Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i am compeltely stuck on these formulas. i thought that i wad getting the hang of it then totally lost it. please put the answers

i am compeltely stuck on these formulas. i thought that i wad getting the hang

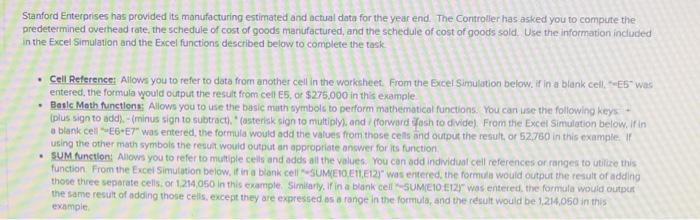

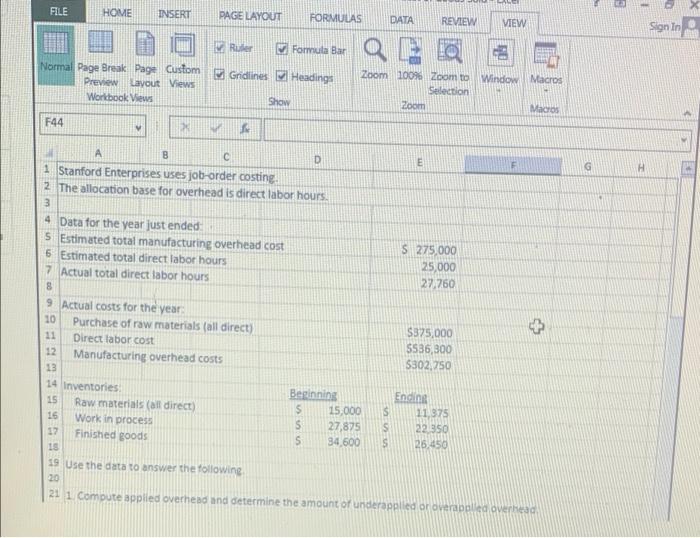

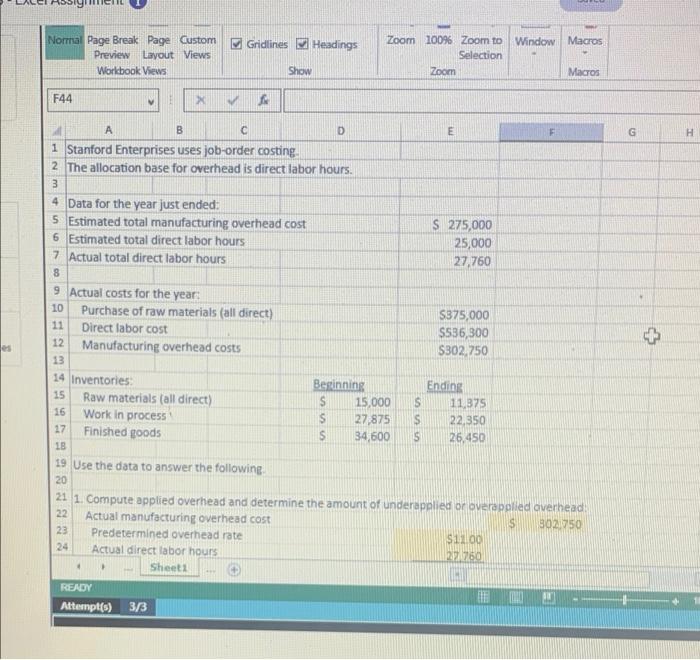

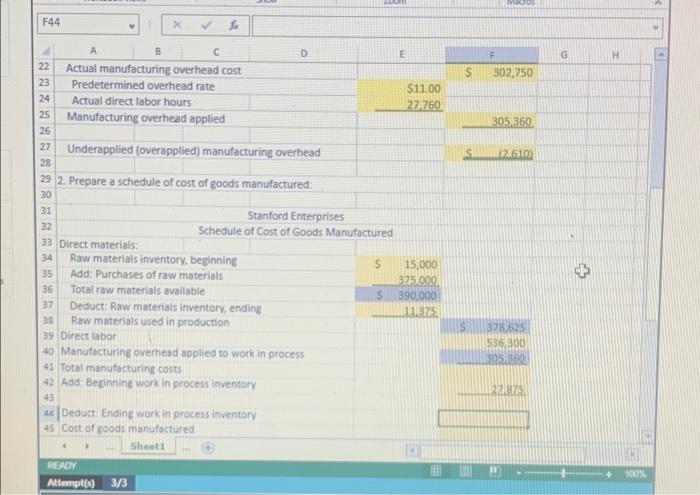

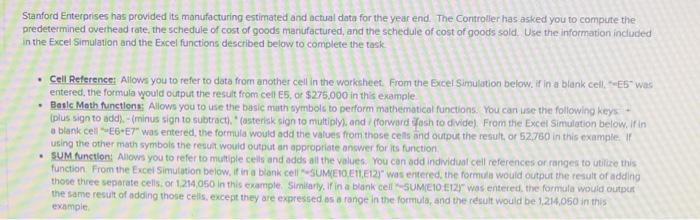

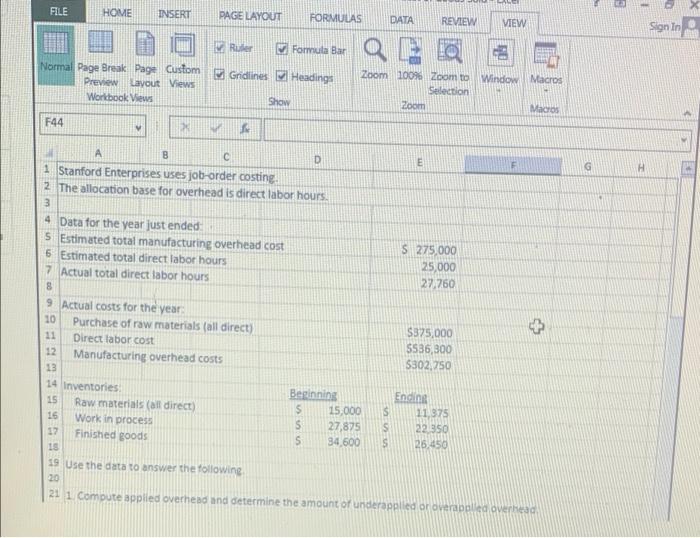

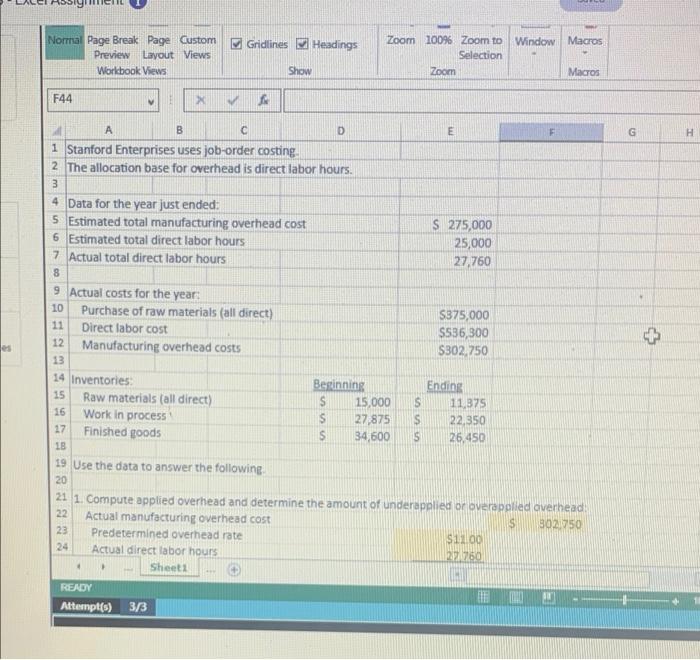

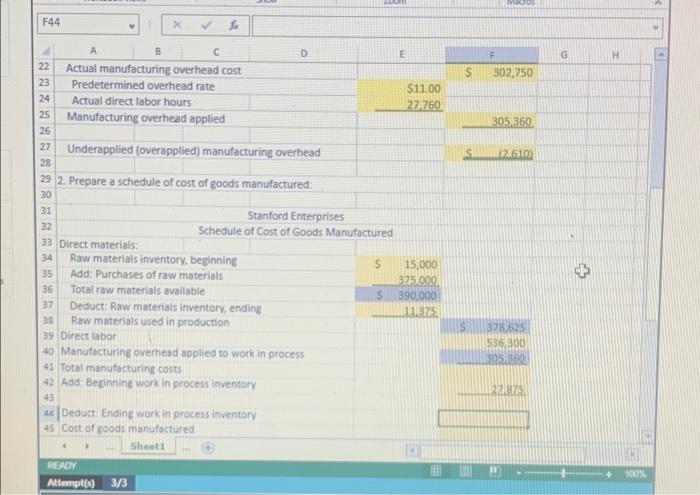

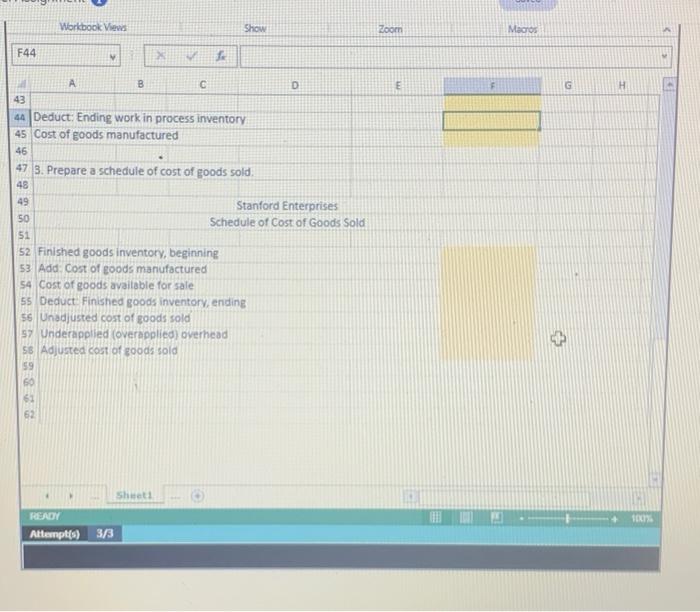

Stanford Enterprises has provided its manufacturing estimated and actual data for the year end. The Controller has asked you to compute the predetermined overhead rate the schedule of cost of goods manufactured, and the schedule of cost of goods sold. Use the information included in the Excel Simulation and the Excel functions described below to complete the task Cell Reference: Allows you to refer to data from another cell in the worksheet . From the Bxcel Simulation below if in a blank cell. --E5" was entered, the formula would output the result from cell 5, or $275,000 in this example Beslc Moth functions: Allows you to use the basic math symbol to perform mathematical functions. You can use the following keys (plus sign to add) - (minus sign to subtract, Custerisk sign to multiply), and forward closh to divide). From the Excel Simulation below. If in a blank cell-E6 E7" was entered the formula would add the values from those cells and output the result, or 52760 in this example. If using the other math symbols the result would output an appropriate answer for its function SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function from the Excel Simulation below, if in a blank cellSUME1011123" was entered the formule would output the result of adding those three separate cells of 1.214.050 in this example. Similarly, if in a blank cellSUME10 E12" was entered the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 1,214,050 in this example FILE . HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign in Ruler Formula Bar QE Normal Page Break Page Custom Preview Layout Views Workbook Views Gridlines Headings Window Macros Zoom 100% Zoom to Selection zoom Show Macros F44 24 A D G H C E 1 Stanford Enterprises uses job-order costing, 2 The allocation base for overhead is direct labor hours. 3 4 Data for the year just ended 5 Estimated total manufacturing overhead cost 5 275,000 5 Estimated total direct labor hours 25,000 7 Actual total direct labor hours 27.760 8 9 Actual costs for the year 10 Purchase of raw materials (all direct) $375,000 11 Direct labor cost 5536,300 12 Manufacturing overhead costs $302.750 13 14 Inventories Beginning Ending 15 Raw materials (all direct) $ 15,000 S 11,375 16 Work in process S 27,875 S 22.350 17 Finished goods S 34,600 S 26.450 18 19 Use the data to answer the following 20 21 1 Compute applied overhead and determine the amount of underapplied or over alle overhead Gridlines Headings Normal Page Break Page Custom Preview Layout Views Workbook Views Zoom 100% Zoom to Window Macros Selection Zoom Macros Show F44 C D G H A B E 1 Stanford Enterprises uses job-order costing. 2 The allocation base for overhead is direct labor hours. 3 4 Data for the year just ended: 5 Estimated total manufacturing overhead cost S 275,000 6 Estimated total direct labor hours 25,000 7 Actual total direct labor hours 27,760 8 9 Actual costs for the year: 10 Purchase of raw materials (all direct) 5375,000 11 Direct labor cost S536,300 12 Manufacturing overhead costs 5302,750 13 14 Inventories: Beginning Ending 15 Raw materials (all direct) S 15,000 S 11,375 16 Work in process S 27,875 S 22,350 17 Finished goods S 34,600 5 26,450 1B 19 Use the data to answer the following 20 21 1. Compute applied overhead and determine the amount of underapplied or overapplied overhead 22 Actual manufacturing overhead cost $ 302750 23 Predetermined overhead rate S1100 24 Actual direct labor hours 2760 Sheet1 READY Attempt(s) 3/3 F44 X B D E F G s 302,750 A C Actual manufacturing overhead cost Predetermined overhead rate Actual direct labor hours Manufacturing overhead applied 22 23 24 25 26 27 28 $11.00 277760 305360 Underapplied coverapplied) manufacturing overhead s 12610 29 2. Prepare a schedule of cost of goods manufactured: 30 31 Stanford Enterprises 32 Schedule of Cost of Goods Manufactured 33 Direct materials: 34 Raw materials inventory, beginning S 15,000 35 Add: Purchases of raw materials 325.000 36 Total raw materials available S 390,000 37 Deduct: Raw w materials inventory, ending 1 38 Raw materials used in production 39 Direct labor 40 Manufacturing overhead applied to work in process 41 Total manufacturing costs 42 Add Beginning work in process Inventory 43 Deduct Ending work in process inventory 45 Cost of goods manufactured Sheet1 S 378,625 596.300 3105 127 READY Attempt(s) 100% 3/3 Workbook Views Show Zoom Magos F44 fo 00 D E G H A B C 43 44 Deduct: Ending work in process inventory 45 Cost of goods manufactured 46 47 3. Prepare a schedule of cost of goods sold 48 49 Stanford Enterprises 50 Schedule of Cost of Goods Sold 51 52 Finished goods inventory, beginning 53 Add: Cost of goods manufactured 54 Cost of goods available for sale 55 Deduct. Finished goods inventory, ending 56 Unadjusted cost of goods sold 57 Underapplied (overapplied) overhead 56 Adjusted cost of goods sold 59 60 68 62 Shit 1 READY Attempts) 3/3 of it then totally lost it. please put the answers in formula form. also ill take some tips on how to better understand excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started