgets B. Which one of these three budgets gives: the director of the de the mayor; and the legislative body, the most discretion/latitude in making budgetary decisions about the agency? Think about the roles of these persons prior to an swering the question. The response for each entity should be explained separately 3. From the perspective of a bureaucrat, which government accounting method is more feasible for each revenue source? Cash Basis, Modified Accrual or Full Accrual. Explain your response. The key to your response should be stability of the revenue source over time. For example, if user fees are not stable over time or over a short period, a cash basis system would be better. However, if the user fee is stable, then an accrual system may be better. Further, you should consider whether the revenue source can be broken down into components parts. For ex- ample, user fees collected from a street meter may differ in stability from user fees collected at a toll station. In addition, you should realize that the amount and percentage of revenues collected from each source can vary from year to year depending on any number of social, political and economic factors. In any event, be specific and justify your response. It may be useful to review the reve nue information in Chapter 5, prior to responding to this question. A. Property Taxes D. Block Grants G. Gaming Fees (casinos) E. Licenses and Fees H. Motor Fuel Taxes B. Sales Taxes F. Public Utility Fees I. State Income Taxes C. Donations 4. Describe/define the differences between the following types of budgets. Your response should include who proposes the budget, the period of time covered by the budget, and the overall benefits to using one type of budget over another type as you examine each of the items A. Recommended Budget D. Adopted Budget G. Balanced Budget H. Baseline Budget E. Actual Budget B. Projected Budget F. Estimated Budget I. Actual Budget C. Appropriated Budget 5. Using the internet, retrieve a copy of a local or state government budget. A list of states and cities is located in the appendix (F & G). Based on the contents of the budget, decide whether or not it is "good" using the information in the the text. In addition, the Government section titled, "Reading the Budget" in has a Distinguished Budg Finance officers Association (http://www.gfoa.org/) eting Awards program. These awards are presented to governments that have budgets that meet "best practices." Feel free to utilize their criteria as well. Just responses and attach a copy of pertinent ions of the budget to your homework assignment. Do not copy and turn in the entire budget. Pertinent sec tions should not exceed 7 pages