Question

I already submitted the template for this project on 4/23. please refer to that template. Now I am posting 5 questions consecutively. those all 5

I already submitted the template for this project on 4/23. please refer to that template.

Now I am posting 5 questions consecutively. those all 5 question are combined 1 project but i am posting separately so you could answer all of 5 questions at your own choice. These all 5 questions will be solved in same template which I submitted on 4/23.

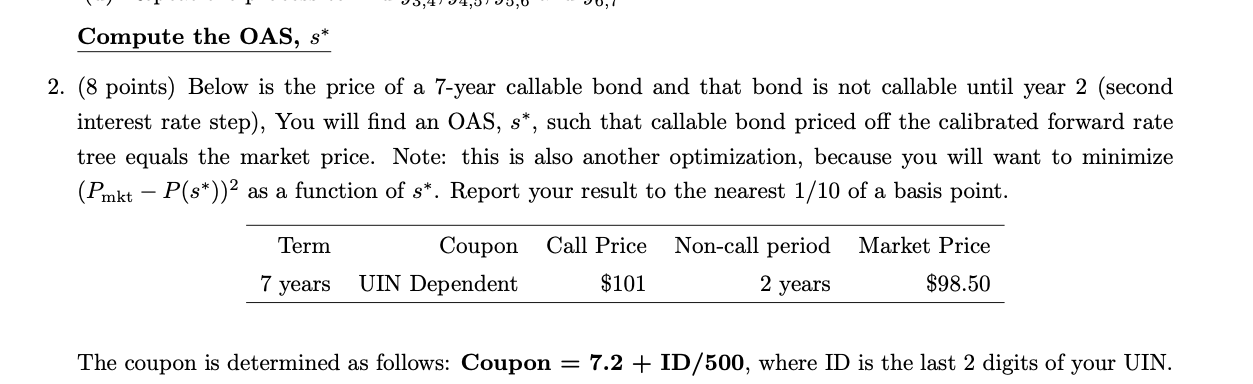

My UIN's last 2 digits are 28. so please solve all these 5 questions with 28. All the extra info which is not given in these 5 questions can be collected from that same template. I am just explaining few here.

In cell E1 of template you see the market price - $99.75. That's the price for the bond we observe in the market and OAS tells us how much extra spread we are earning when taking into account that the bond is callable. You use volatility to calibrate the one-step forward rates such that they are consistent with the zero coupon bond prices given in cells B-E row 6. Time horizon is 4 years (project is 7 years).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started