i already update another picture see the next question please

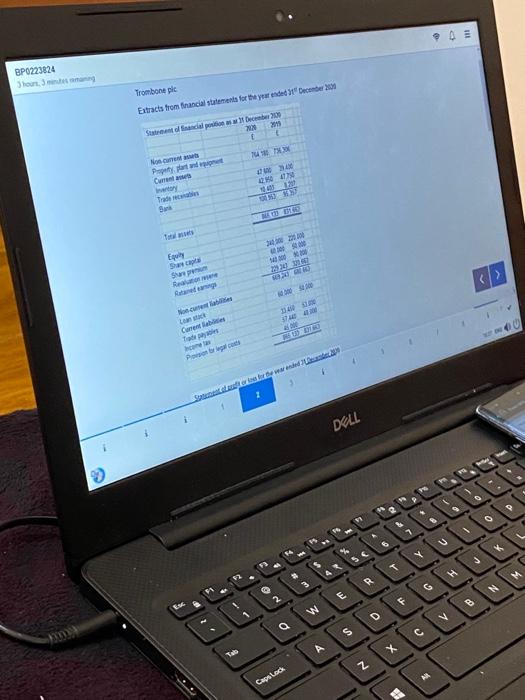

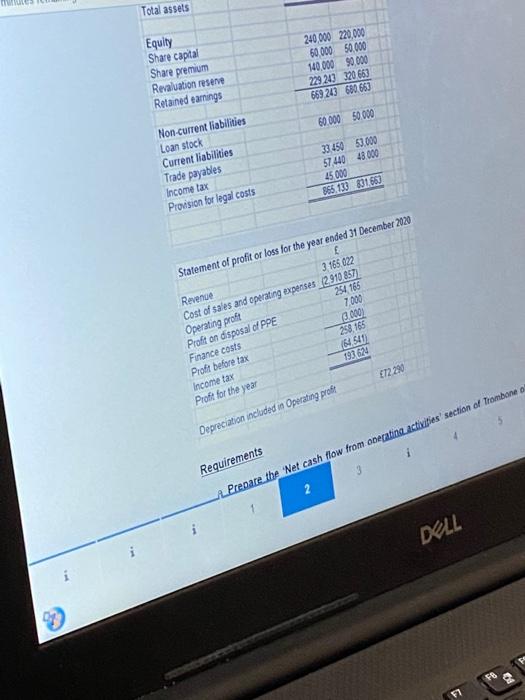

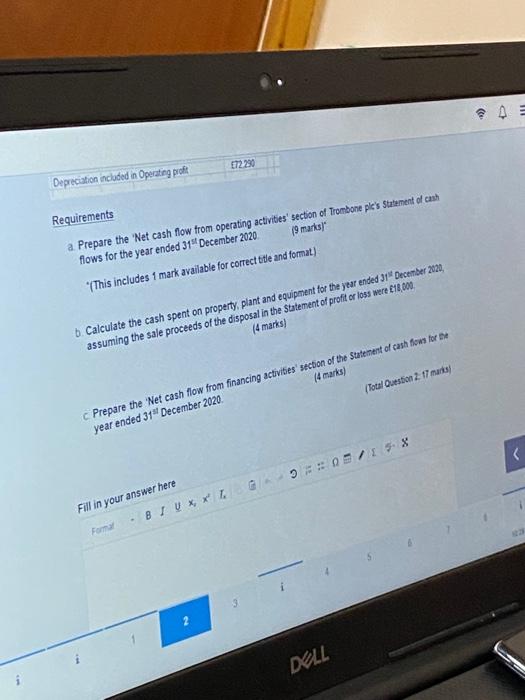

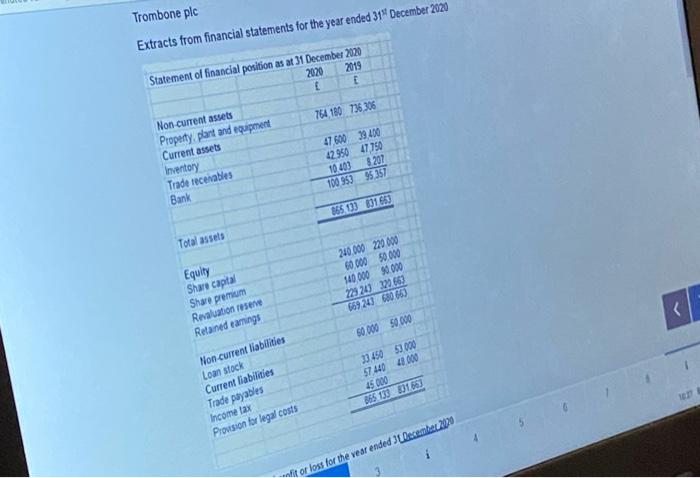

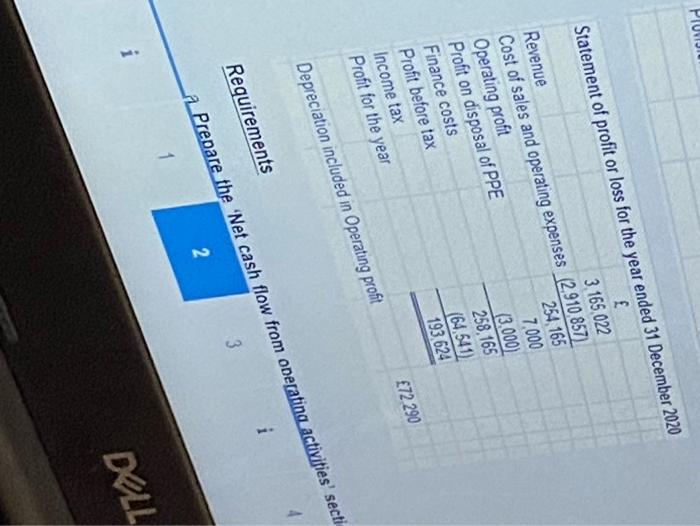

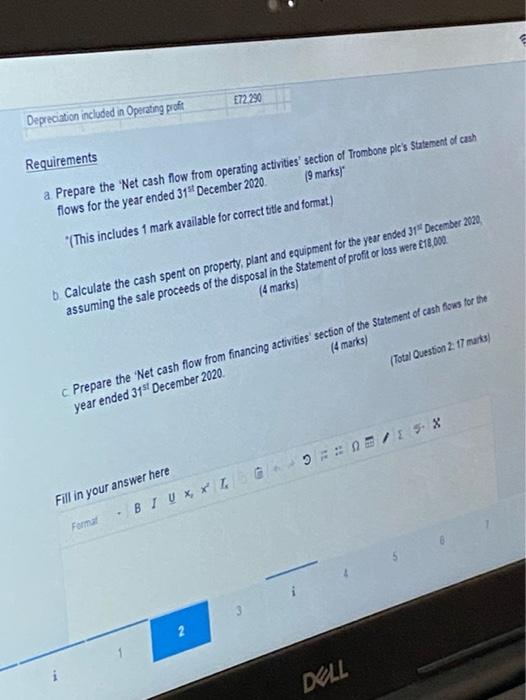

BP0223824 Trombone pic Extracts from financial statements for the year ended December Statement del position as December 200 2015 WW 3 1 Nome Pepelyan wont Current TE 2010 Trade Egy Swap Sun Real 0 Loan Curren Todos TER DELL R G 3 Q s X Z Caps Lock Total assets Equity Share capital Share premium Revaluation reserve Retained earnings 240,000 220,000 60.000 50.000 140.000 90.000 229 213 320663 669 243 660.663 60.000 50.000 Non-current liabilities Loan stock Current liabilities Trade payables Income tax Provision for legal costs 33 450 50.000 57440 48.000 45000 365.130 301.663 Statement of profit or loss for the year ended 31 December 2020 Revenue 3 165022 Cost of sales and operating expenses 2910 857) Operating profit 254 165 Praft on disposal of PPE 7.000 Finance costs 3.000) Proft before tax 258,165 Income tax 6541 Profit for the year 193 624 12 290 Deprecation included in Operating profit Requirements 3 Prepare the "Net cash flow from operating activities' section of Trombone DELL Depreciation included in Operating profit Requirements a Prepare the 'Net cash flow from operating activities' section of Trombone ple's Statement of cash flows for the year ended 31 December 2020 19 marks) "(This includes 1 mark available for correct title and format) b. Calculate the cash spent on property, plant and equipment for the year ended 31 December 2020, assuming the sale proceeds of the disposal in the Statement of profit or loss were 18,000 (4 marks) c Prepare the Net cash flow from financing activities' section of the Statement of cash fows for the year ended 31 December 2020 (4 marks) Total Ouestion 2 17 marts Fill in your answer here Form BIVX, XL 2 DELL Trombone plc Extracts from financial statements for the year ended 319 December 2020 2019 E Statement of financial position as at 31 December 2120 2020 764 180 736 306 Non current assets Property, plant and equipment Current assets Inventory Trade recevables Bank 47.600 39.400 42.950 47,750 8 207 100 953 95357 10403 365 133 01653 Total assets Equity Share capital Share premium Revaluation reserve Retained earings 240.000 220.000 60.000 50.000 140.000 90.000 229 203 22663 669 243 680 653 60.000 50.000 Non current liabilities Loan stock Current liabilities Trade payables Income tax Provision for legal costs 33.450 53.000 57.440 48000 45000 365.133 0163 it or loss for the vear ended Juecember 2010 PIUS Statement of profit or loss for the year ended 31 December 2020 Revenue 3.165,022 Cost of sales and operating expenses (2.910 857) Operating profit 254, 165 Profit on disposal of PPE 7,000 Finance costs (3.000) Profit before tax 258, 165 Income tax (64,541) Profit for the year 193 624 72 290 Depreciation included in Operating profit Requirements 3 a Prepare the 'Net cash flow from operating activities' secti 2 1 i DELL 72 290 Depreciation included in Operating profit Requirements a. Prepare the 'Net cash flow from operating activities' section of Trombone ple's Statement of cash flows for the year ended 31" December 2020 (9 marks) (This includes 1 mark available for correct title and format) b. Calculate the cash spent on property, plant and equipment for the year ended 31* December 2020, assuming the sale proceeds of the disposal in the Statement of profit or loss were 18,000 (4 marks) Prepare the 'Net cash flow from financing activities' section of the Statement of cash flows for the year ended 31st December 2020 (4 marks) (Total Question 2: 17 marts Fill in your answer here Format B IU x x 4 = 2 = = = = = = DELL