I already solved Problem 14-5B. I need Problem 14-8B Solved. I only put in problem 14-5B for all the bond details

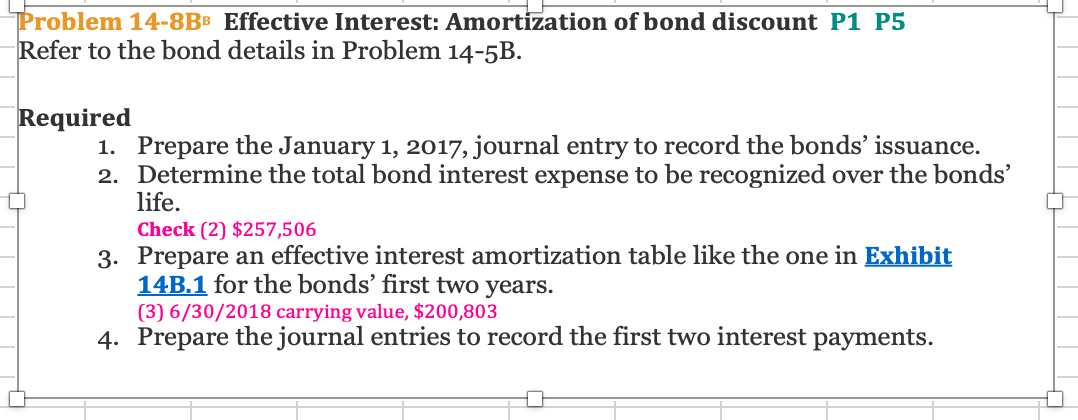

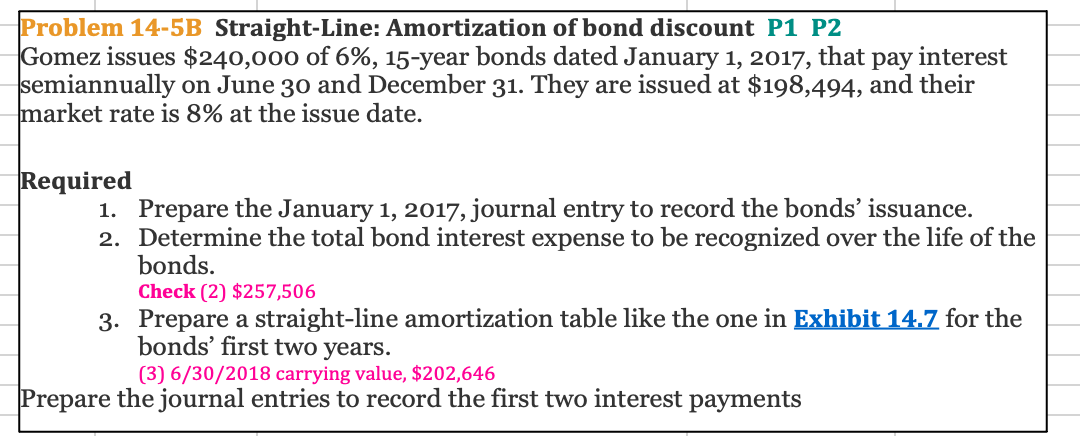

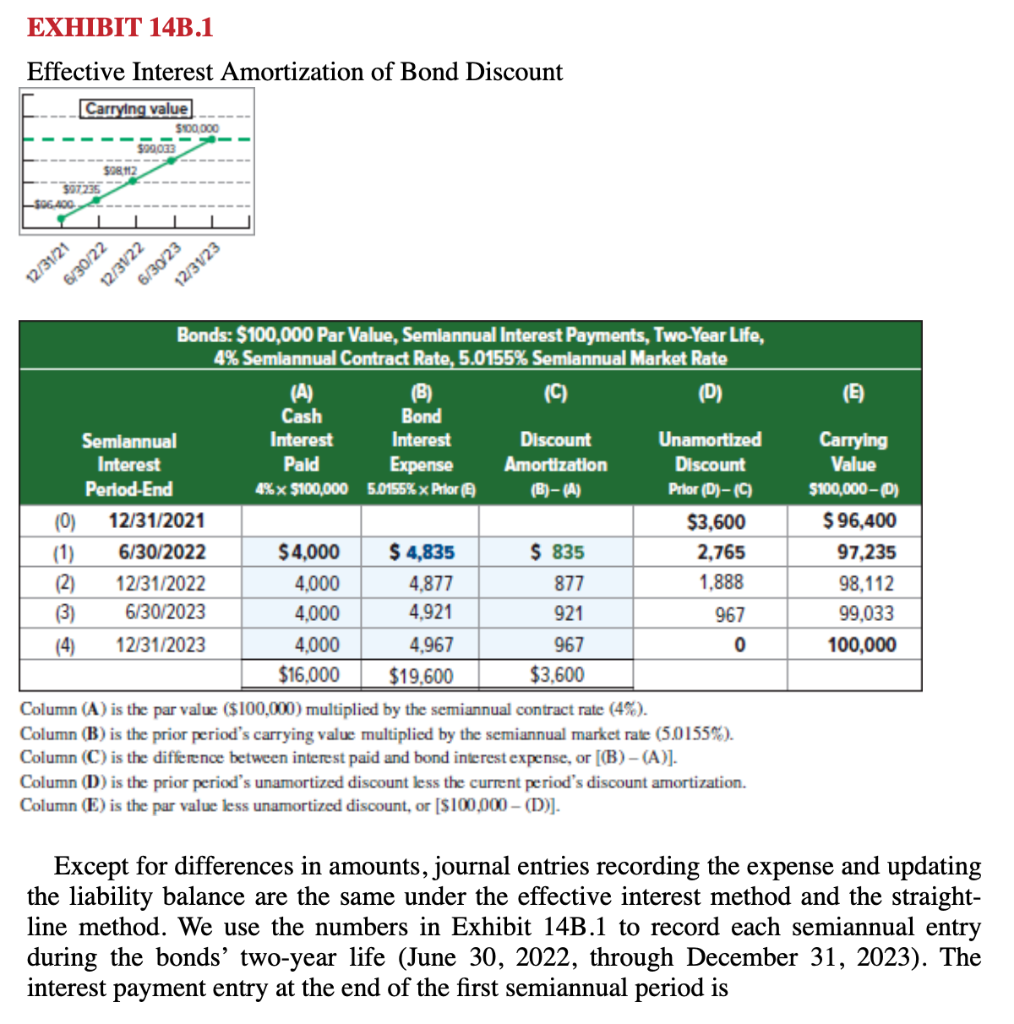

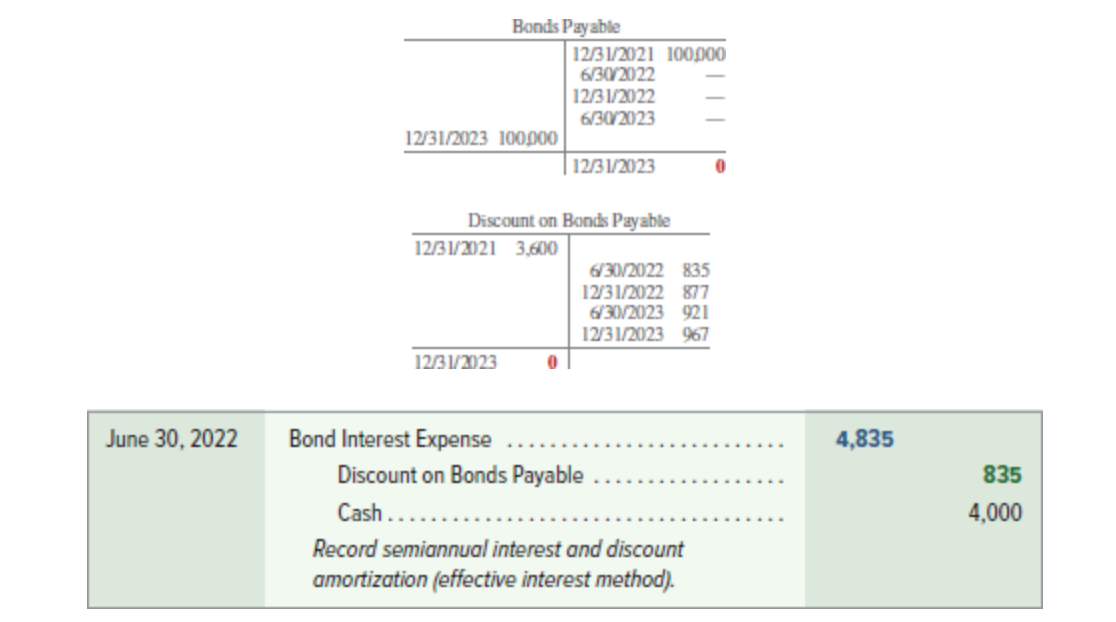

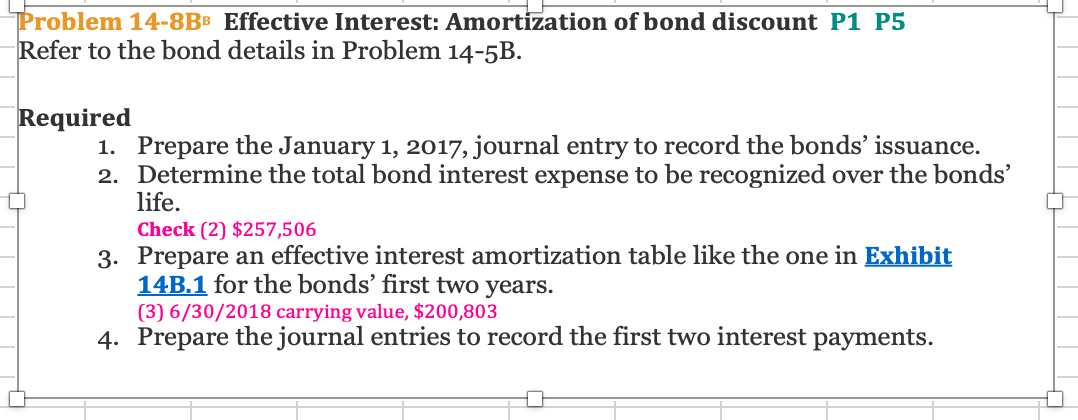

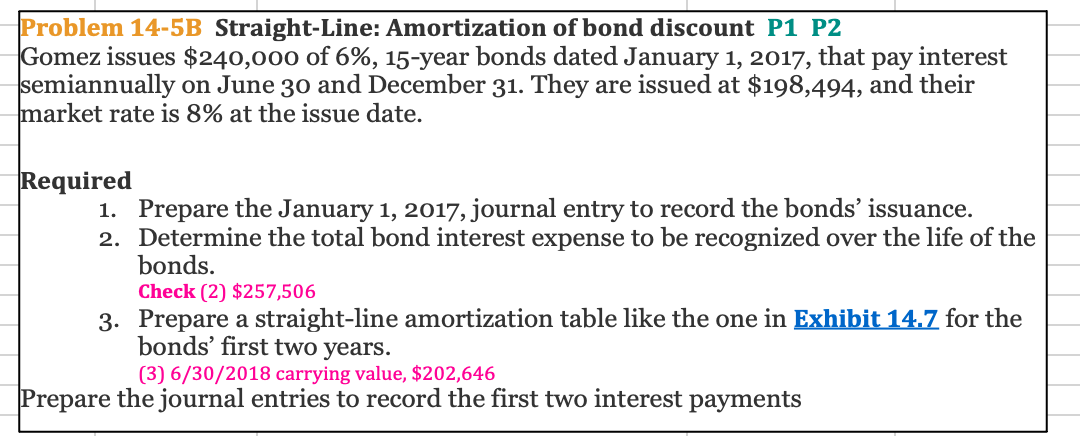

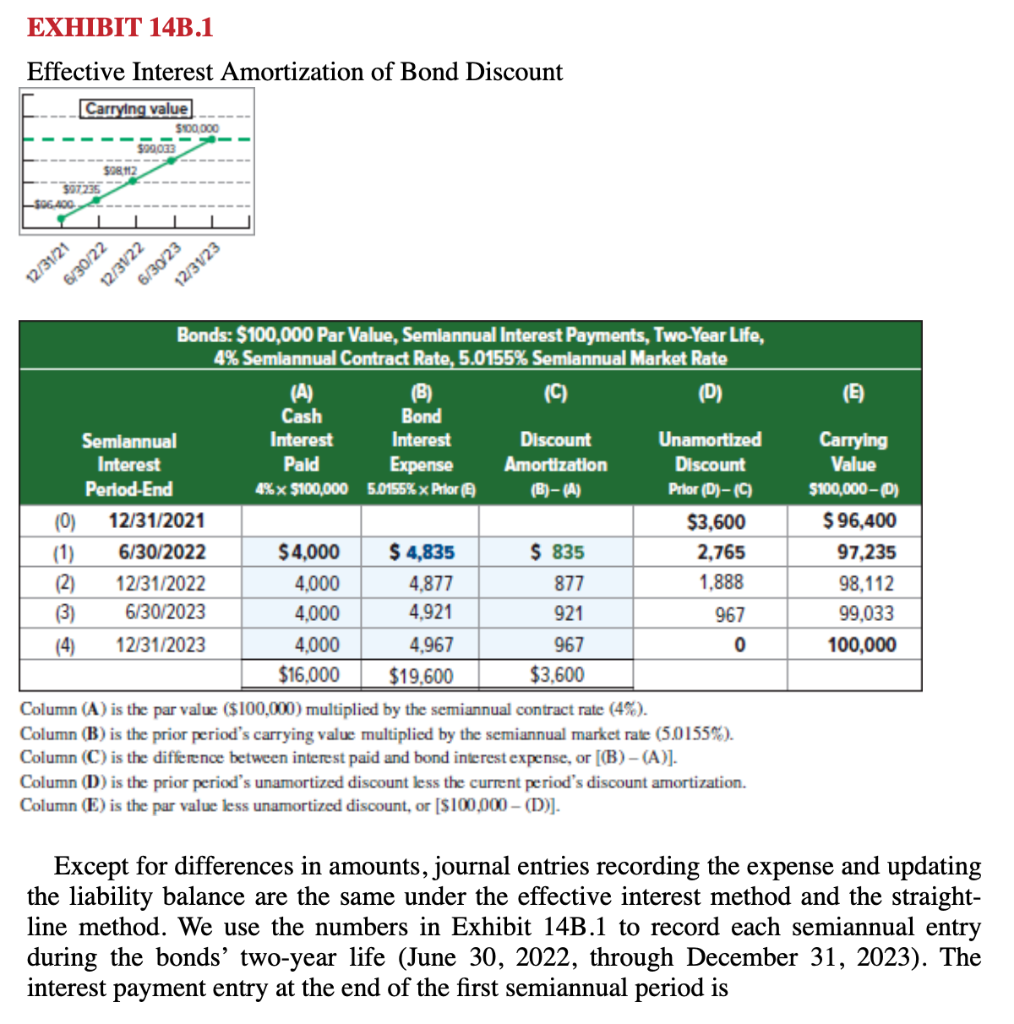

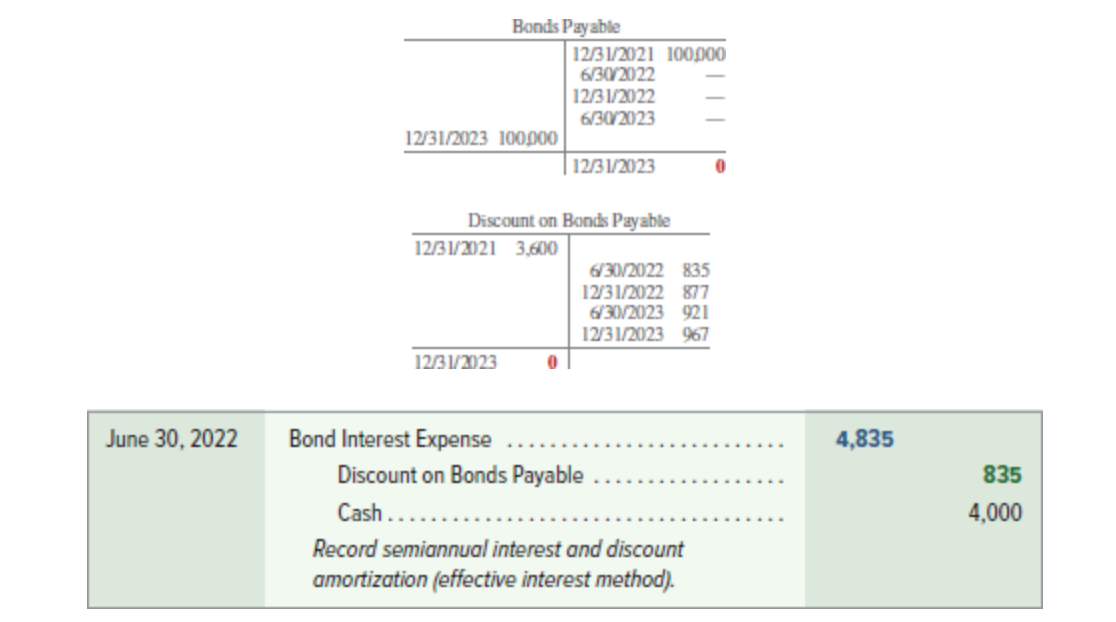

Problem 14-8BB Effective Interest: Amortization of bond discount P1 P5 Refer to the bond details in Problem 14-5B. Required 1. Prepare the January 1, 2017, journal entry to record the bonds' issuance. 2. Determine the total bond interest expense to be recognized over the bonds' life. Check (2) $257,506 3. Prepare an effective interest amortization table like the one in Exhibit 14B.1 for the bonds' first two years. (3) 6/30/2018 carrying value, $200,803 4. Prepare the journal entries to record the first two interest payments. Problem 14-5B Straight-Line: Amortization of bond discount P1 P2 Gomez issues $240,000 of 6%, 15-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. They are issued at $198,494, and their market rate is 8% at the issue date. Required 1. Prepare the January 1, 2017, journal entry to record the bonds issuance. 2. Determine the total bond interest expense to be recognized over the life of the bonds. Check (2) $257,506 3. Prepare a straight-line amortization table like the one in Exhibit 14.7 for the bonds' first two years. (3) 6/30/2018 carrying value, $202,646 Prepare the journal entries to record the first two interest payments EXHIBIT 14B.1 Effective Interest Amortization of Bond Discount Carrying value $100,000 $99033 $98.12 507235 $06.400 12/3122 6/30/23 12/3123 12/31/21 6/30/22 (E) Bonds: $100,000 Par Value, Semiannual Interest Payments, Two-Year Life, 4% Semiannual Contract Rate, 5.0155% Semiannual Market Rate (A) (B) (D) Cash Bond Semiannual Interest Interest Discount Unamortized Interest Pald Expense Amortization Discount Period-End 4%x $100,000 5.0156% x Prior (B)-(A) Prior (D)-(0) (0) 12/31/2021 $3,600 (1) 6/30/2022 $4,000 $ 4,835 $ 835 2,765 (2) 12/31/2022 4,000 4,877 877 1,888 (3) 6/30/2023 4,000 4,921 967 (4) 12/31/2023 4,000 4,967 967 0 $16.000 $19,600 $3.600 Column (A) is the par value ($100,000) multiplied by the semiannual contract rate (45). Column (B) is the prior period's carrying value multiplied by the semiannual market rate (5.0155%). Column (C) is the difference between interest paid and bond interest expense, or ((B) - (A)]. Column (D) is the prior period's unamortized discount less the current period's discount amortization. Column (E) is the par value less unamortized discount, or ($100,000 - (D)]. Carrying Value $100,000-0) $ 96,400 97,235 98,112 99,033 100,000 921 Except for differences in amounts, journal entries recording the expense and updating the liability balance are the same under the effective interest method and the straight- line method. We use the numbers in Exhibit 14B.1 to record each semiannual entry during the bonds' two-year life (June 30, 2022, through December 31, 2023). The interest payment entry at the end of the first semiannual period is Bonds Payable 12/31/2021 100.000 6/30/2022 12/31/2022 6/30/2023 12/31/2023 100.000 12/31/2023 0 Discount on Bonds Payable 12/31/2021 3,600 6/30/2022 835 12/31/2022 877 6/30/2023 921 12/31/2023967 12/31/2023 0 June 30, 2022 4,835 835 Bond Interest Expense Discount on Bonds Payable Cash ....... Record semiannual interest and discount amortization (effective interest method). 4,000